Schlumberger CEO Says Slowing Gas Drilling Will Hurt Business

26 Março 2012 - 11:58AM

Dow Jones News

Schlumberger Ltd.'s (SLB) North American business will suffer

the effects of a slowdown in gas drilling, as well as the increased

cost of shifting rigs to oil-rich areas, Chief Executive Paal

Kibsgaard said Monday.

Over the past two quarters, "hydraulic fracturing pricing is

starting to come under pressure and that this represents an element

of uncertainty to our 2012 outlook," Kibsgaard said at the Howard

Weil energy conference, according to prepared remarks posted on

Schlumberger's website.

Kibsgaard added that during the first quarter, the downward

pricing trend seen in natural gas basins has seeped over into

oil-rich basins too. Also, the constant move of drilling rigs and

hydraulic fracturing capacity from natural gas basins to oil-rich

basins adds costs and cuts on operational time, he said.

"Together, these factors will have an impact on our results both

in North America, and overall, in this and in the coming quarters,"

he said.

The comments by the head of the world's largest oilfield service

company come in the wake of rival Baker Hughes Inc. (BHI)'s

announcement that it was curbing its earnings outlook due to

headwinds in the North American gas market.

Until recently, oilfield service companies were riding high on a

relentless push to tap shale gas resources, but the resulting boom

in natural gas supplies, combined with unseasonably warm weather,

brought natural gas prices to 10-year lows. Now oil and gas

companies are starting to pull back, and redirect their efforts to

oil-rich areas, but the transition is having an impact on

profits.

Kibsgaard said that natural gas drilling activity "is unlikely

to recover in the short term." Globally, however, Japan's embrace

of liquefied natural gas in the wake of its nuclear crisis has

helped boost LNG prices, and will likely spur further investment,

he said.

Kibsgaard said that he maintains a "very positive view" for the

oilfield services industry in the medium term, as companies are

spending increasingly large amounts of money to keep up with demand

for oil. In the past 10 years, exploration and production spending

has grown fourfold while oil production is up only 11%, he said.

Brent crude oil prices have been consistently above $100 per barrel

for more than one year and are "unlikely to lower significantly in

the short to medium term," he said.

Those prices, however, have helped launch a new wave of

exploration, which is critical to maintain production growth.

"Following years of under-investment in exploration, we have

seen the start of a new exploration cycle in the last year, and

based on the recent growth in net acreage held by our customers,

this trend is likely to continue," he said.

The executive also said that currently the risk of a return to

recession seems low.

"At present, the main risk of a global double-dip recession

appears to be behind us," Kibsgaard said.

-By Angel Gonzalez, Dow Jones Newswires;

713-547-9214;angel.gonzalez@dowjones.com

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

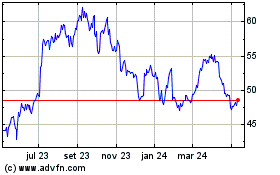

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024