Bemis Company, Inc. (NYSE: BMS) announced today that definitive

proxy materials have been filed with the U.S. Securities and

Exchange Commission (“SEC”) in connection with the Company’s

pending merger with Amcor Limited (ASX: AMC). The definitive proxy

statement is available on the Investor Relations section of Bemis’

website, as well as www.sec.gov, and will be sent to all Bemis

shareholders entitled to vote at the Bemis Special Meeting of

Shareholders.

As previously announced, Bemis’ Special Meeting is scheduled to

take place on May 2, 2019 at 10:00 a.m. Eastern Time (9:00 a.m.

Central Time) at The Langham, Chicago, 330 North Wabash Avenue,

Chicago, Illinois 60611. All shareholders of record of Bemis’

common stock as of the close of business on March 20, 2019 will be

entitled to vote their shares either in person or by proxy at the

Special Meeting. As previously announced, the expected completion

date of the transaction is May 15, 2019.

“The Bemis Board unanimously supports our pending combination

with Amcor and believes it maximizes value for our stakeholders,”

said Bemis’ President and CEO, William F. Austen. “Together, Bemis

and Amcor will create the global leader in consumer packaging with

the footprint, scale, talent, and capabilities to offer customers

the most compelling value proposition in the packaging industry.

Bemis shareholders will have the opportunity to benefit from the

increased dividend, which nearly doubles from Bemis’ current

dividend, and the value creation driven from not only the $180

million of cost synergies identified as part of the transaction but

also additional potential revenue synergies from cross-selling

opportunities. Our employees will benefit as part of a larger, more

diversified organization, and I have every confidence that they

will carry forward the Bemis legacy of innovation, respect, ethics,

and accountability. This is the next exciting chapter for Bemis,

and we look forward to creating value for our stakeholders through

this combination.”

The Bemis Board of Directors unanimously recommends that

shareholders vote “FOR” the merger proposal as well as all other

Bemis proposals.

Bemis shareholders who need assistance in completing the proxy

card, need additional copies of the proxy materials, or have

questions regarding the Bemis Special Meeting may contact Bemis’

proxy solicitors:

Innisfree M&A IncorporatedPhone:

(888) 750-5834 (from the U.S. and Canada)Banks &

Brokers: (212) 750-5833

ABOUT BEMIS COMPANY, INC.

Bemis Company, Inc. (“Bemis” or the “Company”) is a supplier of

flexible and rigid plastic packaging used by leading food, consumer

products, healthcare, and other companies worldwide. Founded in

1858, Bemis reported 2018 net sales of approximately $4.1 billion.

Bemis has a strong technical base in polymer chemistry, film

extrusion, coating and laminating, printing, and converting.

Headquartered in Neenah, Wisconsin, Bemis employs approximately

16,000 individuals worldwide. More information about Bemis is

available at our website, www.bemis.com.

LEGAL DISCLOSURES

Cautionary Statement Regarding Forward-Looking

StatementsThis communication contains certain statements that

are “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended.

Amcor Limited (“Amcor”), its subsidiary Amcor plc (f/k/a Arctic

Jersey Limited) (“New Amcor”) and Bemis have identified some of

these forward-looking statements with words like “believe,” “may,”

“could,” “would,” “might,” “possible,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook”

or “continue,” the negative of these words, other terms of similar

meaning or the use of future dates. Forward-looking statements in

this communication include, without limitation, statements about

the anticipated benefits of the contemplated transactions,

including future financial and operating results and expected

synergies and cost savings related to the contemplated

transactions, the plans, objectives, expectations and intentions of

Amcor, New Amcor or Bemis and the expected timing of the completion

of the contemplated transactions. Such statements are based on the

current expectations of the management of Amcor or Bemis, as

applicable, are qualified by the inherent risks and uncertainties

surrounding future expectations generally, and actual results could

differ materially from those currently anticipated due to a number

of risks and uncertainties. None of Amcor, New Amcor or Bemis, or

any of their respective directors, executive officers or advisors,

provide any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statements will actually occur. Risks and

uncertainties that could cause results to differ from expectations

include, but are not limited to: uncertainties as to the timing of

the contemplated transactions; uncertainties as to the approval of

the transactions by Bemis’s and Amcor’s shareholders, as required

in connection with the contemplated transactions; the possibility

that a competing proposal will be made; the possibility that the

closing conditions to the contemplated transactions may not be

satisfied or waived, including that a governmental entity may

prohibit, delay or refuse to grant a necessary approval; the

effects of disruption caused by the announcement of the

contemplated transactions or the performance of the parties’

obligations under the transaction agreement making it more

difficult to maintain relationships with employees, customers,

vendors and other business partners; the risk that shareholder

litigation in connection with the contemplated transactions may

affect the timing or occurrence of the contemplated transactions or

result in significant costs of defense, indemnification and

liability; uncertainties as to the availability and terms of

refinancing for the existing indebtedness of Amcor or Bemis in

connection with the contemplated transactions; uncertainties as to

whether and when New Amcor may be listed in the US S&P 500

index and the S&P / ASX 200 index; uncertainties as to whether,

when and in what amounts future dividend payments may be made by

Amcor, Bemis or New Amcor; other business effects, including the

effects of industry, economic or political conditions outside of

the control of the parties to the contemplated transactions;

transaction costs; actual or contingent liabilities; disruptions to

the financial or capital markets; other risks and uncertainties

discussed in Amcor’s disclosures to the Australian Securities

Exchange (“ASX”), including the “2018 Principal Risks” section of

Amcor’s Annual Report 2018; and other risks and uncertainties

discussed in Bemis’s filings with the SEC, including the “Risk

Factors” section of Bemis’s annual report on Form 10-K for the

fiscal year ended December 31, 2018. You can obtain copies of

Amcor’s disclosures to the ASX for free at ASX’s website

(www.asx.com.au). You can obtain copies of Bemis’s filings with the

SEC for free at the SEC’s website (www.sec.gov). Forward-looking

statements included herein are made only as of the date hereof and

none of Amcor, New Amcor or Bemis undertakes any obligation to

update any forward-looking statements, or any other information in

this communication, as a result of new information, future

developments or otherwise, or to correct any inaccuracies or

omissions in them which become apparent, except as expressly

required by law. All forward-looking statements in this

communication are qualified in their entirety by this cautionary

statement.

No Offer or SolicitationThis communication is not

intended to and does not constitute an offer to sell or the

solicitation of an offer to subscribe for or buy or an invitation

to purchase or subscribe for any securities or the solicitation of

any vote or approval in any jurisdiction, nor shall there be any

sale, issuance or transfer of securities in any jurisdiction in

contravention of applicable law. No offer of securities will be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act.

Important InformationIn connection with the contemplated

transactions, New Amcor has filed an effective Registration

Statement on Form S-4 (S-4) with the SEC that includes the joint

proxy statement of Bemis and prospectus of New Amcor. The joint

proxy statement/prospectus will also be sent or given to Bemis

shareholders and will contain important information about the

contemplated transactions. Shareholders are urged to read the joint

proxy statement/prospectus and other relevant documents filed or to

be filed with the SEC carefully when they become available because

they will contain important information about Bemis, Amcor, New

Amcor, the contemplated transactions and related matters. Investors

and shareholders may obtain free copies of the joint proxy

statement/prospectus and other documents filed with the SEC by

Bemis, Amcor and New Amcor through the SEC’s website

(www.sec.gov).

Bemis shareholders should carefully read the joint proxy

statement/prospectus, and any other relevant documents filed by New

Amcor or Bemis before making any voting or investment decision.

Participants in the SolicitationBemis, Amcor, New Amcor

and their respective directors and executive officers may be deemed

to be participants in the solicitation of proxies from Bemis

shareholders in connection with the contemplated transactions.

Information about Bemis’s directors and executive officers is set

forth in its annual report on Form 10-K for the fiscal year ended

December 31, 2018, including Amendment No. 1 thereto, which may be

obtained for free at the SEC’s website (www.sec.gov). Information

about Amcor’s directors and executive officers is set forth in its

Annual Report 2018, which may be obtained for free at ASX’s website

(www.asx.com.au). Additional information regarding the interests of

participants in the solicitation of proxies in connection with the

contemplated transactions is included in the joint proxy

statement/prospectus that Bemis has filed with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190327005790/en/

InvestorsBemis Company Inc.Erin M. Winters, Director of

Investor Relations920-527-5288

Innisfree M&A IncorporatedArthur Crozier/Larry

Miller212-750-5833

MediaJoele Frank, Wilkinson Brimmer KatcherMatthew

Sherman / Sharon Stern212-355-4449

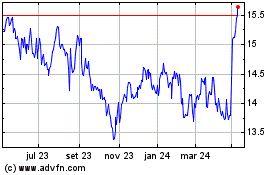

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

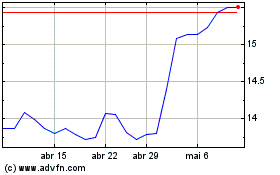

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025