Secure Energy Services Inc. ("Secure" or the "Corporation") (TSX:SES) today

announced financial and operational results for the three months ended March 31,

2014. The following should be read in conjunction with the management's

discussion and analysis ("MD&A"), the condensed consolidated financial

statements and notes of Secure which are available on SEDAR at www.sedar.com.

FINANCIAL AND OPERATIONAL HIGHLIGHTS FOR THE FIRST QUARTER ENDED MARCH 31, 2014

The first quarter of 2014 was the strongest quarter on record for Secure.

Activity levels remained robust through the end of the first quarter due to a

late spring break-up allowing all three divisions to deliver solid results.

Revenue (excluding oil purchase and resale) and EBITDA increased 40% and 43%

respectively, over the 2013 comparative period. In addition, Secure completed

two strategic acquisitions in the quarter that positively contributed to overall

results, and added complimentary services to the OS division. The operating and

financial highlights for the first quarter ending March 31, 2014 can be

summarized as follows:

Three Months Ended March 31,

($000's except share and per share data) 2014 2013 % change

----------------------------------------------------------------------------

Revenue (excludes oil purchase and

resale) 205,632 147,122 40

Oil purchase and resale 320,580 175,856 82

----------------------------------------------------------------------------

Total revenue 526,212 322,978 63

----------------------------------------------------------------------------

EBITDA (1) 56,691 39,705 43

Per share ($), basic 0.48 0.38 26

Per share ($), diluted 0.47 0.37 27

----------------------------------------------------------------------------

Net earnings 22,989 17,758 29

Per share ($), basic 0.20 0.17 18

Per share ($), diluted 0.19 0.17 12

----------------------------------------------------------------------------

Funds from operations (1) 56,357 34,744 62

Per share ($), basic 0.48 0.33 45

Per share ($), diluted 0.47 0.32 47

----------------------------------------------------------------------------

Cash dividends per common share 0.04 nil 100

Capital Expenditures (1) 66,737 42,268 58

Total assets 1,171,891 828,058 42

Long term borrowings 219,486 168,353 30

Total long term liabilities 304,319 229,822 32

----------------------------------------------------------------------------

Common Shares - end of period 118,020,638 104,894,191 13

Weighted average common shares

basic 117,235,063 104,734,964 12

diluted 120,436,149 107,363,836 12

----------------------------------------------------------------------------

(1)Refer to "Non GAAP measures and operational definitions" and "Additional

GAAP measures" for further information

REVENUE INCREASES

-- 40% INCREASE IN REVENUE (EXCLUDING OIL PURCHASE AND RESALE) OVER THE

2013 COMPARATIVE QUARTER

-- PRD division revenue (excluding oil purchase/resale) for the period

ended March 31, 2014 increased 43% from the 2013 comparative period.

Processing volumes increased 22% as increasing demand for services

and the addition of six new facilities that were completed and

commissioned after the first quarter of 2013 all contributed to the

increase. Recovery revenues increased by 27% attributed to a 45%

increase in throughput at the Corporation's facilities. Disposal

volumes increased 56% as a direct result of increased activity and

the addition of the 13 Mile Landfill in North Dakota in October 2013

and the Saddle Hills Landfill in November 2013.

-- DS division Canadian market share was 31% and revenue increased 27%

from the 2013 comparative period. Drilling fluids revenue increased

22% as a result of an increase in meters drilled per well by the

Corporation's customers and a 25% increase in revenue per operating

day. Overall there was higher field activity as meters drilled per

well in Canada increased by 9% for the period ended March 31, 2014

compared to the prior year comparative period as reported by the

Canadian Association of Drilling Contractors ("CAODC"). Revenue from

equipment rentals increased by 111% relating to higher utilization

and an increase in the rental fleet mainly from the acquisition of

Target completed in the second quarter of 2013.

-- OS division revenue increased 149% from the 2013 comparative period.

The acquisition of Frontline on April 1, 2013 and two private

oilfield service companies during the quarter accounted for the

significant increase. Frontline was able to complete large projects

that were delayed in the fourth quarter of 2013 due to unfavourable

weather while overall equipment in Frontline and rental asset

utilization from the current quarter asset acquisitions was strong

throughout the quarter contributing to the solid results.

-- Oil purchase and resale revenue in the PRD division increased 82%

from the 2013 comparative period. Increased pipeline capacity added

at the Judy Creek FST in the third quarter of 2013, a 4% increase in

crude oil prices, increased oil throughput at the Corporation's

pipeline connected FSTs, and increasing crude oil volumes shipped

via rail all contributed to the increase.

-- EBITDA INCREASES 43% TO $56.7 MILLION

-- For the period ended March 31, 2014, EBITDA increased 43% from the

2013 comparative period. The increase in EBITDA is attributable to

higher demand for services and the addition of new facilities in the

PRD division, the increase in revenue per operating day and rentals

revenue in the DS division, and the performance of the OS division

with the newly acquired assets from two acquisitions executed in the

quarter and the acquisition of Frontline in April of 2013.

-- 2014 CAPITAL BUDGET AND STRATEGIC AQUISITIONS

-- In December 2013, the Corporation announced the 2014 capital

expenditure budget of $225.0 million which includes $20.0 million of

carry over capital from 2013 projects related to the Kindersley,

Edson, and Keene FSTs. Total capital expenditures for the first

quarter totaled $66.7 million for both growth and expansion capital

and acquisitions. Growth and expansion capital expenditures totaled

$49.8 million for the period ended March 31, 2014 and included the

following:

-- Kindersley FST was completed and operational during the first

quarter;

-- Edson and Keene FST's are expected to be commissioned and

operational during the second quarter of 2014;

-- Rycroft Full Service Rail ("FSR") facility is the Corporation's

first heavy oil rail facility. The FSR facility will offer

treating, storage, disposal and transloading services. It is

expected the facility will be commissioned and operational in

the fourth quarter of 2014;

-- The Brazeau and Stanley SWDs are currently under construction to

convert to FSTs with the expectation the waste portion of the

facilities will be operational in the fourth quarter of 2014;

-- Construction of a new oil based mud blending plant in Fox Creek,

completion of the plant is anticipated in the third quarter of

2014; and

-- Various rental and long lead equipment for 2014 capital

projects.

-- During the quarter, Secure executed two strategic acquisitions

for a total of $29.2 million paid in cash and shares of the

Corporation. These acquisitions fall into the OS division with

assets that will grow the Corporation's integrated water

solutions service line and establish an onsite market presence

in the US. These two strategic acquisitions are a continuation

of the Corporation's strategy to add complementary services

along the energy services value chain. It will support and

expand the existing water solutions and environmental management

services of the Corporation's OS division, and allow the OS

division to expand into the US market.

-- SOLID BALANCE SHEET

-- Secure's debt to trailing twelve month EBITDA ratio was 1.55 as of

March 31, 2014 compared to 1.38 as of December 31, 2013.

-- As at March 31, 2014, the Corporation had $162.8 million available

under its credit facility.

-- Effective April 1, 2014, the Corporation's board of directors

approved a dividend increase of $0.05 per share to $0.20 per share

on an annualized basis.

-- SUBSEQUENT EVENTS

-- On April 1, 2014, Secure closed the acquisition of a mineral

products plant located in Alberta and closed the acquisition of an

environmental contracting business for total consideration of $15.7

million comprised of cash and shares. The mineral products plant

mainly processes barite which is a product used in drilling fluids.

The mineral products plant allows Secure to vertically integrate the

operations in the DS division to improve supply logistics and

quality. The environmental contracting business provides services

relating to spill cleanup, pond construction, and contaminated soil

excavation, stockpiling, treatment, transportation and disposal.

PRD DIVISION OPERATING HIGHLIGHTS

Three months ended Mar 31,

($000's) 2014 2013 % Change

----------------------------------------------------------------------------

Revenue

Processing, recovery and disposal services

(a) 63,302 44,354 43

Oil purchase and resale service 320,580 175,856 82

------------------------------

Total PRD division revenue 383,882 220,210 74

Operating Expenses

Processing, recovery and disposal services

(b) 23,735 14,781 61

Oil purchase and resale service 320,580 175,856 82

Depreciation, depletion, and amortization 13,739 9,017 52

------------------------------

Total operating expenses 358,054 199,654 79

General and administrative 6,767 4,959 36

------------------------------

Total PRD division expenses 364,821 204,613 78

Operating Margin (1) (a-b) 39,567 29,573 34

Operating Margin (1)as a % of revenue (a) 63% 67%

----------------------------------------------------------------------------

(1) Refer to "Non GAAP measures and operational definitions" and "Additional

GAAP measures" for further information

Highlights for the PRD division included:

-- Processing: For the three months ended March 31, 2014, processing

volumes increased 22% from the comparative period in 2013. The increase

in revenue is a result of an increase in overall demand for the PRD

division's services and the addition of new facilities and expansions at

current facilities subsequent to the first quarter of 2013 which

include: completion of the Rocky and Judy Creek FSTs in May 2013; Kaybob

SWD in August 2013; Stanley SWD in North Dakota in September 2013; Keene

SWD in North Dakota in November 2013; and the Kindersley FST in December

2013.

-- Recovery: Revenue from recovery for the three months ended March 31,

2014 increased by 27% from the comparative period in 2013. The increase

in recovery revenue for the three months ended March 31, 2014 is a

result of a 45% increase in throughput at Secure facilities, an increase

in the price of crude oil of 4% as compared to the first quarter of

2013.

-- Disposal: Secure's disposal volumes increased by 56% for the three

months ended March 31, 2014 from the comparative period of 2013. The

increase in volumes is related to increased demand and a portion of the

increase is due to the addition of the 13 Mile Landfill in North Dakota

in October 2013; and the Saddle Hills Landfill in November 2013.

-- Oil purchase/resale service: Revenue from oil purchase and resale

services increased 82% to $320.6 million from $175.9 million in the

comparative period of 2013. The increase in the period is due to

increased pipeline capacity added at the Judy Creek FST in the third

quarter of 2013, a 4% increase in crude oil prices, increased oil

throughput at the Corporation's pipeline connected FSTs, and increased

crude oil volumes shipped via rail. The revenue from this service line

will fluctuate monthly based on the factors described above.

-- Operating margin as a percentage of revenue for the three months ended

March 31, 2014 was 63% compared to 67% in the comparative period of

2013. The slightly lower operating margin is a direct result of the non-

recurring maintenance expenses incurred in the quarter of approximately

$1.4 million related to liner repairs at one of the Corporation's

landfills and the increase in trucking and commissioning costs

associated with facilities coming on- line.

-- General and administrative ("G&A") expenses increased 36% for the three

months ended March 31, 2014 to $6.8 million from $5.0 million in the

comparative period of 2013. Major drivers are an increase of 59% in

wages & salaries to support the opening of new facilities; organic

growth at existing facilities both in Canada and the US; and a 123%

increase in building and lease costs to accommodate growth of staff in

Canada and the US.

DS DIVISION OPERATING HIGHLIGHTS

Three months ended Mar 31,

($000's) 2014 2013 % Change

----------------------------------------------------------------------------

Revenue

Drilling services (a) 118,683 93,254 27

Operating expenses

Drilling services (b) 88,381 70,872 25

Depreciation and amortization 4,996 3,671 36

--------------------------------

Total DS division operating expenses 93,377 74,543 25

General and administrative 7,854 6,150 28

--------------------------------

Total DS division expenses 101,231 80,693 25

Operating Margin (1) (a-b) 30,302 22,382 35

Operating Margin % (1) 26% 24%

----------------------------------------------------------------------------

(1) Refer to "Non GAAP measures and operational definitions" and "Additional

GAAP measures" for further information

Highlights for the DS division included:

-- Revenue from the DS division for the three months ended March 31, 2014

increased 27% to $118.7 million from $93.3 million in the comparative

period of 2013. The increase in revenue for the three months ended March

31, 2014 is the result of a combined 22% increase in the drilling fluids

service line revenue and a 111% increase in revenue for the equipment

rentals service line from the comparative period in 2013.

-- The drilling fluids service line revenue will fluctuate each quarter

based on market share, meters drilled and the type of wells drilled

which in turn drives revenue per operating day. The DS division market

share in Canada was 31% for the quarter ended March 31, 2014 which was

unchanged from the 2013 comparative period. While the market share

remained unchanged, meters drilled per well by the DS division's

customers increased by 10% over the prior year comparative period. As

meters drilled per well increases, there are higher product usages,

increased probability of lost circulation events and a higher usage of

specialty chemicals. Additionally, the number of SAGD wells increased by

9% over the prior year comparative period. SAGD wells are more complex

and require more costly drilling fluids which contribute to the increase

in revenue per operating day. As a result of the increase in meters

drilled and SAGD wells, the revenue per operating day increased to

$7,253 for the three months ended March 31, 2014 from $5,815 in the

comparative period of 2013.

-- The equipment rentals service line revenue is driven by the size of the

available rental fleet, utilization, and rental rates in any given

quarter. The increase in the equipment rentals service line revenue for

the three months ended March 31, 2014 over the comparative period of

2013 is a direct result of the acquisition of Target on July 2, 2013

which significantly increased the rental asset base and contributed 48%

of the rentals revenue for the quarter. Additionally, overall rental

asset utilization increased over the comparative period of 2013.

-- For the three months ended March 31, 2014, operating margins increased

to 26% from 24% in the 2013 comparative period. Equipment rentals

contribute to higher operating margins. As equipment rentals contributed

significantly to the growth in revenues from the comparative period due

to the acquisition of Target and an increase in equipment utilization,

this has driven the 2% increase in operating margin.

-- G&A expense for the three months ended March 31, 2014 increased 28% to

$7.9 million from $6.2 million in the comparative period of 2013. As a

percentage of revenue for the three months ended March 31, 2014, G&A

expenses were 7% which remained consistent from the comparative period

of 2013.

OS DIVISION OPERATING HIGHLIGHTS

Three months ended Mar 31,

($000's) 2014 2013 % Change

----------------------------------------------------------------------------

Revenue

Onsite services (a) 23,647 9,514 149

Operating expenses

Onsite services (b) 17,129 7,511 128

Depreciation and amortization 1,885 205 820

--------------------------------

Total OS division operating expenses 19,014 7,716 146

General and administrative 1,763 1,105 60

--------------------------------

Total OS division expenses 20,777 8,821 136

Operating Margin (1) (a-b) 6,518 2,003 225

Operating Margin % (1) 28% 21%

----------------------------------------------------------------------------

(1) Refer to "Non GAAP measures and operational definitions" and "Additional

GAAP measures" for further information

Highlights for the OS division included:

-- Revenue for the three months ended March 31, 2014 increased 149% to

$23.6 million from $9.5 million in the comparative period of 2013. The

increase is a result of the acquisition of Frontline on April 1, 2013

and the two acquisitions executed in the quarter. Frontline, along with

the two acquisitions completed in the quarter, contributed to 97% of the

increase in revenue over the 2013 comparative period. The prior year

comparative figures include environmental services revenue and

integrated water solutions revenue. The environmental services and

integrated water solutions groups were previously included in other

divisions but were allocated into the OS division in conjunction with

the Frontline acquisition.

-- Frontline utilization for the three months ended March 31, 2014 was

higher than the fourth quarter of 2013 due to a few large projects that

began in the first quarter of 2014 that were previously delayed due to

unfavourable weather relating to pipeline integrity, a spill clean-up,

and reclamation work.

-- Integrated water solutions equipment utilization was strong for the two

months post acquisition with projects focused in the Northern WCSB. As

the drilling season was extended due to a late spring break-up, this

positively contributed to results for the quarter.

-- For the three months ended March 31, 2014, operating margins increased

to 28% from 21% in the 2013 comparative period. The operating margin for

the OS division is expected to fluctuate depending on the volume and

type of projects undertaken and the blend of business between

remediation and reclamation projects, demolition projects, pipeline

integrity projects, site clean-up, and other services in any given

period. The majority of the 7% increase in the quarter is a result of

the acquisitions executed in the quarter. The more significant

acquisition is a rentals based business which achieves higher margins

than the other service lines in the OS division.

-- G&A expenses for the three months ended March 31, 2014 increased to $1.8

million from $1.1 million in the comparative period of 2013. G&A

expenses increased due to the Frontline in 2013 and the two acquisitions

executed in the quarter. G&A is expected to fluctuate based on the

growth of the division.

OUTLOOK

Activity levels in the oil and gas industry were very robust in the first

quarter. Total meters drilled per well as reported by the CADOC was up 9% in the

first quarter from the previous year comparative period. Longer and deeper well

bores require specialized drilling fluids and result in increased drilling waste

and completion fluid waste per well which creates demand for the Corporation's

products and services and is a key driver that impacts the Corporation's

results. Horizontal wells comprised 74% of all wells drilled in the quarter

compared to 66% in the comparative year period, which is continuing to show a

long term upward trend.

Horizontal well licenses in the deep basin for the first quarter were up 15%

compared to the previous year period. The increase is another indicator that

there is a continued focus on deeper drilling activity which bodes well for

drilling fluids and waste disposal services and points to a strong second half

of 2014 as licenses convert into drilling and completion activity. Additionally,

spending levels by producers are anticipated to hold strong into the second half

of 2014 with a higher backlog of work entering spring break-up than has been

seen in the past few years.

The cold weather in March resulted in a later spring break-up providing

producers extra time to finish up winter drilling projects therefore, results

for the first quarter finished out stronger than anticipated. Spring break-up is

not expected to deviate substantially in length than the historical average

however, it is hard to predict with certainty given it is dependent on weather

trends that can be highly volatile. Depending on the length of spring break-up,

results in both the DS and OS divisions may be impacted if equipment cannot be

moved to site.

As heavy oil differentials continue to hold and pipeline projects are delayed,

crude transport by rail has positively impacted activity levels and continues to

provide an alternative method to transport production to maximize profits.

Secure has commenced construction of its first full service rail terminal in

Rycroft with commissioning anticipated in the fourth quarter of 2014. This is

another example of how Secure is continuing to meet and exceed the needs and

expectations of its customers and take advantage of these opportunities to

maximize shareholder returns.

Secure's recently completed acquisitions in the quarter add complimentary

components to the integrated water solutions service line. OS is now able to

deliver complete in field water management including fluids storage, pumping and

heating, providing source and engineered fluids and disposal at the

Corporation's FSTs.

Secure is committed to developing water recycling initiatives at its FSTs and

has commissioned its first pilot project to develop water recycling technology

at the Grande Prairie FST. By being able to recycle water, this ultimately

reduces the amount of disposal volumes which will increase the capacity of the

disposal wells. Secure is excited about the potential that exists in this

initiative, the ability to further recycle and reduce waste in the drilling

process, provide innovative solutions for its customers, and continue to

strengthen the value chain of services Secure is able to provide to its

customers.

FINANCIAL STATEMENTS AND MD&A

The condensed consolidated financial statements and MD&A of Secure for the three

and months ended March 31, 2014 are available immediately on Secure's website at

www.secure-energy.ca. The condensed consolidated financial statements and MD&A

will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking

statements" and/or "forward-looking information" within the meaning of

applicable securities laws (collectively referred to as forward-looking

statements). When used in this document, the words "may", "would", "could",

"will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and

similar expressions, as they relate to Secure, or its management, are intended

to identify forward-looking statements. Such statements reflect the current

views of Secure with respect to future events and operating performance and

speak only as of the date of this document. In particular, this document

contains forward-looking statements pertaining to: corporate strategy; goals;

general market conditions; the oil and natural gas industry; activity levels in

the oil and gas sector, including market fundamentals, drilling levels,

commodity prices for oil, natural gas liquids ("NGLs") and natural gas; the

increase in meters drilled for the first quarter of 2014; demand for the

Corporation's services; expansion strategy; the amounts of the PRD, DS and OS

divisions' proposed 2014 capital budgets and the intended use thereof; debt

service; capital expenditures; completion of facilities; the impact of new

facilities on the Corporation's financial and operational performance; use of

proceeds from the 2013 offering; future capital needs; access to capital;

acquisition strategy; capital spending on the new Kindersley, Edson, and Keene

FSTs, Rycroft FSR, conversion of Brazeau to an FST, and construction of the oil

based mud blending plant in Fox Creek; oil purchase and resale revenue; and the

impact of the OWL program.

Forward-looking statements concerning expected operating and economic conditions

are based upon prior year results as well as the assumption that increases in

market activity and growth will be consistent with industry activity in Canada,

United States, and internationally and growth levels in similar phases of

previous economic cycles. Forward-looking statements concerning the availability

of funding for future operations are based upon the assumption that the sources

of funding which the Corporation has relied upon in the past will continue to be

available to the Corporation on terms favorable to the Corporation and that

future economic and operating conditions will not limit the Corporation's access

to debt and equity markets. Forward-looking statements concerning the relative

future competitive position of the Corporation are based upon the assumption

that economic and operating conditions, including commodity prices, crude oil

and natural gas storage levels, interest rates, the regulatory framework

regarding oil and natural gas royalties, environmental regulatory matters, the

ability of the Corporation and its subsidiaries' to successfully market their

services and drilling and production activity in North America will lead to

sufficient demand for the Corporation's services and its subsidiaries' services

including demand for oilfield services for drilling and completion of oil and

natural gas wells, that the current business environment will remain

substantially unchanged, and that present and anticipated programs and expansion

plans of other organizations operating in the energy service industry will

result in increased demand for the Corporation's services and its subsidiary's

services. Forward-looking statements concerning the nature and timing of growth

are based on past factors affecting the growth of the Corporation, past sources

of growth and expectations relating to future economic and operating conditions.

Forward-looking statements in respect of the costs anticipated to be associated

with the acquisition and maintenance of equipment and property are based upon

assumptions that future acquisition and maintenance costs will not significantly

increase from past acquisition and maintenance costs.

Forward-looking statements involve significant risks and uncertainties, should

not be read as guarantees of future performance or results, and will not

necessarily be accurate indications of whether such results will be achieved.

Readers are cautioned not to place undue reliance on these statements as a

number of factors could cause actual results to differ materially from the

results discussed in these forward-looking statements, including but not limited

to those factors referred to and under the heading "Business Risks" and under

the heading "Risk Factors" in the Corporation's annual information form ("AIF")

for the year ended December 31, 2013. Although forward-looking statements

contained in this document are based upon what the Corporation believes are

reasonable assumptions, the Corporation cannot assure investors that actual

results will be consistent with these forward-looking statements. The

forward-looking statements in this document are expressly qualified by this

cautionary statement. Unless otherwise required by law, Secure does not intend,

or assume any obligation, to update these forward-looking statements.

Non GAAP Measures and Operational Definitions

1. The Corporation uses accounting principles that are generally accepted

in Canada (the issuer's "GAAP"), which includes, International Financial

Reporting Standards ("IFRS"). These financial measures are Non-GAAP

financial measures and do not have any standardized meaning prescribed

by IFRS. These non-GAAP measures used by the Corporation may not be

comparable to a similar measures presented by other reporting issuers.

See the management's discussion and analysis available at www.sedar.com

for a reconciliation of the Non-GAAP financial measures and operational

definitions. These non-GAAP financial measures and operational

definitions are included because management uses the information to

analyze operating performance, leverage and liquidity. Therefore, these

non-GAAP financial measures and operational definitions should not be

considered in isolation or as a substitute for measures of performance

prepared in accordance with GAAP.

ABOUT SECURE ENERGY SERVICES INC.

Secure is a TSX publicly traded energy services company that provides safe and

environmentally responsible fluids and solids solutions to the oil and gas

industry. The Corporation owns and operates midstream infrastructure and

provides environmental services and innovative products to upstream oil and

natural gas companies operating in the Western Canadian Sedimentary Basin

("WCSB") and the Rocky Mountain Region in the United States. The Corporation

operates three divisions:

Processing, Recovery and Disposal Division: Operating under the name Secure

Energy Services Inc., the Processing, Recovery and Disposal Services division

owns and operates midstream infrastructure that provides processing, storing,

shipping and marketing of crude oil, oilfield waste disposal and recycling.

Specifically these services are clean oil terminalling, custom treating of crude

oil, crude oil marketing, produced and waste water disposal, oilfield waste

processing, landfill disposal, and oil purchase/resale service. Secure currently

operates a network of facilities throughout western Canada and in North Dakota,

providing these services at its full service terminals ("FST"), landfills and

stand-alone water disposal facilities ("SWD").

Drilling Services Division: Operating under the name Marquis Alliance Energy

Group Inc. (together with its wholly owned subsidiaries "Marquis Alliance"), the

trade name XL Fluid Systems ("XL Fluids"), and the name Target Rentals Ltd.

("Target"), the DS division provides equipment and chemicals for building,

maintaining, processing and recycling of drilling and completion fluids. The

drilling fluids service line comprises the majority of the revenue for the

division which includes the design and implementation of drilling fluid systems

for producers drilling for oil, bitumen and natural gas. The DS division focuses

on providing products and systems that are designed for more complex wells, such

as medium to deep wells, horizontal wells and horizontal wells drilled into the

oil sands.

OnSite Division: The OnSite division, operating under the name of Frontline,

offers environmental services which include pre-drilling assessment planning,

drilling waste management, remediation and reclamation of former wellsites,

facilities, commercial, and industrial properties, and laboratory services;

integrated water solutions which include water management, recycling, pumping

and storage solutions; "CleanSite" waste container services; pipeline integrity

(inspection, excavation, repair, replacement and rehabilitation); demolition and

decommissioning. These services are offered throughout the WCSB.

FOR FURTHER INFORMATION PLEASE CONTACT:

Secure Energy Services Inc.

Rene Amirault

Chairman, President and Chief Executive Officer

(403) 984-6100

(403) 984-6101 (FAX)

Secure Energy Services Inc.

Allen Gransch

Chief Financial Officer

(403) 984-6100

(403) 984-6101 (FAX)

www.secure-energy.ca

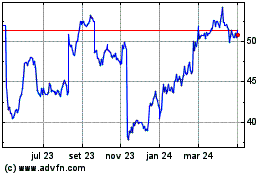

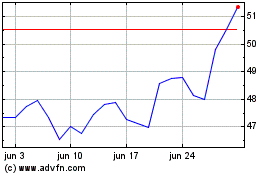

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024