How to Play the Texas Tea Momentum - Investment Ideas

23 Fevereiro 2012 - 10:00PM

Zacks

How to Play Texas Tea Momentum

How

to Play the Texas Tea Momentum

In May 2008 a call from a major brokerage was heard round the

world. It was the “super spike” in the price of oil which called

for prices to dramatically increase from the $115 level to an

unthinkable $150-$200 a barrel. This call came from the same

analyst that three years earlier saw $100 barrel crude when sweet

Texas tea was hovering close to $60. The earlier call was also a

somewhat unthinkable prospect.

Recently, we got another call from the same brokerage… just

a different analyst this time. The call isn’t quite the same,

but the idea is. Oil prices are expected to move higher. We will

leave the details of Iran or supply and demand out of this

discussion and focus on how we can best position our portfolio

based on this move. Of course you'll need to agree with the

basic thesis that oil will be moving higher and have some faith in

Goldman Sach's and thier research.

Who Benefits

The immediate thought of who benefits rests with the largest

players in the oil patch. Chevron (CVX), Exxon Mobil (XOM) and

ConocoPhillips (COP) come to mind. The services like Halliburton

Company (HAL) and Schlumberger (SLB) could also see some benefit as

a result.

One area that could see exaggerated benefit would be the

drillers. As oil prices continue to increase, the willingness of

speculators to search new sources of oil should lead to gains for

the drillers. Those that are succesfull at new holes in proven

reserves are even more attractive. Diamond Offshore Drilling

(DO) at $9 billion carries a small multiple of 9x trailing earnings

and is one of the largest drillers. As one of the biggest drillers,

the stock is protected from large price swings via

diversification.

Nabors Industries (NBR) is another driller that is a little

smaller Diamond Offshore Drilling at $6 billion in market

capitalization. A 10 year chart of NBR points out just how the

drillers of smaller size can be affected by a super spike in oil.

From early January of 2008 through late June 2008, NBR nearly

doubled.

Drilling deeper into the segment we reach Rowan Companies (RDC)

with a market capitalization of $4.8 billion. This stock did not

see the same spike that NBR saw in the 2008 time frame, mostly

because it is diversified into forestry and steel products.

Again, it's all a matter of preference and exactly how much pure

exposure you want to oil.

For the most speculative out there, the small (wildcat) drilling

companies can offer the some great potential returns, but also

carry significant risks. Pioneer Drilling (PDC) is about $600

million in market capitalization and already trades at a lofty 50x

trailing earnings. Its small size make it a potential M&A play

as well, but this stock does not come without its inherent risks.

As the price of oil returned from its super spike, PDC saw its

stock react like a gusher – a gusher that lost all of its pressure.

The stock slid from a high of $20 in June 2008 to $6.75 in October

of the same year and that wasn’t the bottom. Mid-March of 2009 saw

the stock reach rock bottom around the $3.50 level, a move that

underscores “what spikes up, is likely to spike down.”

Who has the most to

lose?

When oil spikes, the cost of fuel soars. Airlines generally feel

the effect of higher fuel costs more than other transportation

stocks as they have no other alternative fuel sources and in a

tough economic envirnment not much room to raise prices on

consumers. Many will view this as yet another reason to not own an

airline stock, as most airlines end up losing money and or going

bankrupt.

Another segment of the economy that gets hit during oil super

spikes is the automotive segment. Car makers saw sales of SUV’s and

other gas guzzlers plummeted in 2008 as consumers looked for better

gas mileage. Higher energy costs in general will hurt major

manufacturing companies like the auto-makers as well because of

increased production costs which equate to higher

margins.

Ford (F) saw its stock crumble during the super spike. There

were other factors that lead to the debacle that was the US auto

industry, but 2008 saw F move from a high of $8 to $1.50. Don’t

think that the US auto industry was alone, Toyota (TM) also saw a

“super spike” of its own. Shares of the Japanese car maker slid

throughout all of 2008, but saw a sizeable spike downward late in

the year losing one third its value.

Conclusion

Higher oil prices pump a crimp on all spending in the US economy,

but some sectors feel the pain more than others. Airlines and

automakers bear the brunt of it, but higher fuel costs send prices

higher on just about everything from food to computer parts. That

does not mean we cannot find a few areas of strength to take

advantage of big moves in the price of oil. Alternitives like

wind, solar and nat gas should also see a rise in prices.

Look for the "best in breed" in each alternitives sector to

be rewarded if oil prices continue to rise.

CONOCOPHILLIPS (COP): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

DIAMOND OFFSHOR (DO): Free Stock Analysis Report

FORD MOTOR CO (F): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

NABORS IND (NBR): Free Stock Analysis Report

PIONEER DRILLNG (PDC): Free Stock Analysis Report

ROWAN COS INC (RDC): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

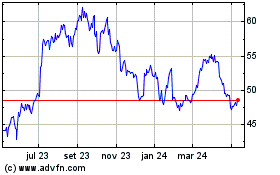

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024