Forsys Announces Third Quarter 2011 Operational Results and Outlook

14 Novembro 2011 - 10:30AM

Marketwired

Forsys Metals Corp. ("Forsys" or the "Company")

(TSX:FSY)(FRANKFURT:F2T)(NSX:FSY) announced today the release of

its unaudited consolidated financial and operating results for the

three months and nine months ended September 30, 2011, together

with its Management's Discussion and Analysis ("MD&A") for the

corresponding period. These documents are posted on the Company's

profile on SEDAR at www.sedar.com and on the Company's website at

www.forsysmetals.com.

Marcel Hilmer, Chief Executive Officer, commented, "Our third

quarter was among our most active for the group with an emphasis on

developing our Namibplaas Uranium Project in Namibia. During the

third quarter, we released the initial Namibplaas National

Instrument 43-101 ("NI 43-101") technical report summarizing the

results of the phase one drilling program and have now commenced a

$2.5 million phase two drilling program. We also entered into an

agreement to acquire the remaining 30% of Namibplaas. This

acquisition is a significant step towards the consolidation of

production from Namibplaas with production from our 100% owned

fully licensed Valencia uranium deposit in Namibia. The

announcement of an additional financing of up to $10 million will

enable us to focus on advancing our Namibian uranium assets and

complete a new feasibility study before the end of 2012".

As at September 30, 2011, the Company had working capital of

$4,979,588.

Highlights from the MD&A include:

-- On September 15, 2011 the Company reported the results of its initial NI

43-101 Resource Statement for its 70% owned Namibplaas Uranium Project

("Namibplaas"). An inferred ore resource of 88 million tonnes containing

25 million pounds of U3O8 at a 100 ppm cut-off grade was reported. The

Company confirmed that the mineralization type is similar to that found

at the Valencia Uranium Project ("Valencia") and that there were a

number of significant high-grade zones.

-- Forsys announced that it was acquiring the remaining 30% interest in

Namibplaas on October 24, 2011. With this acquisition the Company will

be able to benefit fully from the advanced exploration program at

Namibplaas and have full control over the assessment of the

consolidation with the already 100% owned Valencia. Consideration for

this acquisition is 13,000,000 new common shares and 2,000,000 common

share purchase warrants of the Company, exercisable for two years at

$1.10.

-- In October 2011, the Phase two drilling program at Namibplaas commenced,

consisting of an additional 40,000 metres of percussion drilling in

approximately 200 holes. The objective of this in-fill drilling program

is to bring the drill spacing to 40 by 40 metres and allow for

completion of an updated NI 43-101 Resource Statement by the third

quarter of 2012.

-- On October 5 the Company announced that it had entered into a

subscription agreement with Leo Fund Managers Limited ("Leo") whereby

Leo will invest $8,000,000, on a private placement basis for additional

shares of the Company. Completion of the transaction is subject to

approval of the Company's shareholders at a Special Meeting of

Shareholders which has been scheduled for November 18, 2011. The share

subscription will form part of a larger private placement of new shares

by the Company for gross proceeds of up to a maximum amount of

C$10,000,000.

-- Following on from the August 2011 Mintek report on heap leach testing of

Valencia ore, the Company has now commenced the phase two optimization

testing. Ore samples have been shipped to Mintek in South Africa and the

Company remains confident of achieving improved recoveries in the

optimization phase studies that are focusing on larger samples and

improved processes. Simulus, a leading Perth based engineering group,

continue to manage this process.

-- The internal study on potential plant design efficiencies, improved

recoveries and reduced capital and operating costs continues. This

review also includes the economics of consolidating the Valencia and

Namibplaas ore bodies and increasing the plant size and throughput.

Company Outlook

The Phase two drilling program at Namibplaas commenced in

October 2011 with the objective of completing an additional 40,000

metres of percussion drilling and bringing the drill hole spacing

to 40 by 40 metres to allow for preparation of an updated NI 43-101

technical report in the third quarter of 2012. Forsys expects to

complete the acquisition of the remaining 30% interest in

Namibplaas in Q4, 2011.

The optimization phase of the heap leach testing on the Valencia

ore body continues. The Company is also focused on advancing the

design of a consolidated Valencia and Namibplaas uranium projects

with an annual plant capacity of approximately 6.0 Mlbs of U3O8

from the two deposits. Preliminary pit designs and mining schedules

are expected to confirm the potential of a consolidated

operation.

The Company is targeting to complete an updated feasibility

report before the end of 2012.

Uranium Price Outlook

The long-term contract price for uranium is reported on a

monthly basis by Ux Consulting. It was US$62.00/lb at December 31,

2010 and had moved up to US$73.00/lb at the end of January 2011. At

the end of October 2011, the monthly quote for the long-term

contract price for uranium was US$63.00/lb.

About Forsys Metals Corp.

Forsys Metals Corp. is an emerging uranium producer with 100%

ownership in the fully permitted Valencia Uranium Project and

currently 70% ownership in the Namibplaas Uranium Project in

Namibia, Africa a politically stable and mining friendly

jurisdiction. Current NI 43-101 compliant resource and reserves at

Valencia and Namibplaas Uranium Project's are available on our

Website.

On behalf of the Board of Directors of Forsys Metals Corp.

Marcel Hilmer, Chief Executive Officer

Sedar Profile #00008536 (11-12)

Forward-Looking Information

This news release contains projections and forward-looking

information that involve various risks and uncertainties regarding

future events. Such forward-looking information can include without

limitation statements based on current expectations involving a

number of risks and uncertainties and are not guarantees of future

performance of the Company. The following are important factors

that could cause Forsys actual results to differ materially from

those expressed or implied by such forward looking statements:

fluctuations in uranium prices and currency exchange rates;

uncertainties relating to interpretation of drill results and the

geology; continuity and grade of mineral deposits; uncertainty of

estimates of capital and operating costs; recovery rates,

production estimates and estimated economic return; general market

conditions; the uncertainty of future profitability; and the

uncertainty of access to additional capital. Full description of

these risks can be found in Forsys Annual Information Form, dated

March 29, 2011, available on the Company's profile on the SEDAR

website at www.sedar.com. These risks and uncertainties could cause

actual results and the Company's plans and objectives to differ

materially from those expressed in the forward looking information.

Actual results and future events could differ materially from

anticipated in such information. These and all subsequent written

and oral forward looking information are based on estimates and

opinions of management on the dates they are made and expressed

qualified in their entirety by this notice. The Company assumes no

obligation to update forward looking information should

circumstances or management's estimates or opinions change.

Shares Outstanding: 80,130,231

The Toronto Stock Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Contacts: Forsys Metals Corp. Marcel Hilmer Chief Executive

Officer +61 417 177 942mhilmer@forsysmetals.comwww.forsysmetals.com

TMX Equicom Nisha Hasan +1 416-815-0700 ext.

258-258-9721nhasan@equicomgroup.com

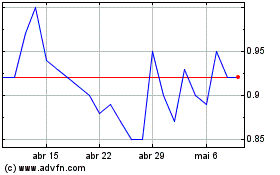

Forsys Metals (TSX:FSY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

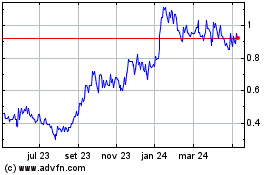

Forsys Metals (TSX:FSY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024