Record Third Quarter Bookings of $676

million

10+ GWh Software and Services Agreement with SB

Energy

Expect Full-Year Adjusted EBITDA Positive in

2024

Outlook

- The Company expects to achieve adjusted EBITDA positive in 2H

2023, which reflects an adjustment to exclude the impact of a $37.4

million reduction in revenue(1)

- Expect full year adjusted EBITDA positive in 2024, with no

expectation of a need for additional equity issuance to achieve

goal

- Revenue growth poised for strong momentum

- Q3 2023 bookings of $676.4 million (~2x guidance for the

quarter)

- Solar asset performance management backlog up +41% YoY

- Service revenue growth expected to accelerate; SB Energy

agreement on software and services for multi-GWh development

pipeline

- Working capital intensity expected to decline

- Engaged with supply chain partners, including U.S. domestic

manufacturers, with expected double-digit declines in costs and

improved payment terms

Third Quarter 2023 Financial and Operating Highlights

Financial Highlights

- Revenue of $133.7 million, up from $99.5 million (+34%) in Q3

2022. Q3 revenue reflects the reduction in revenue referred to

below

- GAAP gross margin of (15)%, down from 9% in Q3 2022

- Non-GAAP gross margin of 12%, down from 13% in Q3 2022

- Net loss of $77.1 million versus net loss of $34.3 million in

Q3 2022

- Adjusted EBITDA of $(0.9) million versus $(12.5) million in Q3

2022

- Ended Q3 with $125.4 million in cash, cash equivalents, and

short-term investments

Operating Highlights

- Bookings of $676.4 million, up from $222.9 million (+203%) in

Q3 2022

- Record contracted backlog of $1.84 billion at end of Q3 2023,

up from $817.2 million (+125%) at end of Q3 2022

- Record contracted storage assets under management (“AUM”) of

5.0 gigawatt hours (“GWh”) at end of Q3 2023, up from 3.8 GWh

(+32%) at end of Q2 2023

- Solar monitoring AUM of 26.3 gigawatts (“GW”), up from 26.0 GW

(+1%) at the end of Q2 2023

- Contracted annual recurring revenue (“CARR”) of $87.5 million,

up from $61.4 million (+43%) at end of Q3 2022, and sequentially up

from $74.9 million (+17%)

(1) Adjusted EBITDA for the nine months and three months ended

September 30, 2023 reflects an adjustment for such reduction in

revenue. The revenue reduction is a result of changes in estimates

related to guarantees issued by the Company under certain customer

contracts, which were primarily entered into in 2022. The Company

accounts for such guarantees as variable consideration. $16.9

million of the $37.4 million reduction in revenue relates to

deliveries of hardware that occurred during the fourth quarter of

2022, $15.8 million relates to hardware deliveries that occurred

during the second quarter of 2023, and $4.7 million relates to

hardware deliveries that occurred during the third quarter of 2023.

The Company updates its estimate of variable consideration,

including changes in estimates related to such guarantees, each

quarter for facts or circumstances that have changed from the time

of the initial estimate. As a result, the Company recorded the

above reduction in revenue during the third quarter. The Company

does not intend to provide such guarantees in customer contracts

going forward and does not expect that future revenue reduction, if

any, with regard to guarantees outstanding as of September 30,

2023, will be material. Adjusted EBITDA and non-GAAP gross profit

and margin percentage for the period have been adjusted to exclude

the impact of such revenue reduction. Further details are provided

below in the section entitled “Definitions of Non-GAAP Financial

Measures.”

Stem, Inc. (“Stem” or the “Company”) (NYSE: STEM), a global

leader in artificial intelligence (AI)-driven clean energy

solutions and services, announced today its financial results for

the three and nine months ended September 30, 2023. Reported

results in this press release reflect AlsoEnergy’s operations from

February 1, 2022.

John Carrington, Chief Executive Officer of Stem, commented, “We

generated strong results in the third quarter, highlighted by

record bookings, AUM, CARR, and contracted backlog. Our bookings

grew more than 3x versus the same quarter last year, which led to a

17% sequential increase in CARR. We are raising our CARR guidance

based on our strong bookings, which we believe positions us well to

grow our high-margin software and services revenue in 2024 and

beyond.

“Today, we are excited to announce a significant technology and

commercial alliance with SB Energy where we will offer software and

services for 10+ GWh of deployments across North America to deliver

24x7 clean energy to customers. In September, we introduced Athena®

PowerBidder™ Pro, an exciting new SaaS product for participation in

wholesale energy markets, which has received strong early traction

with customers.

“In addition, we are confident in our long-term outlook, and

expect to achieve full-year positive adjusted EBITDA in 2024

without the need for additional equity issuance, based in part on

supply chain negotiations that we believe will reflect improved

terms and financing structures, leading to lower working capital

utilization going forward.”

Key Financial Results and Operating Metrics

(in $ millions unless otherwise

noted):

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Key Financial Results

Revenue (1)

$

133.7

$

99.5

$

294.1

$

207.5

GAAP Gross (Loss) Profit

$

(20.3

)

$

9.1

$

(7.4

)

$

20.5

GAAP Gross Margin (%)

(15

)%

9

%

(3

)%

10

%

Non-GAAP Gross Profit*

$

21.4

$

12.4

$

52.9

$

30.3

Non-GAAP Gross Margin (%)*

12

%

13

%

15

%

15

%

Net Loss

$

(77.1

)

$

(34.3

)

$

(102.7

)

$

(88.8

)

Adjusted EBITDA*

$

(0.9

)

$

(12.5

)

$

(24.1

)

$

(36.4

)

Key Operating Metrics

Bookings

$

676.4

$

222.9

$

1,276.3

$

599.4

Contracted Backlog**

$

1,836.6

$

817.2

$

1,836.6

$

817.2

Contracted Storage AUM (in GWh)(2)**

5.0

2.7

5.0

2.7

Solar Monitoring AUM (in GW)**

26.3

25.0

26.3

25.0

CARR**

$

87.5

61.4

87.5

61.4

(1)

Revenue, gross (loss) profit, and

net loss were negatively impacted by a $37.4 million reduction in

revenue as discussed below.

(2)

Contracted storage AUM as of

September 30, 2022 has been adjusted from 2.4 GWh, as previously

disclosed, to 2.7 GWh. Revised AUM reflects adjustments to total

GWh of energy storage as a result of revisions to the contracted

system configuration or changes in hardware specifications due to

updates from the original equipment manufacturer.

*Non-GAAP financial measures.

Adjusted EBITDA and non-GAAP gross profit and margin have been

adjusted to exclude the impact of the reduction in revenue, as

discussed below. See the section below titled “Use of Non-GAAP

Financial Measures” for details and the section below titled

“Reconciliations of Non-GAAP Financial Measures” for

reconciliations.

** At period end.

Third Quarter 2023 Financial and Operating Results

Financial Results

Revenue increased 34% to $133.7 million, versus $99.5 million in

the third quarter of 2022. Higher storage hardware revenue from

Front-of-the-Meter (“FTM”) and Behind-the-Meter (“BTM”) partnership

agreements drove a majority of the year-over-year increase, in

addition to higher solar asset performance revenue. Revenue for the

third quarter of 2023 was adversely impacted by a $37.4 million

reduction in revenue, as described below.

GAAP gross profit was $(20.3) million, or (15)%, versus $9.1

million, or 9%, in the third quarter of 2022. The year-over-year

decrease in GAAP gross profit resulted primarily from a $37.4

million reduction in revenue, as described below.

Non-GAAP gross profit was $21.4 million, or 12%, versus $12.4

million, or 13%, in the third quarter of 2022. The year-over-year

increase in non-GAAP gross margin was largely due to the sale of

lower margin hardware products.

Net loss was $77.1 million versus third quarter 2022 net loss of

$34.3 million. The year-over-year change was largely due to a $37.4

million reduction in revenue, as described below.

Adjusted EBITDA was $(0.9) million compared to $(12.5) million

in the third quarter of 2022. The change in adjusted EBITDA was

largely due to an increase in sales and continuing cost control

programs initiated by the Company, which led to a sequential

decline in cash operating expenses.

The Company ended the third quarter of 2023 with $125.4 million

in cash and short-term investments, consisting of $97.1 million in

cash and cash equivalents and $28.3 million in short-term

investments, as compared to $138.2 million in cash and short-term

investments at the end of the second quarter 2023. The primary

drivers of the decrease in cash were purchases of hardware for

customer projects that are expected to convert to revenue in the

near term and increases in accounts receivable, which are also

expected to be collected in the near-term. Based on current

forecasts, the Company expects to exit 2023 with no less than $150

million in cash, cash equivalents and short-term investments.

Operating Results

Contracted backlog was $1.84 billion at the end of the quarter,

compared to $1.36 billion as of the end of the second quarter of

2023, representing a 35% sequential increase. The increase in

contracted backlog in the quarter resulted from bookings of $676.4

million, partially offset by revenue recognition and contract

cancellations and amendments. Bookings of $676.4 million in the

third quarter of 2023 increased by 203% year-over-year versus

$222.9 million in the third quarter of 2022.

Third quarter 2023 contracted storage AUM increased 32%

sequentially to 5.0 GWh, driven by new contracts.

Third quarter 2023 solar monitoring AUM increased 1%

sequentially to 26.3 GW, driven by new contracts.

Third quarter 2023 CARR increased to $87.5 million, up from

$74.9 million as of the end of the second quarter of 2023, a 17%

sequential increase.

The following table provides a summary of backlog at the end of

the third quarter of 2023, compared to backlog at the end of the

second quarter of 2023 ($ in millions):

End of 2Q23

$

1,364.3

Add:

Bookings

$

676.4

Less:

Hardware revenue

$

(128.1

)

Software/services adjustments

$

(10.3

)

Amendments/other

$

(65.7

)

End of 3Q23

$

1,836.6

Some Factors Affecting our Business and Operations

The Company continues to diversify its supply chain, integrate

additional energy technologies, and deploy a portion of its balance

sheet to help position the Company to meet the expected significant

growth in customer demand. However, we are subject to risk and

exposure from the evolving macroeconomic, geopolitical and business

environment, including the effects of increased global inflationary

pressures and interest rates, potential import tariffs, potential

economic slowdowns or recessions, the prospect of a shutdown of the

U.S. federal government, and geopolitical pressures, including the

Russia-Ukraine armed conflict, rising tensions between China and

the United States, and unknown effects of current and future trade

and other regulations. We regularly monitor the direct and indirect

effects of these circumstances on our business and financial

results, although there is no guarantee of the extent to which we

will be successful in these efforts.

As stated above, the Company accounts for specified contractual

guarantees as variable consideration. $16.9 million of the $37.4

million reduction in revenue referred to above relates to

deliveries of hardware that occurred during the fourth quarter of

2022, $15.8 million relates to hardware deliveries that occurred

during the second quarter of 2023, and $4.7 million relates to

hardware deliveries that occurred during the third quarter of 2023.

The Company updates its estimate of variable consideration,

including changes in estimates related to such guarantees, each

quarter for facts or circumstances that have changed from the time

of the initial estimate. As a result, the Company recorded the

$37.4 million reduction in revenue during the third quarter. The

Company does not expect that future revenue reductions, if any,

with regard to guarantees outstanding as of September 30, 2023,

will be material.

Recent Business Highlights

Today the Company is announcing a Commercial and Technology

Alliance with SB Energy Global, LLC to collaborate on delivering

24x7 clean energy to customers. This agreement includes providing

software and professional services to accelerate and execute on

approximately 10 GWh of energy storage projects SB Energy has in

development in North America.

On October 25, 2023, EDP Renewables (“EDPR”) announced a 23 MW

Solar plus 60 MWh Storage Project for Mohave Electric Cooperative

(“MEC”), a not-for-profit distribution cooperative in Arizona. EDPR

partnered with Stem on the energy storage system for the project

which will be operated by Athena to monitor and dispatch into

high-demand time periods. In addition, MEC will be using Stem’s

PowerTrack solar management application within Athena for AI-driven

solar forecasting, and advanced modeling to help streamline solar

optimization for added value for MEC and its members.

On October 24, 2023, the Company announced its key role in the

development and recent completion of the first battery energy

storage site in the Bronx, New York City. The Gunther site is owned

and operated by NineDot Energy® and features a 3 MW/12 MWh battery

energy storage system, a solar canopy, and infrastructure ready for

bi-directional electric vehicle chargers. Under this software-only

arrangement, Stem’s AI-driven Athena platform responds to grid

calls within ten minutes, while simultaneously optimizing for local

and seasonal system peaks.

On September 17, 2023, the Company announced a new

state-of-the-art office in Cyber Hub, Gurgaon, India. As the

company’s global Center of Excellence, Stem is investing in the

region to help it support customers around the world, while driving

operational excellence in critical areas such as software

development, customer operations, data science, and technology. The

42,000 square feet space can double its current capacity as Stem

scales for future growth.

On September 7, 2023, the Company announced the launch of

Athena® PowerBidder™ Pro application to help energy professionals

actively manage clean energy assets with confidence, control, and

scalability. Asset owners, traders, and tolling offtakers can

leverage PowerBidder Pro’s AI-driven automated bid optimization

workflows as well as its comprehensive suite of advanced real-time

monitoring and control features to break open the ‘black box’ of

merchant battery storage asset operations and tailor strategies to

their organization’s risk tolerance.

On August 30, 2023, the Company announced that its Athena

platform was named a Sustainability Product of the Year as part of

the Business Intelligence Group’s 2023 Sustainability Awards. The

awards honor products designed to help companies improve their

sustainability efforts, as well as the people, initiatives, and

organizations that have made sustainability an integral part of

their business practices.

Outlook

The Company is updating its full-year 2023 guidance ranges as

follows ($ millions, unless otherwise noted):

Previous

Updated*

Revenue

$550 - $650

$513 - $613

Non-GAAP Gross Margin (%)

15% - 20%

unchanged

Adjusted EBITDA

$(35) - $(5)

($25) - ($15)

Bookings

$1,400 - $1,600

unchanged

CARR (year-end)

$80 - $90

$90 - $95

See the section below titled

“Reconciliations of Non-GAAP Financial Measures” for information

regarding why the Company is unable to reconcile non-GAAP gross

margin and adjusted EBITDA guidance to their most comparable

financial measures calculated in accordance with GAAP.

* Adjusted EBITDA and non-GAAP

gross margin percentage have been adjusted to exclude the impact of

the $37.4 million reduction in revenue. Full year revenue guidance

has been adjusted downward dollar-for-dollar solely as a result of

the $37.4 million reduction in revenue.

The Company is updating full-year 2023 revenue and bookings

projected quarterly performance as follows:

Metric

Q1A

Q2A

Q3A

Q4E

Revenue

$67M

$93M

$134M

$219-319M

Bookings

$364M

$236M

$676M

$125-325M

Conference Call Information

Stem will hold a conference call to discuss this earnings press

release and business outlook on Thursday, November 2, 2023,

beginning at 5:00 p.m. Eastern Time. The conference call and

accompanying slides may be accessed via a live webcast on a

listen-only basis on the Events & Presentations page of the

Investor Relations section of the Company’s website at

https://investors.stem.com/events-and-presentations. The call can

also be accessed live over the telephone by dialing (855) 327-6837,

or for international callers, (631) 891-4304 and referencing Stem.

An audio replay will be available shortly after the call until

December 2, 2023, and can be accessed by dialing (844) 512-2921 or

for international callers by dialing (412) 317-6671. The passcode

for the replay is 10022354. A replay of the webcast will be

available on the Company’s website at

https://investors.stem.com/overview for approximately 12 months

after the call.

Use of Non-GAAP Financial Measures

In addition to financial results determined in accordance with

U.S. generally accepted accounting principles (“GAAP”), this

earnings press release contains the following non-GAAP financial

measures: adjusted EBITDA, non-GAAP gross profit and non-GAAP gross

margin.

We use these non-GAAP financial measures for financial and

operational decision-making and to evaluate our operating

performance and prospects, develop internal budgets and financial

goals, and to facilitate period-to-period comparisons. Management

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding our performance and liquidity by

excluding certain expenses and expenditures that may not be

indicative of our operating performance, such as stock-based

compensation and other non-cash charges, as well as discrete cash

charges that are infrequent in nature. We believe that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing our performance and when planning,

forecasting, and analyzing future periods. These non-GAAP financial

measures also facilitate management’s internal comparisons to our

historical performance and liquidity as well as comparisons to our

competitors’ operating results, to the extent that competitors

define these metrics in the same manner that we do. We believe

these non-GAAP financial measures are useful to investors both

because they (1) allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making and (2) are used by investors and analysts to help

them analyze the health of our business. Our calculation of these

non-GAAP financial measures may differ from similarly-titled

non-GAAP measures, if any, reported by other companies. In

addition, other companies may not publish these or similar

measures. These non-GAAP financial measures should be considered in

addition to, not as a substitute for, or superior to, other

measures of financial performance prepared in accordance with GAAP.

For reconciliation of adjusted EBITDA and non-GAAP gross profit and

margin to their most comparable GAAP measures, see the section

below entitled “Reconciliations of Non-GAAP Financial

Measures.”

Definitions of Non-GAAP Financial Measures

We define adjusted EBITDA as net income (loss) attributable to

Stem before depreciation and amortization, including amortization

of internally developed software, net interest expense, further

adjusted to exclude stock-based compensation and other income and

expense items, including gain (loss) on the extinguishment of debt,

revenue constraint, reduction in revenue, change in fair value of

derivative liability, transaction and acquisition-related charges,

litigation settlement, restructuring costs, and income tax

provision or benefit. The expenses and other items that we exclude

in our calculation of adjusted EBITDA may differ from the expenses

and other items, if any, that other companies may exclude when

calculating adjusted EBITDA.

We define non-GAAP gross profit as gross profit excluding both

amortization of capitalized software and impairments related to

decommissioning of end-of-life systems and reduction in revenue,

and including revenue constraint. Non-GAAP gross margin is defined

as non-GAAP gross profit as a percentage of revenue.

The Company generally records the full purchase order value as

revenue at the time of hardware delivery; however, for certain

non-cancelable purchase orders entered into during the first

quarter of 2023, the final settlement amount payable to the Company

is variable and indexed to the price per ton of lithium carbonate

in the first quarter of 2024 such that the Company may increase or

decrease the final prices in such purchase orders based on the

price per ton of lithium carbonate at final settlement. Lithium

carbonate is a key raw material used in the production of hardware

systems that the Company ultimately sells to customers. The total

dollar amount of such purchase orders for the indexed contracts is

approximately $52 million. However, as a result of the pricing

structure in such purchase orders, the Company recorded revenue in

the first quarter of 2023 of approximately $42 million in

accordance with GAAP, net of a $10 million revenue constraint,

using a third party forecast of the lithium carbonate trading value

in the first quarter of 2024. Because the Company had not before

used indexed pricing in its customer contracts or purchase orders

and had not previously constrained revenue related to forecasted

inputs of its hardware systems, the Company believes that including

the $10 million revenue constraint from the first quarter of 2023

into non-GAAP profit enhances the comparability to the Company’s

non-GAAP profit in prior periods. Because the purchase orders are

variable and depend on the specified price per ton of lithium

carbonate at the time of final measurement in the first quarter of

2024, the Company may, pursuant to such purchase orders, ultimately

adjust final revenue downward to $34 million, subject to market

conditions upon settlement. The Company recorded the full cost of

hardware revenue for these indexed contracts in the first quarter

of 2023.

In certain customer contracts, the Company previously agreed to

provide a guarantee to customers that the value of purchased

hardware will not decline for a certain period of time. Under such

guarantee, if a customer were unable to install or designate the

hardware to a specified project within such period of time, the

Company would be required to assist the customer in re-marketing

the hardware for resell by the customer. The guarantee provided

that, in such cases, if the customer resold the hardware for less

than the amount initially sold to the customer, the Company would

be required to compensate the customer for any shortfall in fair

value for the hardware from the initial contract purchase price.

The Company accounts for such guarantees as variable consideration

at each measurement date. The Company updates its estimate of

variable consideration each quarter for facts or circumstances that

have changed from the time of the initial estimate and, as a

result, the Company recorded a revenue reduction of $37.4 million

during the three and nine months ended September 30, 2023.

The Company does not intend to provide such parent company

guarantees in customer contracts going forward. Because these

guarantees in customer contracts had not previously resulted in a

revenue reduction in prior periods, and because the Company does

not intend to provide such parent company guarantees going forward,

the Company believes that excluding the impact of the $37.4 million

reduction in revenue enhances the comparability to the Company’s

adjusted EBITDA and non-GAAP gross profit and margin percentage in

prior periods.

See the section below entitled “Reconciliations of Non-GAAP

Financial Measures.”

About Stem Stem provides clean energy solutions and

services designed to maximize the economic, environmental, and

resiliency value of energy assets and portfolios. Stem’s leading

AI-driven enterprise software platform, Athena® enables

organizations to deploy and unlock value from clean energy assets

at scale. Powerful applications, including AlsoEnergy’s PowerTrack,

simplify and optimize asset management and connect an ecosystem of

owners, developers, assets, and markets. Stem also offers

integrated partner solutions to help improve returns across energy

projects, including storage, solar, and EV fleet charging. For more

information, visit www.stem.com.

Forward-Looking Statements This earnings press release,

as well as other statements we make, contains “forward-looking

statements” within the meaning of the federal securities laws,

which include any statements that are not historical facts. Such

statements often contain words such as “expect,” “may,” “can,”

“believe,” “predict,” “plan,” “potential,” “projected,”

“projections,” “forecast,” “estimate,” “intend,” “anticipate,”

“ambition,” “goal,” “target,” “think,” “should,” “could,” “would,”

“will,” “hope,” “see,” “likely,” and other similar words.

Forward-looking statements address matters that are, to varying

degrees, uncertain, such as statements about our financial and

performance targets and other forecasts or expectations regarding,

or dependent on, our business outlook; our ability to secure

sufficient and timely inventory from suppliers; our ability to meet

contracted customer demand; our ability to manage supply chain

issues and manufacturing or delivery delays; our joint ventures,

partnerships and other alliances; forecasts or expectations

regarding energy transition and global climate change; reduction of

greenhouse gas (“GHG”) emissions; the integration and optimization

of energy resources; our business strategies and those of our

customers; our ability to retain or upgrade current customers,

further penetrate existing markets or expand into new markets; our

ability to manage the effects of natural disasters and other events

beyond our control; our preparedness for future widespread health

emergencies (and government and business responses thereto); the

direct or indirect effects on our business of macroeconomic factors

and geopolitical instability, such as the ongoing conflict in

Ukraine; the expected benefits of the Inflation Reduction Act of

2022 on our business; and future results of operations, including

adjusted EBITDA and the other metrics presented under Outlook. Such

forward-looking statements are subject to risks, uncertainties, and

other factors that could cause actual results to differ materially

from those expressed or implied by such forward-looking statements,

including but not limited to our inability to secure sufficient and

timely inventory from our suppliers, as well as contracted

quantities of equipment; our inability to meet contracted customer

demand; supply chain interruptions and manufacturing or delivery

delays; disruptions in sales, production, service or other business

activities; general macroeconomic and business conditions in key

regions of the world, including inflationary pressures, general

economic slowdown or a recession, rising interest rates, changes in

monetary policy, instability in financial institutions, and the

prospect of a shutdown of the U.S. federal government; the direct

and indirect effects of widespread health emergencies on our

workforce, operations, financial results and cash flows;

geopolitical instability, such as the ongoing conflict in Ukraine;

the results of operations and financial condition of our customers

and suppliers; pricing pressures; weather and seasonal factors; our

inability to continue to grow and manage our growth effectively;

our inability to attract and retain qualified employees and key

personnel; our inability to comply with, and the effect on our

business of, evolving legal standards and regulations, including

concerning data protection and consumer privacy and evolving labor

standards; risks relating to the development and performance of our

energy storage systems and software-enabled services; our inability

to retain or upgrade current customers, further penetrate existing

markets or expand into new markets; the risk that our business,

financial condition and results of operations may be adversely

affected by other political, economic, business and competitive

factors; and other risks and uncertainties discussed in this

release and in our most recent Forms 10-K, 10-Q and 8-K filed with

or furnished to the SEC. If one or more of these or other risks or

uncertainties materialize (or the consequences of any such

development changes), or should our underlying assumptions prove

incorrect, actual results or outcomes, or the timing of these

results or outcomes, may vary materially from those reflected in

our forward-looking statements. Forward-looking and other

statements in this release regarding our environmental, social, and

other sustainability plans and goals are not an indication that

these statements are necessarily material to investors or required

to be disclosed in our filings with the SEC. In addition,

historical, current, and forward-looking environmental, social, and

sustainability-related statements may be based on standards for

measuring progress that are still developing, internal controls and

processes that continue to evolve, and assumptions that are subject

to change in the future. Statements in this earnings press release

are made as of the date of this release, and Stem disclaims any

intention or obligation to update publicly or revise such

statements, whether as a result of new information, future events,

or otherwise, except as required by law.

Source: Stem, Inc.

STEM, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share amounts)

September 30, 2023

December 31, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

97,064

$

87,903

Short-term investments

28,301

162,074

Accounts receivable, net of allowances of

$5,328 and $3,879 as of September 30, 2023 and December 31, 2022,

respectively

288,674

223,219

Inventory, net

65,656

8,374

Deferred costs with suppliers

20,298

43,159

Other current assets (includes $53 and $74

due from related parties as of September 30, 2023 and December 31,

2022, respectively)

10,520

8,026

Total current assets

510,513

532,755

Energy storage systems, net

80,709

90,757

Contract origination costs, net

11,930

11,697

Goodwill

547,164

546,649

Intangible assets, net

158,321

162,265

Operating lease right-of-use assets

13,023

12,431

Other noncurrent assets

77,132

65,339

Total assets

$

1,398,792

$

1,421,893

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

85,444

$

83,831

Accrued liabilities

60,615

85,258

Accrued payroll

10,439

12,466

Financing obligation, current portion

17,381

15,720

Deferred revenue, current portion

82,676

64,311

Other current liabilities (includes $40

and $687 due to related parties as of September 30, 2023 and

December 31, 2022, respectively)

12,689

5,412

Total current liabilities

269,244

266,998

Deferred revenue, noncurrent

83,028

73,763

Asset retirement obligation

4,085

4,262

Notes payable, noncurrent

—

1,603

Convertible notes, noncurrent

523,068

447,909

Financing obligation, noncurrent

54,314

63,867

Lease liabilities, noncurrent

11,145

10,962

Other liabilities

565

362

Total liabilities

945,449

869,726

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value;

1,000,000 shares authorized as of September 30, 2023 and December

31, 2022; zero shares issued and outstanding as of September 30,

2023 and December 31, 2022

—

—

Common stock, $0.0001 par value;

500,000,000 shares authorized as of September 30, 2023 and December

31, 2022; 155,883,088 and 154,540,197 issued and outstanding as of

September 30, 2023 and December 31, 2022, respectively

16

15

Additional paid-in capital

1,187,628

1,185,364

Accumulated other comprehensive income

(loss)

23

(1,672

)

Accumulated deficit

(734,809

)

(632,081

)

Total Stem’s stockholders’ equity

452,858

551,626

Non-controlling interests

485

541

Total stockholders’ equity

453,343

552,167

Total liabilities and stockholders’

equity

$

1,398,792

$

1,421,893

STEM, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and

per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Revenue

Services and other revenue

$

16,597

$

13,692

$

47,630

$

36,178

Hardware revenue

117,143

85,809

246,461

171,358

Total revenue

133,740

99,501

294,091

207,536

Cost of revenue

Cost of services and other revenue

13,684

11,445

36,944

30,219

Cost of hardware revenue

140,347

78,929

264,573

156,758

Total cost of revenue

154,031

90,374

301,517

186,977

Gross (loss) profit

(20,291

)

9,127

(7,426

)

20,559

Operating expenses:

Sales and marketing

11,605

13,187

37,691

35,284

Research and development

14,420

10,526

42,020

28,432

General and administrative

21,955

18,013

58,656

54,218

Total operating expenses

47,980

41,726

138,367

117,934

Loss from operations

(68,271

)

(32,599

)

(145,793

)

(97,375

)

Other (expense) income, net:

Interest expense, net

(4,405

)

(2,520

)

(10,085

)

(8,429

)

Gain on extinguishment of debt, net

—

—

59,121

—

Change in fair value of derivative

liability

(5,155

)

—

(7,731

)

—

Other income, net

713

863

2,114

1,822

Total other (expense) income, net

(8,847

)

(1,657

)

43,419

(6,607

)

Loss before benefit from (provision for)

income taxes

(77,118

)

(34,256

)

(102,374

)

(103,982

)

Benefit from (provision for) income

taxes

46

(19

)

(354

)

15,201

Net loss

(77,072

)

(34,275

)

(102,728

)

(88,781

)

Net income attributed to non-controlling

interests

—

4

—

—

Net loss attributable to Stem

$

(77,072

)

$

(34,279

)

$

(102,728

)

$

(88,781

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.49

)

$

(0.22

)

$

(0.66

)

$

(0.58

)

Weighted-average shares used in computing

net loss per share to common stockholders, basic and diluted

155,829,348

154,392,573

155,474,725

153,043,010

STEM, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

Nine Months Ended

September 30,

2023

2022

OPERATING ACTIVITIES

Net loss

$

(102,728

)

$

(88,781

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization expense

33,593

32,060

Non-cash interest expense, including

interest expenses associated with debt issuance costs

1,969

1,479

Stock-based compensation

28,320

20,410

Change in fair value of derivative

liability

7,731

—

Non-cash lease expense

2,162

1,722

Accretion of asset retirement

obligations

178

183

Impairment loss of energy storage

systems

2,347

1,293

Impairment loss of project assets

158

—

Net (accretion of discount) amortization

of premium on investments

(1,672

)

301

Income tax benefit from release of

valuation allowance

(335

)

(15,100

)

Provision for accounts receivable

allowance

1,754

1,874

Net loss on investments

1,561

—

Gain on sale of project assets

—

(592

)

Gain on extinguishment of debt, net

(59,121

)

—

Other

(831

)

(39

)

Changes in operating assets and

liabilities:

Accounts receivable

(67,029

)

(75,390

)

Inventory

(57,282

)

(2,237

)

Deferred costs with suppliers

30,579

(47,836

)

Other assets

(17,947

)

(25,242

)

Contract origination costs, net

(4,184

)

(4,842

)

Project assets

(2,827

)

—

Accounts payable

1,771

63,207

Accrued expenses and other liabilities

(28,910

)

38,329

Deferred revenue

27,630

31,620

Lease liabilities

(2,135

)

(1,053

)

Net cash used in operating activities

(205,248

)

(68,634

)

INVESTING ACTIVITIES

Acquisitions, net of cash acquired

(1,847

)

(533,009

)

Purchase of available-for-sale

investments

(58,034

)

(181,541

)

Proceeds from maturities of

available-for-sale investments

119,650

148,064

Proceeds from sales of available-for-sale

investments

73,917

10,930

Purchase of energy storage systems

(2,912

)

(469

)

Capital expenditures on

internally-developed software

(10,123

)

(12,652

)

Net proceeds from sale of project

assets

—

1,251

Capital expenditures on project assets

—

(3,009

)

Purchase of property and equipment

(395

)

(1,490

)

Net cash provided by (used in) investing

activities

120,256

(571,925

)

FINANCING ACTIVITIES

Proceeds from exercise of stock options

and warrants

257

1,194

Payments for taxes related to net share

settlement of stock options

—

(2,302

)

Proceeds from financing obligations

—

1,519

Repayment of financing obligations

(7,766

)

(7,637

)

Proceeds from issuance of convertible

notes, net of issuance costs of $7,601 and $0 for the nine months

ended September 30, 2023 and 2022, respectively

232,399

—

Repayment of convertible notes

(99,754

)

—

Purchase of capped call options

(27,840

)

—

(Redemption of) investment from

non-controlling interests, net

(56

)

407

Repayment of notes payable

(2,101

)

—

Net cash provided by (used in) financing

activities

95,139

(6,819

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

114

(304

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

10,261

(647,682

)

Cash, cash equivalents and restricted

cash, beginning of year

87,903

747,780

Cash, cash equivalents and restricted

cash, end of period

$

98,164

$

100,098

RECONCILIATION OF CASH, CASH

EQUIVALENTS, AND RESTRICTED CASH WITHIN THE CONDENSED CONSOLIDATED

BALANCE SHEETS TO THE AMOUNTS SHOWN IN THE STATEMENTS OF CASH FLOWS

ABOVE:

Cash and cash equivalents

$

97,064

$

100,098

Restricted cash included in other

noncurrent assets

1,100

—

Total cash, cash equivalents, and

restricted cash

$

98,164

$

100,098

STEM, INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

(UNAUDITED)

The following table provides a

reconciliation of adjusted EBITDA to net income (loss):

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

(in thousands)

(in thousands)

Net loss attributable to Stem

$

(77,072

)

$

(34,279

)

$

(102,728

)

$

(88,781

)

Adjusted to exclude the following:

Depreciation and amortization (1)

11,531

11,547

36,098

33,353

Interest expense, net

4,405

2,520

10,085

8,429

Gain on extinguishment of debt, net

—

—

(59,121

)

—

Stock-based compensation

11,198

7,678

28,320

20,410

Revenue constraint (2)

—

—

10,200

—

Revenue reduction (3)

37,377

—

37,377

—

Change in fair value of derivative

liability

5,155

—

7,731

—

Transaction costs in connection with

business combination

—

—

—

6,068

Litigation settlement

—

—

—

(727

)

(Benefit from) provision for income

taxes

(46

)

19

354

(15,201

)

Other expenses (4)

6,591

—

7,612

—

Adjusted EBITDA

$

(861

)

$

(12,515

)

$

(24,072

)

$

(36,449

)

Adjusted EBITDA, as used in the

Company's full-year 2023 guidance, is a non-GAAP financial measure

that excludes or has otherwise been adjusted for items impacting

comparability. The Company is unable to reconcile projected

adjusted EBITDA to net income (loss), its most directly comparable

forward-looking GAAP financial measure, without unreasonable

effort, because the Company is unable to predict with a reasonable

degree of certainty its change in stock-based compensation expense,

depreciation and amortization expense, revenue constraint and other

items that may affect net loss. The unavailable information could

have a significant effect on the Company’s full-year 2023 GAAP

financial results.

(1)

Depreciation and amortization

includes depreciation and amortization expense, impairment loss of

energy storage systems, and impairment loss of project assets.

(2)

Refer to the discussion of

revenue constraint in the definition of non-GAAP profit provided

above.

(3)

Refer to the discussion of

reduction in revenue in the definition of non-GAAP profit provided

above.

(4)

Adjusted EBITDA for the three and

nine months ended September 30, 2023 reflects other expenses of

$6.6 million and $7.6 million, respectively. For the three months

ended September 30, 2023, other expenses includes $5.6 million in

accruals for sales taxes, $0.5 million for impairments, $0.3

million for expenses related to restructuring costs, and $0.2

million of other non-recurring expenses. For the nine months ended

September 30, 2023, other expenses include $5.6 million in accruals

for sales taxes, $0.5 million for impairments, $0.3 million of

other non-recurring expense, and $1.2 million for expenses related

to restructuring costs to pursue greater efficiency and to realign

our business and strategic priorities. Restructuring expenses

consisted of employee severance and other exit costs.

The following table provides a

reconciliation of non-GAAP gross profit and margin to GAAP gross

profit and margin ($ in millions):

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Revenue

$

133.7

$

99.5

$

294.1

$

207.5

Cost of revenue

(154.0

)

(90.4

)

(301.5

)

(187.0

)

GAAP gross (loss) profit

(20.3

)

9.1

(7.4

)

20.5

GAAP gross margin (%)

(15

)%

9

%

(3

)%

10

%

Non-GAAP Gross Profit

GAAP Revenue

$

133.7

$

99.5

$

294.1

$

207.5

Add: Revenue constraint (1)

—

—

10.2

—

Add: Revenue reduction (2)

37.4

—

37.4

—

Subtotal

171.1

99.5

341.7

207.5

Less: Cost of revenue

(154.0

)

(90.4

)

(301.5

)

(187.0

)

Add: Amortization of capitalized software

& developed technology

3.5

2.9

9.8

7.6

Add: Impairments

0.8

0.4

2.9

2.2

Non-GAAP gross profit

$

21.4

$

12.4

$

52.9

$

30.3

Non-GAAP gross margin (%)

12

%

13

%

15

%

15

%

Non-GAAP gross margin as used in the

Company's full-year 2023 guidance, is a non-GAAP financial measure

that excludes or has otherwise been adjusted for items impacting

comparability. The Company is unable to reconcile projected

non-GAAP gross margin to GAAP gross margin, its most directly

comparable forward-looking GAAP financial measure, without

unreasonable efforts, because the Company is currently unable to

predict with a reasonable degree of certainty its change in

amortization of capitalized software, impairments, and other items

that may affect GAAP gross margin. The unavailable information

could have a significant effect on the Company’s full-year 2023

GAAP financial results.

(1)

Refer to the discussion of

revenue constraint in the definition of non-GAAP profit provided

above.

(2)

Refer to the discussion of

reduction in revenue in the definition of non-GAAP profit provided

above.

Key Definitions:

Item

Definition

Total value of executed customer

agreements, as of the end of the relevant period

• Customer contracts are

typically executed 6-18 months ahead of installation

Bookings

• Bookings amount typically

includes:

1. Hardware revenue, which is

typically recognized at delivery of system to customer

2. Software revenue, which

represents total nominal software contract value recognized ratably

over the contract period

• Market participation revenue is

excluded from booking value

Total value of bookings in

dollars, as of a specific date

Contracted Backlog

• Backlog increases as new

contracts are executed (bookings)

• Backlog decreases as integrated

storage systems are delivered and recognized as revenue

Contracted Assets Under

Management (“AUM”)

Total GWh of storage systems in

operation or under contract

Solar Monitoring AUM

Total GW of solar systems in

operation or under contract

Contracted Annual Recurring

Revenue (CARR)

Annual run rate for all executed

software services contracts, including contracts signed in the

applicable period for systems that are not yet commissioned or

operating

Project Services

Professional services and revenue

tied to Development Company investments

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102191337/en/

Stem Investor Contacts Ted Durbin, Stem Marc Silverberg,

ICR IR@stem.com Stem Media Contacts Suraya Akbarzad, Stem

press@stem.com

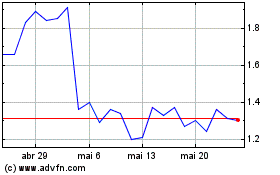

Stem (NYSE:STEM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Stem (NYSE:STEM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025