Schlumberger Buys Antonoil Stake - Analyst Blog

09 Julho 2012 - 10:15AM

Zacks

The world’s largest

oilfield-services provider, Schlumberger Limited

(SLB) acquired stakes of a Hong Kong-listed Chinese oilfield

services company, Anton Oilfield Services Group (Antonoil).

Schlumberger procured 20.1%

interest, or 423,361,944 shares of Antonoil, which declined to

comment on the transaction price. However, based on Antonoil’s

total market capitalization of $408 million as of July 6, 2012,

Reuters projected the value of the shares at approximately $80

million.

Established in 1999, Antonoil is

among the few privately controlled oilfield service companies in

China that joined hands with Schlumberger back in 2010 related to a

cooperation agreement over drilling fluids and well-cementing

services. The deal constituted an integral part of the Chinese

oilfield services industry.

We believe Schlumberger's

combination of technological leadership and management depth will

prove beneficial for Antonoil over the long term, boosting the

Chinese company’s reputation as one of the country’s foremost

oilfield service providers. This will eventually improve Antonoil’s

long-term revenue and profit.

The latest deal will not allow

Schlumberger to intervene in Antonoil’s management, leaving the

latter’s collaboration with other business associates unchanged.

Again, this move will aid Antonoil as well as Schlumberger to

explore the wide-ranging opportunities in the Chinese market.

We believe Schlumberger is favorably

positioned to operate within the current oilfield services

scenario, given the acceleration in international drilling

activity, pricing improvements and an expected recovery in its

seismic operations.

Schlumberger should also benefit

from its oil-driven international growth prospects and near-term

North American performance, given its leading position in

exploration drilling. The company’s top line should continue to

improve going forward due to promising indications from Africa, the

Middle East and the Gulf of Mexico. The Middle East and Asia

constituted 23% of Schlumberger’s revenue last year.

Schlumberger, which ranks ahead of

Halliburton Company (HAL) as the biggest member of

the oilfield services contingent, holds a Zacks #3 Rank, which is

equivalent to a Hold rating for a period of one to three months.

Longer term, we maintain a Neutral recommendation on the stock.

HALLIBURTON CO (HAL): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

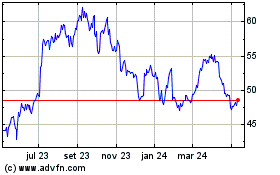

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024