Whirlpool Upgraded to Outperform - Analyst Blog

31 Maio 2012 - 1:29PM

Zacks

We are upgrading our

long-term recommendation on Whirlpool Corporation (WHR)

to Outperform from Neutral based

on its effective cost-control measures, product innovation

strategies and solid quarterly results.

Whirlpool’s operations are spread worldwide. The company derived

51% of its revenues from North America, 27% from Latin America, 17%

from Europe, the Middle East and Africa and 5% from Asia last year.

The geographic diversification has enabled Whirlpool to keep its

top line more or less stable in difficult economic times as it cuts

out some of the risks arising from concentration in one

region.

In addition, Whirlpool is focused on improving its margins. It

has implemented a number of cost-control measures along with

cost-based price increments. This particular strategy will probably

help it withstand the uncertain economic environment.

Moreover, Whirlpool is a company which stresses product

innovation. Its investment in research and development (R&D)

has been consistent over time as shown by the R&D spending of

$500 million in 2009, $532 million in 2010 and $578 million in

2011. Whirlpool’s R&D efforts are bearing positive consequences

as the new products are gaining acceptability among consumers and

driving the company’s positive price-product mix.

Whirlpool had posted solid results in its recently reported

first quarter. The company’s adjusted net income jumped to $1.41

per share in the quarter from 64 cents in the same period last

year, surpassing the Zacks Consensus Estimate of $1.12 by a healthy

25.89%.

However, revenues in the quarter dipped slightly to $4.35

billion from $4.40 billion last year as improving product price/mix

was offset by unfavorable currency, lower industry demand and lower

monetization of tax credits. As a result, revenues failed to meet

the Zacks Consensus Estimate of $4.37 billion.

Going forward, the company expects to earn $6.50 to $7.00 per

share on an adjusted basis in 2012, ahead of the Zacks Consensus

Estimate of $6.42 for the year.

Whirlpool is the largest manufacturer of home-appliances in the

world, ahead of the likes of ElectroluxAB (ELUXY),

LG, Samsung and General Electric Co. (GE). It is a

market leader across the globe, ranking first in North America and

Latin America, second in India and third in Europe.

Whirlpool’s cost and capacity reduction initiatives are

noteworthy, resulting in improved margins. However, we are

concerned about the ongoing weakness in Europe, where the company

expects sales to decline this year.

Whirlpool currently has a Zacks #1 Rank, reflecting a short-term

(1 to 3 months) Strong Buy rating, which is in line with our

long-term (more than 6 months) recommendation.

(ELUXY): ETF Research Reports

GENL ELECTRIC (GE): Free Stock Analysis Report

WHIRLPOOL CORP (WHR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

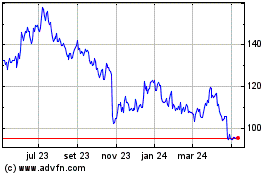

Whirlpool (NYSE:WHR)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

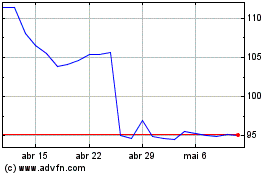

Whirlpool (NYSE:WHR)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025