First Quarter 2022

Highlights

- 1Q 2022 Invoiced Sales Increased 16.8% Compared to 1Q 2021

and 43.7% Compared to 1Q 2020

- Written Orders in 1Q 2022 of €111.5 Million, 35.4% Above 1Q

2021 and 50.7% Above 1Q 2020

- Gross Margin of 34.3%, Compared to 36.2% in 1Q 2021 and

34.2% in 1Q 2020. 1Q 2022 Margin Impacted by Rising Raw Materials

and Energy Costs

- Operating Profit of €1.5 Million, Compared to an Operating

Profit of €3.3 Million in 1Q 2021, Which Benefitted From an

Extraordinary One-Off €2.8 Million COVID-Related Public Support. 1Q

2022 Operating Profit of €1.5 Million Compares With an Operating

Loss of €4.9 Million in 1Q 2020

- Cash of €51.2 Million as of March 31, 2022, Compared to

€53.5 Million as of December 31, 2021 and €48.2 Million as of

December 31, 2020

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”) today reported

its unaudited financial information for its first quarter ended

March 31, 2022.

Pasquale Natuzzi, Chairman of the Group commented: “The demand

of our branded products in the first quarter has been robust. At

the same time, the context around us invites to be extremely

prudent. Generalized inflation, persisting supply-chain disruptions

and the conflict in Ukraine provide multiple challenges to our

supply chain. Recently, we saw the consumer developing a more

prudent attitude. Our CEO and the management team are constantly

monitoring the overall situation to navigate through these

challenging times. The recent approval of a new incentive

stock-option plan as well as the appointment of an independent

Director, Gilles Bonan, former CEO of Roche Bobois with more than

20 years of experience in the furniture sector, demonstrate our

determination to create a stronger governance and a committed

management to reach our long-term goals.”

Antonio Achille, CEO of the Group commented: “Our first quarter

revenues increased 16.8% vs 2021 and we continued improving the

quality of the sales with the increase of weight of our branded

business. During the 1Q 2022, total written orders increased

double-digit versus the three prior years, mainly driven by the

branded business which represented 89.6% of total written orders,

compared to 83.1% and 83.9% in the same quarter of 2021 and 2020,

respectively. The shift towards the brands is an important element

in our quest to improve margins.

Since the month of April, we are seeing a more prudent approach

of consumers, mainly because of the current global uncertainty. The

written orders of the first 19 weeks of the year ended +19.9% above

last year same period, but the more prudent attitude of the

consumer is recently determining a lower traffic in our retail and

in the stores of our wholesale partners.

The current geopolitical and business environment continues to

be uncertain. Generalized inflation, increased costs of raw

materials and transportation shortages, as well as the war in

Ukraine, are challenging our industrial and supply-chain

operations, thus curbing our ability to add more deliveries during

the quarter.

The persistent rising trend in the cost of raw materials remains

one of the key concerns. Components in our production, including

leather, wood, iron, aluminum, steel, cardboard packaging and

polyethylene, as well as energy costs, have been subject to price

increases. During the 1Q we have applied further price-list

adjustments on our products to mitigate this inflationary pressure.

However, there is generally a time lapse between the moment a

written order is confirmed and the time in which it is programmed,

manufactured and delivered to the final customer. Therefore, we

expect our price-list adjustments will be apparent in our margins

towards the end of the second quarter, when written orders

collected begin on average to be translated into invoiced

sales.

Pressures on margins also came from transportation costs, which

remain at unusually high levels, also as an effect of the ongoing

conflict which has caused an increase in the fuel cost and the

closing of some routes, as the one on the Black Sea.

Our purchasing team continues to monitor the developments in the

raw materials market daily to counterbalance the adverse impact

from supply-chain disruptions so to secure a more stable flow of

supplies. We are also scouting new vendors located in more stable

geographic areas and finding new suppliers closer to our European

plants to reduce inventory levels, transit-time of production

inputs and the risk of slowing down our production schedule. For

example, we have just recently started to move some of our top

selling fabrics supplies from China to Turkey, thus reducing the

transit time from 4-5 weeks to less than one week.

The combined effect of continued positive demand of our products

in 1Q 2022 and supply-chain disruptions explains a

higher-than-usual level of order portfolio backlog, which currently

stands at €111.5 million, compared to €114.4 million at the end of

2021 and €103.3 million at the end of 2020. We have been

programming extra shift work hours in the Group’s plants to

increase production rate and provide our customers with a better

level of service. With the same goal of increasing production and

delivery rates, we are increasing the outsourcing of the production

of our unbranded products.

The strength of our two brands and the transparency with our

customers on the likelihood of extended delivery times, have

enabled us to keep the cancellation rate at negligible levels.

As for the ability to serve our demand, it is important to share

that, since the beginning of April, we have been affected by the

rigorous lockdown imposed by local Chinese authorities in response

to the resurgence of COVID-19 in some regions, including Shanghai

where our own factory, that produces Natuzzi Editions products

chiefly for APAC region and parts of North America, is located.

Production at the Natuzzi China factory represents up to €8

million of revenue on average per month, thus these limitations

will be significantly impacting our expected production volumes for

the second quarter of this year.

Restrictions have been gradually lifting since the start of May.

More specifically, at the beginning of May, officials of the

Shanghai region allowed a limited number of our workers, initially

about 20% of the workforce, and more recently up to 30%, to return

to work in the factory. On 27th May, the Chinese authorities

reviewed the Covid-19 restrictions again: by June 1st, our Shanghai

factory will be able to have up to 85% of its total workforce in

the factory. Provided that regulations will not worsen again, this

will help us to significantly restore production levels starting

from June. However, we expect our second quarter results to be

impacted because of the limitations affecting our factory in

Shanghai.

We are constantly monitoring the situation together with local

Chinese officials. At the same time, we are exploring production

alternatives with other plants in Asia, principally Vietnam, where

we have established operations.

We continue executing on our transformation of the Group into

retail and brand. With the aim to accelerate the commercial

expansion of the Natuzzi brands in the Rest of APAC region, a

market with attractive opportunities for us, we recently signed a

partnership with a leading listed Vietnamese company in the

furniture sector, that acquired a 20% stake in our subsidiary,

Natuzzi Singapore, for a total cash consideration of USD 5.4

million. We are firmly convinced that we will benefit from joining

forces with our partner, not only in the Brand/Retail business but

also in the contract segment. With our partner we are also

exploring ways to increase our production capabilities in

Vietnam.

***

Our team is highly focused on identifying and implementing

solutions to navigate the current market context. We remain

committed to our long-term strategic plans which includes: i) grow

faster than our reference market; ii) continue improving product

mix, toward the higher-margin, branded portion of our business;

iii) progressively expand our retail network, both directly

operated and franchised stores; iv) increase the efficiency of our

production plants, by reducing complexity and applying the latest,

innovative lean production processes, and v) increase focus on

working capital management and value creation.

The transformation of the Group’s into a life-style brand can be

led and executed only by a committed group of talented people, who

have their interests coinciding with those of the Company and its

shareholders. For this reason, and to accelerate such

transformation, earlier this month, the Board of Directors approved

the guidelines of a new stock option plan (the “Plan”), for certain

Group’s managers and Directors, subject to the continuation of

their relevant working relationship with the Company and the

achievement of performance targets as determined by the Board. This

Plan should improve the Company’s ability to attract, retain and

motivate people who are expected to contribute to creating value

for the Company’s shareholders over the years covered by the

Plan.

Lastly, we recently strengthened our corporate governance with

the addition of a Non-Executive Director, Mr. Gilles Bonan, to the

Company’s Board of Directors, which is now comprised of four

independent Directors. We are delighted to welcome Mr. Bonan, whose

long-term professional experience, including his role as CFO and

then CEO of Roche Bobois and, more recently, as a consultant in

strategy for lifestyle companies and private equity funds, will

surely contribute significant value to the Board. The entire Board

and I are looking forward to working with him.”

1Q 2022 CONSOLIDATED REVENUE

1Q 2022 consolidated revenue amounted to €118.5 million, an

increase of 16.8% from €101.5 million in 1Q 2021.

Excluding “other sales” of €4.7 million, 1Q 2022 invoiced sales

from upholstered and other home furnishings products amounted to

€113.8 million, an increase of 16.0% compared to 1Q 2021.

To provide a better understanding of the different growth

drivers of our operating model, invoiced sales from upholstered and

other home furnishings are hereafter described according to the

main dimensions of the Group’s business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. BRANDED/UNBRANDED BUSINESS

The Group operates in the branded business (with the Natuzzi

Italia, Natuzzi Editions and Divani&Divani by Natuzzi) and the

unbranded business, the latter with collections dedicated to

large-scale distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brands strategy:

i) Natuzzi Italia, our

luxury furniture brand, offers products entirely designed and

manufactured in Italy and targets an affluent and more

sophisticated global consumer with a highly inspirational

collection that is largely the same across all our global stores to

best represent our Brand. Natuzzi Italia products are almost

exclusively sold in mono-brand stores (directly operated or

franchises).

ii) Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania, Brazil). Natuzzi

Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi. The store merchandising of Natuzzi

Editions, starting from a common collection, is tailored to best

fit the opportunities of each market. The Natuzzi Editions products

are sold primarily through galleries and selected mono-brand

franchise stores.

In 1Q 2022, Natuzzi’s branded invoiced sales amounted to €98.6

million, an increase of 14.7% compared to 1Q 2021.

The Company confirms its strategic plan to grow mainly with the

branded part of the business by extending its retail presence

primarily in strategic markets, such as the US, China and selected

countries in Western Europe, where we already have a commercial

organization in place.

The following is the contribution of each Brand to 1Q 2022

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €41.5 million,

an increase of 12.3% compared to 1Q 2021.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €57.1 million,

an increase of 16.6% compared to 1Q 2021.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €15.2 million, an increase of 25.3% compared

to 1Q 2021, thanks to the increased deliveries to the North

American market of products manufactured by our industrial partner

in Vietnam. During 1Q 2022, our outsourced operations in Vietnam

more than doubled the production compared to 1Q 2021, as they fully

resumed the industrial operations after the lockdown suffered in

the prior year.

The Company’s strategy is to focus on selected large accounts

and serve them with a more efficient go-to-market model.

B. KEY MARKETS

Here below a breakdown of 1Q 2022 upholstery and

home-furnishings invoiced sales compared to 1Q 2021, according to

the following geographic areas.

1Q 2022

1Q 2021

Delta €

Delta %

North America

35.0

26.4

8.5

32.3%

Greater China

14.7

12.9

1.8

14.2%

West & South Europe

36.8

30.9

5.9

19.0%

Emerging Markets

13.1

15.4

(2.3)

(14.7)%

Rest of the World*

14.2

12.5

1.7

14.0%

Total

113.8

98.1

15.7

16.0%

Figures in €/million, except

percentage

*Include South and Central America, Rest

of APAC.

The performance of invoiced sales in the Emerging Markets is

mostly the result of the impact that the war had on our retail and

commercial operation in Ukraine and Russia.

C. DISTRIBUTION

During 1Q 2022, the Group distributed its branded collections in

98 countries, according to the following table.

Direct Retail

FOS**

Galleries**

Total

Mar. 31, 2022

North America

12

8

196

216

West & South Europe

35

98

132

265

Greater China

24(1)

332

─

356

Emerging Markets

─

72

138

210

Rest of the World

16*

82

85

183

Total

87

592

551

1,230

* It includes 11 Natuzzi Concessions

(store-in-store points of sale) directly managed by the Mexican

subsidiary of the Group.

** Managed by independent partners.

(1) All directly operated by our Joint

Venture in China. As the Natuzzi Group owns a 49% stake in the

Joint Venture, we consolidate only the sell-in from such DOS.

During 1Q 2022, Group’s direct retail invoiced sales amounted to

€18.6 million, an increase of 23.0% compared to 1Q 2021, mainly due

to the continued positive momentum in our DOS located in the U.S.

(+50.8% compared to 1Q 2021).

In 1Q 2022, invoiced sales from franchise stores amounted to

€41.4 million, an increase of 22.4% compared to 1Q 2021.

We continue executing our strategy to become a Brand Retailer

and improve the quality of our distribution network. The weight of

Retail (DOS and FOS) on total upholstered and home furnishings

business in 1Q 2022 was 52.7% compared to 49.9% in 1Q 2021.

During the first three months of 2022, we added 19 FOS to our

distribution network, of which 16 located in China, 2 in the US and

one in Italy.

The Group also sells its products through the wholesale channel,

consisting primarily of Natuzzi-branded galleries in multi-brand

stores, as well as mass distributors selling unbranded products.

During 1Q 2022, invoiced sales from the wholesale channel amounted

to €53.8 million, an increase of 9.5% compared to 1Q 2021. The

Company will strategically continue to improve the quality of its

distribution as it intends to decrease the presence in the

wholesale distribution to favor the retail channel, so to exert a

better control on the distribution of its branded products in terms

of merchandising, advertising and pricing, coherently with the

values and the positioning of the Natuzzi brands.

1Q 2022 GROSS MARGIN

In 1Q 2022, we had a gross margin of 34.3%, as compared to 36.2%

in 1Q 2021, mainly as a result of continued rising raw materials

prices and energy costs, that more than offset the improved

sales-mix in the quarter and pricelist revision applied early in

the year to mitigate inflationary pressure. As the pricing

adjustments on our products are reflected in the delivered sales

and not when a written order is confirmed by the customer, and

since it takes up to 4 months for an order to be programmed,

manufactured and then delivered to the final customer, then during

times of high inflation, as the one we have been experiencing, we

have difficulties in enacting price increases on our products as

fast as we have incurred them from our raw material suppliers.

The Company continued to review its pricelists for written

orders received in 1Q 2022, which, for what just said, will start

to become effective on revenue from the last month of the second

quarter. We remain vigilant in finding alternative solutions to

mitigate this inflationary pressure on gross margin, as we do not

see yet signs for a reverting trend in the cost of materials and

energy.

1Q 2022 OPERATING EXPENSES

During 1Q 2022, operating expenses (which include selling

expenses, administrative expenses, other operating income/expenses,

and the impairment of trade receivables) were €39.1 million (or

33.0% on revenues), increasing from €33.5 million (or 33.0% on

revenues) in 1Q 2021.

In particular, in 1Q 2022 transportation costs were 11.9% of

revenue as compared to 11.5% in 1Q 2021 as a result of a continued

spike in transportation costs and a different geographic mix.

COMPARABILITY OF 1Q 2022 OPERATING RESULT VS 1Q 2021

During 1Q 2021, the Group benefitted from the salary and wage

subsidy program introduced by the different countries, Italy in

particular, as well as in some European countries, as part of

public support measures extended to manufacturers in response to

the COVID-19 pandemic. Such governmental measures allowed the Group

to pay temporarily laid-off workers and employees a reduced salary

or wage for a certain period, included 1Q 2021, and were recorded

as a reduction in the labor costs within the cost of sales, selling

expenses and administrative expenses.

As the vaccination campaigns have begun to prove effective, such

COVID-19 related support measures were not confirmed in 2022 by

governments in Italy and Europe. The benefits received by the Group

in 1Q 2021 for such measures were approximately €2.8 million. The

operating result in 1Q 2021 was positively affected by these

interventions which were not renewed in 1Q 2022.

UPDATE ON COVID-19 FOR OUR CHINESE OPERATIONS

The COVID-19 related restrictions, that have been in force in

Shanghai since the beginning of April 2022, following a

record-breaking level of contagion in the region during the first

part of the year, have been affecting the Group’s manufacturing and

logistics operations of Natuzzi (China) Ltd (“Natuzzi China”), a

subsidiary wholly owned by the Company, by limiting its workers and

employees from accessing its facility and therefore curbing the

ability to manufacture new products and deliver finished goods to

customers. The same restrictions have also resulted in the closure

of 18 points of sales in the Shanghai district, whose sell-in

contribution to the Group is not significant, as they represent

less than 1% of the consolidated revenue.

Natuzzi China, located in the Shanghai district, is the Group’s

factory that manufactures upholstery products for the APAC and

North American markets. This factory, under standard condition, can

generate about €8 million on average of revenue per month. In 2021,

26.2% of the consolidated revenue of upholstery furniture come from

Natuzzi China. The stop in production of Natuzzi China does not

relate to the Company’s Natuzzi Italia brand, which is completely

manufactured in Italy.

Following the improvement in the general sanitary conditions,

our representatives of Natuzzi China were informed by the local

authorities that, starting from the beginning of May and after

meeting certain sanitary conditions, a limited number of workers,

initially about 20% of the entire Natuzzi China workforce, recently

incremented to about 30%, were allowed to return to work so to

resume operations in the factory, currently at about 30% of its

production capacity.

From June 1st, 85% of workers will be allowed to return to work,

thus enabling our Shanghai factory to increase its operational

rate. Still, we expect the Group’s revenue for the quarter

beginning in April 2022 to be significantly affected.

The Group has started evaluating alternative solutions to

manufacture written orders by leveraging on our global industrial

footprint or external producers, such as our partner in Vietnam,

even if we are aware that it takes time to adjust the supply and

logistics aspects accordingly.

DEVELOPMENT OF THE PARTNERSHIP IN THE REST OF APAC

REGION

Following the preliminary agreement entered into in 2021 with

Truong Thanh Furniture Corporation (“TTF”), a company incorporated

under the laws of the Republic of Vietnam, to form a partnership

aimed at strengthening the Natuzzi Group’s operations in the APAC

region, Greater China excluded (“Rest of APAC”), TTF obtained all

the applicable authorization by the relevant Vietnamese authorities

and acquired a 20% stake in Natuzzi Singapore PTE. LTD (“Natuzzi

Singapore”), for a total cash consideration of $5.4 million in

favor of Natuzzi Singapore.

As a result of the above, Natuzzi S.p.A. owns 74.4% of Natuzzi

Singapore, TTF owns 20% whereas the other minority shareholder, Mr.

Richard Tan, owns 5.6% of the share capital.

Natuzzi Singapore will be now our platform to develop

commercially the Natuzzi Brands in the Rest of APAC Region and

accelerate our presence in the contract business, a very

interesting opportunity in the Region. This joint venture will be

supporting also the enhancement of the Vietnamese factories, which

serve as outsourcer for the production of Natuzzi products.

BALANCE SHEET AND CASH FLOW

During 1Q 2022, €3.1 million of net cash were used in in

operating activities as a result of:

- profit for the period of €1.3 million;

- adjustments for non-monetary items of €5.7 million, of which

depreciation and amortization of €5.3 million;

- (€8.2) million of cash used due to higher working capital needs

to support the increased business, of which (€5.6) million for

inventory and (€10.7) million for trade and other receivables,

partially offset by higher advance payments from customers.

- interest and taxes paid of (€2.0) million.

During 1Q 2022, (€2.2) million of cash were used in investing

activities, as a result of (€3.3) million of cash invested in

capital expenditures and €1.1 million collected in connection with

the completion of the sale transaction of a former Company’s

subsidiary.

In the same period, €2.7 million of cash were provided by

financing activities, mainly due to a €4.0 million long-term loan

made available by the Italian government as part of the COVID-19

measures to support businesses, €4.9 million as a capital

contribution by the Vietnamese partner who acquired a 20% stake in

Natuzzi Singapore, partially offset by lease and long-term

borrowings repayments.

As a result, as of March 31, 2022, cash and cash equivalents was

€51.2 million, compared to €53.5 million as of December 31,

2021.

As of March 31, 2022, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€4.1) million compared

to (€0.1) million as of December 31, 2021.

Natuzzi S.p.A. and

Subsidiaries

Unaudited consolidated

statement of profit or loss for the first quarter of 2022 and

2021

on the basis of IFRS-IAS

(expressed in millions Euro, except per ordinary share)

Fourth Quarter ended on Change Percentage

of revenue 31-Mar-22 31-Mar-21 %

31-Mar-22 31-Mar-21 Revenue

118.5

101.5

16.8%

100.0%

100.0%

Cost of Sales

(77.9)

(64.7)

20.4%

-65.7%

-63.8%

Gross profit

40.6

36.8

10.4%

34.3%

36.2%

Other income

1.0

1.3

0.9%

1.3%

Selling expenses

(31.5)

(27.8)

13.6%

-26.6%

-27.4%

Administrative expenses

(8.3)

(7.0)

17.5%

-7.0%

-6.9%

Impairment on trade receivables

(0.3)

─

-0.3%

0.0%

Other expenses

(0.1)

(0.0)

-0.1%

0.0%

Operating profit/(loss)

1.5

3.3

1.2%

3.2%

Finance income

0.0

0.0

0.0%

0.0%

Finance costs

(1.8)

(1.6)

-1.5%

-1.6%

Net exchange rate gains/(losses)

1.1

(0.8)

0.9%

-0.8%

Gain from disposal and loss of control of a subsidiary ─

4.8

0.0%

4.7%

Net finance income/(costs)

(0.7)

2.4

-0.6%

2.4%

Share of profit/(loss) of equity-method investees

1.0

1.1

0.8%

1.0%

Profit/(Loss) before tax

1.8

6.7

1.5%

6.6%

Income tax expense

(0.5)

(0.8)

-0.4%

-0.8%

Profit/(Loss) for the period

1.3

5.9

1.1%

5.9%

Profit/(Loss) attributable to: Owners of the Company

1.0

6.1

Non-controlling interests

0.3

(0.2)

Profit/(loss) per Ordinary Share

0.02

0.11

Natuzzi S.p.A. and

Subsidiaries

Unaudited consolidated

statements of financial position (condensed)

on the basis of

IFRS-IAS

(Expressed in millions of

Euro)

31-Mar-22 31-Dec-21 ASSETS

Non-current assets

188.4

189.6

Current assets

212.0

200.4

TOTAL ASSETS

400.4

390.0

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

87.9

82.3

Non-controlling interests

3.6

1.5

Non-current liabilities

106.5

107.5

Current liabilities

202.4

198.7

TOTAL EQUITY AND LIABILITIES

400.4

390.0

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

31-Mar-22 31-Dec-21

Net cash provided by (used in) operating activities

(3.1)

0.5

Net cash provided by (used in) investing activities

(2.2)

7.0

Net cash provided by (used in) financing activities

2.7

(2.0)

Increase (decrease) in cash and cash equivalents

(2.6)

5.5

Cash and cash equivalents, beginning of the year

52.2

46.1

Effect of movements in exchange rates on cash held

0.5

0.6

Cash and cash equivalents, end of the period

50.1

52.2

For the purpose of the

statements of cash flow, cash and cash equivalents comprise the

following: (Expressed in millions of Euro)

31-Mar-22 31-Dec-21 Cash and cash equivalents

in the statement of financial position

51.2

53.5

Bank overdrafts repayable on demand

(1.1)

(1.2)

Cash and cash equivalents in the statement of cash flows

50.1

52.2

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS Certain statements included

in this press release constitute forward-looking statements within

the meaning of the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, as amended. These statements may be expressed in a

variety of ways, including the use of future or present tense

language. Words such as “estimate,” “forecast,” “project,”

“anticipate,” “likely,” “target,” “expect,” “intend,” “continue,”

“seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,”

“may,” “might,” “will,” “strategy,” “synergies,” “opportunities,”

“trends,” “ambition,” “objective,” “aim,” “future,” “potentially,”

“outlook” and words of similar meaning may signify forward-looking

statements. These statements involve risks and uncertainties that

could cause the Company’s actual results to differ materially from

those stated or implied by such forward-looking statements

including, but not limited to, potential risks and uncertainties

described at page 3 of this document relating to the supply-chain,

the cost and availability of raw material, production and shipping

and the modernization of our Italian manufacturing and those

relating to the duration, severity and geographic spread of the

COVID-19 pandemic, actions that may be taken by governmental

authorities to contain the COVID-19 pandemic or to mitigate its

impact, the potential negative impact of COVID-19 on the global

economy, consumer demand and our supply chain, and the impact of

COVID-19 on the Company's financial condition, business operations

and liquidity, as well as the geopolitical tensions and market

uncertainties resulting from the Russian invasion of Ukraine and

current conflict. Additional information about potential factors

that could affect the Company’s business and financial results is

included in the Company’s filings with the U.S. Securities and

Exchange Commission, including the Company’s most recent Annual

Report on Form 20-F. The Company undertakes no obligation to update

any of the forward-looking statements after the date of this press

release.

Additional Information This

news release is just one part of the Company’s financial

disclosures and should be read in conjunction with other

information filed with the U.S. Securities and Exchange Commission,

available at https://natuzzigroup.com/en-EN/ir/investors.html under

the “SEC Filings” section.

About Natuzzi S.p.A. Founded

in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of the most

renowned brands in the production and distribution of design and

luxury furniture. With a global retail network of 679 mono-brand

stores and 551 galleries as of March 31, 2022, Natuzzi distributes

its collections worldwide. Natuzzi products embed the finest spirit

of Italian design and the unique craftmanship details of the “Made

in Italy”, where a predominant part of its production takes place.

Natuzzi has been listed on the New York Stock Exchange since May

13, 1993. Always committed to social responsibility and

environmental sustainability, Natuzzi S.p.A. is ISO 9001 and 14001

certified (Quality and Environment), ISO 45001 certified (Safety on

the Workplace) and FSC® certified (Forest Stewardship Council).

www.natuzzi.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220527005368/en/

Natuzzi Investor Relations James Carbonara | +1

(646)-755-7412 | james@haydenir.com Piero Direnzo | +39

080-8820-812 | pdirenzo@natuzzi.com

Natuzzi Corporate Communication Giacomo Ventolone (Press

Office) | +39.335.7276939 | gventolone@natuzzi.com

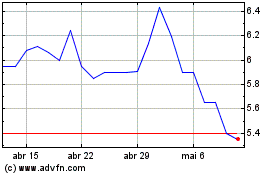

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025