Quarterly Revenue Increases 29% Year over

Year to $42.0 Million

Quarterly Net Income Increases 32% Year over

Year to $8.9 Million

Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled quick-turn manufacturer, today announced record

financial results for the third quarter ended September 30,

2013.

Highlights include:

- Revenue for the third quarter of 2013

increased to a record $42.0 million, 29 percent above revenue of

$32.5 million in the third quarter of 2012.

- The record quarterly revenue was

achieved through a 23 percent increase in the number of product

developers served, combined with an increase of 5 percent in

spending per product developer.

- Net income for the third quarter of

2013 increased to a record $8.9 million, or $0.34 per diluted

share. Non-GAAP net income, excluding the after tax expense of

stock compensation, was $9.5 million, or $0.37 per diluted share.

See “Non-GAAP Financial Measure” below.

“Our world-wide marketing and sales efforts led to a record

number of product developers selecting Proto Labs to help them

accelerate their ideas to markets. This resulted in record revenue

globally and in each of our geographic markets. As we prepare to

roll out additional services over the next few quarters, we remain

confident that our ability to offer solutions to product developers

will continue to drive our business forward,” said Proto Labs’

President and CEO Brad Cleveland.

Additional highlights include:

- Gross margin was 61.8 percent of

revenue in the third quarter of 2013 compared with 60.7 percent

during the same quarter in 2012.

- During the third quarter of 2013,

spending on research and development, including the Protoworks

initiatives, totaled $3.0 million, or 7.2 percent of revenue. This

compares to $2.6 million, or 7.9 percent of revenue during the

third quarter of 2012.

- Operating margin was 31.9 percent of

revenue during the third quarter of 2013 compared to 29.5 percent

in the third quarter of 2012.

- As measured on a year to date basis,

cash generated from operations totaled $34.9 million and

expenditures on capital equipment were $13.0 million.

Proto Labs also announced that CEO Brad Cleveland has notified

the Board of Directors of his intent to resign once the Company has

found a new CEO capable of leading the company’s continued

growth.

“I feel very fortunate to be a part of this successful

organization and I am grateful to have worked with so many talented

people through the years. I’ve been the CEO from $1 million in

revenue until today. I’ve thoroughly enjoyed the experience and

would welcome the chance to someday do it all over again in another

industry. I am confident that in the coming months we will recruit

an excellent executive with the experience required to lead Proto

Labs to even greater levels of success. I look forward to staying

with the company through the entire leadership transition period,”

concluded Mr. Cleveland.

Non-GAAP Financial Measure

The company has included non-GAAP net income, adjusted for

stock-based compensation expense in this press release to provide

investors with additional information regarding the company’s

financial results. The company has provided below a reconciliation

of non-GAAP net income, adjusted for stock-based compensation

expense, to net income, the most directly comparable measure

calculated and presented in accordance with GAAP. Non-GAAP net

income, adjusted for stock-based compensation expense, is used by

the company’s management and board of directors to understand and

evaluate operating performance and trends and provides a useful

measure for period-to-period comparisons of the company’s business.

Accordingly, the company believes that non-GAAP net income,

adjusted for stock-based compensation expense, provides useful

information to investors and others in understanding and evaluating

operating results in the same manner as our management and board of

directors.

Conference Call

The company has scheduled a conference call to discuss its third

quarter financial results today, October 31 at 8:30 a.m. ET. To

access the call in the U.S. please dial 877-415-3184. Outside the

U.S. please dial 857-244-7327. Use participant code 58246380#. A

simultaneous webcast of the call will also be available on the

investor relations section of the company’s website at

www.protolabs.com/investors. An audio replay will be available for

14 days following the call on the investor relations website of

Proto Lab’s website.

About Proto Labs, Inc.Proto Labs is a leading online and

technology-enabled quick-turn manufacturer of custom parts for

prototyping and short-run production. Proto Labs provides “Real

Parts, Really Fast” to product developers worldwide. Proto Labs

utilizes computer numerical control (CNC) machining and injection

molding to manufacture custom parts for our customers. For more

information, visit protolabs.com.

Forward-Looking StatementsStatements contained in this

press release regarding matters that are not historical or current

facts are “forward-looking statements” within the meaning of The

Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors

which may cause the results of Proto Labs to be materially

different than those expressed or implied in such statements.

Certain of these risk factors and others are described in the “Risk

Factors” section within reports filed with the SEC. Other unknown

or unpredictable factors also could have material adverse effects

on Proto Labs’ future results. The forward-looking statements

included in this press release are made only as of the date hereof.

Proto Labs cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, you should not place

undue reliance on these forward-looking statements. Finally, Proto

Labs expressly disclaims any intent or obligation to update any

forward-looking statements to reflect subsequent events or

circumstances.

Proto Labs, Inc. Condensed

Consolidated Balance Sheets (In thousands)

September 30, December 31, 2013

2012 (Unaudited)

Assets Current assets Cash and cash equivalents $ 39,382 $

36,759 Short-term marketable securities 33,647 25,137 Accounts

receivable, net 18,016 15,791 Inventory 4,966 4,619 Other current

assets 8,302 7,850 Total current assets 104,313

90,156 Property and equipment, net 52,378 45,316 Long-term

marketable securities 59,441 36,965 Other long-term assets

247 285 Total assets $ 216,379 $ 172,722

Liabilities and shareholders' equity Current liabilities

Accounts payable $ 6,340 $ 4,758 Accrued compensation 6,848 5,995

Accrued liabilities and other 1,149 513 Current portion of

long-term debt obligations 195 273 Total current

liabilities 14,532 11,539 Deferred tax liabilities 3,345

3,346 Long-term debt obligations 206 356 Other long-term

liabilities 699 782 Shareholders' equity 197,597

156,699 Total liabilities and shareholders' equity $ 216,379

$ 172,722

Proto Labs, Inc. Condensed Consolidated Statements of

Operations (In thousands, except share and per share

amounts) (Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2013

2012

2013

2012

Revenues Protomold $ 29,534 $ 23,458 $ 84,338 $ 66,697 Firstcut

12,474 8,996

34,732 25,678 Total

revenues 42,008 32,454 119,070 92,375 Cost of revenues

16,053 12,760

44,983 37,242 Gross profit

25,955 19,694 74,087 55,133 Operating expenses Marketing and

sales 5,409 4,442 16,222 13,440 Research and development 3,026

2,561 8,405 6,622 General and administrative

4,118 3,118

12,035 10,394 Total

operating expenses

12,553

10,121 36,662

30,456 Income from operations 13,402 9,573

37,425 24,677 Other income (expense), net

31

314 149

(90 ) Income before income taxes 13,433

9,887 37,574 24,587 Provision for income taxes

4,561 3,185

11,804 7,957 Net income

$ 8,872 $ 6,702

$ 25,770 $

16,630 Net income per share: Basic

$ 0.35 $ 0.28

$ 1.03 $ 0.72

Diluted

$ 0.34 $

0.26 $ 1.00 $

0.68 Shares used to compute net income

per share: Basic 25,384,940 24,052,409 25,121,941 22,975,950

Diluted 26,002,240 25,312,643 25,794,950 24,356,785

Proto Labs, Inc. Condensed Consolidated Statements of

Cash Flows (In thousands) (Unaudited)

Nine Months Ended September 30,

2013 2012 Operating activities Net

income $ 25,770 $ 16,630 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 5,528 4,380 Stock-based compensation expense 2,595

2,362 Deferred taxes (61 ) - Excess tax benefit from stock-based

compensation (8,198 ) (2,635 ) Amortization of held-to-maturity

securities 1,007 173 Loss on disposal of property and equipment 111

- Changes in operating assets and liabilities:

8,148 (1,476 )

Net cash provided by operating activities

34,900 19,434

Investing activities Purchases of property and equipment

(12,976 ) (14,435 ) Purchases of marketable securities (82,657 )

(61,568 ) Proceeds from maturities of marketable securities

50,663 10,290 Net

cash used in investing activities

(44,970

) (65,713 )

Financing activities Proceeds from initial public offering,

net of offering costs - 71,530 Payments on debt (211 ) (289 )

Proceeds from exercises of warrants and stock options 4,635 728

Excess tax benefit from stock-based compensation

8,198 2,635 Net cash

provided by financing activities

12,622

74,604 Effect of exchange rate changes

on cash and cash equivalents

71

(170 ) Net increase in cash and cash

equivalents 2,623 28,155

Cash and cash equivalents,

beginning of period 36,759

8,135 Cash and cash equivalents, end of

period $ 39,382 $

36,290

Proto Labs, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measure (In

thousands, except share and per share amounts)

(Unaudited) Three Months

Ended Nine Months Ended September 30,

2013 September 30, 2013 Non-GAAP net

income, adjusted for stock-based compensation expense: GAAP net

income $ 8,872 $ 25,770 Add back: Stock-based compensation expense

Cost of revenue 89 233 Marketing and sales 154 455 Research and

development 201 555 General and administrative

415 1,352 Total

stock-based compensation expense 859 2,595 Less: Tax benefit on

stock-based compensation

(216 )

(624 ) Non-GAAP net income

$ 9,515 $

27,741 Non-GAAP net income per share:

Basic

$ 0.37 $

1.10 Diluted

$ 0.37

$ 1.08 Shares used

to compute non-GAAP net income per share: Basic 25,384,940

25,121,941 Diluted 26,002,240 25,794,950

Proto

Labs, Inc. Revenue by Geography - Based on Shipping

Location (In thousands) (Unaudited)

Three Months Ended Nine

Months Ended September 30,

September 30,

2013

2012

2013

2012

Revenues Domestic United States $ 30,561 $ 24,807 $ 88,816 $ 69,887

International Europe 8,556 5,771 21,860 16,305 Japan 1,588 1,101

4,253 3,418 United States

1,303

775 4,141

2,765 Total international

11,447

7,647 30,254

22,488 Total revenue

$

42,008 $ 32,454

$ 119,070 $

92,375

Proto Labs, Inc. Customer Information (In

thousands, except customer amounts) (Unaudited)

Nine Months Ended September 30,

2013 2012 Number of Revenue ($)

Number of Revenue ($) Customers

Customers New customers 2,261 $ 14,636 2,251 $ 13,564

Existing customers

5,315 104,434

4,394 78,811 Total

7,576 $ 119,070

6,645 $ 92,375

Proto

Labs, Inc. Product Developer Information

(Unaudited) Three Months

Ended Nine Months Ended September 30,

September 30, 2013 2012 2013

2012 Unique product developers served

7,308 5,928 13,421

11,126

Proto Labs, Inc.Investor Relations:Jack Judd,

763-479-7408jack.judd@protolabs.comorMedia Relations:Bill Dietrick,

763-479-7664bill.dietrick@protolabs.com

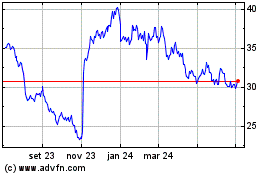

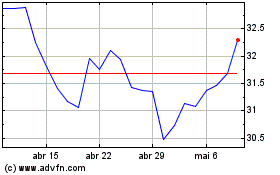

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024