RYAM Announces Expiration of Cash Tender Offer for Any and All of Rayonier A.M. Products’ 7.625% Senior Secured Notes due 2026

05 Novembro 2024 - 10:00AM

Business Wire

Rayonier Advanced Materials Inc. (NYSE: RYAM) (the “Company” or

“RYAM”), the global leader in High Purity Cellulose, and its

wholly-owned subsidiary, Rayonier A.M. Products Inc. (the

“Issuer”), announced today that the previously-announced cash

tender offer by the Issuer to purchase any and all of the Issuer’s

outstanding 7.625% Senior Secured Notes due 2026 (the “notes”)

expired at 5:00 p.m., New York City time, on November 4, 2024 (such

time and date, the “Expiration Date”), pursuant to the terms of the

offer to purchase, dated as of October 29, 2024 (the “Offer to

Purchase”), and the notice of guaranteed delivery attached thereto

(the “Notice of Guaranteed Delivery”). As of the Expiration Date,

according to information provided by the information and tender

agent for the tender offer, $135,486,000 aggregate principal amount

of the notes were validly tendered and not validly withdrawn,

representing 29.93% of the aggregate principal amount of the notes

outstanding, which does not include $143,000 aggregate principal

amount of the notes for which a Notice of Guaranteed Delivery was

timely delivered and that remain subject to the guaranteed delivery

procedures set forth in the Offer to Purchase and the Notice of

Guaranteed Delivery. Withdrawal rights for the tender offer expired

at the Expiration Date, and accordingly, notes validly tendered in

the tender offer may no longer be withdrawn except where additional

withdrawal rights are required by law.

The Issuer expects to accept for payment all notes validly

tendered and not validly withdrawn in the tender offer, including

any notes that are timely and validly tendered pursuant to the

guaranteed delivery procedures, and expects to make payment for

such notes on November 7, 2024. Consummation of the tender offer

remains subject to the satisfaction or waiver of certain conditions

set forth in the Offer to Purchase.

As previously disclosed, the Issuer intends to legally defease

all of its obligations under the outstanding notes that are not

validly tendered and purchased in the tender offer pursuant to the

terms of the indenture for such notes.

Persons with questions regarding the tender offer should contact

the sole dealer manager for the tender offer, Houlihan Lokey

Capital, Inc., by telephone at (888) 613-7288 (toll-free) or at

(212) 497-7864. Global Bondholder Services Corporation is the

information and tender agent for the tender offer, and may be

reached by telephone at (855) 654-2015 (toll-free) or at (212)

430-3774 (banks and brokers only), by e-mail at

contact@gbsc-usa.com or at the following web address:

https://www.gbsc-usa.com/ryam/.

This press release is not an offer to purchase or a solicitation

of an offer to sell any securities and does not constitute a

redemption notice or notice of defeasance or satisfaction and

discharge for any securities. The tender offer was made solely by

means of the Offer to Purchase and Notice of Guaranteed Delivery

and only in such jurisdictions as is permitted under applicable

law.

About RYAM

RYAM is a global leader of cellulose-based technologies,

including high purity cellulose specialties, a natural polymer

commonly used in the production of filters, food, pharmaceuticals

and other industrial applications. RYAM’s specialized assets,

capable of creating the world’s leading high purity cellulose

products, are also used to produce biofuels, bioelectricity and

other biomaterials such as bioethanol and tall oils. The Company

also manufactures products for paper and packaging markets. With

manufacturing operations in the U.S., Canada and France, RYAM

generated $1.6 billion of revenue in 2023. More information is

available at www.RYAM.com.

Forward-Looking Statements

Certain statements in this document regarding anticipated

financial, business, legal, or other outcomes, including business

and market conditions, outlook, and other similar statements

relating to RYAM’s or the Issuer’s future or expected events,

developments, or financial or operational performance or results,

are “forward-looking statements” made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and other federal securities laws. These forward-looking statements

are identified by the use of words such as “may,” “will,” “should,”

“expect,” “estimate,” “believe,” “intend,” “anticipate,” and other

similar language. However, the absence of these or similar words or

expressions does not mean that a statement is not forward-looking.

While we believe these forward-looking statements are reasonable

when made, forward-looking statements are not guarantees of future

performance or events, and undue reliance should not be placed on

these statements. Although we believe the expectations reflected in

any forward-looking statements are based on reasonable assumptions,

we can give no assurance that these expectations will be attained.

It is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties.

Other important factors that could cause actual results or

events to differ materially from those expressed in forward-looking

statements that may have been made in this document are described

or will be described in our filings with the U.S. Securities and

Exchange Commission, including our Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. RYAM and the Issuer assume no

obligation to update these statements except as is required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105342309/en/

Media Ryan Houck (904) 357-9134 Investors Mickey Walsh (904)

357-9162

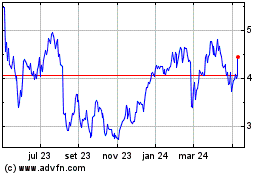

Rayonier Advanced Materi... (NYSE:RYAM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

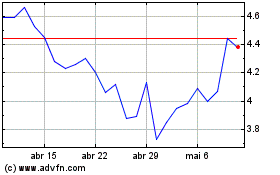

Rayonier Advanced Materi... (NYSE:RYAM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025