Statoil Boosts Oil Recovery Efforts - Analyst Blog

26 Setembro 2012 - 12:00PM

Zacks

Norwegian energy giant

Statoil ASA (STO) is all set to boost the recovery

rate of the oilfields in the Norwegian Continental Shelf (NCS) by

an added 10% as it has started building the country's biggest

research center.

This center − located near the company's existing research center

at Rotvoll in Trondheim, in the north of Norway − will cost around

$42 million (NOK 240 million) to the company. It will assist

Statoil to maximize output at fields where it remains the operator

or co-partner both on the NCS and worldwide.

The unique 2700 square-meter center will comprise four floors that

will prioritize areas of technology such as drilling, reservoir

mapping and advanced injection techniques. It will be well equipped

with an industrial CT scanner that is 100 times more potent than

its medical equivalent. This center is expected to be completed by

the end of 2013.

Increased oil recovery (IOR) is considered as the money-spinning

method of generating reserves already in place with the help of

existing production infrastructure. Hence, this results in

substantial revenue gains. Presently, Statoil employs about 3000

people for working on developing a range of 300 IOR activities.

At August end, the company stated that it was targeting a 60%

average oil recovery rate from its NCS fields. The world's largest

offshore operator − Statoil − already holds the leading position in

oil recovery with a recovery rate of 50% last year compared with a

global oil recovery rate of just 35%. It also marked a 1%

year-on-year rise in oil recovery for Statoil. The 1% rise in oil

recovery equates to 327 million barrels of oil or more than NOK 200

billion at an oil price of $100 per barrel. Statoil is also

deploying nearly half of its annual research and development

(R&D) budget of $490 million (NOK 2.8 billion) for testing and

developing technology for IOR.

Recently, Statoil announced the start of spudding of the appraisal

well 16/2-14 in PL 265 in the Norwegian North Sea. This new

appraisal emphasizes Statoil’s belief in the exploration potential

of the mature region of NCS.

We have a favorable outlook on Statoil’s long-term production

growth, given the company’s growing upstream presence in the

emerging basins of the Barents Sea, West Africa and the deepwater

U.S. Gulf of Mexico. We also believe that the growing share of

natural gas in Statoil’s NCS volume mix and its extensive interests

in infrastructure assets strengthen its leadership position in the

European natural gas market.

Statoil, which recently contracted Schlumberger

Limited (SLB) for electric wireline logging services on

the NCS, carries a Zacks #2 Rank, which translates to a Buy rating

for a period of one to three months. Longer term, we maintain a

Neutral recommendation on the stock.

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

STATOIL ASA-ADR (STO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

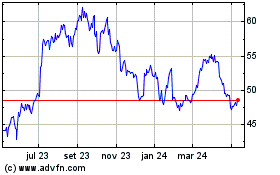

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024