DocuSign Stocks Drop 8.5%, Braze Surges 15% as 1Q Results Beat Expectations, and More in Earning

07 Junho 2024 - 9:09AM

IH Market News

Braze (NASDAQ:BRZE) – Braze reported an

adjusted loss of 5 cents per share in the first quarter, better

than the expected loss of 10 cents per share projected by analysts,

according to LSEG. Revenue reached $135 million, exceeding

expectations of $132 million. The cloud-based software company

forecasts an adjusted loss per share of $0.03 to $0.04 for the next

quarter, compared to the consensus forecast of -$0.04. It also

projects revenue of $140.5 million to $141.5 million for the second

quarter, above the consensus estimate of $139.8 million. Shares

rose 15.2% in pre-market trading.

DocuSign (NASDAQ:DOCU) – The electronic

contracts company reported adjusted earnings of 82 cents per share

in the first quarter, with revenue of $710 million. Analysts,

according to LSEG, expected earnings of 79 cents per share and

revenue of $707 million. For the current quarter, the company

expects revenue between $725 million and $729 million. Analysts

surveyed by FactSet expected $726.5 million. Additionally, DocuSign

authorized a $1 billion increase in its share repurchase program.

Shares fell 8.5% in pre-market trading.

GameStop (GME) – Despite being boosted by the

enthusiasm surrounding Gill, GameStop reported a 29% drop in

first-quarter sales, totaling $881.8 million. The company lost

$32.3 million, an improvement from the $50.5 million loss in the

previous year. GameStop also announced plans to sell an additional

$30 million in shares. The stock reversed from a gain of over 30%

to a 16.4% drop in pre-market trading shortly after the video game

retailer announced its first-quarter results.

Samsara (NYSE:IOT) – The IoT company reported

adjusted earnings of 3 cents per share and revenue of $281 million,

beating analysts’ expectations of 1 cent per share and $272 million

in revenue, according to LSEG. For fiscal year 2025, Samsara

forecasts earnings per share between $0.13 and $0.15, above the

consensus estimate of $0.12. The company also projects revenue

between $1.205 billion and $1.213 billion, slightly above the

consensus forecast of $1.2 billion. As a result, shares fell 6.2%

in pre-market trading.

Vail Resorts (NYSE:MTN) – The mountain resort

company reported third-quarter fiscal earnings of $381.4 million,

or $9.54 per share, on revenue of $1.28 billion. These results were

below analysts’ expectations of $9.97 per share in earnings and

$1.3 billion in revenue, according to LSEG. The company expects net

income of $224 million to $256 million for its fiscal year, below

the forecast given in March. Shares fell 8.5% in pre-market

trading.

Mission Produce (NASDAQ:AVO) – The producer and

distributor of avocados, mangoes, and blueberries reported a profit

of $7 million, or 10 cents per share, and revenue of $297.6 million

in the second fiscal quarter. Revenue increased 35% compared to the

same period last year, when the company reported a loss of $4.6

million, or 7 cents per share. The results also exceeded analysts’

estimates surveyed by FactSet, who projected an adjusted loss of 3

cents per share and sales of $215 million.

Planet Labs (NYSE:PL) – The satellite imaging

services company exceeded expectations in the first quarter by

reporting a smaller-than-expected adjusted loss of 5 cents per

share and revenue of $60.4 million. Analysts expected a loss of 7

cents per share and revenue of $60 million, according to LSEG.

Rent the Runway (NASDAQ:RENT) – The e-commerce

platform for designer clothing and accessories reported a quarterly

loss of $6.03 per share in the first quarter, better than the

estimated loss of $6.56 per share, according to Zacks consensus.

Revenue was $75 million, slightly above the $74.2 million in

revenue for the same period last year.

Tillys (NYSE:TLYS) – The California-based

clothing retailer reported mixed results in the first quarter. The

loss per share was 48 cents on revenue of $115.86 million.

Analysts’ consensus was a loss per share of 47 cents and revenue of

$115.16 million.

Zumiez (NASDAQ:ZUMZ) – The clothing retailer

reported a loss per share of 86 cents and revenue of $177.39

million in the first quarter. This was above Wall Street’s

estimates of a loss per share of $1.14 and expected revenue of

$171.40 million.

NGL Energy Partners (NYSE:NGL) – The

diversified energy logistics company reported a net loss of $236.8

million, or $2.05 per share, in the fourth quarter of 2024, a

significant worsening from the loss of $33.5 million, or 51 cents

per share, in the same period last year. Revenue fell 20% to $1.63

billion due to declines in its three units. The adjusted EBITDA for

the quarter was $147.5 million.

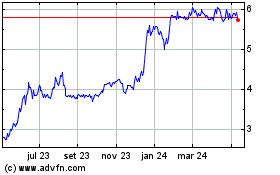

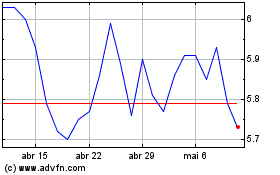

NGL Energy Partners (NYSE:NGL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NGL Energy Partners (NYSE:NGL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025