Schlumberger Cuts Jobs, Slashes Dividend 75% in Historic Oil Rout -- Update

17 Abril 2020 - 12:08PM

Dow Jones News

By Collin Eaton

Schlumberger Ltd., the world's largest oil-field-services

company, cut its shareholder dividend 75% and is restructuring

businesses, cutting jobs and closing facilities to cope with a

historic energy rout.

Chief Executive Olivier Le Peuch said Friday that Schlumberger

is bracing for an acute downturn, with North American oil-field

activity set to decline 40%-60% in the second quarter, the most

severe drop in several decades.

Globally, the capital spending by oil companies that sustains

services firms is set to fall 20% this year, with North American

capital budgets falling 40%, he said. Schlumberger, he added, cut

1,500 jobs in North America in the first quarter.

"Despite the recent agreements by the world's largest oil

producers" including OPEC and Russia to curtail production, "Q2 is

likely to be the most uncertain and disruptive quarter that the

industry has ever seen," Mr. Le Peuch said in a conference

call.

Schlumberger disclosed its plans while reporting a $7.4 billion

net loss in first-quarter earnings. The company is taking an $8.5

billion pretax charge on asset impairments, almost all noncash. It

said it planned to furlough workers and reduce head count in

response to the challenging environment. In the first quarter, it

cut 1,500 jobs in North America.

Schlumberger's board approved a quarterly cash dividend of

$0.125 per share, compared with a quarterly dividend of 50 cents

per share last year.

Shares rose about 5.2% in morning trading.

Mr. Le Peuch, appointed CEO in July, was already working to

shift away from some U.S. businesses, reducing a fracking fleet it

had built when shale was booming. But selling underperforming units

will be difficult in the current market, analysts said. The company

has less cash and more debt than prior to the last downturn.

Schlumberger shares have dropped about 65% this year as oil

prices crashed under the weight of a global glut and a historic

demand slump. In the first quarter, it swung to a $7.4 billion net

loss, or $5.32 per share, compared with a net income of $421

million, or 30 cents per share, in the same period last year.

Revenue dropped to $7.45 billion from $7.9 billion. In North

America, sales fell 19% as producers cut spending.

Schlumberger, which has corporate offices in Paris, Houston,

London and The Hague, has about $4 billion in debt maturities

through 2022, according to FactSet.

By the end of the first quarter, Schlumberger reduced its

spending plan in North America by 60%, while it is reducing overall

spending for the year about 35% to $1.8 billion.

The oil-field services sector, always the first in line to feel

the effects of any downturn, is expected to shed more than 200,000

U.S. jobs this year, analysts said, due to combined pressures of

coronavirus and an oil-price war that ended last weekend.

"The job losses are going to be profound, some of them

structural," said Bill Herbert, an analyst at Simmons Energy, a

unit of Piper Sandler. "It's a vastly overcapitalized

industry."

All told, the oil-field services industry will likely cut 21% of

its global workforce this year, according to consulting firm Rystad

Energy. The number of drilling rigs operating on U.S. land has

plunged to 584, the lowest since late 2016 and down from 773 in

mid-March, according to Baker Hughes.

For smaller oil-field services companies with revenue of $1

billion or below, job reductions have ranged from 40%-50% and most

layoffs have already occurred over the past month, said Richard

Spears, vice president at energy-consulting firm Spears &

Associates.

Earlier this week, rival Weatherford International PLC said it

would cut 25% of its global workforce and delist from the New York

Stock Exchange. Baker Hughes Co. planned to take about $1.8 billion

in charges related to a restructuring plan and expected to write

down $15 billion in assets. Last month, Halliburton Co. furloughed

3,500 employees at a Houston campus.

Schlumberger had 105,000 employees at the end of last year, down

from 120,000 at the peak of the last oil boom in 2014.

Write to Collin Eaton at collin.eaton@wsj.com

(END) Dow Jones Newswires

April 17, 2020 10:53 ET (14:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

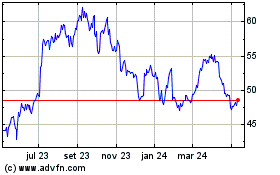

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024