Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

22 Maio 2024 - 9:47AM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

| SCHEDULE 13D/A |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. 5)* |

| |

|

SilverBow

Resources, Inc. |

| (Name of Issuer) |

| |

|

Common

Stock, par value $0.01 per share |

| (Title of Class of Securities) |

| |

|

82836G102 |

| (CUSIP Number) |

| |

| Benjamin Dell |

| Kimmeridge Energy Management Company, LLC |

| 15 Little West 12th Street, 4th Floor |

| New York, NY 10014 |

| |

| Eleazer Klein, Esq. |

| Adriana Schwartz, Esq. |

| Schulte Roth & Zabel LLP |

| 919 Third Avenue |

| New York, NY 10022 |

|

(212)

756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

May

22, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [X]

(Page 1 of 4 Pages)

______________________________

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP No. 82836G102 | SCHEDULE 13D/A | Page 2 of 4 Pages |

| 1 |

NAME OF REPORTING PERSON

Kimmeridge Energy Management

Company, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

AF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

3,281,356 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

3,281,356 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY EACH REPORTING PERSON

3,281,356 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

12.8% |

| 14 |

TYPE OF REPORTING PERSON

OO, IA |

| |

|

|

|

|

| CUSIP No. 82836G102 | SCHEDULE 13D/A | Page 3 of 4 Pages |

This

Amendment No. 5 (“Amendment No. 5”) amends and supplements the statement on Schedule 13D filed by the

Reporting Person on September 23, 2022 (the “Original Schedule 13D”), as amended by Amendment No. 1 to the Original

Schedule 13D filed by the Reporting Person on February 21, 2024 (“Amendment No. 1”), Amendment No. 2 to the Original

Schedule 13D filed by the Reporting Person on March 13, 2024 (“Amendment No. 2”), Amendment No. 3 to the Original Schedule

13D filed by the Reporting Person on April 9, 2024 (“Amendment No. 3”) and Amendment No. 4 to the Original Schedule

13D filed by the Reporting Person on April 16, 2024 (“Amendment No. 4”, and together with the Original Schedule 13D,

Amendment No. 1, Amendment No. 2, Amendment No. 3 and this Amendment No. 5, the “Schedule 13D”) as specifically set

forth herein. Capitalized terms used herein and not otherwise defined in this Amendment No. 5 have the meanings set forth in the Schedule

13D.

| Item 4. |

PURPOSE OF TRANSACTION |

| |

|

| |

Item 4 of the Schedule 13D is hereby amended and supplemented by the addition of the following: |

| |

|

| |

On May 22, 2024, the Reporting Person and certain subsidiaries of funds

advised by the Reporting Person withdrew their nomination of the Nominees for election to the Board at the Issuer’s 2024 annual

meeting of shareholders and issued a press release (the “Press Release”). A copy of the Press Release is attached hereto

as Exhibit 99.6 and is incorporated by reference herein. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| |

|

| |

Item 5(a) of the Schedule 13D is hereby amended and restated as follows: |

| |

|

| |

(a) |

See

rows (11) and (13) of the cover page to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of the

shares of Common Stock beneficially owned by the Reporting Person. The percentages used in this Schedule 13D are

calculated based upon 25,538,487 shares of Common Stock outstanding as of April 26, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 2, 2024. |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| Exhibit 99.6 |

Press Release, dated as of May 22, 2024 (incorporated by reference to the Schedule 14A on form DFAN14A filed by the Reporting Person with the Securities and Exchange Commission on May 22, 2024). |

| CUSIP No. 82836G102 | SCHEDULE 13D/A | Page 4 of 4 Pages |

SIGNATURES

After

reasonable inquiry and to the best of his or its knowledge and belief, the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Date: May 22, 2024

| |

KIMMERIDGE ENERGY MANAGEMENT COMPANY, LLC |

| |

|

| |

|

| |

By: |

/s/ Tamar Goldstein |

| |

Name: |

Tamar Goldstein |

| |

Title: |

General Counsel |

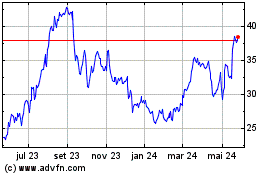

SilverBow Resources (NYSE:SBOW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

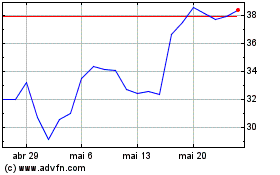

SilverBow Resources (NYSE:SBOW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025