Weatherford Meets Earnings, Lags Rev - Analyst Blog

06 Maio 2013 - 6:10AM

Zacks

Leading oilfield services company,

Weatherford International Ltd.’s (WFT)

first-quarter 2013 adjusted earnings of 15 cents per share came in

at par with the Zacks Consensus Estimate. The results also dropped

substantially from the year-earlier adjusted earnings of 25 cents.

The earnings declined mainly due to the weakness in North American

earnings.

The total revenue in the first quarter increased by nearly 7% year

over year to $3,837.0 million from $3,591 million in prior-year

quarter but missed the Zacks Consensus Estimate of $3,878

million.

Operational Performance

North American revenues decreased 3.5% year over

year to $1,692.0 million. The relative decline in the U.S. land rig

count compared to the first quarter of 2012 as well as oversupply

of hydraulic fracturing capacity resulted in the loss. The

Stimulation and Chemicals segment was also weak, with operating

income of $224.0 million compared with $358.0 million in the

year-ago quarter.

Middle East/North Africa/Asia revenues climbed

31.9% year over year to $785 million. The segment’s operating

income plunged 15.1% year over year to $45 million. The decline is

attributable to typical seasonal effects in Asia.

Europe/Sub-Sahara Africa/Russia posted revenues of

$633.0 million, up 10.9% year over year. The segment’s operating

income dropped marginally by 1.5% year over year to $65.0

million.

Latin American revenues climbed 8.3% year over

year to $727.0 million. Operating income from this segment rose to

$98.0 million from the year-ago level of $83.0 million.

Liquidity

As of Mar 31, 2012, Weatherford had $286 million in cash and cash

equivalents and long-term debt was $7,032 million. Weatherford

spent $400 million in capital expenditures during the quarter.

Guidance

With respect to the second half of 2013, the company maintains a

neutral outlook for its North American business and expects

moderate growth in revenues and operating income.

Weatherford foresees sustained growth and expanding margins in its

Latin America region, supported by improvements in Argentina and

Mexico.

The company also expects improvements in the Eastern Hemisphere in

2013, with upside in Europe, Sub-Saharan Africa and Russia, as well

as stronger activity levels in the Middle East, North Africa and

Asia-Pacific.

The annual effective tax rate in 2013 is expected to be about

34%.

Our Recommendation

We remain optimistic on Weatherford’s operational and financial

leverage to international growth in 2013. However, Weatherford’s

debt-heavy balance sheet, weak free cash flow and competition from

larger peers such as Schlumberger Limited (SLB)

are causes of concern.

Weatherford holds a Zacks Rank #3 (Hold). However, there are other

stocks in the oil and gas sector – Newpark Resources

Inc. (NR) and EPL Oil & Gas, Inc.

(EPL) – which hold a Zacks Rank #1 (Strong Buy) and are expected to

perform better.

EPL OIL&GAS INC (EPL): Free Stock Analysis Report

NEWPARK RESOUR (NR): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

WEATHERFORD INT (WFT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

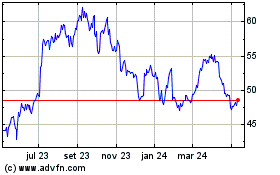

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024