Baker Wins LUKOIL Contract - Analyst Blog

09 Agosto 2011 - 12:58PM

Zacks

Baker Hughes Incorporated (BHI) has won a

contract from the Russian oil company, LUKOIL, to offer full

drilling and completion services for 23 wells at the West Qurna

field in Iraq.

Under the two-year contract, Baker is entitled to provide supply

drilling services, formation evaluation, casing and tubing running

services, completion tools and services, wellbore intervention

services, wireline logging as well as perforation operations.

Additionally, the company expects to contract all third-party

services, equipment, personnel, tools and materials required for

the project, including five drilling and three workover rigs.

At the West Qurna field, located in southeast Iraq and 31 miles

west of Basra, the company expects to drill a few wells

directionally in order to touch the Mishrif formation. The maneuver

requires implementation of the cluster/pad drilling technique as

the wells are closely spaced.

Houston, Texas-based oilfield service company, Baker Hughes, is

well suited to accomplish the West Qurna project in Iraq. Last

year, the company untied a 1.3 million square-feet operations base

in Basra. Apart from the current contract, Baker runs drilling and

workover rigs in the Zubair field for an international oil

company.

Baker also remains engaged with the South Oil Company for the

development of Iraqi wireline capabilities and furnishing

electrical submersible pumping systems and services to three major

international operators.

Among the diversified oilfield service players, Baker Hughes, is

one of the best positioned with significant improvement in activity

levels in both North America and overseas. We believe Baker Hughes

is well positioned to gain from two positive influences on the

global oil service business. The first is a structural shift in

North America mainly from the integration of BJ Services business

and the other is an international turnaround that is in its early

stage.

Management stated that international margins could exit 2011 at

around the targeted 15% given its second-quarter 2011 margin

improvement. Baker Hughes’ international operations reported

substantial year-over-year margin improvement in the quarter, owing

to its international restructuring and divestiture of unprofitable

assets.

The company also registered an impressive sequential margin

improvement primarily in the Europe, Africa, Russia/Caspian

segment. We expect activities to improve further in the second half

of the year, particularly in the Middle East, including Saudi

Arabia and Iraq.

We maintain our long-term Neutral recommendation for Baker,

which retains a Zacks #3 Rank (short-term Hold rating). The company

competes with Halliburton Company (HAL) and

Schlumberger Limited (SLB).

BAKER-HUGHES (BHI): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

Zacks Investment Research

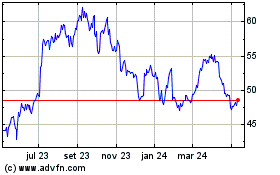

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024