— Third quarter net income of $152 million, or

$0.99 per diluted share —

— Return on equity of 13.2% —

— Book value per share growth of 18%

year-over-year to $31.37 —

— Returned $86 million of capital to

stockholders through dividends and share repurchases —

— Holding company debt-to-capital ratio reduced

to 18.5% following retirement of $450 million senior notes —

— $185 million ordinary dividend paid from

Radian Guaranty to holding company during the third quarter —

— Available holding company liquidity of $844

million and PMIERs excess Available Assets of $2.1 billion —

Radian Group Inc. (NYSE: RDN) today reported net income for the

quarter ended September 30, 2024, of $152 million, or $0.99 per

diluted share. This compares with net income for the quarter ended

September 30, 2023, of $157 million, or $0.98 per diluted

share.

Adjusted pretax operating income for the quarter ended September

30, 2024, was $199 million, or $1.03 per diluted share. This

compares with adjusted pretax operating income for the quarter

ended September 30, 2023, of $210 million, or $1.04 per diluted

share.

Key Financial Highlights

Quarter ended

($ in millions, except per-share

amounts)

September 30, 2024

June 30, 2024

September 30, 2023

Total revenues

$334

$321

$313

Net income

$152

$152

$157

Diluted net income per share

$0.99

$0.98

$0.98

Consolidated pretax income

$195

$188

$201

Adjusted pretax operating income

(1)

$199

$193

$210

Adjusted diluted net operating

income per share (1) (2)

$1.03

$0.99

$1.04

Return on equity (3)

13.2%

13.6%

15.0%

Adjusted net operating return on

equity (1) (2)

13.7%

13.6%

16.0%

New Insurance Written (NIW) -

mortgage insurance

$13,493

$13,902

$13,922

Net premiums earned - mortgage

insurance

$235

$235

$237

New defaults

13,708

11,104

11,156

Provision for losses - mortgage

insurance

$6

$(2)

$(8)

As of

($ in millions, except per-share

amounts)

September 30, 2024

June 30, 2024

September 30, 2023

Book value per share

$31.37

$29.66

$26.69

Accumulated other comprehensive

income (loss) value per share (4)

$(1.56)

$(2.50)

$(3.35)

PMIERs Available Assets (5)

$5,984

$5,978

$5,758

PMIERs excess Available Assets

(6)

$2,122

$2,206

$1,670

Available holding company

liquidity (7)

$844

$1,190

$1,004

Total investments

$6,497

$6,588

$5,886

Residential mortgage loans held

for sale, at fair value (8)

$530

$458

$138

Primary mortgage insurance in

force

$274,721

$272,827

$269,511

Percentage of primary loans in

default (9)

2.25%

2.04%

2.03%

Mortgage insurance loss

reserves

$357

$351

$362

(1)

Adjusted results, including adjusted

pretax operating income, adjusted diluted net operating income per

share and adjusted net operating return on equity, are non-GAAP

financial measures. For definitions and reconciliations of these

measures to the comparable GAAP measures, see Exhibits F and G.

(2)

Calculated using the Company’s federal

statutory tax rate of 21%.

(3)

Calculated by dividing annualized net

income by average stockholders’ equity, based on the average of the

beginning and ending balances for each period presented.

(4)

Included in book value per share for each

period presented.

(5)

Represents Radian Guaranty’s Available

Assets, calculated in accordance with the Private Mortgage Insurer

Eligibility Requirements (PMIERs) financial requirements in effect

for each date shown.

(6)

Represents Radian Guaranty’s excess or

“cushion” of Available Assets over its Minimum Required Assets,

calculated in accordance with the PMIERs financial requirements in

effect for each date shown.

(7)

Represents Radian Group’s available

liquidity after the repayment of our $450 million senior notes

without considering available capacity under its undrawn $275

million unsecured revolving credit facility.

(8)

Included in total investments on our

condensed consolidated balance sheets.

(9)

Represents the number of primary loans in

default as a percentage of the total number of insured primary

loans.

Book value per share at September 30, 2024, was $31.37, compared

to $29.66 at June 30, 2024, and $26.69 at September 30, 2023. This

represents an 18% growth in book value per share at September 30,

2024, as compared to September 30, 2023, and includes accumulated

other comprehensive income (loss) of $(1.56) per share as of

September 30, 2024, and $(3.35) per share as of September 30, 2023.

Changes in accumulated other comprehensive income (loss) are

primarily from net unrealized gains or losses on investments as a

result of decreases or increases, respectively, in market interest

rates.

“We were pleased to deliver another quarter of excellent

financial results for Radian, increasing book value per share by

18% year-over-year, generating net income of $152 million, and

growing our primary mortgage insurance in force, which is the main

driver of future earnings for our company, to $275 billion,” said

Radian’s Chief Executive Officer Rick Thornberry. “These results

reflect the economic value of our high-quality mortgage insurance

portfolio, the strength and quality of our investment portfolio,

our strong capital and liquidity positions, the depth of our

customer relationships and the dedication of our team.”

THIRD QUARTER HIGHLIGHTS

- NIW was $13.5 billion in the third quarter of 2024, compared to

$13.9 billion in the second quarter of 2024, and $13.9 billion in

the third quarter of 2023.

- Purchase NIW decreased 3% in the third quarter of 2024 compared

to the second quarter of 2024 and decreased 3% compared to the

third quarter of 2023.

- Refinances accounted for 4% of total NIW in the third quarter

of 2024, compared to 2% in the second quarter of 2024, and 1% in

the third quarter of 2023.

- Total primary mortgage insurance in force of $274.7 billion as

of September 30, 2024, compared to $272.8 billion as of June 30,

2024, and $269.5 billion as of September 30, 2023.

- Persistency, which is the percentage of mortgage insurance that

remains in force after a twelve-month period, was 84% for the

twelve months ended September 30, 2024, compared to 84% for the

twelve months ended June 30, 2024, and 84% for the twelve months

ended September 30, 2023.

- Annualized persistency for the three months ended September 30,

2024, was 84%, compared to 84% for the three months ended June 30,

2024, and 84% for the three months ended September 30, 2023.

- Net mortgage insurance premiums earned were $235 million for

the third quarter of 2024, compared to $235 million for the second

quarter of 2024, and $237 million for the third quarter of

2023.

- Mortgage insurance in force portfolio premium yield was 38.2

basis points in the third quarter of 2024. This compares to 38.2

basis points in the second quarter of 2024 and 38.0 basis points in

the third quarter of 2023.

- Total net mortgage insurance premium yield, which includes the

impact of ceded premiums earned and accrued profit commission, was

34.4 basis points in the third quarter of 2024. This compares to

34.5 basis points in the second quarter of 2024, and 35.3 basis

points in the third quarter of 2023.

- Details regarding premiums earned may be found in Exhibit

D.

- The mortgage insurance provision for losses was a provision of

$6 million in the third quarter of 2024, compared to a benefit of

$2 million in the second quarter of 2024 and a benefit of $8

million in the third quarter of 2023.

- Favorable reserve development on prior period defaults was $51

million in the third quarter of 2024, compared to $50 million in

the second quarter of 2024 and $55 million in the third quarter of

2023.

- The number of primary delinquent loans was 22,350 as of

September 30, 2024, compared to 20,276 as of June 30, 2024, and

20,406 as of September 30, 2023. This increase in delinquent loans

is consistent with seasonal credit trends and the natural seasoning

of the insured portfolio, and reflects the growth in the company’s

total primary mortgage insurance in force in recent years.

- The loss ratio in the third quarter of 2024 was 3%, compared to

(1)% in the second quarter of 2024, and (4)% in the third quarter

of 2023.

- Total mortgage insurance claims paid were $3 million in the

third quarter of 2024, compared to $6 million in the second quarter

of 2024 and $5 million in the third quarter of 2023.

- Additional details regarding mortgage insurance provision for

losses may be found in Exhibit D.

- During the third quarter of 2024, Radian Mortgage Capital

closed its inaugural private-label prime jumbo mortgage

securitization transaction of $349 million.

- Radian Group’s wholly owned subsidiary, Radian Investment Group

Inc., retained certificates from the securitization with an initial

fair value of $6 million and is considered to be the primary

beneficiary of the securitization trust. As a result, Radian Group

is consolidating the trust, which is a variable interest entity

(“VIE”), in its financial statements. The consolidation of the VIE

did not have a material impact on Radian Group’s results of

operations in the third quarter of 2024.

- Additional details regarding the income statement and balance

sheet impacts of the VIE can be found in Exhibit A and Exhibit C,

respectively.

- Other operating expenses were $86 million in the third quarter

of 2024, compared to $92 million in the second quarter of 2024, and

$79 million in the third quarter of 2023.

- Other operating expenses decreased in the third quarter of 2024

as compared to the second quarter of 2024. The decrease in other

operating expenses was partially offset by a $10 million impairment

on internal-use software recognized in the third quarter of

2024.

- Additional details regarding other operating expenses may be

found in Exhibit D.

CAPITAL AND LIQUIDITY UPDATE

Radian Group

- As previously announced, Radian Group completed the redemption

of its 2024 senior notes in the amount of $450 million in the third

quarter of 2024. This redemption resulted in a corresponding $450

million reduction in holding company debt and reduced the holding

company debt-to-capital ratio to 18.5% as of September 30,

2024.

- As of September 30, 2024, Radian Group maintained $844 million

of available liquidity. Total holding company liquidity, including

the company’s undrawn $275 million unsecured revolving credit

facility, was $1.1 billion as of September 30, 2024.

- During the third quarter of 2024, the company repurchased 1.5

million shares of Radian Group common stock at a total cost of $49

million. As of September 30, 2024, purchase authority of up to $618

million remained available under the existing program.

- Radian Group paid a dividend on its common stock in the amount

of $0.245 per share, totaling $37 million, on September 11,

2024.

Radian Guaranty

- Radian Guaranty paid an ordinary dividend to Radian Group of

$185 million in the third quarter of 2024, bringing total

year-to-date ordinary dividends paid to $485 million.

- At September 30, 2024, Radian Guaranty’s Available Assets under

PMIERs totaled $6.0 billion, resulting in PMIERs excess Available

Assets of $2.1 billion.

CONFERENCE CALL

Radian will discuss third quarter 2024 financial results in a

conference call tomorrow, Thursday, November 7, 2024, at 10:00 a.m.

Eastern time. The conference call will be webcast live on the

company’s website at

https://radian.com/who-we-are/for-investors/webcasts or at

www.radian.com. The webcast is listen-only. Those interested in

participating in the question-and-answer session should follow the

conference call dial-in instructions below.

The call may be accessed via telephone by registering for the

call here to receive the dial-in numbers and unique PIN. It is

recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call).

A digital replay of the webcast will be available on Radian’s

website approximately two hours after the live broadcast ends for a

period of one year at

https://radian.com/who-we-are/for-investors/webcasts.

In addition to the information provided in the company’s

earnings news release, other statistical and financial information,

which is expected to be referred to during the conference call,

will be available on Radian’s website at www.radian.com, under

Investors.

NON-GAAP FINANCIAL MEASURES

Radian believes that adjusted pretax operating income (loss),

adjusted diluted net operating income (loss) per share and adjusted

net operating return on equity (non-GAAP measures) facilitate

evaluation of the company’s fundamental financial performance and

provide relevant and meaningful information to investors about the

ongoing operating results of the company. On a consolidated basis,

these measures are not recognized in accordance with accounting

principles generally accepted in the United States of America

(GAAP) and should not be considered in isolation or viewed as

substitutes for GAAP measures of performance. The measures

described below have been established in order to increase

transparency for the purpose of evaluating the company’s operating

trends and enabling more meaningful comparisons with Radian’s

competitors.

Adjusted pretax operating income (loss) is defined as GAAP

consolidated pretax income (loss) excluding the effects of: (i) net

gains (losses) on investments and other financial instruments,

except for those investments and other financial instruments

attributable to our Mortgage Conduit business; (ii) amortization

and impairment of goodwill and other acquired intangible assets;

and (iii) impairment of other long-lived assets and other

non-operating items, if any, such as gains (losses) from the sale

of lines of business, acquisition-related income (expenses) and

gains (losses) on extinguishment of debt. Adjusted diluted net

operating income (loss) per share is calculated by dividing

adjusted pretax operating income (loss) attributable to common

stockholders, net of taxes computed using the company’s statutory

tax rate, by the sum of the weighted average number of common

shares outstanding and all dilutive potential common shares

outstanding. Adjusted net operating return on equity is calculated

by dividing annualized adjusted pretax operating income (loss), net

of taxes computed using the company’s statutory tax rate, by

average stockholders’ equity, based on the average of the beginning

and ending balances for each period presented.

See Exhibit F or Radian’s website for a description of these

items, as well as Exhibit G for reconciliations to the most

comparable consolidated GAAP measures.

ABOUT RADIAN

Radian Group Inc. (NYSE: RDN) is ensuring the American dream of

homeownership responsibly and sustainably through products and

services that include industry-leading mortgage insurance and a

comprehensive suite of mortgage, risk, real estate, securitization,

and title services. Powered by technology, informed by data and

driven to deliver new and better ways to transact and manage risk,

Radian is shaping the future of mortgage and real estate services.

Learn more at www.radian.com.

FINANCIAL RESULTS AND SUPPLEMENTAL INFORMATION CONTENTS

(Unaudited)

Exhibit A:

Condensed Consolidated Statements of

Operations

Exhibit B:

Net Income Per Share

Exhibit C:

Condensed Consolidated Balance Sheets

Exhibit D:

Condensed Consolidated Statements of

Operations Detail

Exhibit E:

Segment Information

Exhibit F:

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit G:

Consolidated Non-GAAP Financial Measure

Reconciliations

Exhibit H:

Mortgage Insurance Supplemental

Information - New Insurance Written

Exhibit I:

Mortgage Insurance Supplemental

Information - Primary Insurance in Force and Risk in Force

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations (1)

Exhibit A

2024

2023

(In thousands, except per-share

amounts)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Revenues

Net premiums earned

$

239,133

$

237,731

$

235,857

$

232,649

$

240,262

Services revenue

12,167

13,265

12,588

12,419

10,892

Net investment income

78,396

73,766

69,221

68,824

67,805

Net gains (losses) on investments and

other financial instruments

2,174

(4,487

)

490

13,447

(8,555

)

Income (loss) on consolidated VIEs

465

—

—

—

—

Other income

1,522

872

1,262

1,305

2,109

Total revenues

333,857

321,147

319,418

328,644

312,513

Expenses

Provision for losses

6,889

(1,745

)

(7,034

)

4,170

(8,135

)

Policy acquisition costs

6,724

6,522

6,794

6,147

6,920

Cost of services

9,542

9,535

9,327

8,950

8,886

Other operating expenses

85,919

91,648

82,636

95,218

79,206

Interest expense

29,391

27,064

29,046

23,169

23,282

Impairment of goodwill

—

—

—

9,802

—

Amortization of other acquired intangible

assets

—

—

—

1,371

1,371

Total expenses

138,465

133,024

120,769

148,827

111,530

Pretax income

195,392

188,123

198,649

179,817

200,983

Income tax provision

43,500

36,220

46,295

37,124

44,401

Net income

$

151,892

$

151,903

$

152,354

$

142,693

$

156,582

Diluted net income per share

$

0.99

$

0.98

$

0.98

$

0.91

$

0.98

(1) See Exhibit D for additional

details.

Radian Group Inc. and

Subsidiaries

Net Income Per Share

Exhibit B

The calculation of basic and diluted net

income per share is as follows.

2024

2023

(In thousands, except per-share

amounts)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Net income—basic and diluted

$

151,892

$

151,903

$

152,354

$

142,693

$

156,582

Average common shares

outstanding—basic

151,846

153,110

153,817

155,318

158,461

Dilutive effect of share-based

compensation arrangements (1)

1,227

1,289

2,154

1,909

1,686

Adjusted average common shares

outstanding—diluted

153,073

154,399

155,971

157,227

160,147

Basic net income per share

$

1.00

$

0.99

$

0.99

$

0.92

$

0.99

Diluted net income per share

$

0.99

$

0.98

$

0.98

$

0.91

$

0.98

(1)

The following number of shares of

our common stock equivalents issued under our share-based

compensation arrangements are not included in the calculation of

diluted net income per share because their effect would be

anti-dilutive.

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Shares of common stock equivalents

—

64

—

—

—

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

Exhibit C

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

(In thousands, except per-share

amounts)

2024

2024

2024

2023

2023

Assets

Investments

$

6,497,180

$

6,588,149

$

6,327,114

$

6,085,654

$

5,885,652

Cash

28,061

13,791

26,993

18,999

55,489

Restricted cash

2,014

1,993

1,832

1,066

1,305

Accrued investment income

49,707

47,607

46,334

45,783

45,623

Accounts and notes receivable

138,439

137,777

130,095

123,857

144,614

Reinsurance recoverable

34,015

31,064

28,151

25,909

24,148

Deferred policy acquisition costs

18,430

18,566

18,561

18,718

18,817

Property and equipment, net

41,892

56,360

60,521

63,822

74,558

Goodwill and other acquired intangible

assets, net

—

—

—

—

11,173

Prepaid federal income taxes

870,336

837,736

750,320

750,320

696,820

Other assets

384,666

396,600

369,944

459,805

420,483

Consolidated VIE assets (1)

355,031

—

—

—

—

Total assets

$

8,419,771

$

8,129,643

$

7,759,865

$

7,593,933

$

7,378,682

Liabilities and stockholders’ equity

Unearned premiums

$

198,007

$

206,094

$

215,124

$

225,396

$

236,400

Reserve for losses and loss adjustment

expense

363,225

357,470

361,833

370,148

367,568

Senior notes

1,064,718

1,513,782

1,512,860

1,417,781

1,416,687

Secured borrowings

551,916

484,665

207,601

119,476

241,753

Reinsurance funds withheld

138,810

135,849

133,460

130,564

156,114

Net deferred tax liability

737,605

656,113

626,353

589,564

497,560

Other liabilities

318,345

293,351

262,902

343,199

309,701

Consolidated VIE liabilities (1)

348,292

—

—

—

—

Total liabilities

3,720,918

3,647,324

3,320,133

3,196,128

3,225,783

Common stock

171

172

171

173

175

Treasury stock

(967,717

)

(967,218

)

(946,202

)

(945,870

)

(945,504

)

Additional paid-in capital

1,315,046

1,356,341

1,390,436

1,430,594

1,482,712

Retained earnings

4,584,453

4,470,335

4,357,823

4,243,759

4,136,598

Accumulated other comprehensive income

(loss)

(233,100

)

(377,311

)

(362,496

)

(330,851

)

(521,082

)

Total stockholders’ equity

4,698,853

4,482,319

4,439,732

4,397,805

4,152,899

Total liabilities and stockholders’

equity

$

8,419,771

$

8,129,643

$

7,759,865

$

7,593,933

$

7,378,682

Shares outstanding

149,776

151,148

151,509

153,179

155,582

Book value per share

$

31.37

$

29.66

$

29.30

$

28.71

$

26.69

Holding company debt-to-capital ratio

(2)

18.5

%

25.2

%

25.4

%

24.4

%

25.4

%

(1)

Reflects the consolidation of

Radian Mortgage Capital’s inaugural private label securitization,

net of our retained interest in the transaction. We determined that

we are the primary beneficiary of this securitization trust, which

is considered to be a variable interest entity (“VIE”), thereby

requiring us to consolidate the VIE.

(2)

Calculated as carrying value of

senior notes, which were issued and are owed by our holding

company, divided by carrying value of senior notes and

stockholders’ equity. This holding company ratio does not include

the effects of amounts owed by our subsidiaries related to secured

borrowings.

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations Detail

Exhibit D (page 1 of 3)

Net Premiums Earned

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Direct - Mortgage insurance

Premiums earned, excluding revenue from

cancellations

$

261,726

$

259,342

$

258,593

$

256,632

$

254,903

Single Premium Policy cancellations

1,783

2,076

2,114

2,058

3,304

Total direct - Mortgage insurance

263,509

261,418

260,707

258,690

258,207

Ceded - Mortgage insurance

Premiums earned, excluding revenue from

cancellations

(41,894

)

(39,925

)

(38,997

)

(40,065

)

(32,363

)

Single Premium Policy cancellations

(1)

818

732

(112

)

(444

)

(873

)

Profit commission - other (2)

12,711

12,593

12,401

12,199

11,830

Total ceded premiums - Mortgage

insurance

(28,365

)

(26,600

)

(26,708

)

(28,310

)

(21,406

)

Net premiums earned - Mortgage

insurance

235,144

234,818

233,999

230,380

236,801

Net premiums earned - Title insurance

3,989

2,913

1,858

2,269

3,461

Net premiums earned

$

239,133

$

237,731

$

235,857

$

232,649

$

240,262

(1)

Includes the impact of related

profit commissions.

(2)

The amounts represent the profit

commission under our QSR Program, excluding the impact of Single

Premium Policy cancellations.

Services Revenue

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Mortgage Insurance

Contract underwriting services

$

244

$

309

$

210

$

202

$

266

All Other

Real estate services

7,876

8,777

9,193

8,888

7,046

Title

3,427

3,540

2,573

2,713

2,964

Real estate technology

620

639

612

616

616

Total services revenue

$

12,167

$

13,265

$

12,588

$

12,419

$

10,892

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations Detail

Exhibit D (page 2 of 3)

Net Investment Income

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Fixed-maturities

$

59,348

$

57,924

$

57,259

$

58,669

$

58,599

Equity securities

3,047

3,067

2,539

3,753

3,222

Mortgage loans held for sale

7,828

5,411

1,793

1,725

1,719

Short-term investments

9,686

8,614

8,958

5,871

5,405

Other (1)

(1,513

)

(1,250

)

(1,328

)

(1,194

)

(1,140

)

Net investment income

$

78,396

$

73,766

$

69,221

$

68,824

$

67,805

(1)

Includes investment management

expenses, as well as the net impact from our securities lending

activities.

Provision for Losses

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Mortgage insurance

Current period defaults (1)

$

57,032

$

47,918

$

53,688

$

53,981

$

46,630

Prior period defaults (2)

(50,686

)

(49,687

)

(60,574

)

(49,373

)

(54,887

)

Total Mortgage insurance

6,346

(1,769

)

(6,886

)

4,608

(8,257

)

Title insurance

543

24

(148

)

(438

)

122

Total provision for losses

$

6,889

$

(1,745

)

$

(7,034

)

$

4,170

$

(8,135

)

(1)

Related to defaulted loans with

the most recent default notice dated in the period indicated. For

example, if a loan had defaulted in a prior period, but then

subsequently cured and later re-defaulted in the current period,

the default would be considered a current period default.

(2)

Related to defaulted loans with a

default notice dated in a period earlier than the period indicated,

which have been continuously in default since that time.

Other Operating

Expenses

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Salaries and other base employee

expenses

$

32,851

$

41,431

$

39,723

$

34,182

$

33,272

Variable and share-based incentive

compensation

17,581

23,223

17,515

20,262

19,546

Other general operating expenses (1)

39,984

31,623

30,262

45,186

29,812

Ceding commissions

(6,276

)

(5,957

)

(5,644

)

(5,327

)

(5,153

)

Title agent commissions

1,779

1,328

780

915

1,729

Total

$

85,919

$

91,648

$

82,636

$

95,218

$

79,206

(1)

Includes $10 million and $14

million in the third quarter of 2024 and the fourth quarter of

2023, respectively, of impairment of long-lived assets, consisting

of impairments to our lease-related assets and internal-use

software.

Radian Group Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations Detail

Exhibit D (page 3 of 3)

Interest Expense

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Senior notes

$

20,945

$

21,156

$

22,128

$

20,335

$

20,320

Mortgage loan financing facilities

7,500

5,107

1,438

1,421

1,609

Loss on extinguishment of debt

—

—

4,275

—

—

FHLB advances

538

544

945

1,059

1,039

Revolving credit facility

408

257

260

354

310

Other

—

—

—

—

4

Total interest expense

$

29,391

$

27,064

$

29,046

$

23,169

$

23,282

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 1 of 4)

Summarized financial information

concerning our operating segments as of and for the periods

indicated is as follows. For a definition of adjusted pretax

operating income (loss), along with a reconciliation to its

consolidated GAAP measure, see Exhibits F and G.

Three Months Ended September

30, 2024

(In thousands)

Mortgage Insurance

All Other (1)

Inter- segment

Total

Net premiums written

$

233,648

$

3,989

$

—

$

237,637

(Increase) decrease in unearned

premiums

1,496

—

—

1,496

Net premiums earned

235,144

3,989

—

239,133

Services revenue

244

12,001

(78

)

12,167

Net investment income

50,236

28,160

—

78,396

Net gains (losses) on investments and

other financial instruments

—

(4,611

)

—

(4,611

)

Income (loss) on consolidated VIEs

—

465

—

465

Other income

1,948

(399

)

(27

)

1,522

Total

287,572

39,605

(105

)

327,072

Provision for losses

6,346

543

—

6,889

Policy acquisition costs

6,724

—

—

6,724

Cost of services

126

9,416

—

9,542

Other operating expenses before allocated

corporate operating expenses

16,408

23,583

(105

)

39,886

Interest expense

21,891

7,500

—

29,391

Total

51,495

41,042

(105

)

92,432

Adjusted pretax operating income (loss)

before allocated corporate operating expenses

236,077

(1,437

)

—

234,640

Allocation of corporate operating

expenses

32,534

3,438

—

35,972

Adjusted pretax operating income (loss)

(2)

$

203,543

$

(4,875

)

$

—

$

198,668

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 2 of 4)

Three Months Ended September

30, 2023

(In thousands)

Mortgage Insurance

All Other (1)

Inter- segment

Total

Net premiums written

$

235,169

$

3,461

$

—

$

238,630

(Increase) decrease in unearned

premiums

1,632

—

—

1,632

Net premiums earned

236,801

3,461

—

240,262

Services revenue

266

10,723

(97

)

10,892

Net investment income

49,953

17,852

—

67,805

Net gains (losses) on investments and

other financial instruments

—

283

—

283

Other income

1,237

9

(5

)

1,241

Total

288,257

32,328

(102

)

320,483

Provision for losses

(8,257

)

122

—

(8,135

)

Policy acquisition costs

6,920

—

—

6,920

Cost of services

172

8,714

—

8,886

Other operating expenses before allocated

corporate operating expenses

16,776

26,062

(102

)

42,736

Interest expense

21,673

1,609

—

23,282

Total

37,284

36,507

(102

)

73,689

Adjusted pretax operating income (loss)

before allocated corporate operating expenses

250,973

(4,179

)

—

246,794

Allocation of corporate operating

expenses

31,744

4,595

—

36,339

Adjusted pretax operating income (loss)

(2)

$

219,229

$

(8,774

)

$

—

$

210,455

(1)

All Other activities include: (i)

income (losses) from assets held by our holding company; (ii)

related general corporate operating expenses not attributable or

allocated to our reportable segments; and (iii) the operating

results from certain other immaterial activities and operating

segments, including our mortgage conduit, title, real estate

services and real estate technology businesses.

(2)

See Exhibits F and G for

additional information on the use and definition of this term and a

reconciliation to consolidated net income.

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 3 of 4)

Mortgage Insurance

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Net premiums written

$

233,648

$

232,645

$

231,877

$

225,112

$

235,169

(Increase) decrease in unearned

premiums

1,496

2,173

2,122

5,268

1,632

Net premiums earned

235,144

234,818

233,999

230,380

236,801

Services revenue

244

309

210

202

266

Net investment income

50,236

50,102

49,574

51,061

49,953

Other income

1,948

754

1,240

1,302

1,237

Total

287,572

285,983

285,023

282,945

288,257

Provision for losses

6,346

(1,769

)

(6,886

)

4,608

(8,257

)

Policy acquisition costs

6,724

6,522

6,794

6,147

6,920

Cost of services

126

156

153

157

172

Other operating expenses before allocated

corporate operating expenses

16,408

17,157

17,270

15,559

16,776

Interest expense

21,891

21,957

23,333

21,748

21,673

Total

51,495

44,023

40,664

48,219

37,284

Adjusted pretax operating income before

allocated corporate operating expenses

236,077

241,960

244,359

234,726

250,973

Allocation of corporate operating

expenses

32,534

43,197

34,509

36,929

31,744

Adjusted pretax operating income (1)

$

203,543

$

198,763

$

209,850

$

197,797

$

219,229

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 4 of 4)

All Other (2)

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Net premiums earned

$

3,989

$

2,913

$

1,858

$

2,269

$

3,461

Services revenue

12,001

13,064

12,493

12,311

10,723

Net investment income

28,160

23,664

19,647

17,763

17,852

Net gains (losses) on investments and

other financial instruments

(4,611

)

(49

)

383

356

283

Income (loss) on consolidated VIEs

465

—

—

—

—

Other income

(399

)

130

25

14

9

Total (3)

39,605

39,722

34,406

32,713

32,328

Provision for losses

543

24

(148

)

(438

)

122

Cost of services

9,416

9,379

9,174

8,793

8,714

Other operating expenses before allocated

corporate operating expenses

23,583

26,615

27,264

23,660

26,062

Interest expense

7,500

5,107

1,438

1,421

1,609

Total

41,042

41,125

37,728

33,436

36,507

Adjusted pretax operating income (loss)

before allocated corporate operating expenses

(1,437

)

(1,403

)

(3,322

)

(723

)

(4,179

)

Allocation of corporate operating

expenses

3,438

4,677

3,711

5,340

4,595

Adjusted pretax operating income (loss)

(1)

$

(4,875

)

$

(6,080

)

$

(7,033

)

$

(6,063

)

$

(8,774

)

(1)

See Exhibits F and G for

additional information on the use and definition of this term and a

reconciliation to consolidated net income.

(2)

All Other activities include: (i)

income (losses) from assets held by our holding company; (ii)

related general corporate operating expenses not attributable or

allocated to our reportable segments; and (iii) the operating

results from certain other immaterial activities and operating

segments, including our mortgage conduit, title, real estate

services and real estate technology businesses.

(3)

Details of All Other revenue are

as follows.

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Holding company (a)

$

19,113

$

17,042

$

16,536

$

15,374

$

15,601

Real estate services

8,185

9,110

9,517

9,014

7,126

Title

7,973

7,047

4,997

5,516

6,948

Mortgage conduit

3,658

5,815

2,690

2,171

2,020

Real estate technology

676

708

666

638

633

Total

$

39,605

$

39,722

$

34,406

$

32,713

$

32,328

(a)

Consists of net investment income

earned from assets held by Radian Group, our holding company, that

are not attributable or allocated to our underlying businesses.

Selected Mortgage Insurance

Key Ratios

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Loss ratio (1)

2.7

%

(0.8

)%

(2.9

)%

2.0

%

(3.5

)%

Expense ratio (2)

23.7

%

28.5

%

25.0

%

25.5

%

23.4

%

(1)

For our Mortgage Insurance

segment, calculated as provision for losses expressed as a

percentage of net premiums earned.

(2)

For our Mortgage Insurance

segment, calculated as operating expenses, (which consist of policy

acquisition costs and other operating expenses, as well as

allocated corporate operating expenses), expressed as a percentage

of net premiums earned.

Radian Group Inc. and

Subsidiaries

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit F (page 1 of 2)

Use of Non-GAAP Financial Measures

In addition to the traditional GAAP financial measures, we have

presented “adjusted pretax operating income (loss),” “adjusted

diluted net operating income (loss) per share” and “adjusted net

operating return on equity,” which are non-GAAP financial measures

for the consolidated company, among our key performance indicators

to evaluate our fundamental financial performance. These non-GAAP

financial measures align with the way our business performance is

evaluated by both management and by our board of directors. These

measures have been established in order to increase transparency

for the purposes of evaluating our operating trends and enabling

more meaningful comparisons with our peers. Although on a

consolidated basis adjusted pretax operating income (loss),

adjusted diluted net operating income (loss) per share and adjusted

net operating return on equity are non-GAAP financial measures, we

believe these measures aid in understanding the underlying

performance of our operations. Our senior management, including our

Chief Executive Officer (Radian’s chief operating decision maker),

uses adjusted pretax operating income (loss) as our primary measure

to evaluate the fundamental financial performance of our businesses

and to allocate resources to them.

Adjusted pretax operating income (loss) is defined as GAAP

consolidated pretax income (loss) excluding the effects of: (i) net

gains (losses) on investments and other financial instruments,

except for those investments and other financial instruments

attributable to our Mortgage Conduit business; (ii) amortization

and impairment of goodwill and other acquired intangible assets;

and (iii) impairment of other long-lived assets and other

non-operating items, if any, such as gains (losses) from the sale

of lines of business, acquisition-related income (expenses) and

gains (losses) on extinguishment of debt. Adjusted diluted net

operating income (loss) per share is calculated by dividing

adjusted pretax operating income (loss) attributable to common

stockholders, net of taxes computed using the company’s statutory

tax rate, by the sum of the weighted average number of common

shares outstanding and all dilutive potential common shares

outstanding. Adjusted net operating return on equity is calculated

by dividing annualized adjusted pretax operating income (loss), net

of taxes computed using the company’s statutory tax rate, by

average stockholders’ equity, based on the average of the beginning

and ending balances for each period presented.

Although adjusted pretax operating income (loss) excludes

certain items that have occurred in the past and are expected to

occur in the future, the excluded items represent those that are:

(i) not viewed as part of the operating performance of our primary

activities or (ii) not expected to result in an economic impact

equal to the amount reflected in pretax income (loss). These

adjustments, along with the reasons for their treatment, are

described below.

(1)

Net gains (losses) on

investments and other financial instruments. The recognition of

realized investment gains or losses can vary significantly across

periods as the activity is highly discretionary based on the timing

of individual securities sales due to such factors as market

opportunities, our tax and capital profile and overall market

cycles. Unrealized gains and losses arise primarily from changes in

the market value of our investments that are classified as trading

or equity securities. These valuation adjustments may not

necessarily result in realized economic gains or losses.

Trends in the profitability of

our fundamental operating activities can be more clearly identified

without the fluctuations of these realized and unrealized gains or

losses and changes in fair value of other financial instruments.

Except for certain investments and other financial instruments

attributable to specific operating segments, we do not view them to

be indicative of our fundamental operating activities.

(2)

Amortization and impairment of

goodwill and other acquired intangible assets. Amortization of

acquired intangible assets represents the periodic expense required

to amortize the cost of acquired intangible assets over their

estimated useful lives. Acquired intangible assets are also

periodically reviewed for potential impairment, and impairment

adjustments are made whenever appropriate. We do not view these

charges as part of the operating performance of our primary

activities.

(3)

Impairment of other long-lived

assets and other non-operating items, if any. Impairment of

other long-lived assets and other non-operating items includes

activities that we do not view to be indicative of our fundamental

operating activities, such as: (i) impairment of internal-use

software and other long-lived assets; (ii) gains (losses) from the

sale of lines of business; (iii) acquisition-related income and

expenses; and (iv) gains (losses) on extinguishment of debt.

Radian Group Inc. and

Subsidiaries

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit F (page 2 of 2)

See Exhibit G for the reconciliations of the most comparable

GAAP measures, consolidated pretax income (loss), diluted net

income (loss) per share and return on equity to our non-GAAP

financial measures for the consolidated company, adjusted pretax

operating income (loss), adjusted diluted net operating income

(loss) per share and adjusted net operating return on equity,

respectively.

Total adjusted pretax operating income (loss), adjusted diluted

net operating income (loss) per share and adjusted net operating

return on equity should not be considered in isolation or viewed as

substitutes for GAAP pretax income (loss), diluted net income

(loss) per share, return on equity or net income (loss). Our

definitions of adjusted pretax operating income (loss) and adjusted

diluted net operating income (loss) per share may not be comparable

to similarly-named measures reported by other companies.

Radian Group Inc. and

Subsidiaries

Consolidated Non-GAAP Financial Measure

Reconciliations

Exhibit G (page 1 of 2)

Reconciliation of Consolidated

Pretax Income to Adjusted Pretax Operating Income

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Consolidated pretax income

$

195,392

$

188,123

$

198,649

$

179,817

$

200,983

Less reconciling income (expense)

items

Net gains (losses) on investments and

other financial instruments (1)

6,785

(4,438

)

107

13,091

(8,838

)

Amortization and impairment of goodwill

and other acquired intangible assets

—

—

—

(11,173

)

(1,371

)

Impairment of other long-lived assets and

other non-operating items

(10,061

)

(2)

(122

)

(4,275

)

(3)

(13,835

)

(2)

737

Total adjusted pretax operating income

(4)

$

198,668

$

192,683

$

202,817

$

191,734

$

210,455

(1)

Excludes net gains (losses) on

investments and other financial instruments that are attributable

to our Mortgage Conduit business, which are included in adjusted

pretax operating income (loss).

(2)

This amount is included in other

operating expenses on the Condensed Consolidated Statement of

Operations in Exhibit A and primarily relates to impairment of

other long-lived assets.

(3)

This amount is included in

interest expense on the Condensed Consolidated Statement of

Operations in Exhibit A and relates to the loss on extinguishment

of debt.

(4)

Total adjusted pretax operating

income consists of adjusted pretax operating income (loss) for our

reportable segment and All Other activities as follows.

2024

2023

(In thousands)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Adjusted pretax operating income

(loss)

Mortgage Insurance segment

$

203,543

$

198,763

$

209,850

$

197,797

$

219,229

All Other activities

(4,875

)

(6,080

)

(7,033

)

(6,063

)

(8,774

)

Total adjusted pretax operating income

$

198,668

$

192,683

$

202,817

$

191,734

$

210,455

Reconciliation of Diluted Net

Income Per Share to Adjusted Diluted Net Operating Income Per

Share

2024

2023

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Diluted net income per share

$

0.99

$

0.98

$

0.98

$

0.91

$

0.98

Less per-share impact of reconciling

income (expense) items

Net gains (losses) on investments and

other financial instruments

0.04

(0.03

)

—

0.08

(0.06

)

Amortization and impairment of goodwill

and other acquired intangible assets

—

—

—

(0.07

)

(0.01

)

Impairment of other long-lived assets and

other non-operating items

(0.06

)

—

(0.03

)

(0.09

)

0.01

Income tax (provision) benefit on

reconciling income (expense) items (1)

—

—

0.01

0.02

0.01

Difference between statutory and effective

tax rates

(0.02

)

0.02

(0.03

)

0.01

(0.01

)

Per-share impact of reconciling income

(expense) items

(0.04

)

(0.01

)

(0.05

)

(0.05

)

(0.06

)

Adjusted diluted net operating income per

share (1)

$

1.03

$

0.99

$

1.03

$

0.96

$

1.04

(1)

Calculated using the company’s

federal statutory tax rate of 21%.

Radian Group Inc. and

Subsidiaries

Consolidated Non-GAAP Financial Measure

Reconciliations

Exhibit G (page 2 of 2)

Reconciliation of Return on

Equity to Adjusted Net Operating Return on Equity (1)

2024

2023

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Return on equity (1)

13.2

%

13.6

%

13.8

%

13.4

%

15.0

%

Less impact of reconciling income

(expense) items (2)

Net gains (losses) on investments and

other financial instruments

0.6

%

(0.4

)%

—

%

1.2

%

(0.9

)%

Amortization and impairment of goodwill

and other acquired intangible assets

—

%

—

%

—

%

(1.0

)%

(0.2

)%

Impairment of other long-lived assets and

other non-operating items

(0.9

)%

—

%

(0.4

)%

(1.3

)%

0.1

%

Income tax (provision) benefit on

reconciling income (expense) items (3)

—

%

0.1

%

0.1

%

0.2

%

0.2

%

Difference between statutory and effective

tax rates

(0.2

)%

0.3

%

(0.4

)%

0.1

%

(0.2

)%

Impact of reconciling income (expense)

items

(0.5

)%

—

%

(0.7

)%

(0.8

)%

(1.0

)%

Adjusted net operating return on equity

(3)

13.7

%

13.6

%

14.5

%

14.2

%

16.0

%

(1)

Calculated by dividing annualized

net income by average stockholders’ equity, based on the average of

the beginning and ending balances for each period presented.

(2)

Annualized, as a percentage of

average stockholders’ equity.

(3)

Calculated using the company’s

federal statutory tax rate of 21%.

On a consolidated basis,

“adjusted pretax operating income (loss),” “adjusted diluted net

operating income (loss) per share” and “adjusted net operating

return on equity” are measures not determined in accordance with

GAAP. These measures should not be considered in isolation or

viewed as substitutes for GAAP pretax income (loss), diluted net

income (loss) per share, return on equity or net income (loss).

Our definitions of adjusted

pretax operating income (loss), adjusted diluted net operating

income (loss) per share and adjusted net operating return on equity

may not be comparable to similarly-named measures reported by other

companies. See Exhibit F for additional information on our

consolidated non-GAAP financial measures.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - New Insurance Written

Exhibit H

2024

2023

($ in millions)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

NIW

$

13,493

$

13,902

$

11,534

$

10,629

$

13,922

NIW by premium type

Direct monthly and other

recurring premiums

95.9

%

96.5

%

96.7

%

96.4

%

96.0

%

Direct single premiums

4.1

%

3.5

%

3.3

%

3.6

%

4.0

%

NIW for purchases

95.6

%

98.3

%

96.9

%

98.8

%

98.7

%

NIW for refinances

4.4

%

1.7

%

3.1

%

1.2

%

1.3

%

NIW by FICO score (1)

>=740

69.5

%

69.4

%

67.3

%

66.5

%

67.3

%

680-739

24.8

%

25.5

%

27.1

%

27.9

%

27.4

%

620-679

5.7

%

5.1

%

5.6

%

5.6

%

5.3

%

<=619

0.0

%

0.0

%

0.0

%

0.0

%

0.0

%

Total NIW

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

NIW by LTV (2)

95.01% and above

16.5

%

16.5

%

15.4

%

15.4

%

16.5

%

90.01% to 95.00%

37.1

%

37.2

%

40.8

%

40.0

%

38.6

%

85.01% to 90.00%

31.5

%

32.4

%

31.3

%

31.3

%

30.2

%

85.00% and below

14.9

%

13.9

%

12.5

%

13.3

%

14.7

%

Total NIW

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

(1)

For loans with multiple

borrowers, the percentage of NIW by FICO score represents the

lowest of the borrowers’ FICO scores at origination.

(2)

At origination.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - Primary Insurance in Force and Risk in Force

Exhibit I

2024

2023

($ in millions)

Qtr 3

Qtr 2

Qtr 1

Qtr 4

Qtr 3

Primary insurance in force

$

274,721

$

272,827

$

270,986

$

269,979

$

269,511

Primary risk in force (“RIF”)

$

71,834

$

71,109

$

70,299

$

69,710

$

69,298

Primary RIF by premium type

Direct monthly and other

recurring premiums

89.8

%

89.5

%

89.2

%

88.9

%

88.6

%

Direct single premiums

10.2

%

10.5

%

10.8

%

11.1

%

11.4

%

Primary RIF by FICO score (1)

>=740

59.6

%

59.2

%

58.8

%

58.5

%

58.2

%

680-739

33.0

%

33.3

%

33.6

%

33.9

%

34.0

%

620-679

7.1

%

7.2

%

7.3

%

7.3

%

7.4

%

<=619

0.3

%

0.3

%

0.3

%

0.3

%

0.4

%

Total RIF

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Primary RIF by LTV (2)

95.01% and above

19.5

%

19.2

%

18.9

%

18.6

%

18.4

%

90.01% to 95.00%

48.0

%

48.1

%

48.2

%

48.2

%

48.2

%

85.01% to 90.00%

27.3

%

27.3

%

27.1

%

27.1

%

27.0

%

85.00% and below

5.2

%

5.4

%

5.8

%

6.1

%

6.4

%

Total RIF

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Persistency Rate (12 months

ended)

84.4

%

84.3

%

84.3

%

84.0

%

83.6

%

Persistency Rate (quarterly,

annualized) (3)

84.1

%

83.5

%

85.3

%

85.8

%

84.2

%

(1)

For loans with multiple

borrowers, the percentage of primary RIF by FICO score represents

the lowest of the borrowers’ FICO scores at origination.

(2)

At origination.

(3)

The Persistency Rate on a

quarterly, annualized basis is calculated based on loan-level

detail for the quarter ending as of the date shown. It may be

impacted by seasonality or other factors, including the level of

refinance activity during the applicable periods and may not be

indicative of full-year trends.

FORWARD-LOOKING STATEMENTS

All statements in this press release that address events,

developments or results that we expect or anticipate may occur in

the future are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934 and the U.S. Private Securities

Litigation Reform Act of 1995. In most cases, forward-looking

statements may be identified by words such as “anticipate,” “may,”

“will,” “could,” “should,” “would,” “expect,” “intend,” “plan,”

“goal,” “contemplate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “seek,” “strategy,” “future,” “likely” or

the negative or other variations on these words and other similar

expressions. These statements, which may include, without

limitation, projections regarding our future performance and

financial condition, are made on the basis of management’s current

views and assumptions with respect to future events. These

statements speak only as of the date they were made, and we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. We operate in a changing environment where new risks

emerge from time to time and it is not possible for us to predict

all risks that may affect us. The forward-looking statements are

not guarantees of future performance, and the forward-looking

statements, as well as our prospects as a whole, are subject to

risks and uncertainties that could cause actual results to differ

materially from those set forth in the forward-looking statements.

These risks and uncertainties include, without limitation:

- the health of the U.S. housing market generally and changes in

economic conditions that impact the size of the insurable mortgage

market, the credit performance of our insured mortgage portfolio,

the returns on our investments in residential mortgage loans

acquired through our Mortgage Conduit business and other

investments held in our investment portfolio, as well as our

business prospects, including: changes resulting from inflationary

pressures, the interest rate environment and the risk of higher

unemployment rates; other macroeconomic stresses and uncertainties,

including potential impacts resulting from political and

geopolitical events, civil disturbances and endemics/pandemics or

extreme weather events and other natural disasters that may

adversely affect regional economic conditions and housing

markets;

- changes in the way customers, investors, ratings agencies,

regulators or legislators perceive our performance, financial

strength and future prospects;

- Radian Guaranty’s ability to remain eligible under the PMIERs

to insure loans purchased by the GSEs;

- our ability to maintain an adequate level of capital in our

insurance subsidiaries to satisfy current and future regulatory

requirements;

- changes in the charters or business practices of, or rules or

regulations imposed by or applicable to, the GSEs or loans

purchased by the GSEs, or changes in the requirements for Radian

Guaranty to remain an approved insurer to the GSEs, such as changes

in the PMIERs or the GSEs’ interpretation and application of the

PMIERs or other applicable requirements;

- the effects of the Enterprise Regulatory Capital Framework,

finalized in February 2022, which establishes a new regulatory

capital framework for the GSEs, and which, as finalized, increases

the capital requirements for the GSEs, and among other things,

could impact the GSEs’ operations and pricing as well as the size

of the insurable mortgage market;

- changes in the current housing finance system in the United

States, including the roles of the FHA, the VA, the GSEs and

private mortgage insurers in this system;

- our ability to successfully execute and implement our capital

plans, including our risk distribution strategy through the capital

markets and traditional reinsurance markets, and to maintain

sufficient holding company liquidity to meet our liquidity

needs;

- our ability to successfully execute and implement our business

plans and strategies, including plans and strategies that may

require GSE and/or regulatory approvals and licenses, that are

subject to complex compliance requirements that we may be unable to

satisfy, or that may expose us to new risks, including those that

could impact our capital and liquidity positions;

- risks related to the quality of third-party mortgage

underwriting and mortgage loan servicing;

- a decrease in the Persistency Rates of our mortgage insurance

on Monthly Premium Policies;

- competition in the private mortgage insurance industry

generally, and more specifically: price competition in our mortgage

insurance business and competition from the FHA and the VA as well

as from other forms of credit enhancement, such as any potential

GSE-sponsored alternatives to traditional mortgage insurance;

- U.S. political conditions, which may be more volatile and

present a heightened risk in Presidential election years, and

legislative and regulatory activity (or inactivity), including

adoption of (or failure to adopt) new laws and regulations, or

changes in existing laws and regulations, or the way they are

interpreted or applied;

- legal and regulatory claims, assertions, actions, reviews,

audits, inquiries and investigations that could result in adverse

judgments, settlements, fines, injunctions, restitutions or other

relief that could require significant expenditures, new or

increased reserves or have other effects on our business;

- the amount and timing of potential payments or adjustments

associated with federal or other tax examinations;

- the possibility that we may fail to estimate accurately,

especially in the event of an extended economic downturn or a

period of extreme market volatility and economic uncertainty, the

likelihood, magnitude and timing of losses in establishing loss

reserves for our mortgage insurance business or to accurately

calculate and/or project our Available Assets and Minimum Required

Assets under the PMIERs, which could be impacted by, among other

things, the size and mix of our IIF, future changes to the PMIERs,

the level of defaults in our portfolio, the reported status of

defaults in our portfolio (including whether they are subject to

mortgage forbearance, a repayment plan or a loan modification trial

period), the level of cash flow generated by our insurance

operations and our risk distribution strategies;

- volatility in our financial results caused by changes in the

fair value of our assets and liabilities carried at fair

value;

- changes in GAAP or SAP rules and guidance, or their

interpretation;

- risks associated with investments to grow our existing

businesses, or to pursue new lines of business or new products and

services, including our ability and related costs to develop,

launch and implement new and innovative technologies and digital

products and services, whether these products and services receive

broad customer acceptance or disrupt existing customer

relationships, and additional financial risks related to these

investments, including required changes in our investment,

financing and hedging strategies, risks associated with our

increased use of financial leverage, which could expose us to

liquidity risks resulting from changes in the fair values of

assets, and the risk that we may fail to achieve forecasted

results, which could result in lower or negative earnings

contribution;

- the effectiveness and security of our information technology

systems and digital products and services, including the risk that

these systems, products or services fail to operate as expected or

planned or expose us to cybersecurity or third-party risks,

including due to malware, unauthorized access, cyberattack,

ransomware or other similar events;

- our ability to attract and retain key employees;

- the amount of dividends, if any, that our insurance

subsidiaries may distribute to us, which under applicable

regulatory requirements is based primarily on the financial

performance of our insurance subsidiaries, and therefore, may be

impacted by general economic, competitive and other factors, many

of which are beyond our control; and

- the ability of our operating subsidiaries to distribute amounts

to us under our internal tax- and expense-sharing arrangements,

which for our insurance subsidiaries are subject to regulatory

review and could be terminated at the discretion of such

regulators.

For more information regarding these risks and uncertainties as

well as certain additional risks that we face, you should refer to

“Item 1A. Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023, and to subsequent reports and

registration statements filed from time to time with the U.S.

Securities and Exchange Commission. We caution you not to place

undue reliance on these forward-looking statements, which are

current only as of the date on which we issued this press release.

We do not intend to, and we disclaim any duty or obligation to,

update or revise any forward-looking statements to reflect new

information or future events or for any other reason.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101415115/en/

For Investors Dan Kobell - Phone: 215.231.1113 email:

daniel.kobell@radian.com For Media Rashi Iyer - Phone:

215.231.1167 email: rashi.iyer@radian.com

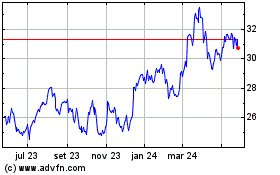

Radian (NYSE:RDN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

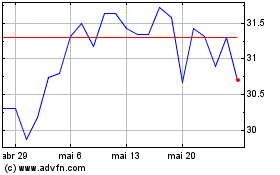

Radian (NYSE:RDN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024