Increases 2024 EBITDA and Free Cash Flow

Guidance

- Net sales for the second quarter of $419 million, up $34

million from prior year quarter

- Income from continuing operations for the second quarter of $8

million, up $24 million from prior year quarter

- Adjusted EBITDA from continuing operations for the second

quarter of $68 million, up $41 million from prior year quarter,

including $10 million of CEWS benefits recognized

- Total debt of $778 million; Net Secured Debt of $659 million

with a covenant net secured debt ratio of 3.4 times

- 2024 Adjusted EBITDA guidance increased to $205 million to $215

million

- 2024 Adjusted Free Cash Flow guidance increased to $100 million

to $110 million

- Given the upgraded guidance, the Company is targeting a

covenant net secured debt ratio of less than 3.0 times by the end

of 2024

Rayonier Advanced Materials Inc. (NYSE:RYAM) (the “Company”)

today reported results for its second quarter ended June 29,

2024.

“The Company delivered another solid quarter on its financial

results as we continued to improve our product mix and manage

operating costs. Demand for cellulose specialties has remained

higher than expectations and margins have improved as we have

minimized losses associated with commodity viscose pulp driven by

our decision to suspend operations at our Temiscaming High Purity

Cellulose plant. Along with solid EBITDA results, the Company

generated $69 million of Adjusted Free Cash Flow, which was

supported by the $39 million sale of our refund rights related to

our softwood lumber duties. As a result, we reduced our net secured

debt leverage ratio to 3.4 times covenant EBITDA,” stated De Lyle

Bloomquist, President and CEO of RYAM. “In addition to the solid

financial results, we have also made significant progress on

executing our Biomaterials strategy. The bioethanol facility in

Tartas began shipments in April and is ramping up production. We

also continue to advance other Biomaterials projects, including

bioethanol and prebiotics at our Fernandina and Jesup plants,

respectively.

“With the better-than-expected start to 2024, reduced exposure

to commodity viscose pulp, progress in reducing operating costs and

tightening market dynamics, we are increasing our full-year 2024

Adjusted EBITDA guidance to $205 to $215 million and Adjusted Free

Cash Flow to $100 to $110 million. With this improvement in our

financial metrics, we are confident that we will refinance our

senior secured notes prior to them becoming current in early 2025,”

concluded Mr. Bloomquist.

Second Quarter 2024 Financial Results

The Company reported net income of $11 million, or $0.17 per

diluted share, for the quarter ended June 29, 2024, compared to a

net loss of $17 million, or $(0.26) per diluted share, for the

prior year quarter. Income from continuing operations for the

quarter ended June 29, 2024 was $8 million, or $0.12 per diluted

share, compared to a loss from continuing operations of $16

million, or $(0.24) per diluted share, for the prior year

quarter.

The Company operates in three business segments: High Purity

Cellulose, Paperboard and High-Yield Pulp.

Net sales was comprised of the following for the periods

presented:

Three Months Ended

Six Months Ended

(in millions)

June 29,

2024

March 30,

2024

July 1,

2023

June 29,

2024

July 1,

2023

High Purity Cellulose

$

332

$

307

$

300

$

639

$

674

Paperboard

60

53

48

113

107

High-Yield Pulp

33

34

44

67

86

Eliminations

(6

)

(6

)

(7

)

(12

)

(15

)

Net sales

$

419

$

388

$

385

$

807

$

852

Operating results were comprised of the following for the

periods presented:

Three Months Ended

Six Months Ended

(in millions)

June 29,

2024

March 30,

2024

July 1,

2023

June 29,

2024

July 1,

2023

High Purity Cellulose

$

30

$

21

$

—

$

51

$

13

Paperboard

12

8

6

20

16

High-Yield Pulp

1

(1

)

1

—

8

Corporate

(15

)

(11

)

(14

)

(26

)

(27

)

Operating income (loss)

$

28

$

17

$

(7

)

$

45

$

10

High Purity Cellulose

Net sales for the second quarter increased $32 million, or 11

percent, to $332 million compared to the same prior year quarter.

Included in the current and prior year quarters were $23 million

and $22 million, respectively, of other sales primarily from

bio-based energy and lignosulfonates. Due to improved mix, total

sales prices increased 5 percent. Total sales volumes increased 5

percent due to a 25 percent increase in cellulose specialties

volumes that was partially offset by a 13 percent decrease in

commodity volumes. Cellulose specialties sales volumes increased

due to additional volumes sold to customers affected by the

indefinite suspension of Temiscaming HPC operations that began in

the third quarter, the closure of a competitor’s plant in late 2023

and a continued uptick in ethers sales. The decrease in commodity

sales volumes was primarily driven by a higher mix of cellulose

specialties production.

Net sales for the six months ended June 29, 2024 decreased $35

million, or 5 percent, to $639 million compared to the same prior

year period. Included in the current and prior year six-month

periods were $46 million and $45 million, respectively, of other

sales primarily from bio-based energy and lignosulfonates. Total

sales prices increased 2 percent due to a 1 percent increase in

cellulose specialties prices that was partially offset by a 6

percent decrease in commodity prices. Despite a cellulose

specialties sales volumes increase of 2 percent, total sales

volumes decreased 7 percent driven by a 16 percent decrease in

commodity volumes. Increased cellulose specialties sales volumes

resulting from the additional volumes sold ahead of the suspension

of Temiscaming HPC operations, the closure of a competitor’s plant

in late 2023 and an uptick in ethers sales were nearly entirely

offset by the one-time favorable impact from a change in customer

contract terms in the prior year first quarter. The decrease in

commodity sales volumes was primarily driven by a higher mix of

cellulose specialties production.

Operating income for the quarter and six months ended June 29,

2024 increased $30 million and $38 million, respectively, compared

to the same prior year periods. The quarter increase was driven by

the higher cellulose specialties sales volumes, decreased key input

and logistics costs and higher productivity, partially offset by

the impact of the timing of planned maintenance outages compared to

the prior year. The increase in the six-month period was driven by

the increase in cellulose specialties sales prices and volumes,

decreased key input and logistics costs and higher productivity,

partially offset by the lower commodity sales prices and volumes

and the impact of the timing of planned maintenance outages

compared to the prior year. Also included in operating income in

the current quarter and six-month periods was the recognition of $5

million in Canada Emergency Wage Subsidy (CEWS) benefit claims

deferred since 2021 and $7 million in costs incurred related to the

suspension of Temiscaming HPC operations. Included in the operating

results of the prior year quarter and six-month periods was the

recognition of a $3 million benefit from payroll tax credit

carryforwards and $4 million and $11 million, respectively, of

energy cost benefits from sales of excess emission allowances that

did not repeat in the current year.

Compared to the first quarter of 2024, net sales increased $25

million driven by a 6 percent increase in total sales prices,

comprised of a 5 percent increase in commodity prices and flat

cellulose specialties prices, and a 3 percent increase in total

sales volumes, including a 14 percent increase in cellulose

specialties volumes driven by volumes sold ahead of the suspension

of Temiscaming HPC operations, partially offset by a 9 percent

decrease in commodity volumes due to a higher mix of cellulose

specialties production. Operating income increased $9 million

primarily due to the higher commodity sales prices and cellulose

specialties sales volumes, lower production costs and the income

recognized related to the CEWS benefit claims, partially offset by

the lower commodity sales volumes, increases in key input and labor

costs and the recognition of costs incurred related to the

suspension of Temiscaming HPC operations.

Paperboard

Net sales for the second quarter increased $12 million, or 25

percent, to $60 million compared to the same prior year quarter.

Net sales for the six months ended June 29, 2024 increased $6

million, or 6 percent, to $113 million compared to the same period

year period. Sales volumes increased 38 percent and 17 percent

during the quarter and six-month periods, respectively, due to the

easing of prior year customer destocking. Sales prices decreased 8

percent and 10 percent, respectively, driven by mix and increased

competitive activity from European imports.

Operating income for the quarter and six months ended June 29,

2024 increased $6 million and $4 million, respectively, compared to

the same prior year periods. These quarter and six-month increases

were each driven by the higher sales volumes and lower purchased

pulp costs, partially offset by the lower sales prices and the

impact of the planned maintenance outage in the prior year. Also

included in operating income in the current quarter and six-month

periods was the recognition of $2 million in CEWS benefit claims

deferred since 2021.

Compared to the first quarter of 2024, operating income

increased $4 million driven by a 16 percent increase in sales

volumes due to increased demand and the income recognized related

to the CEWS benefit claims, partially offset by higher purchased

pulp costs. Sales prices were flat.

High-Yield Pulp

Net sales for the second quarter decreased $11 million, or 25

percent, to $33 million compared to the same prior year quarter.

Net sales for the six months ended June 29, 2024 decreased $19

million, or 22 percent, to $67 million compared to the same prior

year period. Sales prices decreased 9 percent and 18 percent during

the quarter and six-month periods, respectively, due to market

supply dynamics in China. Sales volumes decreased 25 percent and 8

percent, respectively, due to lower demand.

Operating income for the quarter and six months ended June 29,

2024 was flat and decreased $8 million, respectively, compared to

the same prior year periods. In both the quarter and six-month

periods, the lower sales prices and volumes and the impact of the

planned maintenance outage in the prior year were offset by lower

logistics and chemicals costs. Also included in operating income in

the current quarter and six-month periods was the recognition of $2

million in CEWS benefit claims deferred since 2021.

Compared to the first quarter of 2024, operating results

increased $2 million due to a 3 percent increase in sales prices,

lower chemicals costs and the income recognized related to the CEWS

benefit claims, partially offset by a 10 percent decrease in sales

volumes.

Corporate

Operating loss for the quarter and six months ended June 29,

2024 increased $1 million and decreased $1 million, respectively,

compared to the same prior year periods. The increase in the

quarter loss was driven by higher costs related to the Company’s

ERP transformation project and higher variable compensation costs

and discounting and financing fees, partially offset by more

favorable foreign exchange rates in the current quarter. The

improvement in the operating loss in the six-month period was

driven by more favorable foreign exchange rates in the current

year, partially offset by higher costs related to the Company’s ERP

transformation project and higher variable compensation costs and

discounting and financing fees.

Compared to the first quarter of 2024, operating loss increased

$4 million driven by less favorable foreign exchange rates in the

current quarter and higher ERP transformation project costs and

environmental expense.

Non-Operating Income & Expense

Interest expense for the quarter and six months ended June 29,

2024 increased $5 million and $11 million, respectively, compared

to the same prior year periods driven by an increase in the average

effective interest rate on debt, partially offset by a decrease in

the average outstanding balance of debt. Total debt decreased $56

million from July 1, 2023 to June 29, 2024.

Included in “other income, net” in the six months ended June 29,

2024 was a $1 million impact from favorable foreign exchange

rates.

Included in “other income, net” in the quarter and six months

ended July 1, 2023 was a $2 million gain on a passive land sale and

a $1 million net gain on debt extinguishment, which were partially

offset by a $1 million impact from unfavorable foreign exchange

rates. Also included in the prior six-month period was a pension

settlement loss of $2 million.

Income Taxes

The effective tax rate on the income from continuing operations

for the quarter and six months ended June 29, 2024 was a benefit of

11 percent and 21 percent, respectively. The 2024 effective tax

rate differed from the federal statutory rate of 21 percent

primarily due to the release of certain tax reserves,

return-to-accrual adjustments, excess deficit on vested stock

compensation and changes in the valuation allowance on disallowed

interest deductions.

The effective tax rate on the loss from continuing operations

for the quarter and six months ended July 1, 2023 was a benefit of

18 percent and 32 percent, respectively. The 2023 effective tax

rates differed from the federal statutory rate of 21 percent

primarily due to disallowed interest deductions in the U.S. and

nondeductible executive compensation, offset by U.S. tax credits,

return-to-accrual adjustments related to previously filed tax

returns and an excess tax benefit on vested stock compensation.

Discontinued Operations

During the quarter ended June 29, 2024, the Company recorded

pre-tax income from discontinued operations of $5 million related

to CEWS benefit claims deferred since 2021 and a loss of $1 million

on the sale of its softwood lumber duty refund rights.

Cash Flows & Liquidity

The Company generated operating cash flows of $99 million during

the six months ended June 29, 2024, driven by lower costs, proceeds

of $39 million for the sale of its duty refund rights and net tax

refunds of $5 million, partially offset by cash outflows from

working capital and payments of interest on long-term debt.

The Company used $58 million in investing activities during the

six months ended June 29, 2024 related to net capital expenditures,

which included $28 million of strategic capital spending focused on

the investment in the 2G bioethanol plant in Tartas.

The Company had $1 million of net cash outflows from financing

activities during the six months ended June 29, 2024 as net

borrowings of long-term debt were offset by Term Loan financing

fees paid in the first quarter.

The Company ended the second quarter with $260 million of global

liquidity, including $114 million of cash, borrowing capacity under

the ABL Credit Facility of $135 million and $11 million of

availability under the France factoring facility.

As of June 29, 2024, the Company’s consolidated secured net

leverage ratio was 3.4 times covenant EBITDA.

2024 Outlook

The Company is actively pursuing the refinancing of its 2026

Senior Notes before they go current in January 2025 and strongly

believes that, due to improving business performance and credit

metrics, it will secure refinancing at satisfactory terms. The

Company has engaged Houlihan Lokey to explore refinancing

options.

In October 2023, the Company announced that it is exploring the

potential sale of its Paperboard and High-Yield Pulp assets located

at its Temiscaming site. The Company continues to run a thorough

process involving multiple suitors. While this process has been

slowed due to complexities relating to the recently announced

indefinite suspension of operations of the site’s HPC line, the

Company remains highly committed to completing a near-term sale of

these assets at a fair price.

In July 2024, the Company indefinitely suspended operations at

its Temiscaming HPC plant. This plan is expected to mitigate high

capital needs and operating losses related to exposure to commodity

viscose products and improve the Company’s consolidated free cash

flow, however, future operational loss reductions will be partially

offset by custodial site expenses. In connection with the

suspension of operations, the Company expects to incur one-time

operating charges in 2024 of approximately $25 million to $30

million, including mothballing and severance and other employee

costs. Further, the Company also expects to incur non-cash charges

in the third quarter of 2024 related to asset impairments. The

Company continues to expect that for 2024, the suspension of the

Temiscaming HPC plant will be positive to Adjusted EBITDA and will

increase free cash flow by $25 million to $30 million as lower

capital expenditures and benefits from the monetization of working

capital are expected to more than offset the one-time and other

cash costs associated with the suspension of operations.

The Company expects to generate between $205 million and $215

million of Adjusted EBITDA in 2024 with $100 million to $110

million of Adjusted Free Cash Flow, including passive asset sales

but excluding any operating asset sales.

The following market assessment represents the Company’s current

outlook of its business segments’ future performance.

High Purity Cellulose

Average sales prices for cellulose specialties in 2024 are

expected to increase by a low single-digit percentage as compared

to average sales prices in 2023 as the Company continues to

prioritize value over volume. Sales volumes for cellulose

specialties are expected to increase compared to 2023 driven by

increased volumes from the closure of a competitor’s plant, a

modest increase in ethers sales and additional volume sold to

customers ahead of the suspension of Temiscaming HPC operations,

partially offset by a one-time favorable impact from a change in

customer contract terms in the prior year first quarter and

customer destocking in the acetate markets. Demand for RYAM

commodity products remains stable. Commodity average sales prices

are expected to be in line with 2023 prices. Commodity sales

volumes are expected to increase slightly in the second half of

2024 due to increased fluff sales. Costs are expected to be lower

in 2024 driven by lower key input and logistics costs, improved

productivity and the suspension of operations at the Temiscaming

HPC plant, partially offset by increased maintenance costs due to

the timing of projects and net custodial site expenses related to

the suspension. The Company’s bioethanol facility in Tartas, France

became operational in the first quarter of 2024 and is expected to

deliver $3 million to $4 million of EBITDA in 2024, growing to $8

million to $10 million beginning in 2025. EBITDA in the third

quarter of 2024 is expected to be lower than the second quarter of

2024 due to the anticipated net custodial site expenses at the

Temiscaming site, no additional CEWS benefits to be recognized and

lower cellulose specialties volumes to be sold ahead of the

suspension of operations; however, EBITDA in the third quarter of

2024 is expected to be significantly stronger than the third

quarter of 2023.

Paperboard

Paperboard prices in the second half of 2024 are expected to

decrease slightly compared to the first half of 2024, while sales

volumes are expected to increase slightly as inventories reduce,

despite higher planned maintenance downtime for the Company’s

distributed control system upgrade. Raw material prices are

expected to increase compared to the first half of the year.

Overall, the Company expects a decline in EBITDA from this segment

in the coming quarter.

High-Yield Pulp

High-Yield Pulp prices are expected to decline in the second

half of 2024, while sales volumes are expected to increase due to

improved productivity. Overall, the Company expects to generate

moderately higher EBITDA from this segment in the coming

quarter.

Corporate

Corporate costs are expected to increase in the second half of

2024 as the Company continues its ERP transformation project and

considering the favorable foreign exchange rates in the first half

of the year. The ERP transformation project will enhance the

Company’s operating and reporting systems and is expected to drive

additional improvements and efficiencies beginning in 2025.

Biomaterials Strategy

The Company continues to invest in new products to provide both

increased end market diversity and incremental profitability. These

new products will target the growing green energy and renewable

product markets. The Company’s bioethanol facility in Tartas,

France is operating as expected and represents a significant

milestone towards the Company’s goal of generating $42 million of

annual EBITDA from these biomaterial products in 2027. The Company

has submitted notice of its GRAS (generally recognized as safe)

self-certification for a prebiotics product to the U.S. Food and

Drug Administration and continues to move forward with plans for a

bioethanol facility in Fernandina. The Company is also advancing

various other projects and is in the final stages of securing green

capital to support these efforts.

Conference Call Information

RYAM will host a conference call and live webcast at 9:00 a.m.

ET on Wednesday, August 7, 2024 to discuss these results.

Supplemental materials and access to the live audio webcast will be

available at www.RYAM.com. A replay of this webcast will be

archived on the Company’s website shortly after the call.

Investors may listen to the conference call by dialing

800-715-9871, no passcode required. For international parties, dial

646-307-1963, Conference ID 3242908. A replay of the teleconference

will be available one hour after the call ends until 6:00 p.m. ET

on Wednesday, August 21, 2024. The replay dial-in number within the

U.S. is 877-660-6853, international is 201-612-7415, Access ID

13748045.

About RYAM

RYAM is a global leader of cellulose-based technologies,

including high purity cellulose specialties, a natural polymer

commonly used in the production of filters, food, pharmaceuticals

and other industrial applications. RYAM’s specialized assets,

capable of creating the world’s leading high purity cellulose

products, are also used to produce biofuels, bioelectricity and

other biomaterials such as bioethanol and tall oils. The Company

also manufactures products for the paper and packaging markets.

With manufacturing operations in the U.S., Canada and France, RYAM

generated $1.6 billion of revenue in 2023. More information is

available at www.RYAM.com.

Forward-Looking Statements

Certain statements in this document regarding anticipated

financial, business, legal or other outcomes, including business

and market conditions, outlook and other similar statements

relating to future events, developments or financial or operational

performance or results, are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

These forward-looking statements are identified by the use of words

such as “may,” “will,” “should,” “expect,” “estimate,” “target,”

“believe,” “intend,” “plan,” “forecast,” “anticipate,” “guidance”

and other similar language. However, the absence of these or

similar words or expressions does not mean a statement is not

forward-looking. Forward-looking statements are not guarantees of

future performance or events and undue reliance should not be

placed on these statements. Although we believe the expectations

reflected in any forward-looking statements are based on reasonable

assumptions, we can give no assurance that these expectations will

be attained, and it is possible that actual results may differ

materially from those indicated by these forward-looking statements

due to a variety of risks and uncertainties. All statements made in

this earnings release are made only as of the date set forth at the

beginning of this release. The Company undertakes no obligation to

update the information made in this release in the event facts or

circumstances subsequently change after the date of this release.

The Company has not filed its Form 10-Q for the quarter ended June

29, 2024. As a result, all financial results described in this

earnings release should be considered preliminary, and are subject

to change to reflect any necessary adjustments or changes in

accounting estimates, that are identified prior to the time the

Company files its Form 10-Q.

The Company’s operations are subject to a number of risks and

uncertainties including, but not limited to, those listed below.

When considering an investment in the Company’s securities, you

should carefully read and consider these risks, together with all

other information in the Company’s Annual Report on Form 10-K and

other filings and submissions to the SEC, which provide more

information and detail on the risks described below. If any of the

events described in the following risk factors occur, the Company’s

business, financial condition, operating results and cash flows, as

well as the market price of the Company’s securities, could be

materially adversely affected. These risks and events include,

without limitation: Macroeconomic and Industry Risks The

Company’s business, financial condition and results of operations

could be adversely affected by disruptions in the global economy

caused by geopolitical conflicts and related impacts. The Company

is subject to risks associated with epidemics and pandemics, which

could have a material adverse impact on the Company’s business,

financial condition, results of operations and cash flows. The

businesses the Company operates are highly competitive and many of

them are cyclical, which may result in fluctuations in pricing and

volume that can materially adversely affect the Company’s business,

financial condition, results of operations and cash flows. Changes

in the availability and price of raw materials and energy and

continued inflationary pressure could have a material adverse

effect on the Company’s business, financial condition and results

of operations. The Company is subject to material risks associated

with doing business outside of the United States. Foreign currency

exchange fluctuations may have a material adverse impact on the

Company’s business, financial condition and results of operations.

Restrictions on trade through tariffs, countervailing and

anti-dumping duties, quotas and other trade barriers, in the United

States and internationally, could materially adversely affect the

Company’s ability to access certain markets. Business and

Operational Risks The Company’s ten largest customers

represented approximately 40 percent of 2023 revenue and the loss

of all or a substantial portion of revenue from these customers

could have a material adverse effect on the Company’s business. A

material disruption at any of the Company’s manufacturing plants

could prevent the Company from meeting customer demand, reduce

sales and profitability, increase the cost of production and

capital needs, or otherwise materially adversely affect the

Company’s business, financial condition and results of operations.

Unfavorable changes in the availability of, and prices for, wood

fiber may have a material adverse impact on the Company’s business,

financial condition and results of operations. Substantial capital

is required to maintain the Company’s production facilities, and

the cost to repair or replace equipment, as well as the associated

downtime, could materially adversely affect the Company’s business.

The Company faces substantial asset risk, including the potential

for impairment related to long-lived assets and the potential

impact to the value of recorded deferred tax assets. The Company

depends on third parties for transportation services and

unfavorable changes in the cost and availability of transportation

could materially adversely affect the Company’s business. Failure

to maintain satisfactory labor relations could have a material

adverse effect on the Company’s business. The Company is dependent

upon attracting and retaining key personnel, the loss of whom could

materially adversely affect the Company’s business. Failure to

develop new products or discover new applications for existing

products, or inability to protect the intellectual property

underlying new products or applications, could have a material

adverse impact on the Company’s business. Loss of Company

intellectual property and sensitive data or disruption of

manufacturing operations due to a cybersecurity incident could

materially adversely impact the business. Regulatory and

Environmental Risks The Company’s business is subject to

extensive environmental laws, regulations and permits that may

materially restrict or adversely affect how the Company conducts

business and its financial results. The potential longer-term

impacts of climate-related risks remain uncertain at this time.

Regulatory measures to address climate change may materially

restrict how the Company conducts business or adversely affect its

financial results. Financial Risks The Company may need to

make significant additional cash contributions to its retirement

benefit plans if investment returns on pension assets are lower

than expected or interest rates decline, and/or due to changes to

regulatory, accounting and actuarial requirements. The Company has

debt obligations that could materially adversely affect the

Company’s business and its ability to meet its obligations.

Covenants in the Company’s debt agreements may impair its ability

to operate its business. Challenges in the commercial and credit

environments may materially adversely affect the Company’s future

access to capital. The Company may require additional financing in

the future to meet its capital needs or to make acquisitions, and

such financing may not be available on favorable terms, if at all,

and may be dilutive to existing stockholders. Common Stock and

Certain Corporate Matters Risks Stockholders’ ownership in RYAM

may be diluted. Certain provisions in the Company’s amended and

restated certificate of incorporation and bylaws, and of Delaware

law, could prevent or delay an acquisition of the Company, which

could decrease the price of its common stock.

Other important factors that could cause actual results or

events to differ materially from those expressed in forward-looking

statements that may have been made in this document are described

or will be described in the Company’s filings with the U.S.

Securities and Exchange Commission, including the Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. The Company assumes

no obligation to update these statements except as is required by

law.

Non-GAAP Financial Measures

This earnings release and the accompanying schedules contain

certain non-GAAP financial measures, including EBITDA, adjusted

EBITDA, adjusted free cash flow, adjusted net income, adjusted net

debt and net secured debt. The Company believes these non-GAAP

financial measures provide useful information to its Board of

Directors, management and investors regarding its financial

condition and results of operations. Management uses these non-GAAP

financial measures to compare its performance to that of prior

periods for trend analyses, to determine management incentive

compensation and for budgeting, forecasting and planning

purposes.

The Company does not consider these non-GAAP financial measures

an alternative to financial measures determined in accordance with

GAAP. The principal limitation of these non-GAAP financial measures

is that they may exclude significant expense and income items that

are required by GAAP to be recognized in the consolidated financial

statements. In addition, they reflect the exercise of management’s

judgment about which expense and income items are excluded or

included in determining these non-GAAP financial measures. In order

to compensate for these limitations, reconciliations of the

non-GAAP financial measures to their most directly comparable GAAP

financial measures are provided below. Non-GAAP financial measures

are not necessarily indicative of results that may be generated in

future periods and should not be relied upon, in whole or part, in

evaluating the financial condition, results of operations or future

prospects of the Company.

Rayonier Advanced Materials

Inc. Condensed Consolidated Statements of Operations

(Unaudited) (in millions, except share and per share

information)

Three Months Ended

Six Months Ended

June 29,

2024

March 30,

2024

July 1,

2023

June 29,

2024

July 1,

2023

Net sales

$

419

$

388

$

385

$

807

$

852

Cost of sales

(371

)

(351

)

(370

)

(722

)

(800

)

Gross margin

48

37

15

85

52

Selling, general and administrative

expense

(21

)

(21

)

(18

)

(42

)

(37

)

Foreign exchange gain (loss)

—

3

(2

)

3

(2

)

Indefinite suspension charges

(7

)

—

—

(7

)

—

Other operating income (expense), net

8

(2

)

(2

)

6

(3

)

Operating income (loss)

28

17

(7

)

45

10

Interest expense

(21

)

(21

)

(16

)

(42

)

(31

)

Other income, net

1

2

4

3

2

Income (loss) from continuing operations

before income tax

8

(2

)

(19

)

6

(19

)

Income tax benefit

1

—

3

2

6

Equity in loss of equity method

investment

(1

)

—

—

(1

)

(1

)

Income (loss) from continuing

operations

8

(2

)

(16

)

7

(14

)

Income (loss) from discontinued

operations, net of tax

3

—

(1

)

3

(1

)

Net income (loss)

$

11

$

(2

)

$

(17

)

$

10

$

(15

)

Basic and Diluted earnings per common

share

Income (loss) from continuing

operations

$

0.12

$

(0.02

)

$

(0.24

)

$

0.10

$

(0.22

)

Income (loss) from discontinued

operations

0.05

—

(0.02

)

0.05

(0.02

)

Net income (loss)

$

0.17

$

(0.02

)

$

(0.26

)

$

0.15

$

(0.24

)

Weighted average shares used in

determining EPS

Basic EPS

65,716,362

65,447,454

65,226,344

65,582,651

64,865,272

Diluted EPS

68,790,311

65,447,454

65,226,344

68,006,328

64,865,272

Rayonier Advanced Materials

Inc. Condensed Consolidated Balance Sheets (Unaudited) (in

millions)

June 29, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

114

$

76

Other current assets

521

499

Property, plant and equipment, net

1,057

1,075

Other assets

505

533

Total assets

$

2,197

$

2,183

Liabilities and Stockholders’

Equity

Debt due within one year

$

25

$

25

Other current liabilities

352

351

Long-term debt

753

752

Non-current environmental liabilities

160

160

Other liabilities

152

148

Total stockholders’ equity

755

747

Total liabilities and stockholders’

equity

$

2,197

$

2,183

Rayonier Advanced Materials

Inc. Condensed Consolidated Statements of Cash Flows

(Unaudited) (in millions)

Six Months Ended

June 29, 2024

July 1, 2023

Operating Activities

Net income (loss)

$

10

$

(15

)

Adjustments to reconcile net income (loss)

to cash provided by operating activities:

(Income) loss from discontinued

operations

(3

)

1

Depreciation and amortization

67

68

Other

5

(1

)

Changes in working capital and other

assets and liabilities

20

31

Cash provided by operating activities

99

84

Investing Activities

Capital expenditures, net of proceeds

(58

)

(54

)

Cash used in investing activities

(58

)

(54

)

Financing Activities

Changes in debt

1

(21

)

Other

(2

)

(5

)

Cash used in financing activities

(1

)

(26

)

Net increase in cash and cash

equivalents

40

4

Net effect of foreign exchange on cash and

cash equivalents

(2

)

1

Balance, beginning of period

76

152

Balance, end of period

$

114

$

157

Rayonier Advanced Materials

Inc. Sales Volumes and Average Prices (Unaudited)

Three Months Ended

Six Months Ended

June 29,

2024

March 30,

2024

July 1,

2023

June 29,

2024

July 1,

2023

Average Sales Prices ($ per metric

ton)

High Purity Cellulose

$

1,371

$

1,299

$

1,301

$

1,335

$

1,313

Paperboard

$

1,384

$

1,382

$

1,498

$

1,383

$

1,536

High-Yield Pulp (external sales)

$

574

$

559

$

633

$

566

$

691

Sales Volumes (thousands of metric

tons)

High Purity Cellulose

225

219

214

444

479

Paperboard

44

38

32

82

70

High-Yield Pulp (external sales)

45

50

60

95

103

Rayonier Advanced Materials

Inc. Reconciliation of Non-GAAP Measures (Unaudited) (in

millions)

EBITDA and Adjusted EBITDA by

Segment(a)

Three Months Ended June 29,

2024

High Purity

Cellulose

Paperboard

High-Yield

Pulp

Corporate

Total

Income (loss) from continuing

operations

$

30

$

13

$

1

$

(36

)

$

8

Depreciation and amortization

29

2

1

1

33

Interest expense, net

—

—

—

21

21

Income tax benefit

—

—

—

(1

)

(1

)

EBITDA-continuing operations

59

15

2

(15

)

61

Indefinite suspension charges

7

—

—

—

7

Adjusted EBITDA-continuing

operations

$

66

$

15

$

2

$

(15

)

$

68

Three Months Ended March 30,

2024

High Purity

Cellulose

Paperboard

High-Yield

Pulp

Corporate

Total

Income (loss) from continuing

operations

$

21

$

8

$

(1

)

$

(30

)

$

(2

)

Depreciation and amortization

29

4

1

—

34

Interest expense, net

—

—

—

20

20

Income tax benefit

—

—

—

—

—

EBITDA and Adjusted EBITDA-continuing

operations

$

50

$

12

$

—

$

(10

)

$

52

Three Months Ended July 1,

2023

High Purity

Cellulose

Paperboard

High-Yield

Pulp

Corporate

Total

Income (loss) from continuing

operations

$

—

$

6

$

1

$

(23

)

$

(16

)

Depreciation and amortization

28

4

—

1

33

Interest expense, net

—

—

—

14

14

Income tax benefit

—

—

—

(3

)

(3

)

EBITDA-continuing operations

28

10

1

(11

)

28

Gain on debt extinguishment

—

—

—

(1

)

(1

)

Adjusted EBITDA-continuing

operations

$

28

$

10

$

1

$

(12

)

$

27

Six Months Ended June 29,

2024

High Purity

Cellulose

Paperboard

High-Yield

Pulp

Corporate

Total

Income (loss) from continuing

operations

$

51

$

21

$

—

$

(65

)

$

7

Depreciation and amortization

58

6

2

1

67

Interest expense, net

—

—

—

41

41

Income tax benefit

—

—

—

(2

)

(2

)

EBITDA-continuing operations

109

27

2

(25

)

113

Indefinite suspension charges

7

—

—

—

7

Adjusted EBITDA-continuing

operations

$

116

$

27

$

2

$

(25

)

$

120

Six Months Ended July 1,

2023

High Purity

Cellulose

Paperboard

High-Yield

Pulp

Corporate

Total

Income (loss) from continuing

operations

$

13

$

16

$

8

$

(51

)

$

(14

)

Depreciation and amortization

59

7

1

1

68

Interest expense, net

—

—

—

29

29

Income tax benefit

—

—

—

(6

)

(6

)

EBITDA-continuing operations

72

23

9

(27

)

77

Pension settlement loss

—

—

—

2

2

Gain on debt extinguishment

—

—

—

(1

)

(1

)

Adjusted EBITDA-continuing

operations

$

72

$

23

$

9

$

(26

)

$

78

Annual Guidance

2024

Low

High

Loss from continuing operations

$

(57

)

$

(52

)

Depreciation and amortization

140

140

Interest expense, net

85

85

Income tax expense(b)

12

12

EBITDA-continuing operations

180

185

Indefinite suspension charges

25

30

Adjusted EBITDA-continuing

operations

$

205

$

215

___________________________

(a)

EBITDA is defined as net income (loss)

before interest, taxes, depreciation and amortization. Adjusted

EBITDA is defined as EBITDA adjusted for items that management

believes are not representative of core operations. EBITDA and

Adjusted EBITDA are non-GAAP measures used by management, existing

stockholders and potential stockholders to measure how the Company

is performing relative to the assets under management.

(b)

Estimated using the statutory rates of

each jurisdiction and ignoring all permanent book-to-tax

differences.

Adjusted Free Cash

Flow(a)

Six Months Ended

June 29, 2024

July 1, 2023

Cash provided by operating

activities

$

99

$

84

Capital expenditures, net

(30

)

(32

)

Adjusted free cash flow

$

69

$

52

Annual Guidance Range

2024

Low

High

Cash provided by operating

activities

$

175

$

185

Capital expenditures, net

(75

)

(75

)

Adjusted free cash flow

$

100

$

110

___________________________

(a)

Adjusted free cash flow is defined as cash

provided by (used in) operating activities adjusted for capital

expenditures, net of proceeds from the sale of assets and excluding

strategic capital expenditures. Adjusted free cash flow is a

non-GAAP measure of cash generated during a period which is

available for dividend distribution, debt reduction, strategic

acquisitions and repurchase of the Company’s common stock.

Adjusted Net Debt and Net

Secured Debt(a)

June 29, 2024

December 31, 2023

Debt due within one year

$

25

$

25

Long-term debt

753

752

Total debt

778

777

Unamortized premium, discount and issuance

costs

17

20

Cash and cash equivalents

(114

)

(76

)

Adjusted net debt

681

721

Unsecured debt

(22

)

(23

)

Net secured debt

$

659

$

698

___________________________

(a)

Adjusted net debt is defined as the amount

of debt after the consideration of debt premium, discount and

issuance costs, less cash. Net secured debt is defined as adjusted

net debt less unsecured debt.

Adjusted Income (Loss) from

Continuing Operations(a)

Three Months Ended

Six Months Ended

June 29, 2024

March 30, 2024

July 1, 2023

June 29, 2024

July 1, 2023

$

Per

Diluted

Share

$

Per

Diluted

Share

$

Per

Diluted

Share

$

Per

Diluted

Share

$

Per

Diluted

Share

Income (loss) from continuing

operations

$

8

$

0.12

$

(2

)

$

(0.02

)

$

(16

)

$

(0.24

)

$

7

$

0.10

$

(14

)

$

(0.22

)

Indefinite suspension charges

7

0.10

—

—

—

—

7

0.10

—

—

Pension settlement loss

—

—

—

—

—

—

—

—

2

0.04

Gain on debt extinguishment

—

—

—

—

(1

)

(0.01

)

—

—

(1

)

(0.01

)

Tax effect of adjustments

(2

)

(0.03

)

—

—

—

—

(2

)

(0.03

)

—

—

Adjusted income (loss) from continuing

operations

$

13

$

0.19

$

(2

)

$

(0.02

)

$

(17

)

$

(0.25

)

$

12

$

0.17

$

(13

)

$

(0.19

)

___________________________

(a)

Adjusted income (loss) from continuing

operations is defined as income (loss) from continuing operations

adjusted net of tax for items that management believes are not

representative of core operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806060879/en/

Media Ryan Houck 904-357-9134

Investors Mickey Walsh 904-357-9162

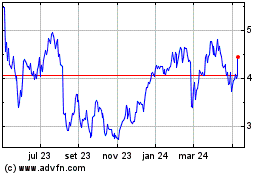

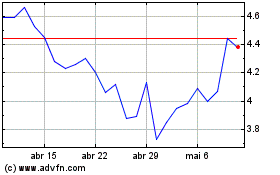

Rayonier Advanced Materi... (NYSE:RYAM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Rayonier Advanced Materi... (NYSE:RYAM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024