Results top consensus expectations driven by

higher production and lower capital expenditures generating record

quarterly EBITDA and strong quarterly free cash flow

Total debt reduced by $178 million since

closing its South Texas acquisition in late 20231; First quarter

2024 leverage ratio of 1.35x2 lower than pre-acquisition

announcement

Year-to-date outperformance leads to increase

in full-year production expectations and free cash flow outlook

SilverBow Resources, Inc. (NYSE: SBOW) (“SilverBow” or the

“Company”) today announced operating and financial results for the

first quarter of 2024. An updated corporate presentation has been

posted to SilverBow’s website and can be accessed at www.sbow.com.

The Company plans to host a conference call at 9 a.m. CT (10 a.m.

ET) on Thursday, May 2, 2024. Participation details can be found

within this release.

First Quarter 2024

Highlights:

- Reported average net production in the upper half of guidance

of 91.4 thousand barrels of oil equivalent per day (“MBoe/d”) (46%

oil/liquids); grew year-over-year net oil production by 116% to

24.5 thousand barrels of oil per day (“MBbls/d”); increases reflect

the South Texas acquisition in late 2023 and ongoing gains in well

productivity and cycle time efficiencies

- Invested $109 million in capital, approximately 20% below

consensus expectations

- Generated a net loss of $16 million, or ($0.61) per diluted

share (all per share amounts stated on a diluted basis), which

includes a net unrealized loss on the value of the Company's

derivative contracts of $90 million and advisory fees of

approximately $5 million, non-GAAP Adjusted EBITDA of $200 million

and non-GAAP free cash flow (“FCF”) of $56 million3

- Reduced total debt by $178 million since closing the South

Texas acquisition in late 20231. Leverage ratio at the end of the

first quarter was 1.35x2, less than SilverBow's leverage ratio

prior to the acquisition announcement

- Enhanced 2024 outlook, raised full year production, FCF and

debt reduction expectations:

- Production expectations raised 5% to a midpoint of 94 MBoe/d,

with oil/liquids representing 48% of volumes

- FCF estimate increased $50 million, or 36%, to a midpoint of

$188 million

- The Company further optimized its planned 2024 investments and

is now allocating 85% of capital to higher-return oil and liquids

developments. Full year capital program of $470 - $510 million

remains unchanged

- Lowered expected year-end leverage ratio to approximately 1.25x

on accelerated debt paydown and expect to attain long-term target

of less than 1.0x in 2025

- Through multiple transactions over the last three years and

culminating with a recent acreage trade, SilverBow has assembled a

contiguous 25,000 gross acre position in the liquids-rich window of

the Eagle Ford. The Company has drilled six wells on the position

with well results and returns exceeding expectations. This position

holds an estimated 150-plus high-return development locations.

SilverBow plans to drill 10-12 additional wells on the asset this

year

- Implemented a successful refrac program with initial wells

demonstrating internal rates of return of more than 100%. SilverBow

has identified more than 100 refrac opportunities and plans

additional refracs in 2024

- The Company drilled its first horseshoe (U-shaped) well in the

Austin Chalk, proving its ability to capture significant upside

through development of complex acreage configurations. More than 30

horseshoe development locations have been identified

- Delivered significant operational achievements year-to-date

which are expected to lead to sustainable capital efficiencies and

recovery of additional resources.4 SilverBow's drilling performance

on its first 10 wells on the South Texas acquisition acreage

exceeds the prior operator's performance by 30%

MANAGEMENT COMMENTS

Sean Woolverton, SilverBow’s Chief Executive Officer, said, "Our

first quarter results were outstanding and are an indicator of the

trajectory of our business. With the successful integration of our

South Texas acquisition, we have greater scale, capital

flexibility, product diversity and cash flow generation. Consistent

with our stated strategy, we are staying disciplined on returns and

demonstrating accelerated debt paydown as we march towards our

long-term leverage ratio target of less than 1.0x. Strong

performance during this quarter supports an increase to our full

year 2024 outlook for production and free cash flow."

Mr. Woolverton commented further, "We are clearly demonstrating

our recent transaction is highly accretive to the business and

accelerates delivery of our stated strategy to create further value

for all shareholders."

FIRST QUARTER 2024 FINANCIAL AND OPERATING SUMMARY

For the first quarter of 2024, SilverBow reported a net loss of

$16 million, or ($0.61) per share, which includes a net unrealized

loss on the value of the Company's derivative contracts of $90

million and advisory fees of approximately $5 million. Non-GAAP

Adjusted EBITDA was $200 million and non-GAAP FCF was $56 million3.

Financial results in the period were driven by production results

in the upper half of SilverBow's guidance. Average net production

increased 80% over the prior year to 91.4 MBoe/d. Oil production

averaged 24.5 MBbls/d, up nearly 116% over the comparable period.

Production mix for the quarter consisted of 54% natural gas, 27%

crude oil and 19% natural gas liquids ("NGLs").

Stated without the impact of hedging, crude oil and natural gas

realizations in the quarter were 97% and 88% of West Texas

Intermediate (“WTI”) and Henry Hub, respectively. Average realized

prices by product were $74.65 per barrel of oil, $1.96 per thousand

cubic feet (“Mcf”) of natural gas and $23.15 per barrel of NGLs

(30% of WTI benchmark). Please refer to the tables included in this

release for complete production volumes and pricing

information.

Total production expenses in the quarter, which include lease

operating expenses, transportation and processing expenses and

production taxes, were $8.14 per barrel of oil equivalent

(“Boe”).

Capital investments for the quarter totaled $109 million on an

accrual basis.

OPERATIONS UPDATE

SilverBow operated three rigs in the quarter, with operations

primarily focusing on the Central Oil, Western Condensate and

Eastern Extension areas, and brought online 12 net wells. The

Company plans to reduce activity to two rigs in June 2024.

Specific to the South Texas acquisition, SilverBow is currently

drilling a 10-well pad developing four stacked zones (Upper and

Lower Eagle Ford and Middle and Lower Austin Chalk). The Company's

drilling performance on its first 10 wells on the South Texas

acquisition acreage exceeds the prior operator's performance by

30%. First production from this pad is expected late in the second

quarter of 2024.

In line with SilverBow's strategic goal of building a scaled and

durable portfolio, the Company completed a land swap with a third

party subsequent to the first quarter; which aided in assembling a

contiguous 25,000 gross acre position. The total position has more

than 150 prospective liquids-rich locations in La Salle and

McMullen counties, Texas. SilverBow targeted this overlooked area

with confidence that historical drilling and completion practices

undervalued the true potential of the Eagle Ford. SilverBow used

its proven operational practices to enhance well productivity and

returns. To date, six wells have been drilled on the acreage with

estimated rates of return of more than 100%, exceeding SilverBow's

initial expectations. The area immediately competes for capital

with an additional 10-12 wells planned for the area in 2024.

Through its disciplined acquisition and trade strategy, the Company

built this impactful inventory position at no incremental cash

cost.

In the first quarter, the Company advanced key operational

achievements, including highly-successful refracs and drilling of

our first horseshoe (U-shaped) well in the Austin Chalk. Both

efforts significantly enhanced returns and can be repeated across

SilverBow's portfolio.

The first two refracs were each completed for under $4 million.

SilverBow estimates that the projects will achieve payout in less

than 10 months and have a project rate of return of more than 100%.

The Company has identified more than 100 refrac opportunities

across its portfolio and is planning for additional refracs this

year.

SilverBow recently drilled an 8,900 foot horseshoe (U-shaped)

lateral well in Live Oak County. The well, which was recently

completed, was designed to optimally develop a complex acreage

configuration to enhance project returns, reduce cycle times and

capture additional resource. When comparing results of the

horseshoe well to two traditional, shorter lateral wells, SilverBow

estimates that total drill and complete costs were about 25% lower,

and cycle times were improved by about 15%. The successful

development approach will be deployed to develop additional targets

in the immediate area. The Company has identified more than 30

horseshoe wells that can be drilled on complex, stranded acreage

configurations to unlock potential significant value.

2024 OUTLOOK

For the second quarter of 2024, SilverBow expects its production

to be 90.8 - 95.4 MBoe/d, with oil volumes of 23.5 - 25.0 MBbls/d.

For the full year 2024, the Company increased its production

guidance to 90.0 - 97.3 MBoe/d. Based on the revised guidance,

SilverBow's full year 2024 oil/liquids volumes are expected to

comprise 48% of the Company's total production. Consistent with

SilverBow's returns driven strategy, the Company's volume guidance

assumes full ethane recovery in the NGL production stream for the

remainder of 2024.

SilverBow increased its estimate for full year 2024 free cash

flow to $175 - $200 million with estimated full year 2024 capital

investments unchanged at $470 - $510 million. Additional detail on

the Company's outlook can be found in the table included in this

release.

RISK MANAGEMENT

SilverBow has a proven track record of effectively managing

commodity price risks through the use of derivatives. As of April

26, 2024, the Company had 63% of total production hedged for the

remainder of 2024, using the midpoint of guidance; 75% of natural

gas production hedged at an average price of $3.78 per million

British thermal units; 67% of oil hedged at an average price of

$74.87 per barrel and 28% of NGLs hedged at an average price of

$25.92 per barrel. The hedged amounts are inclusive of both swaps

and collars with the average price factoring in the floor price of

the collars. Refer to the corporate presentation posted on

SilverBow's website today for a detailed summary of the Company's

derivative contracts.

CAPITAL STRUCTURE AND LIQUIDITY

As of March 31, 2024, SilverBow had approximately $605 million

of liquidity, consisting of $1 million of cash and $604 million of

availability under its senior secured revolving credit facility

(“Credit Facility”). As of April 30, 2024, the Company had $627

million of undrawn capacity under the Credit Facility and $3

million of cash resulting in $630 million of liquidity. This

represents $178 million of debt reduction in the five months since

closing the South Texas acquisition; debt reduction remains the

primary use of FCF in the near-term.

As of March 31, 2024, SilverBow reported total debt of $1.1

billion and non-GAAP Adjusted EBITDA for Leverage Ratio of $814

million3, which, in accordance with the leverage ratio calculation

in its Credit Facility, includes pro forma contributions from

acquired assets prior to their closing dates totaling $189 million.

As of March 31, 2024, the Company had a leverage ratio of 1.35x2.

SilverBow expects to exit the year at a leverage ratio of

approximately 1.25x which is inclusive of the $50 million deferred

payment associated with the South Texas acquisition. Assuming

current strip prices, the Company expects to reach its goal of less

than 1.0x in 2025. As of April 26, 2024, SilverBow had 25.5 million

total common shares outstanding.

CONFERENCE CALL DETAILS

SilverBow plans to host a conference call for investors at 9

a.m. CT (10 a.m. ET) on Thursday May 2, 2023. Investors and

participants can listen to the call by dialing 1-800-715-9871

(U.S.) or 1-646-307-1963 (International) and requesting SilverBow

Resource's First Quarter 2024 Earnings Conference Call (Conference

ID: 5582880) or by visiting the Company's website. A simultaneous

webcast of the call may be found at

www.sbow.com/investor-relations/Investor-Relations-Events-Presentations/event-calendar/default.aspx.

The webcast will be archived for replay on the Company's website

for 14 days.

ABOUT SILVERBOW RESOURCES, INC.

SilverBow Resources, Inc. (NYSE: SBOW) is a Houston-based energy

company actively engaged in the exploration, development, and

production of oil and gas in the Eagle Ford and Austin Chalk in

South Texas. With more than 30 years of history operating in South

Texas, the Company possesses a significant understanding of

regional reservoirs which it leverages to assemble high-quality

drilling inventory while continuously enhancing its operations to

maximize returns on capital invested. For more information, please

visit www.sbow.com. Information on our website is not part of this

release.

FORWARD-LOOKING STATEMENTS

This release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements represent management's

expectations or beliefs concerning future events, and it is

possible that the results described in this release will not be

achieved. These forward-looking statements are based on current

expectations and assumptions and are subject to a number of risks

and uncertainties, many of which are beyond our control. All

statements, other than statements of historical fact included in

this press release, including those regarding our strategy, the

benefits of the acquisitions, future operations, guidance and

outlook, financial position, well expectations and drilling plans,

estimated production levels, expected oil and natural gas pricing,

long-term inventory estimates, estimated oil and natural gas

reserves or the present value thereof, reserve increases, service

costs, impact of inflation, future free cash flow and expected

leverage ratio, value and development of locations, capital

expenditures, budget, projected costs, prospects, plans and

objectives of management are forward-looking statements. When used

in this report, the words “will,” “could,” “believe,” “anticipate,”

“intend,” “estimate,” “budgeted,” “guidance,” “expect,” “may,”

“continue,” “potential,” “plan,” “project,” "positioned," "should"

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. Important factors that could cause actual

results to differ materially from our expectations include, but are

not limited to, the following risks and uncertainties: further

actions by the members of the Organization of the Petroleum

Exporting Countries, Russia and other allied producing countries

with respect to oil production levels and announcements of

potential changes in such levels; risk related to recently

completed acquisitions and integrations of these acquisitions;

volatility in natural gas, oil and NGL prices; ability to obtain

permits and government approvals; our borrowing capacity, future

covenant compliance, cash flow and liquidity, including our ability

to satisfy our short- or long-term liquidity needs; asset

disposition efforts or the timing or outcome thereof; ongoing and

prospective joint ventures, their structures and substance, and the

likelihood of their finalization or the timing thereof; the amount,

nature and timing of capital expenditures, including future

development costs; timing, cost and amount of future production of

oil and natural gas; availability of drilling and production

equipment or availability of oil field labor; availability, cost

and terms of capital; timing and successful drilling and completion

of wells; availability and cost for transportation and storage

capacity of oil and natural gas; costs of exploiting and developing

our properties and conducting other operations; competition in the

oil and natural gas industry; general economic and political

conditions, including inflationary pressures, further increases in

interest rates, a general economic slowdown or recession,

instability in financial institutions, political tensions and war

(including future developments in the ongoing conflicts in Ukraine

and the Middle East); the severity and duration of world health

events, including health crises and pandemics, and related economic

repercussions, including disruptions in the oil and gas industry,

supply chain disruptions, and operational challenges; opportunities

to monetize assets; our ability to execute on strategic

initiatives, including acquisitions; effectiveness of our risk

management activities, including hedging strategy; counterparty and

credit market risk; pending legal and environmental matters,

including potential impacts on our business related to climate

change and related regulations; the impact of shareholder activism

and any changes in composition of the Company's board of directors;

actions by third parties, including customers, service providers

and shareholders; current and future governmental regulation and

taxation of the oil and natural gas industry; including changes in

connection with U.S. elections in 2024; developments in world oil

and natural gas markets and in oil and natural gas-producing

countries; uncertainty regarding our future operating results; and

other risks and uncertainties discussed in the Company’s reports

filed with the SEC, including its annual report on Form 10-K for

the year ended December 31, 2023, and subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K.

All forward-looking statements speak only as of the date of this

release. You should not place undue reliance on these

forward-looking statements. The Company’s capital budget, operating

plan, service cost outlook and development plans are subject to

change at any time. Although we believe that our plans, intentions

and expectations reflected in or suggested by the forward-looking

statements we make in this release are reasonable, we can give no

assurance that these plans, intentions or expectations will be

achieved. The risk factors and other factors noted herein and in

the Company's SEC filings could cause its actual results to differ

materially from those contained in any forward-looking statement.

These cautionary statements qualify all forward-looking statements

attributable to us or persons acting on our behalf.

All subsequent written and oral forward-looking statements

attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the foregoing. We undertake no

obligation to publicly release the results of any revisions to any

such forward-looking statements that may be made to reflect events

or circumstances after the date of this release or to reflect the

occurrence of unanticipated events, except as required by law.

(Footnotes)

1 As of April 30, 2024, the Company had $573 million of

outstanding borrowings under its Credit Facility.

2 Leverage ratio is defined as total long-term debt, before

unamortized discounts, divided by Adjusted EBITDA for Leverage

Ratio (a non-GAAP measure defined and reconciled in the tables

included in this release) for the trailing twelve-month period.

3 Adjusted EBITDA, Adjusted EBITDA for Leverage Ratio and FCF

are non-GAAP measures defined and reconciled in the tables included

in this release.

4 See details in the Company's corporate presentation posted on

its website regarding reinvigorating existing wells, drilling

horseshoe (U-shaped) wells to optimize development and further

drilling enhancements on its South Texas acquisition.

(Financial Highlights to Follow)

Condensed Consolidated Balance

Sheets(Unaudited)

SilverBow Resources, Inc. and Subsidiary

(in thousands, except share amounts)

March 31, 2024

December 31, 2023

ASSETS

Current Assets:

Cash and cash equivalents

$

1,446

$

969

Accounts receivable, net

125,459

138,343

Fair value of commodity derivatives

89,535

116,549

Other current assets

5,652

5,590

Total Current Assets

222,092

261,451

Property and Equipment:

Property and equipment, full cost method,

including $30,899 and $28,375, respectively, of unproved property

costs not being amortized at the end of each period

3,709,469

3,597,160

Less – Accumulated depreciation,

depletion, amortization & impairment

(1,315,364

)

(1,223,241

)

Property and Equipment, Net

2,394,105

2,373,919

Right of use assets

20,658

12,888

Fair value of long-term commodity

derivatives

29,432

55,114

Other long-term assets

28,876

31,090

Total Assets

$

2,695,163

$

2,734,462

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Accounts payable and accrued

liabilities

$

143,684

$

98,816

Deferred acquisition liability

50,000

50,000

Fair value of commodity derivatives

26,333

5,509

Accrued capital costs

42,114

31,900

Current portion of long-term debt

37,500

28,125

Accrued interest

8,325

9,668

Current lease liability

7,765

4,001

Undistributed oil and gas revenues

37,754

20,425

Total Current Liabilities

353,475

248,444

Long-term debt, net of current portion

1,039,469

1,173,766

Non-current lease liability

12,955

8,899

Deferred tax liabilities

94,077

99,227

Asset retirement obligations

11,913

11,584

Fair value of long-term commodity

derivatives

8,110

2,504

Other long-term liabilities

—

710

Commitments and Contingencies

Stockholders' Equity:

Preferred stock, $0.01 par value,

10,000,000 shares authorized, none issued

—

—

Common stock, $0.01 par value, 40,000,000

shares authorized, 26,027,103 and 25,914,956 shares issued,

respectively, and 25,523,808 and 25,429,610 shares outstanding,

respectively

260

259

Additional paid-in capital

681,099

679,202

Treasury stock, held at cost, 503,295 and

485,346 shares, respectively

(11,151

)

(10,617

)

Retained earnings

504,956

520,484

Total Stockholders’ Equity

1,175,164

1,189,328

Total Liabilities and Stockholders’

Equity

$

2,695,163

$

2,734,462

Condensed Consolidated Statements of

Operations (Unaudited)

SilverBow Resources, Inc. and Subsidiary

(in thousands, except per-share amounts)

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Revenues

$

256,680

$

139,954

Operating Expenses:

General and administrative, net

8,791

7,664

Depreciation, depletion, and

amortization

92,103

43,998

Accretion of asset retirement

obligations

316

224

Lease operating expenses

31,825

20,560

Workovers

610

779

Transportation and gas processing

35,199

11,520

Severance and other taxes

16,212

9,385

Total Operating Expenses

185,056

94,130

Operating Income

71,624

45,824

Non-Operating Income (Expense)

Gain (loss) on commodity derivatives,

net

(56,078

)

92,249

Interest expense, net

(36,017

)

(16,745

)

Other income (expense), net

156

(24

)

Income (Loss) Before Income Taxes

(20,315

)

121,304

Provision (Benefit) for Income Taxes

(4,787

)

26,812

Net Income (Loss)

$

(15,528

)

$

94,492

Per Share Amounts:

Basic Earnings (Loss) Per Share

$

(0.61

)

$

4.21

Diluted Earnings (Loss) Per Share

$

(0.61

)

$

4.17

Weighted-Average Shares Outstanding -

Basic

25,445

22,440

Weighted-Average Shares Outstanding -

Diluted

25,445

22,634

Condensed Consolidated Statements of

Cash Flows (Unaudited)

SilverBow Resources, Inc. and Subsidiary

(in thousands)

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Cash Flows from Operating Activities:

Net income (loss)

$

(15,528

)

$

94,492

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities

Depreciation, depletion, and

amortization

92,103

43,998

Accretion of asset retirement

obligations

316

224

Deferred income taxes

(5,150

)

26,612

Share-based compensation

1,830

1,124

(Gain) Loss on derivatives, net

56,078

(92,249

)

Cash settlement (paid) received on

derivatives

38,371

18,699

Settlements of asset retirement

obligations

(2

)

(3

)

Other, net

3,362

756

Change in operating assets and

liabilities:

(Increase) decrease in accounts receivable

and other current assets

(5,374

)

30,687

Increase (decrease) in accounts payable

and accrued liabilities

24,557

(24,504

)

Increase (decrease) in income taxes

payable

465

300

Increase (decrease) in accrued

interest

(1,343

)

(441

)

Net Cash Provided by (Used in) Operating

Activities

189,685

99,695

Cash Flows from Investing Activities:

Additions to property and equipment

(80,225

)

(111,285

)

Acquisition of oil and gas properties, net

of purchase price adjustments

11,821

(1,090

)

Proceeds from the sale of property and

equipment

5,730

—

Net Cash Provided by (Used in) Investing

Activities

(62,674

)

(112,375

)

Cash Flows from Financing Activities:

Proceeds from bank borrowings

128,000

121,000

Payments of bank borrowings

(254,000

)

(104,000

)

Purchase of treasury shares

(534

)

(2,945

)

Net Cash Provided by (Used in) Financing

Activities

(126,534

)

14,055

Net Increase (Decrease) in Cash, Cash

Equivalents and Restricted Cash

477

1,375

Cash, Cash Equivalents and Restricted Cash

at Beginning of Period

8,729

792

Cash, Cash Equivalents and Restricted Cash

at End of Period

$

9,206

$

2,167

Supplemental Disclosures of Cash Flow

Information:

Cash paid during period for interest

$

34,072

$

16,434

Non-cash Investing and Financing

Activities:

Changes in capital accounts payable and

capital accruals

$

29,194

$

(3,097

)

See accompanying Notes to Condensed

Consolidated Financial Statements.

Definition of Non-GAAP Measures as Calculated by the Company

(Unaudited)

The following non-GAAP measures are presented in addition to

financial statements as SilverBow believes these metrics and

performance measures are widely used by the investment community,

including investors, research analysts and others, to evaluate and

useful in comparing upstream oil and gas companies in making

investment decisions or recommendations. These measures, as

presented, may have differing calculations among companies and

investment professionals and may not be directly comparable to the

same measures provided by others. A non-GAAP measure should not be

considered in isolation or as a substitute for the related GAAP

measure or any other measure of a company's financial or operating

performance presented in accordance with GAAP. A reconciliation of

each of these non-GAAP measures to the most directly comparable

GAAP measure or measures is presented below. These measures may not

be comparable to similarly titled measures of other companies.

Adjusted EBITDA: The Company presents Adjusted EBITDA

attributable to common stockholders in addition to reported net

income (loss) in accordance with GAAP. Adjusted EBITDA is

calculated as net income (loss) plus (less) depreciation, depletion

and amortization, accretion of asset retirement obligations,

interest expense, net losses (gains) on commodity derivative

contracts, amounts collected (paid) for commodity derivative

contracts held to settlement, income tax expense (benefit); and

share-based compensation expense. Adjusted EBITDA excludes certain

items that SilverBow believes affect the comparability of operating

results, including items that are generally non-recurring in nature

or whose timing and/or amount cannot be reasonably estimated.

Adjusted EBITDA is used by the Company's management and by external

users of SilverBow's financial statements, such as investors,

commercial banks and others, to assess the Company's operating

performance as compared to that of other companies, without regard

to financing methods, capital structure or historical cost basis.

It is also used to assess SilverBow's ability to incur and service

debt and fund capital expenditures. Adjusted EBITDA should not be

considered an alternative to net income (loss), operating income

(loss), cash flows provided by (used in) operating activities or

any other measure of financial performance or liquidity presented

in accordance with GAAP. Adjusted EBITDA is important as it is

considered among the financial covenants under the Company's First

Amended and Restated Senior Secured Revolving Credit Agreement with

JPMorgan Chase Bank, National Association, as administrative agent,

and certain lenders party thereto (as amended, the “Credit

Agreement”), a material source of liquidity for SilverBow. Please

reference the Company's 2023 Form 10-K for discussion of the Credit

Agreement and its covenants.

Adjusted EBITDA for Leverage Ratio: In accordance with

the Leverage Ratio calculation for SilverBow's Credit Facility, the

Company makes certain adjustments to its calculation of Adjusted

EBITDA. Adjusted EBITDA for Leverage Ratio is calculated as

Adjusted EBITDA plus (less) pro forma EBITDA contributions related

to closed acquisitions. The Company believes that Adjusted EBITDA

for Leverage Ratio is useful to investors because it reflects the

last twelve months EBITDA used by the administrative agent for

SilverBow's Credit Facility in the calculation of its leverage

ratio covenant.

Cash General and Administrative Expenses: Cash G&A

expenses is a non-GAAP measure calculated as net general and

administrative costs less share-based compensation. The Company

believes that cash G&A is commonly used by management, analysts

and investors as an indicator of cost management and operating

efficiency on a comparable basis from period to period. In

addition, SilverBow believes cash G&A expenses are used by

analysts and others in valuation, comparison and investment

recommendations of companies in the oil and gas industry to allow

for analysis of G&A spend without regard to stock-based

compensation which can vary substantially from company to company.

Cash G&A expenses should not be considered as an alternative

to, or more meaningful than, total G&A expenses. From time to

time the Company provides forward-looking cash G&A estimates or

targets; however, SilverBow is unable to provide a quantitative

reconciliation of these forward-looking non-GAAP measures to the

most directly comparable forward-looking GAAP measure because the

items necessary to estimate such forward-looking GAAP measure are

not accessible or estimable at this time without unreasonable

efforts. The reconciling items in future periods could be

significant.

Free Cash Flow: Free cash flow is calculated as Adjusted

EBITDA (defined above) plus (less) cash interest expense and bank

fees, capital expenditures and current income tax (expense)

benefit. The Company believes that free cash flow is useful to

investors and analysts because it assists in evaluating SilverBow's

operating performance, and the valuation, comparison, rating and

investment recommendations of companies within the oil and gas

industry. SilverBow uses this information as one of the bases for

comparing its operating performance with other companies within the

oil and gas industry. Free cash flow should not be considered an

alternative to net income (loss), operating income (loss), cash

flows provided by (used in) operating activities or any other

measure of financial performance or liquidity presented in

accordance with GAAP. From time to time the Company provides

forward-looking free cash flow estimates or targets; however,

SilverBow is unable to provide a quantitative reconciliation of

these forward-looking non-GAAP measures to the most directly

comparable forward-looking GAAP measure because the items necessary

to estimate such forward-looking GAAP measure are not accessible or

estimable at this time without unreasonable efforts. The

reconciling items in future periods could be significant.

Total Debt to Adjusted EBITDA (Leverage Ratio): Leverage

Ratio is calculated as total debt, defined as long-term debt

excluding unamortized discount and debt issuance costs, divided by

Adjusted EBITDA for the most recent twelve-month period.

Calculation of Adjusted EBITDA and Free

Cash Flow (Unaudited)

SilverBow Resources, Inc. and Subsidiary

(in thousands, except share amounts)

The below tables provide the calculation

of Adjusted EBITDA and Free Cash Flow for the following periods (in

thousands).

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Net Income (Loss)

$

(15,528

)

$

94,492

Plus:

Depreciation, depletion and

amortization

92,103

43,998

Accretion of asset retirement

obligations

316

224

Interest expense

36,017

16,745

Loss (gain) on commodity derivatives,

net

56,078

(92,249

)

Derivative cash settlements

collected/(paid) (1)

34,057

19,868

Income tax expense/(benefit)

(4,787

)

26,812

Share-based compensation expense

1,829

1,124

Adjusted EBITDA

$

200,085

$

111,014

Plus:

Cash interest expense and bank fees,

net

(34,073

)

(16,434

)

Capital expenditures(2)

(109,491

)

(108,033

)

Current income tax (expense)/benefit

(363

)

(200

)

Free Cash Flow

$

56,158

$

(13,653

)

(1) Amounts relate to settled contracts

covering the production months during the period.

(2) Excludes proceeds/(payments) related

to the divestiture/(acquisition) of oil and gas properties and

equipment, outside of regular way land and leasing costs.

Last Twelve Months Ended March

31, 2024

Last Twelve Months Ended March

31, 2023

Net Income (Loss)

$

187,698

$

499,183

Plus:

Depreciation, depletion and

amortization

267,220

156,826

Accretion of asset retirement

obligations

1,077

660

Interest expense

99,391

52,136

Loss (gain) on commodity derivatives,

net

(92,982

)

(158,607

)

Derivative cash settlements

collected/(paid) (1)

104,584

(164,348

)

Income tax expense/(benefit)

52,013

39,166

Share-based compensation expense

6,231

5,164

Adjusted EBITDA

$

625,232

$

430,180

Plus:

Cash interest expense and bank fees,

net

(88,492

)

(54,656

)

Capital expenditures(2)

(410,048

)

(395,179

)

Current income tax (expense)/benefit

(690

)

(25

)

Free Cash Flow

$

126,002

$

(19,680

)

Adjusted EBITDA

$

625,232

$

430,180

Pro forma contribution from closed

acquisitions

189,033

119,109

Adjusted EBITDA for Leverage Ratio

(3)

$

814,265

$

549,289

(1) Amounts relate to settled contracts

covering the production months during the period.

(2) Excludes proceeds/(payments) related

to the divestiture/(acquisition) of oil and gas properties and

equipment, outside of regular way land and leasing costs.

(3) Adjusted EBITDA for Leverage Ratio,

which is calculated in accordance with SilverBow's Credit Facility,

includes pro forma EBITDA contributions reflecting the results of

acquired assets' operations for referenced time periods preceding

the acquired assets' close date. Leverage Ratio is calculated as

total debt, defined as Credit Facility borrowings plus Second Lien

notes, divided by Adjusted EBITDA for Leverage Ratio for the most

recently completed twelve-month period. The below table provides

the calculation for Leverage Ratio for the following periods:

March 31, 2024

March 31, 2023

Credit Facility Borrowings due 2026

$

596,000

$

559,000

Second Lien Notes due 2026

500,000

150,000

Total debt

$

1,096,000

$

709,000

Adjusted EBITDA for Leverage Ratio

814,265

549,289

Leverage Ratio

1.35x

1.29x

Calculation of Adjusted Earnings Per

Share (Unaudited)

SilverBow Resources, Inc. and Subsidiary

(in thousands, except share amounts)

The below tables provide the calculation

of Adjusted Earnings Per Share for the following periods (all

amounts except Adjusted Net Income Per Share in thousands).

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Net Income / (Loss)

$

(15,528

)

$

94,492

Plus:

Unrealized Loss / (Gain) on Commodity

Derivatives, net(1)

90,135

(72,381

)

Tax Impact of Adjustments

(21,239

)

15,998

Adjusted Net Income

53,368

38,109

Weighted average Shares Outstanding -

Diluted (MM)

25.5

22.6

Adjusted Net Income per Share (Adjusted

EPS)

$

2.09

$

1.69

Income Tax Expense / (Benefit)

(4,787

)

26,812

Income (Loss) Before Income

Taxes

$

(20,315

)

$

121,304

Effective Tax Rate

24

%

22

%

Last Twelve Months Ended March

31, 2024

Last Twelve Months Ended March

31, 2023

Net Income / (Loss)

$

187,698

$

499,183

Plus:

Unrealized Loss / (Gain) on Commodity

Derivatives, net(1)

11,602

(322,955

)

Tax Impact of Adjustments

(2,517

)

23,496

Adjusted Net Income

196,783

199,724

Weighted average Shares Outstanding -

Diluted (MM)

25.5

22.6

Adjusted Net Income per Share (Adjusted

EPS)

$

7.71

$

8.83

Income Tax Expense / (Benefit)

52,013

39,166

Income (Loss) Before Income Taxes

$

239,711

$

538,349

Effective Tax Rate

22

%

7

%

Production Volumes & Pricing

(Unaudited)

SilverBow Resources, Inc. and

Subsidiary

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Production volumes:

Oil (MBbl)

2,233

1,023

Natural gas (MMcf) (1)

27,093

17,974

Natural gas liquids (MBbl)

1,565

539

Total (MBoe)

8,313

4,558

Oil, natural gas and natural gas liquids

sales (in thousands):

Oil

$

166,704

$

74,655

Natural gas

53,123

52,922

Natural gas liquids

36,218

12,377

Total

$

256,045

$

139,954

Average realized price before impact of

cash-settled derivatives:

Oil (per Bbl)

$

74.65

$

73.01

Natural gas (per Mcf)

1.96

2.94

Natural gas liquids (per Bbl)

23.15

22.95

Average per Boe

$

30.80

$

30.71

Price impact of cash-settled

derivatives:

Oil (per Bbl)

$

(0.70

)

$

0.92

Natural gas (per Mcf)

1.31

0.94

Natural gas liquids (per Bbl)

0.16

3.61

Average per Boe

$

4.10

$

4.36

Average realized price including impact of

cash-settled derivatives:

Oil (per Bbl)

$

73.95

$

73.93

Natural gas (per Mcf)

3.27

3.88

Natural gas liquids (per Bbl)

23.31

26.56

Average per Boe

$

34.90

$

35.07

(1) Natural gas is converted at the rate

of six Mcfe to one barrel. Mcf refers to one thousand cubic feet,

and MMcf refers to one million cubic feet. Bbl refers to one barrel

of oil, and MBbl refers to one thousand barrels.

Second Quarter 2024 & Full Year 2024

Guidance

Guidance

2Q 2024

FY 2024

Production Volumes:

Oil (MBbls/d)

23.5 - 25.0

24.5 - 26.5

Natural Gas (MMcf/d)

290 - 305

285 - 305

NGLs (MBbls/d)

19.0 - 19.6

18.0 - 20.0

Total Reported Production (MBoe/d)

90.8 - 95.4

90.0 - 97.3

% Oil/Liquids

47%

48%

Product Pricing:

Crude Oil NYMEX Differential ($/Bbl)

($5.00) - ($2.00)

N/A

Natural Gas NYMEX Differential ($/Mcf)

($0.40) - $0.00

N/A

Natural Gas Liquids (% of WTI)

24% - 28%

N/A

Operating Costs & Expenses:

Lease Operating Expenses ($/Boe)

$3.90 - $4.30

$3.90 - $4.10

Transportation & Processing

($/Boe)

$4.15 - $4.55

$4.25 - $4.75

Production Taxes (% of Revenue)

6.0% - 7.0%

6.0% - 7.0%

Cash G&A, net ($MM)

$7.0 - $8.0

$24.0 - $25.0

A forward-looking estimate of net G&A

expenses is not provided with the forward-looking estimate of cash

G&A (a non-GAAP measure) because the items necessary to

estimate net G&A expenses are not accessible or estimable at

this time without unreasonable efforts. Such items could have a

significant impact on net G&A expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501347474/en/

Jeff Magids Vice President of Finance & Investor Relations

(281) 874-2700, (888) 991-SBOW

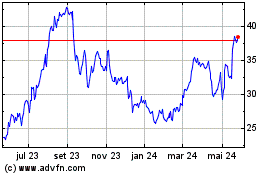

SilverBow Resources (NYSE:SBOW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

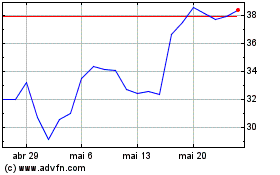

SilverBow Resources (NYSE:SBOW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025