UNFI Announces Proposed Refinancing of Senior Secured Term Loan

16 Abril 2024 - 8:25AM

Business Wire

United Natural Foods, Inc. (NYSE: UNFI) today announced that it

launched the refinancing of its senior secured term loan facility.

The amended term loan credit facility is expected to be in an

aggregate principal amount of $500.0 million. The amendment is

expected to extend the maturity date, modify the interest rate

margins applicable to the term loan thereunder and make other

modifications to the terms thereof. UNFI expects to use the

proceeds of the amended term loan, together with borrowings under

its asset-based revolving credit facility, to repay the existing

term loan.

The closing of the proposed transaction is expected to occur in

April 2024, subject to market and other customary conditions. There

can be no assurance that the proposed transaction will be completed

on favorable terms or at all.

About UNFI

UNFI is North America's premier grocery wholesaler delivering

the widest variety of fresh, branded, and owned brand products to

more than 30,000 locations throughout North America, including

natural product superstores, independent retailers, conventional

supermarket chains, ecommerce providers, and food service

customers. UNFI also provides a broad range of value-added services

and segmented marketing expertise, including proprietary

technology, data, market insights, and shelf management to help

customers and suppliers build their businesses and brands. As the

largest full-service grocery partner in North America, UNFI is

committed to building a food system that is better for all and is

uniquely positioned to deliver great food, more choices, and fresh

thinking to customers. To learn more about how UNFI is delivering

value for its stakeholders, visit www.unfi.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this press release regarding the

Company’s business that are not historical facts are

“forward-looking statements” that involve risks and uncertainties

and are based on current expectations and management estimates;

actual results may differ materially. Examples of these statements

include statements regarding the proposed closing and the proposed

terms of the amendment. The risks and uncertainties which could

impact these statements include the market for secured debt and

those described in the Company’s filings under the Securities

Exchange Act of 1934, as amended, including its annual report on

Form 10-K for the year ended July 29, 2023 filed with the

Securities and Exchange Commission (the “SEC”) on September 26,

2023 and other filings the Company makes with the SEC. Any

forward-looking statements are made pursuant to the Private

Securities Litigation Reform Act of 1995 and, as such, speak only

as of the date made. Any estimates of future results of operations

are based on a number of assumptions, many of which are outside the

Company’s control and should not be construed in any manner as a

guarantee that such results will in fact occur.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240415255132/en/

For UNFI Investors: Kristyn Farahmand 401-213-2160

kristyn.farahmand@unfi.com -or- Steve Bloomquist 952-828-4144

steve.j.bloomquist@unfi.com

For Media: UNFI Charles Davis 215-539-1696

cdavis@unfi.com

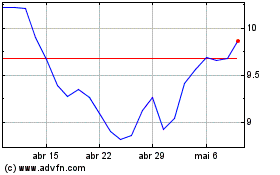

United Natural Foods (NYSE:UNFI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

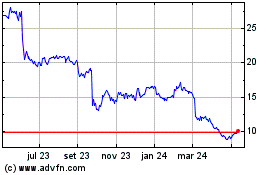

United Natural Foods (NYSE:UNFI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024