Citi Securities Services and Taskize Partner to Streamline Counterparty Operational Workflow

24 Novembro 2021 - 6:00AM

Business Wire

Citi (NYSE:C) and Taskize Limited announced today that they have

entered into a strategic agreement where Citi Securities Services’

custody clients can leverage Taskize’s query management platform to

directly connect to their Citi Operations counterparts.

This collaboration brings together Taskize’s structured workflow

capabilities and Citi’s industry-leading proprietary custody

network spanning over 60 markets to create a network effect between

Citi, its counterparts and various market infrastructures to

address operational workflow challenges.

“This partnership is based on a shared vision of secure

inter-company workflows for query management and to move away from

email chains between operational counterparts," said Jeffrey King,

Global Head of Custody Product Development at Citi. “By leveraging

Taskize’s email management, flexible API integration and

traceability on queries with fully auditable workflow, our custody

clients will be able to gain greater insight into the status of

their queries.”

Taskize’s user interface provides Citi’s custody clients with a

direct means to contact their operational counterparts, replacing

the traditional email mechanism, and provides real-time visibility

on current query status and full audit trail capabilities. By

creating an end-to-end operational workflow experience with

counterparties, Citi custody clients can benefit from an

accelerated and enhanced counterparty resolution experience.

“We are delighted to be partnering with Citi, empowering them to

service their clients in a secure, efficient and transparent way,”

said Philip Slavin, CEO and co-founder of Taskize. “This is another

great example of Citi and Taskize embracing the industry’s drive to

greater efficiency and control through best-of-breed partnering and

inter-operability.”

This agreement further illustrates Citi’s commitment to

delivering innovative solutions to clients while mitigating risk.

The Taskize platform streamlines costly counterparty workflows

across buy-sides, sell-sides, custodians, market infrastructures

and Fintech providers, without risking data sovereignty. Citi’s

custody clients will not only have access to the Taskize network,

but also the ability to raise queries to all other institutions

currently operating on the platform.

About Citi With approximately $30 trillion1 of assets

under custody and administration and the industry-leading

proprietary network spanning over 60 markets, Citi Securities

Services provides clients with extensive on-the ground local market

expertise, innovative post-trade technologies, customized data

solutions and a wide range of custody and fund services that can be

tailored to meet clients’ needs.

Citi has approximately 200 million customer accounts and does

business in more than 160 countries and jurisdictions. Citi

provides consumers, corporations, governments and institutions with

a broad range of financial products and services, including

consumer banking and credit, corporate and investment banking,

securities brokerage, transaction services, and wealth

management.

Additional information may be found at http://www.citigroup.com

| Twitter: @Citi | YouTube: http://www.youtube.com/citi | Blog:

http://blog.citigroup.com | Facebook: http://www.facebook.com/citi

| LinkedIn: www.linkedin.com/company/citi.

About Taskize Taskize is trusted by over 360 financial

firms in 53 countries making it the leading provider of structured

inter-company workflow to the Financial Services Industry to

improve operational efficiency across buy-sides, sell-sides,

custodians, market infrastructures and Fintech providers. Founded

by industry veterans, Taskize eliminates the inefficiency and

insecurity of email, phone, and chat to provide everything needed

to resolve back-office cross-party issues securely and efficiently.

Taskize is cloud-native, with an open architecture leading to easy

adoption and benefit realization. Taskize is owned by Euroclear, a

leading global provider of Financial Market Infrastructure

services. Follow @Taskize on LinkedIn or visit www.taskize.com.

___________________ 1] As of Q3 2021.AUC/A figure separately

represents gross assets for which Citi provides Global Custody and

sub-custodian services via its Direct Custody and Clearing business

and includes Issuer Services. Citi previously reported AUC/A

numbers on a net basis, therefore discounting assets serviced by

both businesses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211124005672/en/

Media Citi: Rekha Jogia-Soni – Rekha.Jogniasoni@citi.com

Taskize: Simon McDowell – Simon.Mcdowell@taskize.com

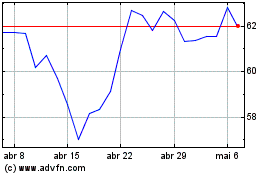

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

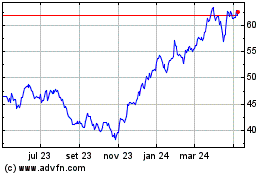

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024