Public Storage (NYSE:PSA) (the “Company”) announced today that

it has completed the previously announced acquisition of Simply

Self Storage (“Simply”) from Blackstone Real Estate Income Trust,

Inc. (“BREIT”) for $2.2 billion.

The portfolio comprises 127 wholly-owned properties and 9

million net rentable square feet that are geographically

diversified across 18 states and located in markets with population

growth that has been approximately double the national average

since 2018. Approximately 65% of the properties are located in

high-growth Sunbelt markets.

Public Storage is deploying its industry-leading brand and

operating platform to drive customer recognition and enhance

performance. The Company has integrated an additional 25 properties

into its PS Advantage® third-party management platform. By

combining the Simply team with Public Storage’s leading platform,

the Company is deepening its presence in fast-growing markets,

bolstering its core strengths, and unlocking additional

opportunities for growth and value creation.

Public Storage funded the acquisition by utilizing its

growth-oriented balance sheet to issue $2.2 billion of senior

unsecured notes and quickly closed the transaction in a

well-coordinated effort with the Simply and Blackstone teams. The

Company expects the transaction will be accretive to FFO per share,

with accretion accelerating through stabilization. A presentation

with further detail is available on the Investor Relations section

of PublicStorage.com.

The acquisition reflects Public Storage’s continued execution of

its opportunistic growth strategy. Since the start of 2019, the

Company has expanded its portfolio by 54 million net rentable

square feet, or 33%, through $10.7 billion of acquisitions,

development, and redevelopment, including properties under

contract. Recent acquisition and development properties in the

Company’s non-same store pool account for nearly 30% of the

portfolio, providing significant growth for Public Storage and its

stakeholders as the properties lease up over the next few

years.

“We are pleased to welcome Simply’s team, customers, and

third-party management partners to Public Storage’s

industry-leading brand and platform,” said Joe Russell, Public

Storage’s Chief Executive Officer. “We thank the Simply and

Blackstone teams for their partnership through this process. The

expeditious execution and integration further demonstrate our

position as an acquirer of choice in the self-storage

industry.”

Nadeem Meghji, Head of Blackstone Real Estate Americas, said,

“This sale represents a terrific outcome for BREIT investors and

enables us to further concentrate BREIT’s portfolio in its highest

growth sectors. Public Storage is a leader in its space and will be

an excellent steward of this portfolio.”

Eastdil Secured served as financial advisor to Public Storage,

and Wachtell, Lipton, Rosen & Katz and Hogan Lovells US LLP

acted as legal advisors.

Wells Fargo and Newmark Group, Inc. served as lead financial

advisors to BREIT, and BMO Capital Markets, Citigroup Global

Markets Inc. and Sumitomo Mitsui Banking Corporation (SMBC) also

served as financial advisors. Simpson Thacher & Bartlett LLP

acted as BREIT’s legal advisor.

About Public Storage

Public Storage, a member of the S&P 500 and FT Global 500,

is a REIT that primarily acquires, develops, owns, and operates

self-storage facilities. At June 30, 2023, we had: (i) interests in

2,888 self-storage facilities located in 40 states with

approximately 206 million net rentable square feet in the United

States and (ii) a 35% common equity interest in Shurgard Self

Storage Limited (Euronext Brussels:SHUR), which owned 266

self-storage facilities located in seven Western European nations

with approximately 15 million net rentable square feet operated

under the Shurgard® brand. Our headquarters are located in

Glendale, California.

Additional information about Public Storage is available on the

Company’s website at PublicStorage.com.

About Blackstone Real Estate Income

Trust

Blackstone Real Estate Income Trust, Inc. (BREIT) is a

perpetual-life, institutional quality real estate investment

platform that brings private real estate to income focused

investors. BREIT invests primarily in stabilized, income-generating

U.S. commercial real estate across key property types and to a

lesser extent in real estate debt investments. BREIT is externally

managed by a subsidiary of Blackstone (NYSE: BX), a global leader

in real estate investing. Blackstone’s real estate business was

founded in 1991 and has approximately $333 billion in investor

capital under management. Further information is available at

www.breit.com.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements are based on the beliefs and assumptions of

the Company’s and BREIT’s management made based on information

currently available to them and may be identified by the use of the

words “outlook,” “guidance,” “expects,” “believes,” “anticipates,”

“should,” “estimates,” and similar expressions. These

forward-looking statements involve known and unknown risks and

uncertainties, which may cause the Company’s or BREIT’s respective

actual results and performance to be materially different from

those expressed or implied in the forward-looking statements. Risks

and uncertainties that may impact the Company’s or BREIT’s

respective future results and performance include, but are not

limited to those described in the Company’s Annual Report on Form

10-K filed with the Securities and Exchange Commission (the “SEC”)

on February 21, 2023, BREIT’s Annual Report on Form 10-K filed with

the SEC on March 17, 2023 as well as under the section entitled

“Risk Factors” in BREIT’s prospectus and in the Company’s and

BREIT’s other filings with the SEC, each of which is accessible on

the SEC’s website at www.sec.gov. These include changes in demand

for the Company’s and BREIT’s facilities, impacts of natural

disasters, adverse changes in laws and regulations including

governing property tax, evictions, rental rates, minimum wage

levels, and insurance, adverse economic effects from the COVID-19

Pandemic, international military conflicts, or similar events

impacting public health and/or economic activity, adverse impacts

from inflation, unfavorable foreign currency rate fluctuations,

changes in federal or state tax laws related to the taxation of

REITs, security breaches, including ransomware, or a failure of

networks, systems, or technology. These forward-looking statements

are not guarantees of future plans and speak only as of the date of

this press release or as of the dates indicated in the statements.

Actual plans and operating results may differ materially from what

is expressed or forecasted in this press release. All

forward-looking statements, including those in this press release,

are qualified in their entirety by this cautionary statement. The

Company and BREIT expressly disclaim any obligation to update

publicly or otherwise revise any forward-looking statements,

whether as a result of new information, new estimates, or other

factors, events, or circumstances after the date of these

forward-looking statements, except when expressly required by law.

Given these risks and uncertainties, you should not rely on any

forward-looking statements in this press release, or which the

Company’s or BREIT’s management may make orally or in writing from

time to time, neither as predictions of future events nor

guarantees of future performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230913293539/en/

Public Storage Ryan Burke (818) 244-8080, Ext. 1141

Blackstone Jeffrey Kauth Jeffrey.Kauth@Blackstone.com

(212) 583-5395

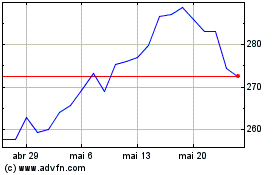

Public Storage (NYSE:PSA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Public Storage (NYSE:PSA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025