MGM Resorts Narrows Loss - Analyst Blog

09 Agosto 2011 - 7:00AM

Zacks

MGM Resorts

International (MGM) reported second quarter 2011 adjusted

loss of 8 cents per share narrower than the Zacks Consensus

Estimate of a loss of 13 cents per share. The better-than-expected

result was attributable to the expansion of the company’s

controlling stake from 50% to 51% in MGM China Holdings Limited

when it went public on the Hong Kong stock exchange in June.

On a GAAP basis, MGM Resorts posted

a net profit of $3.44 billion or $6.22 per share compared with a

net loss of $883.5 million or $2.00 per share in the prior-year

quarter. The reported quarter includes a gain of $3.5 billion or

$6.30 per share from the MGM China transaction as opposed to a

charge of $1.12 billion or $1.64 per share related to an impairment

of the company’s investment in the CityCenter joint venture in the

year-ago quarter.

Net revenue jumped 17% year over

year to $1.81 billion, but was slightly below the Zacks Consensus

Estimate of $1.59 billion. The year-over-year increase in revenue

was mainly driven by strong results from Las Vegas Strip, as

economic condition continues to improve resulting in higher

demand.

Inside the Headline

Numbers

Total casino revenue inched up 1%

year over year to $797.5 million despite lower-than-normal table

games hold percentage. The overall table games hold, as a

percentage of turnover, was below the low-end of the company’s

expected range of 19% to 23% in the quarter. The percentage was

lower on a year-over-year basis as well. However, revenues from

slots climbed 4% during the quarter.

Revenues from rooms climbed 9% year

over year primarily attributable to higher RevPAR (revenue per

available room) at Las Vegas Strip (up 10%), as occupancy improved

from 93% to 94%, and Average daily rate (ADR) spiked 9.6% year over

year to $126. The company also experienced improved revenue in each

of its remaining segments except reimbursement costs, which dropped

1%.

MGM Resorts reported an operating

income of $3.7 billion compared with an operating loss of $1.0

billion in the year-earlier quarter. Operating income during the

quarter benefited from the Macau transaction. Further, adjusted

EBITDA during the quarter soared 51% to $366 million, due to strong

performance at MGM Macau and Las Vegas Resorts.

Financial

Position

At quarter end, MGM Resorts’ total

cash balance was $922 million. Long-term debt outstanding was $12.6

billion.

Outlook

MGM Resorts provided positive

outlook for the second half of 2011.

Our Take

We believe MGM Resorts is ideally

positioned to take advantage of both domestic and international

opportunities, and is executing well on its business strategy.

Moreover, the acquisition of a controlling interest in MGM China

will strengthen its position in Macau and ensure higher

profitability. Business at Las Vegas has begun to stabilize, MGM

Grand Detroit also reported strong growth and results at MGM Macau

and CityCenter were also impressive in the reported quarter.

The company holds a Zacks #3 Rank

(short-term Hold rating). Our long-term recommendation remains

Neutral.

MGM Resorts’ close competitors

Las Vegas Sands Corp. (LVS) recorded adjusted

earnings of 54 cents per share in the second quarter of 2011,

beating the Zacks Consensus Estimate of 44 cents as well as the

year-ago quarter's earnings of 17 cents.

LAS VEGAS SANDS (LVS): Free Stock Analysis Report

MGM RESORTS INT (MGM): Free Stock Analysis Report

Zacks Investment Research

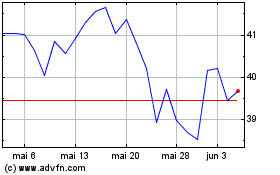

MGM Resorts (NYSE:MGM)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

MGM Resorts (NYSE:MGM)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024