— Second quarter net income of $152 million, or

$0.98 per diluted share —

— Return on equity of 13.6% —

— Book value per share growth of 12%

year-over-year to $29.66 —

— Available Holding Company Liquidity increased

to $1.2 billion following $200 million ordinary dividend from

Radian Guaranty during the second quarter —

— Share repurchase authorization increased to

$900 million and extended through June 2026; $50 million of shares

repurchased during the second quarter and $667 million of purchase

authority remaining —

Radian Group Inc. (NYSE: RDN) today reported net income for the

quarter ended June 30, 2024, of $152 million, or $0.98 per diluted

share. This compares with net income for the quarter ended June 30,

2023, of $146 million, or $0.91 per diluted share.

Adjusted pretax operating income for the quarter ended June 30,

2024, was $193 million, or $0.99 per diluted share. This compares

with adjusted pretax operating income for the quarter ended June

30, 2023, of $184 million, or $0.91 per diluted share.

Key Financial Highlights

Quarter ended

($ in millions, except per-share

amounts)

June 30, 2024

March 31, 2024

June 30, 2023

Total revenues

$321

$319

$290

Net income

$152

$152

$146

Diluted net income per share

$0.98

$0.98

$0.91

Consolidated pretax income

$188

$199

$183

Adjusted pretax operating income

(1)

$193

$203

$184

Adjusted diluted net operating

income per share (1) (2)

$0.99

$1.03

$0.91

Return on equity (3)

13.6%

13.8%

14.1%

Adjusted net operating return on

equity (1) (2)

13.6%

14.5%

14.1%

New Insurance Written (NIW) -

mortgage insurance

$13,902

$11,534

$16,946

Net premiums earned - mortgage

insurance

$235

$234

$211

New defaults

11,104

11,756

9,775

Provision for losses - mortgage

insurance

($2)

($7)

($22)

As of

($ in millions, except per-share

amounts)

June 30, 2024

March 31, 2024

June 30, 2023

Book value per share

$29.66

$29.30

$26.51

Accumulated other comprehensive

income (loss) value per share (4)

($2.50)

($2.39)

($2.69)

PMIERs Available Assets (5)

$5,978

$5,989

$5,689

PMIERs excess Available Assets

(6)

$2,206

$2,282

$1,662

Available Holding Company

Liquidity (7)

$1,190

$1,094

$1,010

Total investments

$6,588

$6,327

$5,896

Primary mortgage insurance in

force

$272,827

$270,986

$266,859

Percentage of primary loans in

default (8)

2.0%

2.1%

2.0%

Mortgage insurance loss

reserves

$351

$357

$373

(1)

Adjusted results, including

adjusted pretax operating income, adjusted diluted net operating

income per share and adjusted net operating return on equity, are

non-GAAP financial measures. For definitions and reconciliations of

these measures to the comparable GAAP measures, see Exhibits F and

G.

(2)

Calculated using the Company’s

federal statutory tax rate of 21%.

(3)

Calculated by dividing annualized

net income by average stockholders’ equity, based on the average of

the beginning and ending balances for each period presented.

(4)

Included in book value per share

for each period presented.

(5)

Represents Radian Guaranty’s

Available Assets, calculated in accordance with the Private

Mortgage Insurer Eligibility Requirements (PMIERs) financial

requirements in effect for each date shown.

(6)

Represents Radian Guaranty’s

excess or “cushion” of Available Assets over its Minimum Required

Assets, calculated in accordance with the PMIERs financial

requirements in effect for each date shown.

(7)

Represents Radian Group’s

available liquidity, excluding available capacity under its $275

million unsecured revolving credit facility.

(8)

Represents the number of primary

loans in default as a percentage of the total number of insured

primary loans.

Book value per share at June 30, 2024, was $29.66, compared to

$29.30 at March 31, 2024, and $26.51 at June 30, 2023. This

represents a 12% growth in book value per share at June 30, 2024,

as compared to June 30, 2023, and includes accumulated other

comprehensive income (loss) of $(2.50) per share as of June 30,

2024, and $(2.69) per share as of June 30, 2023. Changes in

accumulated other comprehensive income (loss) are primarily from

net unrealized gains or losses on investments as a result of

decreases or increases, respectively, in market interest rates.

“We reported another quarter with excellent results for Radian.

We increased book value per share by 12% year-over-year, generated

net income of $152 million and delivered a return on equity of

13.6% in the second quarter,” said Radian’s Chief Executive Officer

Rick Thornberry. “Our strong operational performance reflects the

high quality of our mortgage insurance portfolio, the resilience of

our business model, the strength and quality of our investment

portfolio, the depth of our customer relationships and the

commitment of our team.”

SECOND QUARTER HIGHLIGHTS

- NIW was $13.9 billion in the second quarter of 2024, compared

to $11.5 billion in the first quarter of 2024, and $16.9 billion in

the second quarter of 2023.

- Purchase NIW increased 22% in the second quarter of 2024

compared to the first quarter of 2024 and decreased 18% compared to

the second quarter of 2023.

- Refinances accounted for 2% of total NIW in the second quarter

of 2024, compared to 3% in the first quarter of 2024, and 1% in the

second quarter of 2023.

- Total primary mortgage insurance in force of $272.8 billion as

of June 30, 2024, compared to $271.0 billion as of March 31, 2024,

and $266.9 billion as of June 30, 2023.

- Persistency, which is the percentage of mortgage insurance that

remains in force after a twelve-month period, was 84% for the

twelve months ended June 30, 2024, compared to 84% for the twelve

months ended March 31, 2024, and 83% for the twelve months ended

June 30, 2023.

- Annualized persistency for the three months ended June 30,

2024, was 84%, compared to 85% for the three months ended March 31,

2024, and 84% for the three months ended June 30, 2023.

- Net mortgage insurance premiums earned were $235 million for

the second quarter of 2024, an increase compared to $234 million

for the first quarter of 2024, and $211 million for the second

quarter of 2023.

- Mortgage insurance in force portfolio premium yield was 38.2

basis points in the second quarter of 2024. This compares to 38.2

basis points in each of the first quarter of 2024 and the second

quarter of 2023.

- Total net mortgage insurance premium yield, which includes the

impact of ceded premiums earned and accrued profit commission, was

34.5 basis points in the second quarter of 2024. This compares to

34.6 basis points in the first quarter of 2024, and 31.9 basis

points in the second quarter of 2023. The second quarter of 2023

included an increase of 3.2 basis points in ceded premiums earned,

as a result of the tender offers by Eagle Re 2019-1 Ltd. and Eagle

Re 2020-1 Ltd, in that quarter.

- Details regarding premiums earned may be found in Exhibit

D.

- The mortgage insurance provision for losses was a benefit of $2

million in the second quarter of 2024, compared to a benefit of $7

million in the first quarter of 2024 and a benefit of $22 million

in the second quarter of 2023.

- Favorable reserve development on prior period defaults was $50

million in the second quarter of 2024, compared to $61 million in

the first quarter of 2024 and $63 million in the second quarter of

2023.

- The number of primary delinquent loans was 20,276 as of June

30, 2024, compared to 20,850 as of March 31, 2024, and 19,880 as of

June 30, 2023.

- The loss ratio in the second quarter of 2024 was (0.8)%,

compared to (2.9)% in the first quarter of 2024, and (10.3)% in the

second quarter of 2023.

- Total mortgage insurance claims paid were $6 million in the

second quarter of 2024, compared to $3 million in each of the first

quarter of 2024 and the second quarter of 2023.

- Additional details regarding mortgage insurance provision for

losses may be found in Exhibit D.

- Other operating expenses were $92 million in the second quarter

of 2024, compared to $83 million in the first quarter of 2024, and

$90 million in the second quarter of 2023.

- Other operating expenses increased in the second quarter of

2024 as compared to the first quarter of 2024, primarily due to the

timing of our annual share-based incentive grants as well as

severance and related expenses recognized in the second quarter of

2024.

- Additional details regarding other operating expenses may be

found in Exhibit D.

CAPITAL AND LIQUIDITY UPDATE

Radian Group

- As of June 30, 2024, Radian Group maintained $1.2 billion of

available liquidity. Total holding company liquidity, including the

company’s $275 million unsecured revolving credit facility, was

$1.5 billion as of June 30, 2024.

- As previously announced, in May 2024, the company’s Board of

Directors authorized an increase to its existing share repurchase

program from $300 million to $900 million and extended the term to

June 30, 2026. This program provides Radian the flexibility to

repurchase shares opportunistically from time to time and to spend

up to $900 million, excluding commissions, based on market and

business conditions, stock price and other factors. During the

second quarter of 2024, the company repurchased 1.6 million shares

of Radian Group common stock at a total cost of $50 million,

including commissions. As of June 30, 2024, purchase authority of

up to $667 million remained available under the existing

program.

- Radian Group paid a dividend on its common stock in the amount

of $0.245 per share, totaling $37 million, on June 20, 2024.

Radian Guaranty

- Radian Guaranty paid an ordinary dividend to Radian Group of

$200 million in the second quarter of 2024, compared to $100

million in the first quarter of 2024 and $100 million in the second

quarter of 2023.

- At June 30, 2024, Radian Guaranty’s Available Assets under

PMIERs totaled approximately $6.0 billion, resulting in PMIERs

excess Available Assets of $2.2 billion.

- In June 2024, consistent with our use of risk distribution

strategies to effectively manage capital and proactively mitigate

risk, Radian Guaranty entered into a quota share reinsurance

arrangement (“2024 QSR Agreement”) with a panel of third-party

reinsurance providers. Under the 2024 QSR Agreement, we expect to

cede 25% of NIW between July 1, 2024, and June 30, 2025, subject to

certain conditions.

RECENT EVENTS

- In July 2024, Radian Mortgage Capital brought to market its

inaugural secondary market securitization, a prime jumbo

transaction of $348.9 million in size.

- In July 2024, Radian Group announced the redemption of its 2024

senior notes in the amount of $450 million, payable in September

2024. Once complete, this redemption will result in a corresponding

$450 million reduction in holding company debt and reduce Radian

Group’s financial leverage.

CONFERENCE CALL

Radian will discuss second quarter 2024 financial results in a

conference call tomorrow, Thursday, August 1, 2024, at 12:00 p.m.

Eastern time. The conference call will be webcast live on the

company’s website at

https://radian.com/who-we-are/for-investors/webcasts or at

www.radian.com. The webcast is listen-only. Those interested in

participating in the question-and-answer session should follow the

conference call dial-in instructions below.

The call may be accessed via telephone by registering for the

call here to receive the dial-in numbers and unique PIN. It is

recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call).

A digital replay of the webcast will be available on Radian’s

website approximately two hours after the live broadcast ends for a

period of one year at

https://radian.com/who-we-are/for-investors/webcasts.

In addition to the information provided in the company’s

earnings news release, other statistical and financial information,

which is expected to be referred to during the conference call,

will be available on Radian’s website at www.radian.com, under

Investors.

NON-GAAP FINANCIAL MEASURES

Radian believes that adjusted pretax operating income (loss),

adjusted diluted net operating income (loss) per share and adjusted

net operating return on equity (non-GAAP measures) facilitate

evaluation of the company’s fundamental financial performance and

provide relevant and meaningful information to investors about the

ongoing operating results of the company. On a consolidated basis,

these measures are not recognized in accordance with accounting

principles generally accepted in the United States of America

(GAAP) and should not be considered in isolation or viewed as

substitutes for GAAP measures of performance. The measures

described below have been established in order to increase

transparency for the purpose of evaluating the company’s operating

trends and enabling more meaningful comparisons with Radian’s

competitors.

Adjusted pretax operating income (loss) is defined as GAAP

consolidated pretax income (loss) excluding the effects of: (i) net

gains (losses) on investments and other financial instruments,

except for certain investments and other financial instruments

attributable to our reportable segment or All Other activities;

(ii) amortization and impairment of goodwill and other acquired

intangible assets; and (iii) impairment of other long-lived assets

and other non-operating items, if any, such as gains (losses) from

the sale of lines of business, acquisition-related income

(expenses) and gains (losses) on extinguishment of debt. Adjusted

diluted net operating income (loss) per share is calculated by

dividing adjusted pretax operating income (loss) attributable to

common stockholders, net of taxes computed using the company’s

statutory tax rate, by the sum of the weighted average number of

common shares outstanding and all dilutive potential common shares

outstanding. Adjusted net operating return on equity is calculated

by dividing annualized adjusted pretax operating income (loss), net

of taxes computed using the company’s statutory tax rate, by

average stockholders’ equity, based on the average of the beginning

and ending balances for each period presented.

See Exhibit F or Radian’s website for a description of these

items, as well as Exhibit G for reconciliations to the most

comparable consolidated GAAP measures.

ABOUT RADIAN

Radian Group Inc. (NYSE: RDN) is ensuring the American dream of

homeownership responsibly and sustainably through products and

services that include industry-leading mortgage insurance and a

comprehensive suite of mortgage, risk, title, valuation, asset

management and other real estate services. We are powered by

technology, informed by data and driven to deliver new and better

ways to transact and manage risk. Visit www.radian.com and

homegenius.com to learn more about how Radian and its pioneering

homegenius platform are building a smarter future for mortgage and

real estate services.

FINANCIAL RESULTS AND SUPPLEMENTAL

INFORMATION CONTENTS (Unaudited)

Exhibit A:

Condensed Consolidated Statements of

Operations

Exhibit B:

Net Income Per Share

Exhibit C:

Condensed Consolidated Balance Sheets

Exhibit D:

Condensed Consolidated Statements of

Operations Detail

Exhibit E:

Segment Information

Exhibit F:

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit G:

Consolidated Non-GAAP Financial Measure

Reconciliations

Exhibit H:

Mortgage Insurance Supplemental

Information - New Insurance Written

Exhibit I:

Mortgage Insurance Supplemental

Information - Primary Insurance in Force and Risk in

Force

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations (1)

Exhibit A

2024

2023

(In thousands, except per-share

amounts)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Revenues

Net premiums earned

$

237,731

$

235,857

$

232,649

$

240,262

$

213,429

Services revenue

13,265

12,588

12,419

10,892

11,797

Net investment income

73,766

69,221

68,824

67,805

63,348

Net gains (losses) on investments and

other financial instruments

(4,487

)

490

13,447

(8,555

)

(236

)

Other income

872

1,262

1,305

2,109

1,241

Total revenues

321,147

319,418

328,644

312,513

289,579

Expenses

Provision for losses

(1,745

)

(7,034

)

4,170

(8,135

)

(21,632

)

Policy acquisition costs

6,522

6,794

6,147

6,920

5,218

Cost of services

9,535

9,327

8,950

8,886

10,257

Other operating expenses

91,648

82,636

95,218

79,206

89,885

Interest expense

27,064

29,046

23,169

23,282

21,805

Impairment of goodwill

—

—

9,802

—

—

Amortization of other acquired intangible

assets

—

—

1,371

1,371

1,370

Total expenses

133,024

120,769

148,827

111,530

106,903

Pretax income

188,123

198,649

179,817

200,983

182,676

Income tax provision

36,220

46,295

37,124

44,401

36,589

Net income

$

151,903

$

152,354

$

142,693

$

156,582

$

146,087

Diluted net income per share

$

0.98

$

0.98

$

0.91

$

0.98

$

0.91

(1) See Exhibit D for additional

details.

Radian Group Inc. and

Subsidiaries

Net Income Per Share

Exhibit B

The calculation of basic and diluted net

income per share is as follows.

2024

2023

(In thousands, except per-share

amounts)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Net income—basic and diluted

$

151,903

$

152,354

$

142,693

$

156,582

$

146,087

Average common shares

outstanding—basic

153,110

153,817

155,318

158,461

159,010

Dilutive effect of share-based

compensation arrangements (1)

1,289

2,154

1,909

1,686

1,734

Adjusted average common shares

outstanding—diluted

154,399

155,971

157,227

160,147

160,744

Basic net income per share

$

0.99

$

0.99

$

0.92

$

0.99

$

0.92

Diluted net income per share

$

0.98

$

0.98

$

0.91

$

0.98

$

0.91

(1)

The following number of shares of our

common stock equivalents issued under our share-based compensation

arrangements are not included in the calculation of diluted net

income per share because their effect would be anti-dilutive.

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Shares of common stock equivalents

64

—

—

—

112

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

Exhibit C

June 30, 2024

March 31, 2024

December 31,

2023

September 30, 2023

June 30, 2023

(In thousands, except per-share

amounts)

Assets

Investments

$

6,588,149

$

6,327,114

$

6,085,654

$

5,885,652

$

5,895,871

Cash

13,791

26,993

18,999

55,489

61,142

Restricted cash

1,993

1,832

1,066

1,305

1,317

Accrued investment income

47,607

46,334

45,783

45,623

42,650

Accounts and notes receivable

137,777

130,095

123,857

144,614

138,432

Reinsurance recoverable

31,064

28,151

25,909

24,148

22,979

Deferred policy acquisition costs

18,566

18,561

18,718

18,817

19,272

Property and equipment, net

56,360

60,521

63,822

74,558

73,885

Goodwill and other acquired intangible

assets, net

—

—

—

11,173

12,543

Prepaid federal income taxes

837,736

750,320

750,320

696,820

663,320

Other assets

396,600

369,944

459,805

420,483

375,132

Total assets

$

8,129,643

$

7,759,865

$

7,593,933

$

7,378,682

$

7,306,543

Liabilities and stockholders’ equity

Unearned premiums

$

206,094

$

215,124

$

225,396

$

236,400

$

246,666

Reserve for losses and loss adjustment

expense

357,470

361,833

370,148

367,568

379,434

Senior notes

1,513,782

1,512,860

1,417,781

1,416,687

1,415,610

Secured borrowings

484,665

207,601

119,476

241,753

178,762

Reinsurance funds withheld

135,849

133,460

130,564

156,114

154,354

Net deferred tax liability

656,113

626,353

589,564

497,560

479,754

Other liabilities

293,351

262,902

343,199

309,701

281,127

Total liabilities

3,647,324

3,320,133

3,196,128

3,225,783

3,135,707

Common stock

172

171

173

175

177

Treasury stock

(967,218

)

(946,202

)

(945,870

)

(945,504

)

(945,032

)

Additional paid-in capital

1,356,341

1,390,436

1,430,594

1,482,712

1,522,895

Retained earnings

4,470,335

4,357,823

4,243,759

4,136,598

4,016,482

Accumulated other comprehensive income

(loss)

(377,311

)

(362,496

)

(330,851

)

(521,082

)

(423,686

)

Total stockholders’ equity

4,482,319

4,439,732

4,397,805

4,152,899

4,170,836

Total liabilities and stockholders’

equity

$

8,129,643

$

7,759,865

$

7,593,933

$

7,378,682

$

7,306,543

Shares outstanding

151,148

151,509

153,179

155,582

157,350

Book value per share

$

29.66

$

29.30

$

28.71

$

26.69

$

26.51

Holding company debt-to-capital ratio

(1)

25.2

%

25.4

%

24.4

%

25.4

%

25.3

%

(1)

Calculated as carrying value of senior

notes, which were issued and are owed by our holding company,

divided by carrying value of senior notes and stockholders’ equity.

This holding company ratio does not include the effects of amounts

owed by our subsidiaries related to secured borrowings

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations Detail

Exhibit D (page 1 of 3)

Net Premiums Earned

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Direct - Mortgage insurance

Premiums earned, excluding revenue from

cancellations

$

259,342

$

258,593

$

256,632

$

254,903

$

252,537

Single Premium Policy cancellations

2,076

2,114

2,058

3,304

3,980

Total direct - Mortgage insurance

261,418

260,707

258,690

258,207

256,517

Ceded - Mortgage insurance

Premiums earned, excluding revenue from

cancellations

(39,925

)

(38,997

)

(40,065

)

(32,363

)

(57,916

)

(1)

Single Premium Policy cancellations

(2)

732

(112

)

(444

)

(873

)

(1,114

)

Profit commission - other (3)

12,593

12,401

12,199

11,830

13,245

Total ceded premiums - Mortgage

insurance

(26,600

)

(26,708

)

(28,310

)

(21,406

)

(45,785

)

Net premiums earned - Mortgage

insurance

234,818

233,999

230,380

236,801

210,732

Net premiums earned - Title insurance

2,913

1,858

2,269

3,461

2,697

Net premiums earned

$

237,731

$

235,857

$

232,649

$

240,262

$

213,429

(1)

Includes the impact of the completed

tender offers by Eagle Re 2019-1 Ltd. and Eagle Re 2020-1 Ltd. to

purchase the mortgage insurance-linked notes that supported their

reinsurance agreements with Radian Guaranty. As a result, Radian

Guaranty incurred additional ceded premiums earned during the

second quarter of 2023 of $21 million.

(2)

Includes the impact of related profit

commissions.

(3)

The amounts represent the profit

commission under our QSR Program, excluding the impact of Single

Premium Policy cancellations.

Services Revenue

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Mortgage Insurance

Contract underwriting services

$

309

$

210

$

202

$

266

$

284

All Other

Real estate services

8,777

9,193

8,888

7,046

7,598

Title

3,540

2,573

2,713

2,964

3,233

Real estate technology

639

612

616

616

682

Total services revenue

$

13,265

$

12,588

$

12,419

$

10,892

$

11,797

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations Detail

Exhibit D (page 2 of 3)

Net Investment Income

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Fixed-maturities

$

57,924

$

57,259

$

58,669

$

58,599

$

56,439

Equity securities

3,067

2,539

3,753

3,222

3,512

Mortgage loans held for sale

5,411

1,793

1,725

1,719

574

Short-term investments

8,614

8,958

5,871

5,405

3,976

Other (1)

(1,250

)

(1,328

)

(1,194

)

(1,140

)

(1,153

)

Net investment income

$

73,766

$

69,221

$

68,824

$

67,805

$

63,348

(1)

Includes investment management expenses,

as well as the net impact from our securities lending

activities.

Provision for Losses

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Mortgage insurance

Current period defaults (1)

$

47,918

$

53,688

$

53,981

$

46,630

$

41,223

Prior period defaults (2)

(49,687

)

(60,574

)

(49,373

)

(54,887

)

(62,846

)

Total Mortgage insurance

(1,769

)

(6,886

)

4,608

(8,257

)

(21,623

)

Title insurance

24

(148

)

(438

)

122

(9

)

Total provision for losses

$

(1,745

)

$

(7,034

)

$

4,170

$

(8,135

)

$

(21,632

)

(1)

Related to defaulted loans with the most

recent default notice dated in the period indicated. For example,

if a loan had defaulted in a prior period, but then subsequently

cured and later re-defaulted in the current period, the default

would be considered a current period default.

(2)

Related to defaulted loans with a default

notice dated in a period earlier than the period indicated, which

have been continuously in default since that time.

Other Operating

Expenses

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Salaries and other base employee

expenses

$

41,431

$

39,723

$

34,182

$

33,272

$

39,032

Variable and share-based incentive

compensation

23,223

17,515

20,262

19,546

18,908

Other general operating expenses

31,623

30,262

45,186

(1)

29,812

35,655

Ceding commissions

(5,957

)

(5,644

)

(5,327

)

(5,153

)

(4,824

)

Title agent commissions

1,328

780

915

1,729

1,114

Total

$

91,648

$

82,636

$

95,218

$

79,206

$

89,885

(1)

Includes $14 million of impairment of

long-lived assets, primarily from impairments to our lease-related

assets and internal-use software.

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations Detail

Exhibit D (page 3 of 3)

Interest Expense

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Senior notes

$

21,156

$

22,128

$

20,335

$

20,320

$

20,303

Loss on extinguishment of debt (1)

—

4,275

—

—

—

Mortgage loan financing facilities

5,108

1,438

1,421

1,609

400

FHLB advances

544

945

1,059

1,039

611

Revolving credit facility

256

260

354

310

399

Other

—

—

—

4

92

Total interest expense

$

27,064

$

29,046

$

23,169

$

23,282

$

21,805

(1)

Primarily comprised of the acceleration of

remaining unamortized issuance costs related to the March 2024

redemption of our Senior Notes due 2025.

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 1 of 4)

Summarized financial information

concerning our operating segments as of and for the periods

indicated is as follows. For a definition of adjusted pretax

operating income (loss), along with a reconciliation to its

consolidated GAAP measure, see Exhibits F and G.

Three Months Ended June 30,

2024

(In thousands)

Mortgage Insurance

All Other (1)

Inter-segment

Total

Net premiums written

$

232,645

$

2,913

$

—

$

235,558

(Increase) decrease in unearned

premiums

2,173

—

—

2,173

Net premiums earned

234,818

2,913

—

237,731

Services revenue

309

13,064

(108

)

13,265

Net investment income

50,102

23,664

—

73,766

Net gains (losses) on investments and

other financial instruments

—

(49

)

—

(49

)

Other income

754

130

(12

)

872

Total

285,983

39,722

(120

)

325,585

Provision for losses

(1,769

)

24

—

(1,745

)

Policy acquisition costs

6,522

—

—

6,522

Cost of services

156

9,379

—

9,535

Other operating expenses before allocated

corporate operating expenses

17,157

26,615

(120

)

43,652

Interest expense

21,957

5,107

—

27,064

Total

44,023

41,125

(120

)

85,028

Adjusted pretax operating income (loss)

before allocated corporate operating expenses

241,960

(1,403

)

—

240,557

Allocation of corporate operating

expenses

43,197

4,677

—

47,874

Adjusted pretax operating income (loss)

(2)

$

198,763

$

(6,080

)

$

—

$

192,683

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 2 of 4)

Three Months Ended June 30,

2023

(In thousands)

Mortgage Insurance

All Other (1)

Inter-segment

Total

Net premiums written

$

214,540

$

2,697

$

—

$

217,237

(Increase) decrease in unearned

premiums

(3,808

)

—

—

(3,808

)

Net premiums earned

210,732

2,697

—

213,429

Services revenue

284

11,617

(104

)

11,797

Net investment income

48,070

15,278

—

63,348

Net gains (losses) on investments and

other financial instruments

—

95

—

95

Other income

1,246

(1

)

(4

)

1,241

Total

260,332

29,686

(108

)

289,910

Provision for losses

(21,623

)

(9

)

—

(21,632

)

Policy acquisition costs

5,218

—

—

5,218

Cost of services

143

10,114

—

10,257

Other operating expenses before allocated

corporate operating expenses

20,009

27,537

(108

)

47,438

Interest expense

21,405

400

—

21,805

Total

25,152

38,042

(108

)

63,086

Adjusted pretax operating income (loss)

before allocated corporate operating expenses

235,180

(8,356

)

—

226,824

Allocation of corporate operating

expenses

37,081

5,368

—

42,449

Adjusted pretax operating income (loss)

(2)

$

198,099

$

(13,724

)

$

—

$

184,375

(1)

All Other activities include: (i) income

(losses) from assets held by our holding company; (ii) related

general corporate operating expenses not attributable or allocated

to our reportable segments; and (iii) the operating results from

certain other immaterial activities and operating segments,

including our mortgage conduit, title, real estate services and

real estate technology businesses.

(2)

See Exhibits F and G for additional

information on the use and definition of this term and a

reconciliation to consolidated net income.

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 3 of 4)

Mortgage Insurance

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Net premiums written

$

232,645

$

231,877

$

225,112

$

235,169

$

214,540

(Increase) decrease in unearned

premiums

2,173

2,122

5,268

1,632

(3,808

)

Net premiums earned

234,818

233,999

230,380

236,801

210,732

Services revenue

309

210

202

266

284

Net investment income

50,102

49,574

51,061

49,953

48,070

Other income

754

1,240

1,302

1,237

1,246

Total

285,983

285,023

282,945

288,257

260,332

Provision for losses

(1,769

)

(6,886

)

4,608

(8,257

)

(21,623

)

Policy acquisition costs

6,522

6,794

6,147

6,920

5,218

Cost of services

156

153

157

172

143

Other operating expenses before allocated

corporate operating expenses

17,157

17,270

15,559

16,776

20,009

Interest expense

21,957

23,333

21,748

21,673

21,405

Total

44,023

40,664

48,219

37,284

25,152

Adjusted pretax operating income before

allocated corporate operating expenses

241,960

244,359

234,726

250,973

235,180

Allocation of corporate operating

expenses

43,197

34,509

36,929

31,744

37,081

Adjusted pretax operating income (1)

$

198,763

$

209,850

$

197,797

$

219,229

$

198,099

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 4 of 4)

All Other (2)

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Net premiums earned

$

2,913

$

1,858

$

2,269

$

3,461

$

2,697

Services revenue

13,064

12,493

12,311

10,723

11,617

Net investment income

23,664

19,647

17,763

17,852

15,278

Net gains (losses) on investments and

other financial instruments

(49

)

383

356

283

95

Other income

130

25

14

9

(1

)

Total (3)

39,722

34,406

32,713

32,328

29,686

Provision for losses

24

(148

)

(438

)

122

(9

)

Cost of services

9,379

9,174

8,793

8,714

10,114

Other operating expenses before allocated

corporate operating expenses

26,615

27,264

23,660

26,062

27,538

Interest expense

5,107

1,438

1,421

1,609

400

Total

41,125

37,728

33,436

36,507

38,043

Adjusted pretax operating income (loss)

before allocated corporate operating expenses

(1,403

)

(3,322

)

(723

)

(4,179

)

(8,357

)

Allocation of corporate operating

expenses

4,677

3,711

5,340

4,595

5,367

Adjusted pretax operating income (loss)

(1)

$

(6,080

)

$

(7,033

)

$

(6,063

)

$

(8,774

)

$

(13,724

)

(1)

See Exhibits F and G for additional information on the use and

definition of this term and a reconciliation to consolidated net

income.

(2)

All Other activities include: (i) income (losses) from assets held

by our holding company; (ii) related general corporate operating

expenses not attributable or allocated to our reportable segments;

and (iii) the operating results from certain other immaterial

activities and operating segments, including our mortgage conduit,

title, real estate services and real estate technology businesses.

(3)

Details of All Other revenue are as follows.

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Holding company (a)

$

17,042

$

16,536

$

15,374

$

15,601

$

14,202

Real estate services

9,110

9,517

9,014

7,126

7,676

Title

7,047

4,997

5,516

6,948

6,422

Mortgage conduit

5,815

2,690

2,171

2,020

678

Real estate technology

708

666

638

633

708

Total

$

39,722

$

34,406

$

32,713

$

32,328

$

29,686

(a)

Consists of net investment income earned

from assets held by Radian Group, our holding company, that are not

attributable or allocated to our underlying businesses.

Selected Mortgage Insurance

Key Ratios

2024

2023

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Loss ratio (1)

(0.8

)%

(2.9

)%

2.0

%

(3.5

)%

(10.3

)%

Expense ratio (2)

28.5

%

25.0

%

25.5

%

23.4

%

29.6

%

(1)

For our Mortgage Insurance segment,

calculated as provision for losses expressed as a percentage of net

premiums earned.

(2)

For our Mortgage Insurance segment,

calculated as operating expenses, (which consist of policy

acquisition costs and other operating expenses, as well as

allocated corporate operating expenses), expressed as a percentage

of net premiums earned.

Radian Group Inc. and Subsidiaries

Definition of Consolidated Non-GAAP Financial Measures Exhibit F

(page 1 of 2)

Use of Non-GAAP Financial Measures

In addition to the traditional GAAP financial measures, we have

presented “adjusted pretax operating income (loss),” “adjusted

diluted net operating income (loss) per share” and “adjusted net

operating return on equity,” which are non-GAAP financial measures

for the consolidated company, among our key performance indicators

to evaluate our fundamental financial performance. These non-GAAP

financial measures align with the way our business performance is

evaluated by both management and by our board of directors. These

measures have been established in order to increase transparency

for the purposes of evaluating our operating trends and enabling

more meaningful comparisons with our peers. Although on a

consolidated basis adjusted pretax operating income (loss),

adjusted diluted net operating income (loss) per share and adjusted

net operating return on equity are non-GAAP financial measures, we

believe these measures aid in understanding the underlying

performance of our operations. Our senior management, including our

Chief Executive Officer (Radian’s chief operating decision maker),

uses adjusted pretax operating income (loss) as our primary measure

to evaluate the fundamental financial performance of our businesses

and to allocate resources to them.

Adjusted pretax operating income (loss) is defined as GAAP

consolidated pretax income (loss) excluding the effects of: (i) net

gains (losses) on investments and other financial instruments,

except for certain investments and other financial instruments

attributable to our reportable segment or All Other activities;

(ii) amortization and impairment of goodwill and other acquired

intangible assets; and (iii) impairment of other long-lived assets

and other non-operating items, if any, such as gains (losses) from

the sale of lines of business, acquisition-related income

(expenses) and gains (losses) on extinguishment of debt. Adjusted

diluted net operating income (loss) per share is calculated by

dividing adjusted pretax operating income (loss) attributable to

common stockholders, net of taxes computed using the company’s

statutory tax rate, by the sum of the weighted average number of

common shares outstanding and all dilutive potential common shares

outstanding. Adjusted net operating return on equity is calculated

by dividing annualized adjusted pretax operating income (loss), net

of taxes computed using the company’s statutory tax rate, by

average stockholders’ equity, based on the average of the beginning

and ending balances for each period presented.

Although adjusted pretax operating income (loss) excludes

certain items that have occurred in the past and are expected to

occur in the future, the excluded items represent those that are:

(i) not viewed as part of the operating performance of our primary

activities or (ii) not expected to result in an economic impact

equal to the amount reflected in pretax income (loss). These

adjustments, along with the reasons for their treatment, are

described below.

(1)

Net gains (losses) on investments and

other financial instruments. The recognition of realized

investment gains or losses can vary significantly across periods as

the activity is highly discretionary based on the timing of

individual securities sales due to such factors as market

opportunities, our tax and capital profile and overall market

cycles. Unrealized gains and losses arise primarily from changes in

the market value of our investments that are classified as trading

or equity securities. These valuation adjustments may not

necessarily result in realized economic gains or losses.

Trends in the profitability of our

fundamental operating activities can be more clearly identified

without the fluctuations of these realized and unrealized gains or

losses and changes in fair value of other financial instruments.

Except for certain investments and other financial instruments

attributable to specific operating segments, we do not view them to

be indicative of our fundamental operating activities.

(2)

Amortization and impairment of goodwill

and other acquired intangible assets. Amortization of acquired

intangible assets represents the periodic expense required to

amortize the cost of acquired intangible assets over their

estimated useful lives. Acquired intangible assets are also

periodically reviewed for potential impairment, and impairment

adjustments are made whenever appropriate. We do not view these

charges as part of the operating performance of our primary

activities.

(3)

Impairment of other long-lived assets

and other non-operating items, if any. Impairment of other

long-lived assets and other non-operating items includes activities

that we do not view to be indicative of our fundamental operating

activities, such as: (i) impairment of internal-use software and

other long-lived assets; (ii) gains (losses) from the sale of lines

of business; (iii) acquisition-related income and expenses; and

(iv) gains (losses) on extinguishment of debt.

Radian Group Inc. and

Subsidiaries

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit F (page 2 of 2)

See Exhibit G for the reconciliations of the most comparable

GAAP measures, consolidated pretax income (loss), diluted net

income (loss) per share and return on equity to our non-GAAP

financial measures for the consolidated company, adjusted pretax

operating income (loss), adjusted diluted net operating income

(loss) per share and adjusted net operating return on equity,

respectively.

Total adjusted pretax operating income (loss), adjusted diluted

net operating income (loss) per share and adjusted net operating

return on equity should not be considered in isolation or viewed as

substitutes for GAAP pretax income (loss), diluted net income

(loss) per share, return on equity or net income (loss). Our

definitions of adjusted pretax operating income (loss) and adjusted

diluted net operating income (loss) per share may not be comparable

to similarly-named measures reported by other companies.

Radian Group Inc. and

Subsidiaries

Consolidated Non-GAAP Financial Measure

Reconciliations

Exhibit G (page 1 of 2)

Reconciliation of Consolidated

Pretax Income to Adjusted Pretax Operating Income

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Consolidated pretax income

$

188,123

$

198,649

$

179,817

$

200,983

$

182,676

Less reconciling income (expense)

items

Net gains (losses) on investments and

other financial instruments (1)

(4,438

)

107

13,091

(8,838

)

(331

)

Amortization and impairment of goodwill

and other acquired intangible assets

—

—

(11,173

)

(1,371

)

(1,370

)

Impairment of other long-lived assets and

other non-operating items

(122

)

(4,275

)

(2)

(13,835

)

(3)

737

2

Total adjusted pretax operating income

(4)

$

192,683

$

202,817

$

191,734

$

210,455

$

184,375

(1)

Excludes certain net gains (losses), if

any, on investments and other financial instruments that are

attributable to specific operating segments and therefore included

in adjusted pretax operating income (loss).

(2)

This amount is included in interest expense on the Condensed

Consolidated Statement of Operations in Exhibit A and relates to

the loss on extinguishment of debt.

(3)

This amount is included in other operating

expenses on the Condensed Consolidated Statement of Operations in

Exhibit A and primarily relates to impairment of other long-lived

assets.

(4)

Total adjusted pretax operating income consists of adjusted pretax

operating income (loss) for our reportable segment and All Other

activities as follows.

2024

2023

(In thousands)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Adjusted pretax operating income

(loss)

Mortgage Insurance segment

$

198,763

$

209,850

$

197,797

$

219,229

$

198,099

All Other activities

(6,080

)

(7,033

)

(6,063

)

(8,774

)

(13,724

)

Total adjusted pretax operating income

$

192,683

$

202,817

$

191,734

$

210,455

$

184,375

Reconciliation of Diluted Net

Income Per Share to Adjusted Diluted Net Operating Income Per

Share

2024

2023

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Diluted net income per share

$

0.98

$

0.98

$

0.91

$

0.98

$

0.91

Less per-share impact of reconciling

income (expense) items

Net gains (losses) on investments and

other financial instruments

(0.03

)

—

0.08

(0.06

)

—

Amortization and impairment of goodwill

and other acquired intangible assets

—

—

(0.07

)

(0.01

)

(0.01

)

Impairment of other long-lived assets and

other non-operating items

—

(0.03

)

(0.09

)

0.01

—

Income tax (provision) benefit on

reconciling income (expense) items (1)

—

0.01

0.02

0.01

—

Difference between statutory and effective

tax rates

0.02

(0.03

)

0.01

(0.01

)

0.01

Per-share impact of reconciling income

(expense) items

(0.01

)

(0.05

)

(0.05

)

(0.06

)

—

Adjusted diluted net operating income per

share (1)

$

0.99

$

1.03

$

0.96

$

1.04

$

0.91

(1)

Calculated using the company’s federal

statutory tax rate of 21%.

Radian Group Inc. and

Subsidiaries

Consolidated Non-GAAP Financial Measure

Reconciliations

Exhibit G (page 2 of 2)

Reconciliation of Return on

Equity to Adjusted Net Operating Return on Equity (1)

2024

2023

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

Return on equity (1)

13.6

%

13.8

%

13.4

%

15.0

%

14.1

%

Less impact of reconciling income

(expense) items (2)

Net gains (losses) on investments and

other financial instruments

(0.4

)

—

1.2

(0.9

)

—

Amortization and impairment of goodwill

and other acquired intangible assets

—

—

(1.0

)

(0.2

)

(0.1

)

Impairment of other long-lived assets and

other non-operating items

—

(0.4

)

(1.3

)

0.1

—

Income tax (provision) benefit on

reconciling income (expense) items (3)

0.1

0.1

0.2

0.2

(0.1

)

Difference between statutory and effective

tax rates

0.3

(0.4

)

0.1

(0.2

)

0.2

Impact of reconciling income (expense)

items

—

(0.7

)

(0.8

)

(1.0

)

—

Adjusted net operating return on equity

(3)

13.6

%

14.5

%

14.2

%

16.0

%

14.1

%

(1)

Calculated by dividing annualized net

income by average stockholders’ equity, based on the average of the

beginning and ending balances for each period presented.

(2)

Annualized, as a percentage of average

stockholders’ equity.

(3)

Calculated using the company’s federal

statutory tax rate of 21%.

On a consolidated basis, “adjusted pretax operating income

(loss),” “adjusted diluted net operating income (loss) per share”

and “adjusted net operating return on equity” are measures not

determined in accordance with GAAP. These measures should not be

considered in isolation or viewed as substitutes for GAAP pretax

income (loss), diluted net income (loss) per share, return on

equity or net income (loss).

Our definitions of adjusted pretax operating income (loss),

adjusted diluted net operating income (loss) per share and adjusted

net operating return on equity may not be comparable to

similarly-named measures reported by other companies. See Exhibit F

for additional information on our consolidated non-GAAP financial

measures.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - New Insurance Written

Exhibit H

2024

2023

($ in millions)

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Qtr 2

NIW

$

13,902

$

11,534

$

10,629

$

13,922

$

16,946

NIW by premium type

Direct monthly and other recurring

premiums

96.5

%

96.7

%

96.4

%

96.0

%

96.5

%

Direct single premiums

3.5

%

3.3

%

3.6

%

4.0

%

3.5

%

NIW for purchases

98.3

%

96.9

%

98.8

%

98.7

%

98.6

%

NIW for refinances

1.7

%

3.1

%

1.2

%

1.3

%

1.4

%

NIW by FICO score (1)

>=740

69.4

%

67.3

%

66.5

%

67.3

%

66.1

%

680-739

25.5

27.1

27.9

27.4

28.4

620-679

5.1

5.6

5.6

5.3

5.5

<=619

0.0

0.0

0.0

0.0

0.0

Total NIW

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

NIW by LTV (2)

95.01% and above

16.5

%

15.4

%

15.4

%

16.5

%

17.9

%

90.01% to 95.00%

37.2

40.8

40.0

38.6

39.1

85.01% to 90.00%

32.4

31.3

31.3

30.2

29.5

85.00% and below

13.9

12.5

13.3

14.7

13.5

Total NIW

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

(1)

For loans with multiple borrowers, the

percentage of NIW by FICO score represents the lowest of the

borrowers’ FICO scores at origination.

(2)

At origination.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - Primary Insurance in Force and Risk in Force

Exhibit I

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

($ in millions)

Primary insurance in force

$

272,827

$

270,986

$

269,979

$

269,511

$

266,859

Primary risk in force (“RIF”)

$

71,109

$

70,299

$

69,710

$

69,298

$

68,323

Primary RIF by premium type

Direct monthly and other recurring

premiums

89.5

%

89.2

%

88.9

%

88.6

%

88.2

%

Direct single premiums

10.5

%

10.8

%

11.1

%

11.4

%

11.8

%

Primary RIF by FICO score (1)

>=740

59.2

%

58.8

%

58.5

%

58.2

%

57.8

%

680-739

33.3

33.6

33.9

34.0

34.3

620-679

7.2

7.3

7.3

7.4

7.5

<=619

0.3

0.3

0.3

0.4

0.4

Total

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Primary RIF by LTV (2)

95.01% and above

19.2

%

18.9

%

18.6

%

18.4

%

18.0

%

90.01% to 95.00%

48.1

48.2

48.2

48.2

48.4

85.01% to 90.00%

27.3

27.1

27.1

27.0

26.9

85.00% and below

5.4

5.8

6.1

6.4

6.7

Total

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Persistency Rate (12 months ended)

84.3

%

84.3

%

84.0

%

83.6

%

82.8

%

Persistency Rate (quarterly, annualized)

(3)

83.5

%

85.3

%

85.8

%

84.2

%

83.5

%

(1)

For loans with multiple borrowers, the

percentage of primary RIF by FICO score represents the lowest of

the borrowers’ FICO scores at origination.

(2)

At origination.

(3)

The Persistency Rate on a quarterly,

annualized basis is calculated based on loan-level detail for the

quarter ending as of the date shown. It may be impacted by

seasonality or other factors, including the level of refinance

activity during the applicable periods and may not be indicative of

full-year trends.

FORWARD-LOOKING STATEMENTS

All statements in this press release that address events,

developments or results that we expect or anticipate may occur in

the future are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934 and the U.S. Private Securities

Litigation Reform Act of 1995. In most cases, forward-looking

statements may be identified by words such as “anticipate,” “may,”

“will,” “could,” “should,” “would,” “expect,” “intend,” “plan,”

“goal,” “contemplate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “seek,” “strategy,” “future,” “likely” or

the negative or other variations on these words and other similar

expressions. These statements, which may include, without

limitation, projections regarding our future performance and

financial condition, are made on the basis of management’s current

views and assumptions with respect to future events. These

statements speak only as of the date they were made, and we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. We operate in a changing environment where new risks

emerge from time to time and it is not possible for us to predict

all risks that may affect us. The forward-looking statements are

not guarantees of future performance, and the forward-looking

statements, as well as our prospects as a whole, are subject to

risks and uncertainties that could cause actual results to differ

materially from those set forth in the forward-looking statements.

These risks and uncertainties include, without limitation:

- the health of the U.S. housing market generally and changes in

economic conditions that impact the size of the insurable mortgage

market, the credit performance of our insured mortgage portfolio

and our business prospects, including changes resulting from

inflationary pressures, the higher interest rate environment and

the risk of higher unemployment rates, as well as other

macroeconomic stresses and uncertainties, including potential

impacts resulting from political and geopolitical events;

- changes in the way customers, investors, ratings agencies,

regulators or legislators perceive our performance, financial

strength and future prospects;

- Radian Guaranty’s ability to remain eligible under the PMIERs

to insure loans purchased by the GSEs;

- our ability to maintain an adequate level of capital in our

insurance subsidiaries to satisfy current and future regulatory

requirements;

- changes in the charters or business practices of, or rules or

regulations imposed by or applicable to, the GSEs or loans

purchased by the GSEs, or changes in the requirements for Radian

Guaranty to remain an approved insurer to the GSEs, such as changes

in the PMIERs or the GSEs’ interpretation and application of the

PMIERs or other applicable requirements;

- the effects of the Enterprise Regulatory Capital Framework,

finalized in February 2022, which establishes a new regulatory

capital framework for the GSEs, and which, as finalized, increases

the capital requirements for the GSEs, and among other things,

could impact the GSEs’ operations and pricing as well as the size

of the insurable mortgage market;

- changes in the current housing finance system in the United

States, including the roles of the FHA, the VA, the GSEs and

private mortgage insurers in this system;

- our ability to successfully execute and implement our capital

plans, including our risk distribution strategy through the capital

markets and traditional reinsurance markets, and to maintain

sufficient holding company liquidity to meet our liquidity

needs;

- our ability to successfully execute and implement our business

plans and strategies, including plans and strategies that may

require GSE and/or regulatory approvals and licenses, that are

subject to complex compliance requirements that we may be unable to

satisfy, or that may expose us to new risks, including those that

could impact our capital and liquidity positions;

- risks related to the quality of third-party mortgage

underwriting and mortgage loan servicing;

- a decrease in the Persistency Rates of our mortgage insurance

on Monthly Premium Policies;

- competition in the private mortgage insurance industry

generally, and more specifically: price competition in our mortgage

insurance business and competition from the FHA and the VA as well

as from other forms of credit enhancement, such as any potential

GSE-sponsored alternatives to traditional mortgage insurance;

- U.S. political conditions, which may be more volatile and

present a heightened risk in Presidential election years, and

legislative and regulatory activity (or inactivity), including

adoption of (or failure to adopt) new laws and regulations, or

changes in existing laws and regulations, or the way they are

interpreted or applied;

- legal and regulatory claims, assertions, actions, reviews,

audits, inquiries and investigations that could result in adverse

judgments, settlements, fines, injunctions, restitutions or other

relief that could require significant expenditures, new or

increased reserves or have other effects on our business;

- the amount and timing of potential payments or adjustments

associated with federal or other tax examinations;

- the possibility that we may fail to estimate accurately,

especially in the event of an extended economic downturn or a

period of extreme market volatility and economic uncertainty, the

likelihood, magnitude and timing of losses in establishing loss

reserves for our mortgage insurance business or to accurately

calculate and/or project our Available Assets and Minimum Required

Assets under the PMIERs, which could be impacted by, among other

things, the size and mix of our IIF, future changes to the PMIERs,

the level of defaults in our portfolio, the reported status of

defaults in our portfolio (including whether they are subject to

mortgage forbearance, a repayment plan or a loan modification trial

period), the level of cash flow generated by our insurance

operations and our risk distribution strategies;

- volatility in our financial results caused by changes in the

fair value of our assets and liabilities, including with respect to

our use of derivatives and within our investment portfolio;

- changes in GAAP or SAP rules and guidance, or their

interpretation;

- risks associated with investments to grow our existing

businesses, or to pursue new lines of business or new products and

services, including our ability and related costs to develop,

launch and implement new and innovative technologies and digital

products and services, whether these products and services receive

broad customer acceptance or disrupt existing customer

relationships, and additional financial risks related to these

investments, including required changes in our investment,

financing and hedging strategies, risks associated with our

increased use of financial leverage, which could expose us to

liquidity risks resulting from changes in the fair values of

assets, and the risk that we may fail to achieve forecasted

results, which could result in lower or negative earnings

contribution;

- the effectiveness and security of our information technology

systems and digital products and services, including the risk that

these systems, products or services fail to operate as expected or

planned or expose us to cybersecurity or third-party risks,

including due to malware, unauthorized access, cyberattack,

ransomware or other similar events;

- our ability to attract and retain key employees;

- the amount of dividends, if any, that our insurance

subsidiaries may distribute to us, which under applicable

regulatory requirements is based primarily on the financial

performance of our insurance subsidiaries, and therefore, may be

impacted by general economic, competitive and other factors, many

of which are beyond our control; and

- the ability of our operating subsidiaries to distribute amounts

to us under our internal tax- and expense-sharing arrangements,

which for our insurance subsidiaries are subject to regulatory

review and could be terminated at the discretion of such

regulators.

For more information regarding these risks and uncertainties as

well as certain additional risks that we face, you should refer to

“Item 1A. Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023, and to subsequent reports and

registration statements filed from time to time with the U.S.

Securities and Exchange Commission. We caution you not to place

undue reliance on these forward-looking statements, which are

current only as of the date on which we issued this press release.

We do not intend to, and we disclaim any duty or obligation to,

update or revise any forward-looking statements to reflect new

information or future events or for any other reason.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240726283220/en/

For Investors Dan Kobell - Phone: 215.231.1113 email:

daniel.kobell@radian.com

For Media Rashi Iyer - Phone: 215.231.1167 email:

rashi.iyer@radian.com

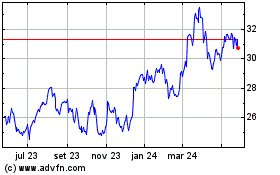

Radian (NYSE:RDN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

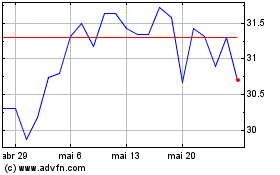

Radian (NYSE:RDN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024