NGL Energy Partners LP Signs Agreements to Sell Marine Assets for $111.65MM

06 Março 2023 - 8:30AM

Business Wire

NGL Energy Partners LP (NYSE:NGL) (“NGL,” “our,” “we,” or the

“Partnership”) announced the signing of two definitive agreements

to sell all of its marine assets for $111.65 million in cash in the

aggregate. NGL provided waterborne transportation of refined

products and crude oil for a diversified group of customers which

include major oil refineries on the Gulf Coast with these assets.

NGL’s marine fleet consists of 13 towboats and 25 tank barges. The

transaction is expected to close at the end of this month, subject

to customary closing conditions.

“I want to thank our Marine employees for their hard work and

service over the years to build one of the best fleets in the

business. This non-core asset sale should allow NGL to further

reduce leverage by March 31, 2023, as these proceeds will be used

for debt reduction.” stated Mike Krimbill, NGL’s CEO. “Our

near-term focus continues to be reducing absolute debt and

leverage.” Krimbill concluded.

BofA Securities, Inc. is serving as NGL’s financial advisor; and

McAfee & Taft of Tulsa, Oklahoma is serving as NGL’s outside

legal counsel.

About NGL Energy Partners LP

NGL Energy Partners LP, a Delaware limited partnership, is a

diversified midstream energy company that transports, stores,

markets and provides other logistics services for crude oil,

natural gas liquids and other products and transports, treats and

disposes of produced water generated as part of the oil and natural

gas production process.

For further information, visit the Partnership’s website at

www.nglenergypartners.com.

Forward-Looking Statements

This press release includes “forward-looking statements.” All

statements other than statements of historical facts included or

incorporated herein may constitute forward-looking statements.

Actual results could vary significantly from those expressed or

implied in such statements and are subject to a number of risks and

uncertainties. While NGL believes such forward-looking statements

are reasonable, NGL cannot assure they will prove to be correct.

The forward-looking statements involve risks and uncertainties that

affect operations, financial performance, and other factors as

discussed in filings with the Securities and Exchange Commission.

Other factors that could impact any forward-looking statements are

those risks described in NGL’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other public filings. You are

urged to carefully review and consider the cautionary statements

and other disclosures made in those filings, specifically those

under the heading “Risk Factors.” NGL undertakes no obligation to

publicly update or revise any forward-looking statements except as

required by law.

NGL provides Adjusted EBITDA guidance that does not include

certain charges and costs, which in future periods are generally

expected to be similar to the kinds of charges and costs excluded

from Adjusted EBITDA in prior periods, such as income taxes,

interest and other non-operating items, depreciation and

amortization, net unrealized gains and losses on derivatives, lower

of cost or net realizable value adjustments, gains and losses on

disposal or impairment of assets, gains and losses on early

extinguishment of liabilities, equity-based compensation expense,

acquisition expense, revaluation of liabilities and items that are

unusual in nature or infrequently occurring. The exclusion of these

charges and costs in future periods will have a significant impact

on the Partnership’s Adjusted EBITDA, and the Partnership is not

able to provide a reconciliation of its Adjusted EBITDA guidance to

net income (loss) without unreasonable efforts due to the

uncertainty and variability of the nature and amount of these

future charges and costs and the Partnership believes that such

reconciliation, if possible, would imply a degree of precision that

would be potentially confusing or misleading to investors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230304005034/en/

David Sullivan, 918-481-1119 Vice President - Finance

David.Sullivan@nglep.com

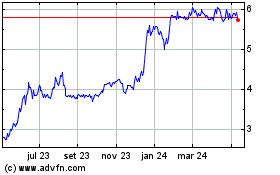

NGL Energy Partners (NYSE:NGL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

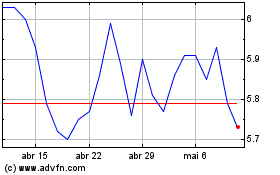

NGL Energy Partners (NYSE:NGL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024