Q3 Earnings Season Takes the Spotlight

Seems like we can start looking ahead to a life without ‘too much’

Washington distractions. We are not quite there yet, as there is no

tangible deal in front of us, but there is growing indication that

Congress may be getting ready to extend the debt-ceiling deadline

by a few more weeks while they work on the budget related issues.

This may sound like nothing more than kicking the can down road,

which it is. But given how deadlocked the situation was just a

couple of days back, we will call this progress.

Washington will still dominate the headlines, but an extension to

the debt-ceiling deadline will remove the default scenario from

investors’ minds. This will help the market focus on the 2013 Q3

earnings season which gets into high gear this week with earnings

reports from 161 companies come out, including 70 from the S&P

500. By the end of this week, we will have seen earnings reports

from more than a fifth of the index’s total membership, giving us a

good enough sample size to judge the Q3 earnings season.

This week’s reporting docket is heavy with Finance sector results,

but we have plenty of bellwethers from other key sectors on deck as

well, which makes this week’s reports a fairly representative

sample. From Google (GOOG), IBM

(IBM), and Intel (INTC) to Coke

(KO) and Johnson & Johnson (JNJ) and

Pepsi (PEP) and much more in between, this week’s

reports span the full spectrum of the economy. While earnings

reports from almost 80% of the S&P 500 companies will still be

awaited by the end of the week, the trends established this week

will likely carry through the rest of this reporting cycle with

only minor changes.

Q3 Earnings Scorecard (as of Friday,

10/11/2013)

Total earnings for the 31 S&P 500 companies that have reported

results are up +9.8% with 51.6% beating earnings expectations,

while total revenues for these companies are up +1.4% and 45.2% are

beating top-line expectations.

This is still early going, but the results thus far are weaker than

what we have seen for this same group of companies in recent

quarters. The +9.8% earnings growth in Q3 for these companies

compares to +18.2% in Q2 and the 4-quarter average of +17.8%, while

the +1.4% revenue growth is below Q2 and the 4-quarter’s average of

+4.2%. The beat ratios are similarly tracking lower. The weak

comparisons are primarily because of the Finance sector. If we

exclude results from the Finance sector, the remaining companies

that have reported results are tracking better than what those same

companies reported in Q2 and the last few quarters.

The J.P. Morgan (JPM) and Wells

Fargo (WFC) reports from the Finance sector represent the

two largest earnings contributors to the sector’s total. The Q3

earnings from these two companies combined account for 23.2% of all

Finance sector earnings this quarter and provide plenty of read

through for the companies still to report results. The market

appears happier with the JPM report despite the bank’s $9.15

billion litigation charge, increasing the size of its total

litigation reserves to an enormous $23 billion. Beyond this charge,

there isn’t that much difference in the results of the two

companies, though they are admittedly very different from each

other in many respects.

In addition to both being huge commercial/retail banks, Wells Fargo

has a big mortgage business, while J.P. Morgan is a big capital

markets player. We knew that the mortgage business was weakening

after the rise in mortgage rates and results from both companies

confirmed that. The capital markets business was so so, with some

momentum on the equities side, but weakness in fixed income. Loan

demand remained tepid and net interest margins were under

pressure.

All of these trends are applicable to the companies reporting next

week. On the capital markets front, we will see the fixed income

weakness in Goldman Sachs’ (GS) results, while

Morgan Stanley (MS) could be a beneficiary of the

positive equity markets trading activity. Overall, if the two best

run firms in the sector had this quality results, then we probably

need to ratchet down our expectations from the others. Total Q3

earnings for the sector are expected to be up +6.8%, with positive

earnings growth at the major banks and brokerage industries, partly

offset by negative comparisons at the insurance industry.

Low Expectations for Q3

Overall expectations for the quarter remain low, having fallen

sharply over the last three months. Total earnings growth for the

remaining 469 companies is barely in the positive relative to the

same period last year (+0.1%) and in the negative excluding the

Finance sector (-1.1%). The composite earnings growth rate,

combining results from the 31 companies that have reported with the

469 still to come, is +0.9% for the S&P 500.

Seven of the 16 Zacks sectors are expected to see earnings decline

in Q3, including Technology, Energy, and Basic Materials. Earnings

in the Tech sector are expected to be down -1.2%, with margin

weakness offsetting modest top-line gains. The Office &

Computer Equipment industry, which alone account for almost 45% of

the Tech sector’s total earnings, will see total earnings decline

-7.6% on -0.4% lower revenues. The equipment makers’ weakness

offsets modest earnings growth in the Software, Semiconductor, and

Telecom Equipment industries.

Earnings in the Energy sector are expected to be down -4.9% in Q3

after the -11.8% decline in Q2. The Energy sector weakness is

concentrated in the Integrated industry that alone accounts for

more than 60% of the sector’s earnings. Negative comparisons at

Exxon (XOM), which brings in more than a quarter of the sector’s

total earnings, more than offsets positive earnings growth at

Chevron and results in the negative growth for the sector.

Predicting Earnings Surprises – Earnings ESP

Earnings ESP, or expected surprise prediction, is our proprietary

metric for predicting earnings surprises. This metric, which

results from comparing the Zacks Consensus earnings estimate for

the company with the most accurate EPS estimate in our database,

significantly improves the odds of foretelling positive earnings

surprises ahead of time.

Our research shows that for stocks with positive ESP and Zacks Rank

# 3 (Hold) or better, the odds of positive earnings surprise is as

high as 70%. For more details on Earnings ESP, please check the

Earnings ESP page on Zacks.com. Please note that the magnitude of

Earnings ESP doesn’t mean that the company’s earnings surprise will

be of an equivalent amount.

Here are three Finance sector companies announcing results next

week that are expected to come out with earnings beats.

- Capital One Financial (COF) has a Zacks Rank #

2 (Buy) and positive Earnings ESP of +5.1%. This consumer finance

company is expected to report Q3 results on October 17th, with its

current Zacks Consensus estimate of $1.75 up from $1.62 three

months ago. The stock hasn’t done much over the past month, but a

positive surprise could push it higher.

- Fifth Third Bank (FTIB). This Zacks Rank #3

(Hold) stock will report Q3 results on October 17th. The company’s

current Zacks Consensus EPS of $0.44 is up a penny over the past

week. The bank’s positive Earnings ESP of +2.3% materially improves

the odds that it will come out with an earnings beat; they missed

expectations in Q2.

- Western Alliance Bancorp (WAL): This Phoenix,

Arizona-based is a $1.65 billion market capitalization bank holding

company that currently has a Zacks Rank #2 (Buy) and Earnings ESP

of +12.5%. Please note that the +12.5% Earnings ESP doesn’t mean

that the expected positive surprise will be of the same

magnitude. The company will report Q3 results on October

17th, with the current Zacks Consensus EPS of $0.32 up 5 cents in

the last three months. Western Alliance in the last two quarters

and remains on track to repeat that performance this time around as

well.

For more companies expected to beat earnings expectations,

please check the Earnings ESP Page. Click here.

High Expectations for Q4

While estimates for Q3 have come down, the same for Q4 and the

following quarters have held up fairly well, as the chart below

shows.

Part of the strong Q4 growth is a function of easier

comparisons, as 2012 Q4 represents the lowest quarterly earnings

total for the S&P 500 in the last six quarters, with the comps

particularly easy for the Finance sector. But it’s not all due to

easy comparisons, as the expected earnings totals for Q4 represent

a new all-time quarterly record. Total earnings for the S&P 500

reached a new record at $259.5 billion in Q2, surpassing Q1’s $255

billion record. But they are expected to reach $269.7 billion in

2013 Q4, with total earnings growth outside of Finance expected at

+4.9%.

The evolving outlook for Q4 is perhaps the most important aspect of

the Q3 earnings season, more so than Q3 earnings/revenue growth

rates and beat ratios. While the overall level of aggregate

earnings is in record territory, there isn’t much growth. The

longstanding hope in the market has been for earnings growth to

eventually ramp up. But the starting point of this expected growth

ramp-up keeps getting delayed quarter after quarter. The hope

currently is that Q4 will be the starting point of such growth.

Guidance has overwhelmingly been negative over the last few

quarters. But if current Q4 expectations have to hold, then we will

need to see a change on the guidance front; we need to see more

companies either guide higher or reaffirm current consensus

expectations.

Anything short of that will result in a replay of the by-now

familiar negative estimate revisions trend that we have been seeing

in recent quarters. The market didn’t care much as estimates came

down in the last few quarters, hoping for better times ahead. Will

it do the same this time as well, pushing its hopes of earnings

ramp up into 2014? We will find out the answer to that question

over the next two months.

For a more detailed look at the overall earnings picture, please

check out our weekly Earnings Trends report. Click here.

Monday - 10/14

- The Columbus Day holiday will most likely shutdown the parts of

federal government that aren’t already closed.

- J.B. Hunt Transport (JBH) and

Packaging Corp (PKG) are the only notable

companies reporting results, both after the close.

Tuesday - 10/15

- We will get the October Empire State regional manufacturing

survey in the morning, with expectations of a modest improvement

from the prior 6.3 reading.

- Citigroup (C), Coca Cola

(KO), and Johnson & Johnson (JNJ) are the key

earnings reports in the morning, while Intel

(INTC) and Yahoo (YHOO) will report after the

close.

Wednesday - 10/16

- The September CPI data is unlikely to see the light of the day,

but the October homebuilder sentiment index will come out and is

expected to be down a bit from the prior month’s 58 reading.

- On a busy earnings day, we will get a host of regional banks

and trust companies report results. The notable reports today are

from Bank of America (BAC) and

Pepsi (PEP) in the morning and

IBM (IBM) and eBay (EBAY) after

the close.

Thursday - 10/17

- Today is deadline for treasury to run out of money unless they

get an extension. The Jobless Claims data will likely still remain

‘polluted’, while the Housing Starts and Industrial Production

numbers may not be available.

- Verizon (VZ), Goldman Sachs

(GS) and Union Pacific (UNP) are the major

earnings reports in the morning, while Google

(GOOG) and Chipotle Mexican Grill (CMG) will

report after the close.

Friday - 10/18

- General Electric (GE), Morgan

Stanley (MS), Schlumberger (SLB), and

Baker Hughes (BHI) are the only notable reports

today, both in the morning.

Here is a list of the 161 companies reporting this week,

including 70 S&P 500 members:

| Company |

Ticker |

Current Qtr |

Year-Ago Qtr |

Last EPS Surprise % |

Report Day |

Time |

| BROWN & BROWN |

BRO |

0.41 |

0.34 |

2.86 |

Monday |

AMC |

| HUNT (JB) TRANS |

JBHT |

0.78 |

0.65 |

-1.35 |

Monday |

AMC |

| PACKAGING CORP |

PKG |

0.89 |

0.55 |

12.7 |

Monday |

AMC |

| STANLEY FURN CO |

STLY |

-0.11 |

-0.14 |

-91.67 |

Monday |

AMC |

| WINTRUST FINL |

WTFC |

0.65 |

0.66 |

13.11 |

Monday |

AMC |

| CITIGROUP INC |

C |

1.06 |

1.06 |

5.93 |

Tuesday |

BTO |

| COCA COLA CO |

KO |

0.53 |

0.51 |

0 |

Tuesday |

BTO |

| COMMERCE BANCSH |

CBSH |

0.72 |

0.71 |

1.41 |

Tuesday |

BTO |

| CSX CORP |

CSX |

0.43 |

0.44 |

10.64 |

Tuesday |

AMC |

| DOMINOS PIZZA |

DPZ |

0.52 |

0.43 |

1.79 |

Tuesday |

BTO |

| FIRST REP BK SF |

FRC |

0.65 |

0.72 |

1.59 |

Tuesday |

BTO |

| INTEL CORP |

INTC |

0.53 |

0.6 |

-2.5 |

Tuesday |

AMC |

| INTERACTIVE BRK |

IBKR |

0.32 |

0.26 |

0 |

Tuesday |

AMC |

| JOES JEANS INC |

JOEZ |

0.02 |

0.02 |

-33.33 |

Tuesday |

AMC |

| JOHNSON & JOHNS |

JNJ |

1.32 |

1.25 |

5.71 |

Tuesday |

BTO |

| LINEAR TEC CORP |

LLTC |

0.45 |

0.46 |

7.14 |

Tuesday |

AMC |

| MARTEN TRANS |

MRTN |

0.23 |

0.19 |

-8 |

Tuesday |

AMC |

| OMNICOM GRP |

OMC |

0.8 |

0.74 |

0 |

Tuesday |

BTO |

| PINNACLE FIN PT |

PNFP |

0.42 |

0.33 |

7.69 |

Tuesday |

AMC |

| RENASANT CORP |

RNST |

0.35 |

0.28 |

3.13 |

Tuesday |

AMC |

| SCHWAB(CHAS) |

SCHW |

0.2 |

0.17 |

-5.26 |

Tuesday |

BTO |

| YAHOO! INC |

YHOO |

0.27 |

0.35 |

15.38 |

Tuesday |

AMC |

| ABBOTT LABS |

ABT |

0.52 |

1.3 |

4.55 |

Wednesday |

BTO |

| ALBEMARLE CORP |

ALB |

1.08 |

1.1 |

-1.01 |

Wednesday |

AMC |

| AMER EXPRESS CO |

AXP |

1.22 |

1.09 |

4.96 |

Wednesday |

AMC |

| ASML HOLDING NV |

ASML |

0.69 |

1.1 |

4.69 |

Wednesday |

BTO |

| ASTORIA FINL CP |

AF |

0.14 |

0.15 |

33.33 |

Wednesday |

AMC |

| BADGER METER |

BMI |

0.61 |

0.62 |

-20 |

Wednesday |

AMC |

| BANCO LATINOAME |

BLX |

0.61 |

0.34 |

5.56 |

Wednesday |

BTO |

| BANK OF AMER CP |

BAC |

0.18 |

0 |

28 |

Wednesday |

BTO |

| BANK OF NY MELL |

BK |

0.58 |

0.63 |

6.9 |

Wednesday |

BTO |

| BLACKROCK INC |

BLK |

3.88 |

3.47 |

8.64 |

Wednesday |

BTO |

| COHEN&STRS INC |

CNS |

0.4 |

0.44 |

-20.93 |

Wednesday |

AMC |

| COMERICA INC |

CMA |

0.71 |

0.69 |

8.57 |

Wednesday |

BTO |

| CORE LABS NV |

CLB |

1.34 |

1.13 |

-2.27 |

Wednesday |

AMC |

| CROWN HLDGS INC |

CCK |

1.08 |

1 |

3.23 |

Wednesday |

AMC |

| EAST WEST BC |

EWBC |

0.54 |

0.48 |

1.96 |

Wednesday |

AMC |

| EBAY INC |

EBAY |

0.53 |

0.49 |

0 |

Wednesday |

AMC |

| EL PASO PIPELIN |

EPB |

0.47 |

0.55 |

-8.51 |

Wednesday |

AMC |

| EXPONENT INC |

EXPO |

0.61 |

0.72 |

30.51 |

Wednesday |

N/A |

| GRAINGER W W |

GWW |

3.09 |

2.81 |

2.71 |

Wednesday |

BTO |

| HERITAGE-CRYSTL |

HCCI |

0.09 |

0.06 |

20 |

Wednesday |

AMC |

| HNI CORP |

HNI |

0.59 |

0.55 |

12 |

Wednesday |

AMC |

| INTL BUS MACH |

IBM |

3.96 |

3.62 |

3.44 |

Wednesday |

AMC |

| KEYCORP NEW |

KEY |

0.22 |

0.23 |

5 |

Wednesday |

BTO |

| KINDER MORG ENG |

KMP |

0.6 |

0.57 |

-19.67 |

Wednesday |

AMC |

| KINDER MORG MGT |

KMR |

0.55 |

N/A |

14.55 |

Wednesday |

AMC |

| KINDER MORGAN |

KMI |

0.32 |

0.19 |

-12.9 |

Wednesday |

AMC |

| KNOLL INC |

KNL |

0.21 |

0.26 |

21.43 |

Wednesday |

BTO |

| LASALLE HTL PRP |

LHO |

0.68 |

0 |

0 |

Wednesday |

AMC |

| MATTEL INC |

MAT |

1.1 |

1.04 |

-34.38 |

Wednesday |

BTO |

| MGIC INVSTMT CP |

MTG |

-0.12 |

-1.25 |

118.75 |

Wednesday |

BTO |

| NOBLE CORP |

NE |

0.71 |

0.45 |

12.5 |

Wednesday |

AMC |

| NORTHERN TRUST |

NTRS |

0.77 |

0.73 |

-6.02 |

Wednesday |

BTO |

| PACIFIC CONTL |

PCBK |

0.21 |

0.19 |

0 |

Wednesday |

AMC |

| PEPSICO INC |

PEP |

1.17 |

1.2 |

10.08 |

Wednesday |

BTO |

| PIPER JAFFRAY |

PJC |

0.48 |

0.72 |

-51.92 |

Wednesday |

BTO |

| PLATINUM UNDRWT |

PTP |

0.97 |

1.96 |

26.8 |

Wednesday |

AMC |

| PNC FINL SVC CP |

PNC |

1.62 |

1.64 |

21.34 |

Wednesday |

BTO |

| RLI CORP |

RLI |

0.95 |

1.02 |

7.63 |

Wednesday |

AMC |

| SANDISK CORP |

SNDK |

1.22 |

0.42 |

29.55 |

Wednesday |

AMC |

| SELECT COMFORT |

SCSS |

0.42 |

0.46 |

-21.74 |

Wednesday |

AMC |

| SLM CORP |

SLM |

0.59 |

0.58 |

47.83 |

Wednesday |

AMC |

| ST JUDE MEDICAL |

STJ |

0.89 |

0.83 |

2.13 |

Wednesday |

BTO |

| STANLEY B&D INC |

SWK |

1.38 |

1.4 |

0.83 |

Wednesday |

BTO |

| STEEL DYNAMICS |

STLD |

0.24 |

0.15 |

0 |

Wednesday |

AMC |

| UMPQUA HLDGS CP |

UMPQ |

0.26 |

0.22 |

9.09 |

Wednesday |

AMC |

| UNIVL FST PRODS |

UFPI |

0.54 |

0.28 |

9.72 |

Wednesday |

AMC |

| US BANCORP |

USB |

0.76 |

0.74 |

0 |

Wednesday |

BTO |

| UTD RENTALS INC |

URI |

1.59 |

1.35 |

10.89 |

Wednesday |

AMC |

| WATSCO INC |

WSO |

1.43 |

1.19 |

4.96 |

Wednesday |

BTO |

| WESTAMER BANCP |

WABC |

0.64 |

0.73 |

-1.54 |

Wednesday |

N/A |

| WNS HLDGS-ADR |

WNS |

0.28 |

0.21 |

8.7 |

Wednesday |

BTO |

| XILINX INC |

XLNX |

0.52 |

0.46 |

19.15 |

Wednesday |

AMC |

| ADV MICRO DEV |

AMD |

0.02 |

-0.2 |

25 |

Thursday |

AMC |

| ALIGN TECH INC |

ALGN |

0.3 |

0.28 |

28.57 |

Thursday |

AMC |

| ALLIANCE DATA |

ADS |

2.52 |

2.18 |

4.13 |

Thursday |

BTO |

| AMPHENOL CORP-A |

APH |

0.96 |

0.9 |

1.06 |

Thursday |

BTO |

| ASSOC BANC CORP |

ASBC |

0.26 |

0.26 |

7.69 |

Thursday |

AMC |

| ATHENAHEALTH IN |

ATHN |

0.15 |

0.18 |

-425 |

Thursday |

AMC |

| B&G FOODS CL-A |

BGS |

0.4 |

0.35 |

-2.94 |

Thursday |

AMC |

| BAXTER INTL |

BAX |

1.19 |

1.14 |

2.65 |

Thursday |

BTO |

| BB&T CORP |

BBT |

0.71 |

0.7 |

5.48 |

Thursday |

BTO |

| BLACKSTONE GRP |

BX |

0.56 |

0.55 |

19.23 |

Thursday |

BTO |

| BOSTON PRIV FIN |

BPFH |

0.19 |

0.17 |

-5.26 |

Thursday |

AMC |

| BRIDGE CAP HLDG |

BBNK |

0.27 |

0.29 |

-52 |

Thursday |

AMC |

| BRIGGS & STRATT |

BGG |

-0.31 |

-0.28 |

15.79 |

Thursday |

BTO |

| CAPITAL BNK FIN |

CBF |

0.2 |

0.12 |

-4.55 |

Thursday |

BTO |

| CAPITAL ONE FIN |

COF |

1.75 |

2.03 |

18.97 |

Thursday |

AMC |

| CEPHEID INC |

CPHD |

-0.11 |

-0.08 |

-166.67 |

Thursday |

AMC |

| CHIPOTLE MEXICN |

CMG |

2.76 |

2.27 |

0 |

Thursday |

AMC |

| COBIZ FINL INC |

COBZ |

0.14 |

0.14 |

28.57 |

Thursday |

AMC |

| CYPRESS SEMICON |

CY |

0.01 |

0.1 |

37.5 |

Thursday |

BTO |

| CYS INVESTMENTS |

CYS |

0.21 |

0.25 |

-40 |

Thursday |

BTO |

| CYTEC INDS INC |

CYT |

1.32 |

1.51 |

18.9 |

Thursday |

AMC |

| DANAHER CORP |

DHR |

0.83 |

0.77 |

2.35 |

Thursday |

BTO |

| DOVER CORP |

DOV |

1.5 |

1.3 |

5.43 |

Thursday |

BTO |

| EASTGROUP PPTYS |

EGP |

0.82 |

0.76 |

2.56 |

Thursday |

AMC |

| ELECTRN IMAGING |

EFII |

0.17 |

0.39 |

66.67 |

Thursday |

AMC |

| FAIRCHILD SEMI |

FCS |

0.12 |

0.25 |

-85.71 |

Thursday |

BTO |

| FIFTH THIRD BK |

FITB |

0.44 |

0.4 |

-2.27 |

Thursday |

BTO |

| FIRST CASH FINL |

FCFS |

0.65 |

0.69 |

1.79 |

Thursday |

BTO |

| FNB CORP |

FNB |

0.21 |

0.22 |

0 |

Thursday |

AMC |

| GOLDMAN SACHS |

GS |

2.48 |

2.85 |

31.67 |

Thursday |

BTO |

| GOOGLE INC-CL A |

GOOG |

8.44 |

7.35 |

-14.27 |

Thursday |

AMC |

| GREENHILL & CO |

GHL |

0.13 |

0.28 |

1.96 |

Thursday |

AMC |

| HOME BANCSHARES |

HOMB |

0.31 |

0.28 |

0 |

Thursday |

BTO |

| HOME LOAN SERVC |

HLSS |

0.5 |

0.34 |

4.35 |

Thursday |

BTO |

| HUB GROUP INC-A |

HUBG |

0.49 |

0.5 |

2.04 |

Thursday |

AMC |

| HUBBELL INC -B |

HUB.B |

1.59 |

1.45 |

5.38 |

Thursday |

BTO |

| HUNTINGTON BANC |

HBAN |

0.17 |

0.19 |

6.25 |

Thursday |

BTO |

| INSTEEL INDS |

IIIN |

0.2 |

0.05 |

66.67 |

Thursday |

BTO |

| INTUITIVE SURG |

ISRG |

3.38 |

4.46 |

-3.7 |

Thursday |

AMC |

| KAISER ALUMINUM |

KALU |

0.98 |

1.02 |

0 |

Thursday |

AMC |

| MB FINANCL INC |

MBFI |

0.46 |

0.42 |

2.22 |

Thursday |

AMC |

| NETSCOUT SYSTMS |

NTCT |

0.25 |

0.27 |

41.67 |

Thursday |

BTO |

| NUCOR CORP |

NUE |

0.38 |

0.45 |

-10 |

Thursday |

BTO |

| OCEANFIRST FINL |

OCFC |

0.28 |

0.28 |

3.57 |

Thursday |

AMC |

| PEABODY ENERGY |

BTU |

-0.03 |

0.51 |

760 |

Thursday |

BTO |

| PEOPLES UTD FIN |

PBCT |

0.21 |

0.19 |

5.26 |

Thursday |

AMC |

| PHILIP MORRIS |

PM |

1.43 |

1.38 |

-7.8 |

Thursday |

BTO |

| POOL CORP |

POOL |

0.73 |

0.59 |

-0.71 |

Thursday |

BTO |

| PPG INDS INC |

PPG |

2.34 |

2.24 |

4.7 |

Thursday |

BTO |

| PRIVATEBANCORP |

PVTB |

0.37 |

0.27 |

12.12 |

Thursday |

BTO |

| QUEST DIAGNOSTC |

DGX |

1.07 |

1.18 |

-2.75 |

Thursday |

BTO |

| SANDY SPRING |

SASR |

0.42 |

0.44 |

25.64 |

Thursday |

BTO |

| SIMMONS FIRST A |

SFNC |

0.41 |

0.41 |

-2.5 |

Thursday |

BTO |

| SNAP-ON INC |

SNA |

1.4 |

1.26 |

6.29 |

Thursday |

BTO |

| SONOCO PRODUCTS |

SON |

0.62 |

0.55 |

1.72 |

Thursday |

BTO |

| STRYKER CORP |

SYK |

0.99 |

0.97 |

-2.91 |

Thursday |

AMC |

| SUPERVALU INC |

SVU |

0.09 |

0 |

250 |

Thursday |

BTO |

| TAIWAN SEMI-ADR |

TSM |

0.34 |

0.32 |

6.45 |

Thursday |

BTO |

| TAYLOR CAP GRP |

TAYC |

0.41 |

0.61 |

19.05 |

Thursday |

AMC |

| TRINITY BIOTECH |

TRIB |

0.2 |

0.2 |

-12 |

Thursday |

BTO |

| ULTRATECH STEP |

UTEK |

0.04 |

0.45 |

-25 |

Thursday |

BTO |

| UNION PAC CORP |

UNP |

2.47 |

2.19 |

0.85 |

Thursday |

BTO |

| UNITEDHEALTH GP |

UNH |

1.53 |

1.5 |

10.24 |

Thursday |

BTO |

| UTD FINL BCP |

UBNK |

0.25 |

0.22 |

-15.38 |

Thursday |

AMC |

| VERIZON COMM |

VZ |

0.75 |

0.64 |

1.39 |

Thursday |

BTO |

| WD 40 CO |

WDFC |

0.45 |

0.56 |

17.86 |

Thursday |

AMC |

| WERNER ENTRPRS |

WERN |

0.29 |

0.34 |

-5.41 |

Thursday |

AMC |

| WESTERN ALLIANC |

WAL |

0.32 |

0.24 |

14.81 |

Thursday |

AMC |

| WINNEBAGO |

WGO |

0.28 |

0.14 |

0 |

Thursday |

BTO |

| BAKER-HUGHES |

BHI |

0.78 |

0.73 |

-6.15 |

Friday |

BTO |

| FIRST HRZN NATL |

FHN |

0.19 |

0.17 |

-10.53 |

Friday |

BTO |

| GENL ELECTRIC |

GE |

0.35 |

0.36 |

0 |

Friday |

BTO |

| GENUINE PARTS |

GPC |

1.2 |

1.11 |

14.88 |

Friday |

BTO |

| HONEYWELL INTL |

HON |

1.24 |

1.2 |

4.92 |

Friday |

BTO |

| INGERSOLL RAND |

IR |

1.1 |

1.07 |

5.56 |

Friday |

BTO |

| INTERPUBLIC GRP |

IPG |

0.18 |

0.15 |

-14.29 |

Friday |

BTO |

| KANSAS CITY SOU |

KSU |

1.12 |

0.82 |

1.05 |

Friday |

BTO |

| LABORATORY CP |

LH |

1.79 |

1.76 |

1.12 |

Friday |

BTO |

| METROCORP BANCS |

MCBI |

0.16 |

0.15 |

0 |

Friday |

AMC |

| MORGAN STANLEY |

MS |

0.43 |

0.28 |

4.65 |

Friday |

BTO |

| MOSYS INC |

MOSY |

-0.14 |

-0.14 |

-27.27 |

Friday |

BTO |

| PARKER HANNIFIN |

PH |

1.47 |

1.57 |

-8.72 |

Friday |

BTO |

| SCHLUMBERGER LT |

SLB |

1.24 |

1.08 |

3.6 |

Friday |

BTO |

| SENSIENT TECH |

SXT |

0.7 |

0.66 |

-9.72 |

Friday |

BTO |

| SUNTRUST BKS |

STI |

0.69 |

1.98 |

1.49 |

Friday |

BTO |

| TEXTRON INC |

TXT |

0.47 |

0.48 |

5.26 |

Friday |

BTO |

| VALMONT INDS |

VMI |

2.48 |

2.12 |

8.56 |

Friday |

BTO |

BANK OF AMER CP (BAC): Free Stock Analysis Report

BAKER-HUGHES (BHI): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

CHIPOTLE MEXICN (CMG): Free Stock Analysis Report

CAPITAL ONE FIN (COF): Free Stock Analysis Report

EBAY INC (EBAY): Free Stock Analysis Report

FIFTH THIRD BK (FITB): Free Stock Analysis Report

GENL ELECTRIC (GE): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

COCA COLA CO (KO): Free Stock Analysis Report

MORGAN STANLEY (MS): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

UNION PAC CORP (UNP): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

WESTERN ALLIANC (WAL): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

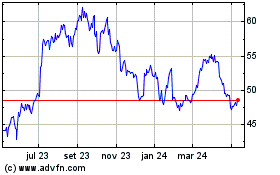

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024