BHP Group (NYSE:BHP) – Anglo American has

rejected BHP’s acquisition proposal of $38.88 billion, stating it

significantly undervalues the company and its future prospects. The

offer of £25.08 per share represented a 31% premium, but Anglo

considered it opportunistic. BHP may need to increase its offer by

May 22 for a successful deal.

Toyota Motor (NYSE:TM) – Toyota announced a

$1.4 billion investment in its Princeton, Indiana facilities to

assemble a three-row electric SUV, bringing the total investment to

$8 billion and adding 340 jobs. The plant will also house a new

lithium-ion battery assembly line.

Amazon (NASDAQ:AMZN) – Key Amazon executives,

including Jeff Bezos and Andy Jassy, reportedly destroyed text

messages via Signal, hampering the FTC’s antitrust investigation.

The lawsuit claims this action hindered the analysis of the

company’s business conduct. The FTC is seeking information on

executive communications and their message retention

instructions.

Rubrik (NYSE:RBRK) – Rubrik’s shares closed up

16%, ending the day at $37 per share, on their New York Stock

Exchange debut on Thursday, valuing the cybersecurity company,

backed by Microsoft, at $5.6 billion. Rubrik raised $752 million in

the IPO. The startup joins others in robust IPOs, driven by hope

for a stable economy.

Reddit (NYSE:RDDT) – Reddit reported on

Thursday a successful fix of an issue that caused a platform outage

for over half an hour. The glitch affected nearly 70,000 users in

the US, as well as users in other countries like the UK and

India.

Warner Bros Discovery (NASDAQ:WBD) – Warner

Bros Discovery is launching Olli, a data platform to optimize ad

targeting on cable and digital channels. The data-driven video

service aims to reach specific demographics, with trials planned by

the Interpublic Group of Companies in the third quarter of this

year.

T-Mobile (NASDAQ:TMUS) – The U.S. Federal

Communications Commission (FCC) announced on Thursday the approval

of the acquisition deal of Ka’ena Corp by T-Mobile US, valued at up

to $1.35 billion. This deal aims to facilitate the transition of

customers and is scheduled to be completed on May 1st.

Additionally, T-Mobile plans to invest approximately $950 million

in a joint venture with the Swedish investment fund EQT to acquire

the fiber network provider Lumos. T-Mobile will invest another $500

million to expand coverage to 3.5 million homes by 2028.

Citigroup (NYSE:C) – About 30 years ago,

Citigroup executives, including Donald Mackenzie, Steven Koltes,

and Rolly van Rappard, left to found CVC Capital

Partners (EU:CVC). Their IPO this week made them big

winners, with a fortune of about $4.4 billion, highlighting the

successful trajectory of the private equity firm.

BlackRock (NYSE:BLK) – BlackRock is adjusting

its wealth management client relationship approach in the U.S.,

moving a seasoned executive to cultivate ties, particularly in

Texas, where it faced environmental criticisms. Michael Lane will

lead this effort, aiming to strengthen connections and ease

tensions as the company seeks to expand its presence.

CME Group (NASDAQ:CME) – BGC Group, in

partnership with major Wall Street banks and traders, challenges

the leadership of CME Group. Investing in FMX, valued at $667

million, the platform offers trading in Treasury securities and

currencies, aiming to compete with CME.

Cigna (NYSE:CI) – Cigna plans to offer

biosimilars of the drug Humira, including high and low

concentration versions, through its Accredo pharmacy, providing an

affordable alternative for eligible patients in the U.S. starting

in June. These biosimilars will have a direct cost reduced to zero,

offering an average savings of $3,500 per year for patients.

GSK (NYSE:GSK), Pfizer

(NYSE:PFE), BioNTech (NASDAQ:BNTX) – GSK sued

Pfizer and BioNTech for patent infringement related to mRNA in

their successful Covid-19 vaccines. Pfizer and BioNTech deny the

allegations, promising a vigorous defense. The litigation adds to

previous disputes over patent royalties between the pharmaceutical

companies in the U.S.

Altria Group (NYSE:MO) – Altria is pressing the

U.S. FDA to combat illegal vaping products, competing with its

NJOY. CEO Billy Gifford argues that the FDA’s approach is

insufficient, considering the proliferation of unauthorized

e-cigarettes, seen as a public health threat.

Walmart (NYSE:WMT) – Rob Walton, the

longest-serving member of Walmart’s board, will retire on June 5th.

During his tenure as chairman, sales increased from $44 billion to

$648.1 billion. Walmart has named Brian Niccol to replace him on

the board. Rob Walton owns 0.09% of the shares, valued at about

$420 million.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

instructed employees to avoid ordering chicken in their meals due

to excessive demand, but now allows them to do so freely again

after a week-long restriction. CEO Brian Niccol stated that the

chicken supply crisis has been overcome. The previous policy caused

controversy among workers.

United Parcel Service (NYSE:UPS),

FedEx (NYSE:FDX) – UPS and FedEx face challenges

in acquiring electric vans in the U.S., crucial for reducing

emissions and meeting climate goals. Battery shortages and the

bankruptcy of manufacturers complicate the transition. Although

California has suspended rules requiring exclusive use of electric

vehicles, the challenge persists.

Boeing (NYSE:BA) – Boeing’s credit rating faced

new pressure this week, with S&P nearly downgrading it to junk

on Thursday. The agency changed its outlook from “stable” to

“negative”, highlighting potential delays in cash flow recovery and

leadership uncertainties.

Tesla (NASDAQ:TSLA) – Elon Musk is opting to

use existing models for more affordable vehicles instead of

creating new ones, indicating a more conventional automotive

future. The change follows plans filed for a new affordable model.

Additionally, according to an SEC document, Drew Baglino, a former

Tesla executive, sold approximately $181.5 million in company

shares. Baglino, a Tesla veteran since 2006 and former senior vice

president, left amid a plan to lay off 10% of the global workforce.

He sold 1.1 million shares.

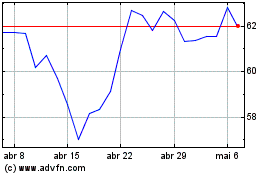

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

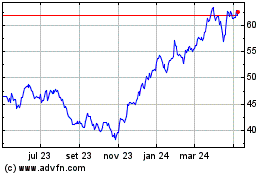

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024