Reaffirms 2024 EBITDA and Increases Free

Cash Flow Guidance

- Net sales for the first quarter of $388 million, down $79

million from prior year quarter

- Net loss for the first quarter of $2 million, a decline of $4

million from prior year quarter

- Adjusted EBITDA for the first quarter of $52 million, up $1

million from prior year quarter

- Total debt of $779 million; Net Secured Debt of $721 million

with a net secured debt ratio of 4.4 times

- 2024 Adjusted EBITDA guidance of $180 million to $200

million

- 2024 Adjusted Free Cash Flow guidance increased to $80 million

to $100 million

Rayonier Advanced Materials Inc. (NYSE:RYAM) (the “Company”)

today reported results for its first quarter ended March 30,

2024.

“First quarter results exceeded our expectations, driven by

lower costs and improved demand for cellulose specialties. We

delivered a solid $52 million in Adjusted EBITDA to maintain a net

secured debt ratio of 4.4 times covenant EBITDA,” stated De Lyle

Bloomquist, President and CEO of RYAM. “We also increased capital

expenditures to support growth in our Biomaterials strategy and

increased net debt to boost inventory levels in preparation for

Jesup’s annual outage.”

“The solid first quarter, along with the start-up of the

bioethanol facility in Tartas and the April completion of the

planned maintenance outage in Jesup, keep us on track to deliver

our full-year guidance of $180 to $200 million in Adjusted EBITDA.

As a result of the indefinite suspension of operations of our

Temiscaming High Purity Cellulose plant and the sale of refund

rights to our softwood lumber duties to OCP Lumber LLC, our 2024

Adjusted Free Cash Flow guidance is increased to $80 to $100

million. The suspension at Temiscaming will also reduce our

exposure to the volatile commodity viscose market. The potential

sale of the Temiscaming Paperboard and High-Yield Pulp facilities

is progressing, albeit slower than originally expected, as we

manage buyers through the complexity of carving out these assets.

While the suspension and asset sale decisions affecting the

Temiscaming site have been approached and carried out

independently, we believe the suspension will bring clarity to the

asset sale diligence process by validating that these assets can be

efficiently run separately. Updates on these processes will be

provided as appropriate. In the meantime, we are focused on

reducing debt with lower earnings volatility as we plan to

refinance our senior secured notes prior to them becoming current

in early 2025,” concluded Mr. Bloomquist.

First Quarter 2024 Financial Results

The Company reported a net loss of $2 million, or $(0.02) per

diluted share, for the quarter ended March 30, 2024, compared to

net income of $2 million, or $0.02 per diluted share, for the prior

year quarter.

The Company operates in the following business segments: High

Purity Cellulose, Paperboard and High-Yield Pulp.

Net sales was comprised of the following for the periods

presented:

Three Months Ended

(in millions)

March 30, 2024

December 31, 2023

April 1, 2023

High Purity Cellulose

$

307

$

347

$

374

Paperboard

53

55

59

High-Yield Pulp

34

25

42

Eliminations

(6

)

(5

)

(8

)

Net sales

$

388

$

422

$

467

Operating results were comprised of the following for the

periods presented:

Three Months Ended

(in millions)

March 30, 2024

December 31, 2023

April 1, 2023

High Purity Cellulose

$

21

$

(49

)

$

13

Paperboard

8

8

10

High-Yield Pulp

(1

)

(5

)

7

Corporate

(11

)

(15

)

(13

)

Operating income (loss)

$

17

$

(61

)

$

17

High Purity Cellulose

Net sales for the quarter decreased $67 million, or 18 percent,

to $307 million compared to the prior year quarter. Included in

each of the current and prior year quarters were $23 million of

other sales primarily from bio-based energy and lignosulfonates.

Despite a 2 percent increase in cellulose specialties prices, total

sales prices decreased 2 percent due to an 11 percent decrease in

commodity prices. Total sales volumes decreased 17 percent driven

by 16 percent and 18 percent decreases in cellulose specialties and

commodity volumes, respectively. Increased cellulose specialties

sales volumes resulting from the closure of a competitor’s plant in

late 2023 and an uptick in ethers sales were more than offset by

customer destocking in acetate products and the one-time favorable

impact from a change in customer contract terms in the prior year

quarter. The decrease in commodity sales volumes was primarily

driven by lower production in favor of cellulose specialties

production as the Company built inventory ahead of Jesup’s second

quarter planned maintenance outage.

Operating income for the quarter increased $8 million compared

to the prior year quarter driven by the higher cellulose

specialties sales prices, decreased key input and logistics costs

and improved productivity, partially offset by the lower cellulose

specialties sales volumes, lower commodity sales prices and volumes

and $7 million of energy cost benefits in the prior year quarter

from sales of excess emission allowances that did not repeat in the

current quarter.

Compared to the fourth quarter of 2023, net sales declined $40

million due to a 15 percent decrease in total sales volumes,

including a 10 percent decrease in cellulose specialties volumes

driven by customer destocking in acetate products that offset an

uptick in ethers sales, and a 21 percent decrease in commodity

volumes due to lower production in favor of cellulose specialties

production. Operating results improved $70 million primarily due to

the $62 million non-cash asset impairment recorded in the fourth

quarter. Also contributing to the improvement in results was a 4

percent increase in total sales prices, including 1 percent and 3

percent increases in cellulose specialties and commodity prices,

respectively, and a decrease in key input costs. Partially

offsetting these improvements were the lower sales volumes and

higher production costs driven by the impact of fourth quarter

annual planned maintenance and market-related production

outages.

Paperboard

Net sales for the quarter decreased $6 million, or 10 percent,

to $53 million compared to the prior year quarter driven by a 12

percent decrease in sales prices due to market-driven demand

declines and mix, partially offset by a slight increase in sales

volumes.

Operating income for the quarter decreased $2 million compared

to the prior year quarter driven by the lower sales prices,

partially offset by lower purchased pulp costs.

Compared to the fourth quarter of 2023, operating income was

flat as a 4 percent decrease in sales prices, due to market-driven

demand declines and mix, was offset by lower unit production costs

due to improved production levels in the current quarter.

High-Yield Pulp

Net sales for the quarter decreased $8 million, or 19 percent,

to $34 million compared to the prior year quarter driven by a 27

percent decrease in sales prices due to market supply dynamics in

China, partially offset by a 16 percent increase in sales

volumes.

Operating results for the quarter declined $8 million compared

to the prior year quarter driven by the lower sales prices,

partially offset by the higher sales volumes and lower logistics

costs.

Compared to the fourth quarter of 2023, operating loss decreased

$4 million driven by 11 percent and 25 percent increases in sales

prices and volumes, respectively, lower logistics and unit

production costs due to improved production levels in the current

quarter.

Corporate

Operating loss for the quarter decreased $2 million compared to

the prior year quarter driven by more favorable foreign exchange

rates in the current quarter, partially offset by higher

discounting and financing fees in the current quarter.

Compared to the fourth quarter of 2023, operating loss decreased

$4 million driven by more favorable foreign exchange rates in the

current quarter, lower environmental expense and lower discounting

and financing fees, partially offset by higher variable

compensation costs.

Non-Operating Income & Expense

Interest expense increased $6 million during the quarter ended

March 30, 2024 compared to the prior year quarter driven by an

increase in the average effective interest rate on debt, partially

offset by a decrease in the average outstanding balance of debt.

Total debt decreased $67 million from April 1, 2023 to March 30,

2024.

Included in non-operating other income in the quarter ended

March 30, 2024 was a $1 million impact from favorable foreign

exchange rates in the current quarter.

Included in non-operating expense in the quarter ended April 1,

2023 was a $2 million pension settlement loss.

Income Taxes

The effective tax benefit rate for the quarter ended March 30,

2024 was 30 percent. The 2024 effective tax rate differed from the

federal statutory rate of 21 percent primarily due to the release

of certain tax reserves, partially offset by return-to-accrual

adjustments, excess deficit on vested stock compensation and

changes in the valuation allowance on disallowed interest

deductions.

The effective tax rate for the quarter ended April 1, 2023 was

not meaningful due to near break-even pretax income for the period,

which results in any discrete tax adjustments significantly

impacting the rate. The largest adjustments creating a difference

between the effective tax rate and the federal statutory rate of 21

percent were an excess tax benefit on vested stock compensation and

return-to-accrual adjustments related to previously filed tax

returns.

Cash Flows & Liquidity

The Company generated operating cash flows of $12 million during

the three months ended March 30, 2024, driven by lower costs and

cash inflows from accounts receivable, partially offset by cash

outflows from other working capital and payments of interest on

long-term debt.

The Company used $33 million in investing activities during the

three months ended March 30, 2024 related to net capital

expenditures, which included $5 million of strategic capital

spending focused on the investment in the 2G bioethanol plant in

Tartas.

The Company had $1 million of net cash inflows from financing

activities during the three months ended March 30, 2024 driven by

net borrowings of long-term Biomaterials project debt.

The Company ended the first quarter with $199 million of global

liquidity, including $55 million of cash, borrowing capacity under

the ABL Credit Facility of $131 million and $13 million of

availability under the France factoring facility.

In January 2024, the Company amended the 2027 Term Loan to

increase the maximum consolidated secured net leverage ratio that

it must maintain beginning in the fourth quarter of 2023 and

through its 2024 fiscal year. The amendment provides the Company

with the operational flexibility to execute its strategic

initiatives in 2024. Should the Company exceed the 4.50 to 1.00

maximum ratio established by the original agreement in any of these

quarters, it will incur a fee of 0.25% of the principal balance

outstanding at the end of the applicable quarter. The Company

incurred total fees of $3 million related to this amendment,

including $1 million in legal and advisory fees recorded to

selling, general and administrative expense in the fourth quarter

of 2023, and $2 million in lender fees recorded as deferred

financing costs in the first quarter of 2024 that will be amortized

to interest expense over the remaining term of the loan.

As of March 30, 2024, the Company’s consolidated secured net

leverage ratio was 4.4 times covenant EBITDA.

2024 Outlook

In October 2023, the Company announced that it is exploring the

potential sale of its Paperboard and High-Yield Pulp assets located

at its Temiscaming site. The potential sale is consistent with the

Company’s commitment to align its portfolio with its long-term

growth strategy and provide flexibility to pay down debt, reduce

leverage and minimize earnings volatility. The sales process is

progressing, albeit slower than originally anticipated, as buyers

work through the complexity of carving out these assets from

existing operations and consider the impact of the indefinite

suspension of the Temiscaming High Purity Cellulose plant. While

the suspension and asset sale decisions affecting the Temiscaming

site have been approached and carried out independently, the

Company believes the suspension will bring clarity to the asset

sale diligence process by validating that these assets can be

efficiently run separately.

The indefinite suspension of operations at the Temiscaming High

Purity Cellulose plant, announced on April 29, 2024, is anticipated

to mitigate the plant’s ongoing operating losses and high capital

needs and improve the Company’s consolidated free cash flow. The

Company realized an $18 million Adjusted EBITDA loss from these

operations in 2023 and invested an average of $15 million in

capital expenditures over the past three years; however, any future

operational loss reductions will be partially offset by stranded

costs. In connection with the suspension of operations, the Company

expects to incur one-time operating charges in 2024 of

approximately $30 million, including mothball, severance and other

employee costs. Further, the Company also expects to incur non-cash

charges in 2024 related to impairments. Overall, the Company

expects that for 2024, the indefinite suspension of the Temiscaming

High Purity Cellulose plant will be marginally positive to Adjusted

EBITDA and will increase free cash flow by $15 million to $20

million as lower capital expenditures and benefits from the

monetization of working capital are expected to more than offset

the one-time and other cash costs associated with the suspension of

operations.

On May 6, 2024, the Company announced the sale of its refund

rights, including interest, related to softwood lumber duties paid

from 2017 through 2021 for $39 million, with the opportunity for

additional sale proceeds in the future contingent upon the timing

and terms of the ultimate outcome of the trade dispute between the

USDOC and Canada.

The Company expects to generate between $180 million and $200

million of Adjusted EBITDA in 2024 with $80 million to $100 million

of Adjusted Free Cash Flow including passive asset sales but

excluding any operating asset sales.

The following market assessment represents the Company’s current

outlook of its business segments’ future performance.

High Purity Cellulose

Average sales prices for cellulose specialties in 2024 are

expected to increase by a low single-digit percentage as compared

to average sales prices in 2023 as the Company prioritizes value

over volume. Sales volumes for cellulose specialties are expected

to be comparable to 2023 driven by increased volumes from the

closure of a competitor’s plant and a modest increase in ethers

sales, offset by a one-time favorable impact from a change in

customer contract terms in the prior year quarter and customer

destocking in the acetate markets. Demand for RYAM commodity

products remains stable as prices are expected to be flat to 2023,

despite a difficult comparison to the first quarter of 2023.

Commodity sales volumes are expected to decline in 2024 as the

Company suspends operations at its Temiscaming High Purity

Cellulose plant for the second half of 2024. Costs are expected to

be lower in 2024 driven by lower key input and logistics costs,

improved productivity and the indefinite suspension of operations

at the Temiscaming High Purity Cellulose plant. The Company’s

bioethanol facility in Tartas, France became operational in the

first quarter of 2024 and is expected to deliver $3 million to $4

million of EBITDA in 2024, growing to $8 million to $10 million

beginning in 2025. EBITDA is expected to decrease in the second

quarter of 2024 compared to the first quarter of 2024 due to the

annual planned maintenance outage at Jesup, but stronger than the

second quarter of 2023.

Paperboard

Paperboard prices in 2024 are expected to remain relatively

stable compared to the first quarter of 2024, while sales volumes

are expected to improve due to improved customer demand. Raw

material prices are expected to increase as purchased pulp prices

are forecast to increase from the first quarter 2024 levels.

Overall, EBITDA is expected to increase sequentially.

High-Yield Pulp

High-Yield Pulp prices are expected to improve slightly in the

second quarter and increase further in the second half of 2024,

while sales volumes are expected to remain stable sequentially and

then increase in the second half of 2024. Overall, the Company

expects to generate positive EBITDA from this segment in the coming

quarter.

Corporate

Corporate costs are expected to be flat or increase slightly in

2024 as the Company continues its ERP implementation. The project

will enhance the Company’s operating and reporting systems and is

expected to drive additional improvements and efficiencies

beginning in 2025.

Biomaterials Strategy

The Company continues to invest in new products to provide both

increased end market diversity and incremental profitability. These

new products will target the growing green energy and products

markets. The successful shipment of the Company’s first production

of 2G bioethanol from its Tartas, France bioethanol facility is a

significant milestone towards the Company’s goal of generating $42

million of annual EBITDA from these new products by 2027. Recent

achievements include receiving conditional Generally Recognized As

Safe (GRAS) regulatory approval for a prebiotics product and moving

forward with plans for a bioethanol facility in Fernandina Beach.

The Company is also advancing various other projects and is in the

process of securing green capital to support these efforts. Updates

on the progress of these initiatives will be provided throughout

the year.

Conference Call Information

RYAM will host a conference call and live webcast at 9:00 a.m.

ET on Wednesday, May 8, 2024 to discuss these results. Supplemental

materials and access to the live audio webcast will be available at

www.RYAM.com. A replay of this webcast will be archived on the

Company’s website shortly after the call.

Investors may listen to the conference call by dialing

877-407-8293, no passcode required. For international parties, dial

201-689-8349. A replay of the teleconference will be available one

hour after the call ends until 6:00 p.m. ET on Wednesday, May 22,

2024. The replay dial-in number within the U.S. is 877-660-6853,

international is 201-612-7415, Conference ID: 13745424.

About RYAM

RYAM is a global leader of cellulose-based technologies,

including high purity cellulose specialties, a natural polymer

commonly used in the production of filters, food, pharmaceuticals

and other industrial applications. RYAM’s specialized assets,

capable of creating the world’s leading high purity cellulose

products, are also used to produce biofuels, bioelectricity and

other biomaterials such as bioethanol and tall oils. The Company

also manufactures products for the paper and packaging markets.

With manufacturing operations in the U.S., Canada and France, RYAM

generated $1.6 billion of revenue in 2023. More information is

available at www.RYAM.com.

Forward-Looking Statements

Certain statements in this document regarding anticipated

financial, business, legal or other outcomes, including business

and market conditions, outlook and other similar statements

relating to future events, developments or financial or operational

performance or results, are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

These forward-looking statements are identified by the use of words

such as “may,” “will,” “should,” “expect,” “estimate,” “target,”

“believe,” “intend,” “plan,” “forecast,” “anticipate,” “guidance”

and other similar language. However, the absence of these or

similar words or expressions does not mean a statement is not

forward-looking. Forward-looking statements are not guarantees of

future performance or events and undue reliance should not be

placed on these statements. Although we believe the expectations

reflected in any forward-looking statements are based on reasonable

assumptions, we can give no assurance that these expectations will

be attained, and it is possible that actual results may differ

materially from those indicated by these forward-looking statements

due to a variety of risks and uncertainties. All statements made in

this earnings release are made only as of the date set forth at the

beginning of this release. The Company undertakes no obligation to

update the information made in this release in the event facts or

circumstances subsequently change after the date of this release.

The Company has not filed its Form 10-Q for the quarter ended March

30, 2024. As a result, all financial results described in this

earnings release should be considered preliminary, and are subject

to change to reflect any necessary adjustments or changes in

accounting estimates, that are identified prior to the time the

Company files its Form 10-Q.

The Company’s operations are subject to a number of risks and

uncertainties including, but not limited to, those listed below.

When considering an investment in the Company’s securities, you

should carefully read and consider these risks, together with all

other information in the Company’s Annual Report on Form 10-K and

other filings and submissions to the SEC, which provide more

information and detail on the risks described below. If any of the

events described in the following risk factors occur, the Company’s

business, financial condition, operating results and cash flows, as

well as the market price of the Company’s securities, could be

materially adversely affected. These risks and events include,

without limitation: Macroeconomic and Industry Risks The

Company’s business, financial condition and results of operations

could be adversely affected by disruptions in the global economy

caused by geopolitical conflicts and related impacts. The Company

is subject to risks associated with epidemics and pandemics, which

could have a material adverse impact on the Company’s business,

financial condition, results of operations and cash flows. The

businesses the Company operates are highly competitive and many of

them are cyclical, which may result in fluctuations in pricing and

volume that can materially adversely affect the Company’s business,

financial condition, results of operations and cash flows. Changes

in the availability and price of raw materials and energy and

continued inflationary pressure could have a material adverse

effect on the Company’s business, financial condition and results

of operations. The Company is subject to material risks associated

with doing business outside of the United States. Foreign currency

exchange fluctuations may have a material adverse impact on the

Company’s business, financial condition and results of operations.

Restrictions on trade through tariffs, countervailing and

anti-dumping duties, quotas and other trade barriers, in the United

States and internationally, could materially adversely affect the

Company’s ability to access certain markets. Business and

Operational Risks The Company’s ten largest customers

represented approximately 40 percent of 2023 revenue and the loss

of all or a substantial portion of revenue from these customers

could have a material adverse effect on the Company’s business. A

material disruption at any of the Company’s manufacturing plants

could prevent the Company from meeting customer demand, reduce

sales and profitability, increase the cost of production and

capital needs, or otherwise materially adversely affect the

Company’s business, financial condition and results of operations.

Unfavorable changes in the availability of, and prices for, wood

fiber may have a material adverse impact on the Company’s business,

financial condition and results of operations. Substantial capital

is required to maintain the Company’s production facilities, and

the cost to repair or replace equipment, as well as the associated

downtime, could materially adversely affect the Company’s business.

The Company faces substantial asset risk, including the potential

for impairment related to long-lived assets and the potential

impact to the value of recorded deferred tax assets. The Company

depends on third parties for transportation services and

unfavorable changes in the cost and availability of transportation

could materially adversely affect the Company’s business. Failure

to maintain satisfactory labor relations could have a material

adverse effect on the Company’s business. The Company is dependent

upon attracting and retaining key personnel, the loss of whom could

materially adversely affect the Company’s business. Failure to

develop new products or discover new applications for existing

products, or inability to protect the intellectual property

underlying new products or applications, could have a material

adverse impact on the Company’s business. Loss of Company

intellectual property and sensitive data or disruption of

manufacturing operations due to a cybersecurity incident could

materially adversely impact the business. Regulatory and

Environmental Risks The Company’s business is subject to

extensive environmental laws, regulations and permits that may

materially restrict or adversely affect how the Company conducts

business and its financial results. The potential longer-term

impacts of climate-related risks remain uncertain at this time.

Regulatory measures to address climate change may materially

restrict how the Company conducts business or adversely affect its

financial results. Financial Risks The Company may need to

make significant additional cash contributions to its retirement

benefit plans if investment returns on pension assets are lower

than expected or interest rates decline, and/or due to changes to

regulatory, accounting and actuarial requirements. The Company has

debt obligations that could materially adversely affect the

Company’s business and its ability to meet its obligations.

Covenants in the Company’s debt agreements may impair its ability

to operate its business. Challenges in the commercial and credit

environments may materially adversely affect the Company’s future

access to capital. The Company may require additional financing in

the future to meet its capital needs or to make acquisitions, and

such financing may not be available on favorable terms, if at all,

and may be dilutive to existing stockholders. Common Stock and

Certain Corporate Matters Risks Stockholders’ ownership in RYAM

may be diluted. Certain provisions in the Company’s amended and

restated certificate of incorporation and bylaws, and of Delaware

law, could prevent or delay an acquisition of the Company, which

could decrease the price of its common stock.

Other important factors that could cause actual results or

events to differ materially from those expressed in forward-looking

statements that may have been made in this document are described

or will be described in the Company’s filings with the U.S.

Securities and Exchange Commission, including the Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. The Company assumes

no obligation to update these statements except as is required by

law.

Non-GAAP Financial Measures

This earnings release and the accompanying schedules contain

certain non-GAAP financial measures, including EBITDA, adjusted

EBITDA, adjusted free cash flow, adjusted net income, adjusted net

debt and net secured debt. The Company believes these non-GAAP

financial measures provide useful information to its Board of

Directors, management and investors regarding its financial

condition and results of operations. Management uses these non-GAAP

financial measures to compare its performance to that of prior

periods for trend analyses, to determine management incentive

compensation and for budgeting, forecasting and planning

purposes.

The Company does not consider these non-GAAP financial measures

an alternative to financial measures determined in accordance with

GAAP. The principal limitation of these non-GAAP financial measures

is that they may exclude significant expense and income items that

are required by GAAP to be recognized in the consolidated financial

statements. In addition, they reflect the exercise of management’s

judgment about which expense and income items are excluded or

included in determining these non-GAAP financial measures. In order

to compensate for these limitations, reconciliations of the

non-GAAP financial measures to their most directly comparable GAAP

financial measures are provided below. Non-GAAP financial measures

are not necessarily indicative of results that may be generated in

future periods and should not be relied upon, in whole or part, in

evaluating the financial condition, results of operations or future

prospects of the Company.

Rayonier Advanced Materials

Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

(in millions, except share and

per share information)

Three Months Ended

March 30, 2024

December 31, 2023

April 1, 2023

Net sales

$

388

$

422

$

467

Cost of sales

(351

)

(395

)

(430

)

Gross margin

37

27

37

Selling, general and administrative

expense

(21

)

(17

)

(19

)

Foreign exchange gain (loss)

3

(2

)

—

Asset impairment

—

(62

)

—

Other operating expense, net

(2

)

(7

)

(1

)

Operating income (loss)

17

(61

)

17

Interest expense

(21

)

(22

)

(15

)

Other income (expense), net

2

1

(2

)

Loss before income tax

(2

)

(82

)

—

Income tax benefit

—

21

3

Equity in loss of equity method

investment

—

—

(1

)

Net income (loss)

$

(2

)

$

(61

)

$

2

Basic and diluted earnings per common

share

Net income (loss) per common share

$

(0.02

)

$

(0.94

)

$

0.02

Shares used in determining EPS

Basic EPS

65,447,454

65,356,895

64,504,200

Diluted EPS

65,447,454

65,356,895

66,596,653

Rayonier Advanced Materials

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(in millions)

March 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

55

$

76

Other current assets

491

499

Property, plant and equipment, net

1,058

1,075

Other assets

531

533

Total assets

$

2,135

$

2,183

Liabilities and Stockholders’

Equity

Debt due within one year

$

23

$

25

Other current liabilities

309

351

Long-term debt

756

752

Non-current environmental liabilities

160

160

Other liabilities

145

148

Total stockholders’ equity

742

747

Total liabilities and stockholders’

equity

$

2,135

$

2,183

Rayonier Advanced Materials

Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(in millions)

Three Months Ended

March 30, 2024

April 1, 2023

Operating Activities

Net income (loss)

$

(2

)

$

2

Adjustments to reconcile net income (loss)

to cash provided by operating activities:

Depreciation and amortization

34

35

Other

1

5

Changes in working capital and other

assets and liabilities

(21

)

9

Cash provided by operating activities

12

51

Investing Activities

Capital expenditures, net of proceeds

(33

)

(21

)

Cash used in investing activities

(33

)

(21

)

Financing Activities

Changes in debt

3

(9

)

Other

(2

)

(5

)

Cash provided by (used in) financing

activities

1

(14

)

Net increase (decrease) in cash and cash

equivalents

(20

)

16

Net effect of foreign exchange on cash and

cash equivalents

(1

)

1

Balance, beginning of period

76

152

Balance, end of period

$

55

$

169

Rayonier Advanced Materials

Inc.

Sales Volumes and Average

Prices

(Unaudited)

Three Months Ended

March 30, 2024

December 31, 2023

April 1, 2023

Average Sales Prices ($ per metric

ton)

High Purity Cellulose

$

1,299

$

1,248

$

1,322

Paperboard

$

1,382

$

1,441

$

1,568

High-Yield Pulp (external sales)

$

559

$

504

$

769

Sales Volumes (thousands of metric

tons)

High Purity Cellulose

219

259

265

Paperboard

38

38

38

High-Yield Pulp (external sales)

50

40

43

Rayonier Advanced Materials

Inc.

Reconciliation of Non-GAAP

Measures

(Unaudited)

(in millions)

EBITDA and Adjusted EBITDA by

Segment(a)

Three Months Ended March 30,

2024

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Net income (loss)

$

21

$

8

$

(1

)

$

(30

)

$

(2

)

Depreciation and amortization

29

4

1

—

34

Interest expense, net

—

—

—

20

20

Income tax benefit

—

—

—

—

—

EBITDA and Adjusted EBITDA

$

50

$

12

$

—

$

(10

)

$

52

Three Months Ended December

31, 2023

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Net income (loss)

$

(49

)

$

9

$

(5

)

$

(16

)

$

(61

)

Depreciation and amortization

32

3

—

1

36

Interest expense, net

—

—

—

21

21

Income tax benefit

—

—

—

(21

)

(21

)

EBITDA

(17

)

12

(5

)

(15

)

(25

)

Asset impairment

62

—

—

—

62

Adjusted EBITDA

$

45

$

12

$

(5

)

$

(15

)

$

37

Three Months Ended April 1,

2023

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Net income (loss)

$

13

$

10

$

7

$

(28

)

$

2

Depreciation and amortization

31

3

1

—

35

Interest expense, net

—

—

—

15

15

Income tax benefit

—

—

—

(3

)

(3

)

EBITDA

44

13

8

(16

)

49

Pension settlement loss

—

—

—

2

2

Adjusted EBITDA

$

44

$

13

$

8

$

(14

)

$

51

Annual Guidance

2024

Low

High

Net loss

$

(34

)

$

(14

)

Depreciation and amortization

140

140

Interest expense, net

75

75

Income tax benefit(b)

(1

)

(1

)

EBITDA and Adjusted EBITDA

$

180

$

200

_________________________

(a)

EBITDA is defined as net income (loss)

before interest, taxes, depreciation and amortization. Adjusted

EBITDA is defined as EBITDA adjusted for items that management

believes are not representative of core operations. EBITDA and

Adjusted EBITDA are non-GAAP measures used by management, existing

stockholders and potential stockholders to measure how the Company

is performing relative to the assets under management.

(b)

Estimated using the statutory rates of

each jurisdiction and ignoring all permanent book-to-tax

differences.

Adjusted Free Cash

Flow(a)

Three Months Ended

March 30, 2024

April 1, 2023

Cash provided by operating

activities

$

12

$

51

Capital expenditures, net

(28

)

(15

)

Adjusted free cash flow

$

(16

)

$

36

Annual Guidance Range

2024

Low

High

Cash provided by operating

activities

$

160

$

180

Capital expenditures, net

(80

)

(80

)

Adjusted free cash flow

$

80

$

100

________________________

(a)

Adjusted free cash flow is defined as cash

provided by (used in) operating activities adjusted for capital

expenditures, net of proceeds from the sale of assets and excluding

strategic capital expenditures. Adjusted free cash flow is a

non-GAAP measure of cash generated during a period which is

available for dividend distribution, debt reduction, strategic

acquisitions and repurchase of the Company’s common stock.

Adjusted Net Debt and Net

Secured Debt(a)

March 30, 2024

December 31, 2023

Debt due within one year

$

23

$

25

Long-term debt

756

752

Total debt

779

777

Unamortized premium, discount and issuance

costs

19

20

Cash and cash equivalents

(55

)

(76

)

Adjusted net debt

743

721

Unsecured debt

(22

)

(23

)

Net secured debt

$

721

$

698

________________________

(a)

Adjusted net debt is defined as the amount

of debt after the consideration of debt premium, discount and

issuance costs, less cash. Net secured debt is defined as adjusted

net debt less unsecured debt.

Adjusted Net Income

(Loss)(a)

Three Months Ended

March 30, 2024

December 31, 2023

April 1, 2023

$

Per Diluted Share

$

Per Diluted Share

$

Per Diluted Share

Net income (loss)

$

(2

)

$

(0.02

)

$

(61

)

$

(0.94

)

$

2

$

0.02

Asset impairment

—

—

62

0.95

—

—

Pension settlement loss

—

—

—

—

2

0.03

Tax effect of adjustments

—

—

(15

)

(0.23

)

—

—

Adjusted net income (loss)

$

(2

)

$

(0.02

)

$

(14

)

$

(0.22

)

$

4

$

0.05

________________________

(a)

Adjusted net income (loss) is defined as

net income (loss) adjusted net of tax for items that management

believes are not representative of core operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507216185/en/

Media Ryan Houck 904-357-9134 Investors Mickey Walsh

904-357-9162

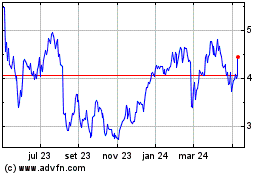

Rayonier Advanced Materi... (NYSE:RYAM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

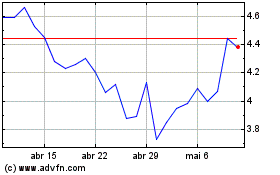

Rayonier Advanced Materi... (NYSE:RYAM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024