- Record quarterly revenue exceeds quarterly guidance range

- First quarter revenue of $102.4 million, up 5%

quarter-over-quarter

- First quarter revenue Net Retention Rate (LTM) of 115%

Fastly, Inc. (NYSE: FSLY), the world’s fastest global edge cloud

network provider, today announced financial results for its first

quarter ended March 31, 2022.

“We are pleased to kick off 2022 with strong revenue growth that

exceeded guidance and a record-breaking quarter for Fastly as we

passed the $100M milestone for the first time,” said Joshua Bixby,

CEO of Fastly.

“The first quarter also brought strong analyst and customer

validation for our product portfolio. These accolades showcase our

customers' ongoing satisfaction and usage of Fastly’s products as

we accelerate the delivery of our product roadmap,” continued

Bixby. “We look forward to sharing further details on our

differentiation, product roadmap, customer acquisition, and

financial growth strategy at our Investor Day on May 12.”

Fastly today separately announced that the Board has initiated a

search to identify the next CEO to lead the company through its

next phase of growth. Once a successor is appointed, current CEO

Joshua Bixby will step down as CEO and from the Fastly Board of

Directors.

Three months ended

March 31,

2022

2021

Revenue

$

102,382

$

84,852

Gross Margin GAAP gross margin

47.3

%

55.8

%

Non-GAAP gross margin

52.6

%

60.1

%

Operating loss GAAP operating loss

$

(63,004

)

$

(49,963

)

Non-GAAP operating loss

$

(17,740

)

$

(12,905

)

Net loss per share GAAP net loss per common share—basic and

diluted

$

(0.54

)

$

(0.44

)

Non-GAAP net loss per common share—basic and diluted

$

(0.15

)

$

(0.12

)

First Quarter 2022 Financial Summary

- Total revenue of $102.4 million, representing 5% sequential

growth and 21% year-over-year growth.

- GAAP gross margin of 47.3%, compared to 55.8% in the first

quarter of 2021. Non-GAAP gross margin of 52.6%, compared to 60.1%

in the first quarter of 2021.

- GAAP net loss of $64.3 million, compared to $50.7 million in

the first quarter of 2021. Non-GAAP net loss of $18.0 million,

compared to $13.6 million in the first quarter of 2021.

- GAAP net loss per basic and diluted shares of $0.54 compared to

$0.44 in the first quarter of 2021. Non-GAAP net loss per basic and

diluted shares of $0.15, compared to $0.12 in the first quarter of

2021.

Key Metrics

- Trailing 12 month net retention rate (NRR LTM)1 decreased to

115% in the first quarter from 118% in the fourth quarter

2021.

- Dollar-Based Net Expansion Rate (DBNER)2 decreased to 118% in

the first quarter from 121% in the fourth quarter 2021.

- Total customer count of 2,880 in the first quarter, of which

457 were enterprise3 customers.

- Average enterprise customer spend of $722K in the first

quarter, up 3% quarter-over-quarter.

For a reconciliation of non-GAAP financial measures to their

corresponding GAAP measures, please refer to the reconciliation

table at the end of this press release.

Recent Business Highlights

- Recognized as the only vendor named as Gartner Peer Insights

Customers’ Choice for web application and API protection for four

consecutive years.

- Acquired Fanout to unlock real-time app development at the edge

with reduced time-to-market, reduced friction, and unprecedented

scale.

- Recognized as a leader by IDC MarketScape in the Worldwide

Commercial CDN 2022 Vendor Assessment.

- Launched a new Observability dashboard that brings end-to-end

security, delivery, application and performance metrics into a

unified view.

- Accelerated edge adoption with a new Compute@Edge Partner

Ecosystem, designed to help customers build a variety of edge

computing use cases utilizing major cloud service provider

integrations.

Second Quarter and Full Year 2022 Guidance: Q2

2022 Full Year 2022 Total Revenue (millions)

$99.0 - $102.0 $405.0 - $415.0

Non-GAAP Operating Loss

(millions) ($21.5) - ($18.5) ($70.0) - ($60.0)

Non-GAAP Net

Loss per share (4)(5) ($0.18) - ($0.15) ($0.60) - ($0.50)

Conference Call Information

Fastly will host an investor conference call to discuss its

results at 2:00 p.m. PT / 5:00 p.m. ET on Wednesday, May 4,

2022.

Date:

Wednesday, May 4, 2022

Time:

2:00 p.m. PT / 5:00 p.m. ET

Webcast:

https://investors.fastly.com

Dial-in:

888-330-2022 (US/CA) or 646-960-0690

(Intl.)

Conf. ID#:

7543239

Please dial in at least 10 minutes prior to the 2:00 p.m. PT

start time. A live webcast of the call will be available at

https://investors.fastly.com where listeners may log on to the

event by selecting the webcast link under the “Quarterly Results”

section.

A telephone replay of the conference call will be available at

approximately 5:00 p.m. PT, May 4 through May 18, 2022 by dialing

800-770-2030 or 647-362-9199 and entering the passcode 7543239.

About Fastly

Fastly is upgrading the internet experience to give people and

organizations more control, faster content, and more dynamic

applications. By combining the world’s fastest global edge cloud

network with powerful software, Fastly helps customers develop,

deliver, and secure modern distributed applications and compelling

digital experiences. Fastly’s customers include many of the world’s

most prominent companies, including Pinterest, The New York Times,

and GitHub. For more information on our mission and products, visit

https://www.fastly.com/.

Forward-Looking Statements

This press release contains “forward-looking” statements that

are based on our beliefs and assumptions and on information

currently available to us on the date of this press release.

Forward-looking statements may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from those

expressed or implied by the forward-looking statements. These

statements include, but are not limited to, statements regarding

our future financial and operating performance, including our

outlook and guidance, the demand for our platform, and our ability

to deliver on our long-term strategy. Except as required by law, we

assume no obligation to update these forward-looking statements

publicly or to update the reasons actual results could differ

materially from those anticipated in the forward-looking

statements, even if new information becomes available in the

future. Important factors that could cause our actual results to

differ materially are detailed from time to time in the reports

Fastly files with the Securities and Exchange Commission (“SEC”),

including in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2021. Additional information will also be set

forth in our Quarterly Report on Form 10-Q for the fiscal quarter

ended March 31, 2022. Copies of reports filed with the SEC are

posted on Fastly’s website and are available from Fastly without

charge.

Use of Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with accounting

principles generally accepted in the United States ("GAAP"), the

Company uses the following non-GAAP measures of financial

performance: non-GAAP gross profit, non-GAAP gross margin, non-GAAP

operating loss, non-GAAP net loss, non-GAAP basic and diluted net

loss per common share, non-GAAP research and development, non-GAAP

sales and marketing, non-GAAP general and administrative, free cash

flow and adjusted EBITDA. The presentation of this additional

financial information is not intended to be considered in isolation

from, as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP. These

non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with our results of operations as

determined in accordance with GAAP. In addition, these non-GAAP

financial measures may be different from the non-GAAP financial

measures used by other companies. These non-GAAP measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP measures. Management compensates for

these limitations by reconciling these non-GAAP financial measures

to the most comparable GAAP financial measures within our earnings

releases.

Non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating

loss, Non-GAAP net loss and non-GAAP basic and diluted net loss per

common share, non-GAAP research and development, non-GAAP sales and

marketing, and non-GAAP general and administrative differ from GAAP

in that they exclude stock-based compensation expense, amortization

of acquired intangible assets, acquisition-related expenses and

amortization of debt discount and issuance costs.

Adjusted EBITDA: excludes stock-based compensation

expense, depreciation and other amortization expenses, amortization

of acquired intangible assets, acquisition-related expenses,

interest income, interest expense (including amortization of debt

discount and issuance costs) other income (expense), (net), and

income taxes.

Acquisition-related Expenses: consists of

acquisition-related charges that are not related to ongoing

operations. Management considers its operating results without the

acquisition-related expenses when evaluating its ongoing non-GAAP

performance and its ongoing adjusted EBITDA performance because

these charges may not be reflective of our core business, ongoing

operating results, or future outlook.

Amortization of Acquired Intangible Assets: consists of

non-cash charges that can be affected by the timing and magnitude

of asset purchases and acquisitions. Amortization of acquired

intangible assets is included in the following cost and expense

line items of our GAAP presentation: cost of revenue and sales and

marketing. Management considers its operating results without the

amortization expense of our acquired intangible assets when

evaluating its ongoing non-GAAP performance and its ongoing

adjusted EBITDA performance because these charges are non-cash

expenses that can be affected by the timing and magnitude of asset

purchases and acquisitions and may not be reflective of our core

business, ongoing operating results, or future outlook.

Amortization of Debt Discount and Issuance Costs:

consists primarily of amortization expenses related to our debt

obligations. Management considers its non-GAAP net loss and

adjusted EBITDA results without this activity when evaluating its

ongoing performance because it is not believed by management to be

reflective of our core business, ongoing operating results or

future outlook. These are included in our total interest

expense.

Capital Expenditures: cash used for purchases of property

and equipment and capitalized internal-use software, as reflected

in our statement of cash flows.

Depreciation and Other Amortization Expense: consists of

non-cash charges that can be affected by the timing and magnitude

of asset purchases. Depreciation and amortization expense is

included in the following cost and expense line items of our GAAP

presentation: cost of revenue, research and development, sales and

marketing, and general and administrative. Management considers its

operating results without the depreciation and other amortization

expense when evaluating its ongoing adjusted EBITDA performance

because these charges are non-cash expenses that can be affected by

the timing and magnitude of asset purchases and may not be

reflective of our core business, ongoing operating results, or

future outlook.

Free Cash Flow: calculated as net cash used in operating

activities less capital expenditures.

Income Taxes: consists primarily of expenses recognized

related to state and foreign income taxes. Management considers its

adjusted EBITDA results without these charges when evaluating its

ongoing performance because it is not believed by management to be

reflective of our core business, ongoing operating results or

future outlook.

Interest Expense: consists primarily of interest expense

related to our debt instruments, including amortization of debt

discount and issuance costs. Management considers its operating

results without total interest expense when evaluating its non-GAAP

net loss and its ongoing adjusted EBITDA performance because it is

not believed by management to be reflective of our core business,

ongoing operating results or future outlook.

Interest Income: consists primarily of interest income

related to our marketable securities. Management considers its

adjusted EBITDA results without this activity when evaluating its

ongoing performance because it is not believed by management to be

reflective of our core business, ongoing operating results or

future outlook.

Non-GAAP Operating Loss: calculated as GAAP revenue less

non-GAAP cost of revenue and non-GAAP operating expenses.

Other Income (Expense), Net: consists primarily of

foreign currency transaction gains and losses. Management considers

its operating results without other income (expense), net when

evaluating its ongoing adjusted EBITDA performance because it is

not believed by management to be reflective of our core business,

ongoing operating results or future outlook.

Stock-based Compensation Expense: consists of expenses

for stock options, restricted stock units, performance awards,

restricted stock awards and Employee Stock Purchase Plan ("ESPP")

under our equity incentive plans. Stock-based compensation is

included in the following cost and expense line items of our GAAP

presentation: cost of revenue, research and development, sales and

marketing, and general and administrative.

Although stock-based compensation is an expense for the Company

and is viewed as a form of compensation, management excludes

stock-based compensation from our non-GAAP measures and adjusted

EBITDA results for purposes of evaluating our continuing operating

performance primarily because it is a non-cash expense not believed

by management to be reflective of our core business, ongoing

operating results, or future outlook. In addition, the value of

some stock-based instruments is determined using formulas that

incorporate variables, such as market volatility, that are beyond

our control.

Management believes these non-GAAP financial measures and

adjusted EBITDA serve as useful metrics for our management and

investors because they enable a better understanding of the

long-term performance of our core business and facilitate

comparisons of our operating results over multiple periods and to

those of peer companies, and when taken together with the

corresponding GAAP financial measures and our reconciliations,

enhance investors' overall understanding of our current financial

performance.

Key Metrics

1 We calculate LTM Net Retention Rate by

dividing the total customer revenue for the prior twelve-month

period (“prior 12-month period”) ending at the beginning of the

last twelve-month period (“LTM period”) minus revenue contraction

due to billing decreases or customer churn, plus revenue expansion

due to billing increases during the LTM period from the same

customers by the total prior 12-month period revenue. We believe

the LTM Net Retention Rate is supplemental as it removes some of

the volatility that is inherent in a usage-based business

model.

2 We calculate Dollar-Based Net Expansion

Rate by dividing the revenue for a given period from customers who

remained customers as of the last day of the given period (the

“current” period) by the revenue from the same customers for the

same period measured one year prior (the “base” period). The

revenue included in the current period excludes revenue from (i)

customers that churned after the end of the base period and (ii)

new customers that entered into a customer agreement after the end

of the base period.

3 Enterprise customers are defined as those

spending $100,000 or more in a twelve-month period.

4 Assumes weighted average basic shares

outstanding of 121.4 million in Q2 2022 and 121.8 million for the

full year 2022.

5 Non-GAAP Net Loss per share is calculated

as full-year Non-GAAP Net Loss divided by weighted average basic

shares for the full year 2022.

Condensed Consolidated Statements of Operations (in

thousands, except per share amounts, unaudited)

Three

months ended March 31,

2022

2021

Revenue

$

102,382

$

84,852

Cost of revenue(1)

53,915

37,494

Gross profit

48,467

47,358

Operating expenses: Research and development(1)

40,437

28,988

Sales and marketing(1)

41,480

34,872

General and administrative(1)

29,554

33,461

Total operating expenses

111,471

97,321

Loss from operations

(63,004

)

(49,963

)

Interest income

681

174

Interest expense

(1,622

)

(661

)

Other expense

(279

)

(64

)

Loss before income taxes

(64,224

)

(50,514

)

Income tax expense

40

169

Net loss

$

(64,264

)

$

(50,683

)

Net loss per share attributable to common stockholders, basic

and diluted

$

(0.54

)

$

(0.44

)

Weighted-average shares used in computing net loss per share

attributable to common stockholders, basic and diluted

119,673

114,134

__________ (1) Includes stock-based compensation

expense as follows:

Three months ended March

31,

2022

2021

Cost of revenue

$

2,946

$

1,186

Research and development

18,589

7,958

Sales and marketing

10,094

5,008

General and administrative

8,393

16,686

Total

$

40,022

$

30,838

Reconciliation of GAAP to Non-GAAP Financial Measures

(in thousands, unaudited)

Three months ended March

31,

2022

2021

Gross Profit GAAP gross profit

$

48,467

$

47,358

Stock-based compensation

2,946

1,186

Amortization of acquired intangible assets

2,475

2,475

Non-GAAP gross profit

$

53,888

$

51,019

GAAP gross margin

47.3

%

55.8

%

Non-GAAP gross margin

52.6

%

60.1

%

Research and development GAAP research and

development

$

40,437

$

28,988

Stock-based compensation

(18,589

)

(7,958

)

Non-GAAP research and development

$

21,848

$

21,030

Sales and marketing GAAP sales and marketing

41,480

34,872

Stock-based compensation

(10,094

)

(5,008

)

Amortization of acquired intangible assets

(2,709

)

(2,816

)

Non-GAAP sales and marketing

28,677

27,048

General and administrative GAAP general and

administrative

$

29,554

$

33,461

Stock-based compensation

(8,393

)

(16,686

)

Acquisition-related expenses

(58

)

(929

)

Non-GAAP general and administrative

$

21,103

$

15,846

Operating loss GAAP operating loss

$

(63,004

)

$

(49,963

)

Stock-based compensation

40,022

30,838

Amortization of acquired intangible assets

5,184

5,291

Acquisition-related expenses

58

929

Non-GAAP operating loss

$

(17,740

)

$

(12,905

)

Net loss GAAP net loss

$

(64,264

)

$

(50,683

)

Stock-based compensation

40,022

30,838

Amortization of acquired intangible assets

5,184

5,291

Amortization of debt discount and issuance costs

963

-

Acquisition-related expenses

58

929

Non-GAAP loss

$

(18,037

)

$

(13,625

)

Non-GAAP net loss per common share—basic and diluted

$

(0.15

)

$

(0.12

)

Weighted average basic and diluted common shares

119,673

114,134

Three months ended March 31,

2022

2021

Adjusted EBITDA GAAP net loss

$

(64,264

)

$

(50,683

)

Stock-based compensation

40,022

30,838

Depreciation and other amortization

9,975

6,491

Amortization of acquired intangible assets

5,184

5,291

Interest income

(681

)

(174

)

Interest expense

1,622

661

Other expense

279

64

Income tax expense

40

169

Acquisition-related expenses

58

929

Adjusted EBITDA

$

(7,765

)

$

(6,414

)

Condensed Consolidated Balance Sheets (in thousands)

As

of As of March 31, 2022 December 31, 2022

(unaudited) (audited) ASSETS Current

assets: Cash and cash equivalents

$

245,794

$

166,068

Marketable securities, current

393,950

361,795

Accounts receivable, net of allowance for credit losses

73,717

64,625

Prepaid expenses and other current assets

23,616

32,160

Total current assets

737,077

624,648

Property and equipment, net

174,550

166,961

Operating lease right-of-use assets, net

63,455

69,631

Goodwill

637,570

636,805

Intangible assets, net

97,287

102,596

Marketable securities, non-current

394,464

528,911

Other assets

30,020

29,468

Total assets

$

2,134,423

$

2,159,020

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable

$

8,248.0

$

9,257.0

Accrued expenses

49,902

36,112

Finance lease liabilities, current

26,766

21,125

Operating lease liabilities, current

18,688

20,271

Other current liabilities

36,569

45,107

Total current liabilities

140,173

131,872

Long-term debt

934,121

933,205

Finance lease liabilities, noncurrent

28,867

22,293

Operating lease liabilities, noncurrent

52,334

55,114

Other long-term liabilities

2,205

2,583

Total liabilities

1,157,700

1,145,067

Stockholders’ equity: Class A common stock

2

2

Additional paid-in capital

1,561,371

1,527,468

Accumulated other comprehensive loss

(9,496

)

(2,627

)

Accumulated deficit

(575,154

)

(510,890

)

Total stockholders’ equity

976,723

1,013,953

Total liabilities and stockholders’ equity

$

2,134,423

$

2,159,020

Condensed Consolidated Statements of Cash Flows (in

thousands, unaudited)

Three months ended March

31,

2022

2021

Cash flows from operating activities: Net loss

$

(64,264

)

$

(50,683

)

Adjustments to reconcile net loss to net cash used in operating

activities: Depreciation expense

9,850

6,419

Amortization of intangible assets

5,309

5,363

Amortization of right-of-use assets and other

6,839

6,357

Amortization of debt discount and issuance costs

964

332

Amortization of deferred contract costs

1,851

1,411

Stock-based compensation

40,022

30,838

Provision for credit losses

127

(420

)

Interest on finance lease

(591

)

(330

)

Loss on disposals of property and equipment

268

27

Amortization and accretion of discounts and premiums on investments

957

—

Other adjustments

128

64

Changes in operating assets and liabilities: Accounts receivable

(9,219

)

(1,685

)

Prepaid expenses and other current assets

(2,111

)

(1,680

)

Other assets

(2,451

)

(2,952

)

Accounts payable

(2,492

)

2,119

Accrued expenses

4,891

(755

)

Operating lease liabilities

(6,557

)

(6,365

)

Other liabilities

3,289

1,071

Net cash used in operating activities

(13,190

)

(10,869

)

Cash flows from investing activities: Purchases of

marketable securities

(148,193

)

(64,331

)

Sales of marketable securities

2,301

12,497

Maturities of marketable securities

240,547

25,503

Business acquisitions, net of cash acquired

(775

)

—

Purchases of property and equipment

(2,387

)

(8,079

)

Capitalized internal-use software

(3,810

)

(989

)

Net cash provided by (used in) investing activities

87,683

(35,399

)

Cash flows from financing activities: Issuance of

convertible note, net of issuance costs

—

930,775

Payments of other debt issuance costs

—

(1,351

)

Repayments of finance lease liabilities

(7,159

)

(2,951

)

Cash received for restricted stock sold in advance of vesting

conditions

10,655

—

Cash paid for early sale of restricted shares

(3,498

)

—

Proceeds from exercise of vested stock options

3,048

2,719

Proceeds from employee stock purchase plan

2,406

3,071

Net cash provided by financing activities

5,452

932,263

Effects of exchange rate changes on cash, cash equivalents, and

restricted cash

(219

)

(112

)

Net increase in cash, cash equivalents, and restricted cash

79,726

885,883

Cash, cash equivalents, and restricted cash at beginning of

period

166,961

63,880

Cash, cash equivalents, and restricted cash at end of period

246,687

949,763

Reconciliation of cash, cash equivalents, and restricted cash as

shown in the statements of cash flows: Cash and cash

equivalents

245,794

948,783

Restricted cash, current

—

87

Restricted cash, non-current

893

893

Total cash, cash equivalents, and restricted cash

$

246,687

$

949,763

Free Cash Flow

(in thousands, unaudited)

Three months ended March

31,

2022

2021

Cash flow provided by (used in) operations

$

(13,190

)

$

(10,869

)

Capital expenditures(1)

(6,197

)

(9,068

)

Free Cash Flow

$

(19,387

)

$

(19,937

)

__________ (1) Capital Expenditures are defined as cash used for

purchases of property and equipment and capitalized internal-use

software, as reflected in our statement of cash flows.

Source: Fastly, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220504005844/en/

Investor Contact: Vernon Essi, Jr. ir@fastly.com

Media Contact: press@fastly.com

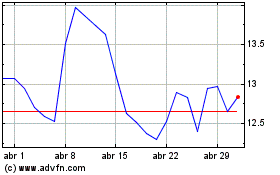

Fastly (NYSE:FSLY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Fastly (NYSE:FSLY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024