FIRST NINE MONTHS OF 2024:

HIGHLIGHTS

- TOTAL NET SALES WERE €243.9 MILLION, IN LINE WITH THE SAME

PERIOD IN 2023 (-0.3%).

- BRANDED SALES WERE €221.2 MILLION, UP 0.3% FROM 2023 SAME

PERIOD AND UP 3.1% FROM 2019 SAME PERIOD. BRANDED SALES WERE 93.0%

OF TOTAL SALES, COMPARED TO 92.6% IN THE SAME PERIOD OF 2023 AND

78.5% IN THE SAME PERIOD OF 2019.

- DOS SALES WERE €57.4 MILLION, UP 6.3% FROM 2023 AND UP 20.8%

FROM 2019 SAME PERIODS. 2024 GROWTH WAS DRIVEN BY A 22.3% SALES

INCREASE FROM DOS IN THE U.S, WHERE WE OPENED 1 ADDITIONAL STORE IN

DENVER. DURING THE FIRST 9 MONTHS OF 2024, WE CLOSED TWO

NON-PERFORMING NATUZZI ITALIA STORES, ONE IN SPAIN AND ONE IN

SWITZERLAND, AS PART OF OUR ONGOING EFFORT TO PROGRESSIVELY IMPROVE

THE QUALITY OF OUR RETAIL.

- AS PART OF OUR TRANSFORMATION, DURING THE FIRST 9 MONTHS OF

2024, WE ACCELERATED OUR RESTRUCTURING WHICH AFFECTED P&L

RESULTS WITH (€4.8) MILLION OF ONE-OFF SEVERANCE COSTS: -

(€4.1) MILLION ACCRUED IN COST OF SALES; - (€0.7) MILLION

ACCRUED IN SELLING AND ADMINISTRATIVE EXPENSES.

- DURING THE FIRST 9 MONTHS OF THE YEAR, 538 PERSONS EXITED

OUR GROUP. THESE EXITS WERE PARTIALLY OFFSET BY HIRES IN STRATEGIC

AREAS SUCH AS RETAIL, MARKETING AND MERCHANDISING. FROM 2021 TO

SEPTEMBER 2024, WE HAD A NET REDUCTION OF 1110 PERSONS, EQUIVALENT

TO A ~26% OF TOTAL.

- IN THE FIRST NINE MONTHS OF 2024, GROSS MARGIN WAS 35.8%,

COMPARED TO 35.8% IN THE FIRST NINE MONTHS OF 2023 AND 29.0% IN THE

FIRST NINE MONTHS OF 2019. EXCLUDING (€4.1) MILLION OF ONE-OFF

SEVERANCE COSTS, GROSS MARGIN WOULD HAVE BEEN 37.4%, WHICH COMPARES

TO 36.3% IN 2023 FIRST NINE MONTHS AND 30.0% IN 2019 FIRST NINE

MONTHS.

- IN THE FIRST NINE MONTHS OF 2024, WE HAD AN OPERATING LOSS

OF (€3.6) MILLION, COMPARED TO AN OPERATING LOSS OF (€2.2) MILLION

IN 2023 FIRST NINE MONTHS AND AN OPERATING LOSS OF (€19.5) MILLION

2019 FIRST NINE MONTHS. EXCLUDING (€4.8) MILLION OF ONE-OFF

SEVERANCE COSTS, WE WOULD HAVE REPORTED AN OPERATING PROFIT OF €1.2

MILLION, WHICH COMPARES TO AN OPERATING LOSS OF (€0.7) MILLION IN

2023 FIRST NINE MONTHS AND TO AN OPERATING LOSS OF (€16.1) MILLION

IN 2019 FIRST NINE MONTHS.

- NET FINANCE COSTS WERE (€7.4) MILLION, COMPARED TO (€5.6)

MILLION IN 2023 AND (€7.7) MILLION IN 2019 SAME PERIOD, MAINLY AS A

CONSEQUENCE OF HIGHER INTEREST EXPENSES ON LEASE CONTRACTS AND

THIRD-PARTY FINANCING, AS WELL AS UNFAVORABLE CURRENCY MOVEMENTS ON

TRADE PAYABLES AND RECEIVABLES.

- DURING THE FIRST 9 MONTHS OF 2024, WE INVESTED €5.4 MILLION,

PRIMARILY TO UPGRADE OUR ITALIAN FACTORIES AND FOR THE DOS LOCATED

IN THE U.S. AND ITALY.

- WE CONTINUE THE DIVESTMENT PROGRAM OF NON-STRATEGIC ASSETS

WE ANNOUNCED: - WE RECEIVED $3.8 MILLION IN OCTOBER 2024 AS

A FIRST INSTALLMENT FOR THE SALE OF A BUILDING LOCATED IN HIGH

POINT, NORTH CAROLINA. - WE SIGNED A PRELIMINARY AGREEMENT

FOR THE SALE OF A LAND IN ROMANIA FOR AN EXPECTED PRICE BETWEEN

€2.9 AND €3.1 MILLION. - AS OF SEPTEMBER 30, 2024, WE HELD

€17.1 MILLION IN CASH, FROM €33.6 MILLION AS OF DECEMBER 31, 2023.

IN PARTICULAR, THE DIFFERENCE IN CASH IS DETERMINED AS

FOLLOWS:

- NET CASH USED IN OPERATING ACTIVITIES

(€5.1) MILLION. OF THIS, (€6.0) MILLION TO REDUCE WORKFORCE; -

NET CASH USED IN INVESTING ACTIVITIES (€5.4) MILLION; -

NET CASH USED IN FINANCING ACTIVITIES (€7.1) MILLION; -

EFFECT OF MOVEMENTS EXCHANGE RATES ON CASH (€0.4) MILLION; -

DIFFERENCE IN BANK-OVERDRAFT REPAYABLE ON DEMAND €1.5

MILLION.

3Q 2024: HIGHLIGHTS

- TOTAL NET SALES WERE €75.0 MILLION, IN LINE WITH 3Q 2023

(+0.1%).

- BRANDED SALES WERE €68.8 MILLION, UP 0.3% FROM 3Q 2023 AND

UP 4.6% FROM 3Q 2019. BRANDED SALES WERE 93.7% OF TOTAL SALES,

COMPARED TO 93.9% IN 3Q 2023 AND 78.6% IN 3Q 2019.

- DOS SALES WERE €16.8 MILLION, DOWN 1.4% FROM €17.1 MILLION

IN 3Q 2023 AND UP 25.7% FROM €13.4 MILLION IN 3Q 2019.

- AS PART OF OUR TRANSFORMATION, DURING 3Q 2024, WE

ACCELERATED OUR RESTRUCTURING WHICH AFFECTED P&L RESULTS WITH

(€3.4) MILLION OF ONE-OFF SEVERANCE COSTS: - (€2.9) MILLION

ACCRUED IN COST OF SALES; - (€0.5) MILLION ACCRUED IN

SELLING AND ADMINISTRATIVE EXPENSES.

- IN 3Q 2024, 276 PERSONS EXITED OUR GROUP. THESE EXITS ARE

MAINLY DUE TO THE CLOSING OF OUR SHANGHAI PLANT, WHOSE PRODUCTION

WAS MOVED TO QUANJIAO.

- IN 3Q 2024, GROSS MARGIN WAS 31.8%, COMPARED TO 35.4% IN 3Q

2023 AND 28.7% IN 3Q 2019. EXCLUDING (€2.9) MILLION OF ONE-OFF

SEVERANCE COSTS, GROSS MARGIN WOULD HAVE BEEN 35.7%, WHICH COMPARES

TO 35.5% IN 3Q 2023 AND 30.5% IN 3Q 2019.

- IN 3Q 2024, WE HAD AN OPERATING LOSS OF (€3.8) MILLION,

COMPARED TO A LOSS OF (€1.4) MILLION IN 3Q 2023 AND A LOSS OF

(€8.7) MILLION IN 3Q 2019. EXCLUDING (€3.4) MILLION OF ONE-OFF

SEVERANCE COSTS, WE WOULD HAVE REPORTED AN OPERATING LOSS OF (€0.4)

MILLION, WHICH COMPARES TO AN OPERATING LOSS OF (€1.1) MILLION IN

3Q 2023 AND AN OPERATING LOSS OF (€6.8) MILLION IN 3Q

2019.

- NET FINANCE COSTS WERE (€3.3) MILLION, COMPARED TO NET

FINANCE COSTS OF (€1.4) MILLION IN 3Q 2023 AND (€3.1) MILLION IN 3Q

2019, MAINLY AS A CONSEQUENCE OF HIGHER INTEREST EXPENSES ON LEASE

CONTRACTS AND THIRD-PARTY FINANCING, AS WELL AS UNFAVORABLE

CURRENCY MOVEMENTS ON TRADE PAYABLES AND RECEIVABLES.

- DURING 3Q 2024, WE INVESTED €1.7 MILLION, PRIMARILY TO

UPGRADE OUR ITALIAN FACTORIES AND FOR THE DOS LOCATED IN THE U.S.

AND ITALY.

***

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the first nine months and third quarter ended

September 30, 2024.

Pasquale Natuzzi, Executive Chairman of the Group, commented:

“We are living in a dual-speed reality. On one hand, our

performance reflects the ongoing challenges posed by the persistent

economic crisis. On the other hand, we are seeing growing evidence

of the strength of our long-term Brand/Retail project, which

continues to gain momentum, paving the conditions to capture the

full potential of our Brands.

On November 12, I had the privilege of inaugurating the Natuzzi

Harmony Residences, a 110,000-square-feet, 9-floor building with 50

apartments, located in a prestigious area in Dubai. For the first

time, we have led the whole architectural and creative direction

both for the exterior and interior design, resulting in a project

which is a living tribute to our Brand DNA. This initiative is a

clear testament that our Brand enjoys global recognition and that

we completed our evolution into a lifestyle brand.

We also continue to innovate and lead where our brand has its

origins. In October, at the High Point Market, we unveiled our

'Re-imagined Gallery' concept — an innovative format designed to

strengthen the coherence of the Natuzzi brand representation and

improve commercial performance with our distribution partners. The

'Re-imagined Gallery' has since become our global standard for the

brand's presence in multi-brand retailers. Along with our global

retail format, it ensures consistent brand representation across

markets and channels. Thanks to these efforts, we are increasingly

presenting our collection in a unified and inspiring way across our

678 stores and 628 galleries worldwide.

These results testify that Natuzzi is one of the few global

design and high-end furniture brands. They also reinforce my belief

that, moving forward, the positive impact of our strategic

initiatives will effectively counterbalance market headwinds,

positioning us for a prosperous future.”

Antonio Achille, CEO of the Group, commented: “Our sales during

the first nine months of 2024 have been in line with the previous

year, despite challenging conditions that continued to impact not

only the furnishings sector but also the broader durable and

consumer goods industries.

This was achieved, despite a soft third quarter, which was

significantly below the year's average, thereby affecting

deliveries in August and September.

In this regard, we need to remember the cycle of our business

innovation. For instance, the merchandising and retail initiatives

for Natuzzi Italia, introduced during April's Milan Design Week,

reached the market only by late September. This was reflected in

Natuzzi Italia's delivered sales for the first nine months, which

were 0.9% lower compared to the same period in 2023. Natuzzi Italia

performance improved in the last two months, effectively closing

the gap with 2023 levels. Looking ahead, the focus for Natuzzi

Italia will remain on the consistent rollout of the

Brand/Retail/Marketing strategy, with a particular emphasis on

priority markets, such as U.S., China, UK, Spain and Italy.

Natuzzi Editions, distributed in Italy under the

“Divani&Divani by Natuzzi” brand, has reported overall revenue

slightly up compared to the previous year (+1.1%). We are actively

engaging customers through targeted global initiatives, such as the

“Re-imagined gallery” project, aimed at building a stronger

foundation to reinforce this positive momentum.

We remain confident that our brands and retail strategy are

poised for significant growth and remain committed to executing the

Company’s long-term plan:

1) Improve the quality of our distribution to accelerate our

Brand journey.

- Retail. The Group continues to make progresses in its

transformation into a retail-branded company. Natuzzi collections

are sold globally in 678 stores, of which 54 free standing DOS

managed directly by the Group, 19 DOS managed by our JV in China, 3

DOS in partnership in the U.S. and 602 franchised stores. Our DOS

sales increased by 6.3% compared to the first nine months of 2023,

with U.S.-based DOS showing a growth of 22.3% over the same period

also supported by the 4 DOS opened in 2023 (in San Diego,

Manhasset, Houston, Atlanta) and the new Denver store opened in

September 2024. Our North American retail network now includes 22

Natuzzi Italia stores (18 of which are directly operated and 4

operated by franchise partners) and 10 Natuzzi Editions stores,

comprising 1 DOS, 3 stores operated in joint venture with a local

partner and 6 franchise stores.

- Re-imagined Gallery. Natuzzi has redefined its wholesale

shop-in-shop format resulting in an innovative concept designed to

support independent retailers to properly represent the

distinctiveness of our brand in their multi-brand environment,

while improving their sell-out performances. We are witnessing a

strong interest from both current and prospective partners. Since

the global launch of this re-imagined Gallery Concept, Natuzzi has

received proposals for 142 projects, including new openings and

refits, which will be implemented starting from 1Q 2025. Reimagined

Gallery program is also enabling us to re-enter into key European

markets. In Germany, we recently signed a partnership with a

leading furniture retailer, which resulted in the opening of 24 new

Natuzzi Editions galleries.

2) Foster new market opportunities: Trade and Contract. I

am particularly proud and thankful to our team for the progress

made by the newly established division. 'Natuzzi Harmony

Residences' in Dubai marks a transformative milestone for our

business, reflecting our evolution and ambitions. It is a true

testament to the power of the Natuzzi Italia brand, as it

represents our first venture into designing and branding an entire

residential building.

This achievement reaffirms that establishing our dedicated Trade

& Contract division was the right decision, enabling us to

fully leverage Natuzzi’s assets and expertise while setting

distinct growth and profitability targets.

3) Enhance margins. Excluding €4.1 million of one-off

severance costs, gross margin would have reached 37.4% in the first

nine months of 2024, which compares to a gross margin of 36.3% in

2023 same period and 30.0% in 2019 same period. The gross margin

was affected by the weak order flow during 3Q 2024, which

negatively weighed on deliveries in August and September, resulting

in a less efficient absorption of fixed costs for the period.

4) Execute our restructuring program. We remain committed

to optimizing our operating model and reducing costs across

factories and offices in Italy and abroad. In the first nine months

of 2024, 538 employees (of which 276 in the third quarter) exited

the Group, partially offset by strategic hires in retail,

advertising, and merchandising. These reductions mainly involved

factory workers in Romania, China, and Italy, as well as employees

at the Group level. Since the beginning of 2021, we have achieved a

net reduction of 1,110 positions—a 26% decrease.

This reduction is part of our strategy of transitioning Natuzzi

from a volume-driven to a value-driven organization. This shift

requires a leaner workforce, new competencies, and an evolved

approach to human resources and organization. We remain committed

to implementing this plan ethically and in full compliance with the

laws. As restructuring progresses, our streamlined model positions

us to unlock greater value when sales return to historical

levels.

5) Production simplification and efficiency improvement.

We continue to conduct a comprehensive review of the Group's

industrial operations to simplify processes, reduce working capital

and drive further efficiencies. Our efforts to optimize the

footprint of our Asian operations are progressing as planned. In 3Q

2024 we completed the closing of our historical factory in

Shanghai, shifting the production to the new plant located in

Quanjiao, Anhui Province, China. This new plant, which will serve

exclusively the Chinese market, offers industrial and

transformation costs which are approximately 30% lower compared to

the Shanghai plant.

6) Divest non-strategic resources The Company continues

to make progress in its strategy of divesting non-strategic assets.

The sale of the building in High Point, NC, is proceeding as

planned, with $3.8 million received in October. Additionally, in

November, we signed a preliminary agreement for the sale of a land

adjacent to our factory in Romania. The final price is expected to

range between €2.9 million and €3.1 million. The transaction is

anticipated to close by mid-2025, pending customary approvals and

processes with the local municipality.

The Company plans to use the net proceeds from the sale of

non-strategic assets to fund restructuring initiatives and expand

its DOS network, with a particular focus on the U.S. market.

The challenging market continues to delay the full realization

of benefits from our retail expansion and restructuring efforts. We

remain dedicated to enhancing our brand-retail value proposition

while steadily reducing the Group's fixed cost base.”

***

2024 FIRST NINE MONTHS

CONSOLIDATED REVENUE

Consolidated revenue for the first nine months of 2024 amounted

to €243.9 million, compared to €244.5 million in 2023 same period.

2024 performance was impacted by ongoing macroeconomic,

geopolitical, and industry-specific challenges, which continued to

dampen consumer spending capacity and delay purchases of durable

goods.

Excluding “other sales” of €6.1 million, 2024 invoiced sales

from upholstered and other home furnishings products amounted to

€237.8 million, compared to €238.1 million in 2023 same period.

Revenues from upholstered and other home furnishings products

are hereafter described according to the main dimensions of the

Group’s business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. Branded/Unbranded business

The Group operates in the branded business (with Natuzzi Italia,

Natuzzi Editions and Divani&Divani by Natuzzi) and unbranded

business, the latter with collections dedicated to large-scale

distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brand strategy:

i) Natuzzi Italia, our luxury furniture

brand, offers products entirely designed and manufactured in Italy

and targets an affluent and more sophisticated global consumer with

a highly inspirational collection that is largely the same across

all our global stores to best represent our Brand. Natuzzi Italia

products are almost exclusively sold in mono-brand stores (directly

operated or franchises).

ii) Natuzzi Editions, our contemporary

collection, offers products entirely designed in Italy and produced

in different plants strategically located to best serve individual

markets (mainly China, Romania and Brazil). Natuzzi Editions

products are distributed in Italy under the brand

“Divani&Divani by Natuzzi”, which is manufactured in Italy to

shorten the lead time to serve the Italian market where the brand

is distributed. The store merchandising of Natuzzi Editions,

starting from a common collection, is tailored to best fit the

opportunities of each market. The Natuzzi Editions products are

sold primarily through galleries and selected mono-brand franchise

stores.

In 2024, Natuzzi’s branded invoiced sales amounted to €221.2

million, compared to €220.6 million in 2023 same period.

The following is the contribution of each Brand in terms of

invoiced sales for the first nine months of 2024:

─ Natuzzi Italia invoiced sales amounted to €91.9

million, compared to €92.7 million in 2023 same period.

─ Natuzzi Editions invoiced sales (including invoiced

sales from “Divani&Divani by Natuzzi”) amounted to €129.3

million, compared to €127.9 million in 2023 same period.

Specifically, Natuzzi Editions invoiced sales were €102.6 million,

compared to €103.0 million in 2023 same period. Invoiced sales for

Divani&Divani by Natuzzi were €26.7 million, compared to €24.9

million in 2023 same period.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €16.6 million, compared to €17.5 million in

2023 same period. The Company’s strategy is to focus on selected

large accounts and serve them with a more efficient go-to-market

model.

B. Key Markets

Below is a breakdown of upholstery and home-furnishings invoiced

sales for the first nine months of 2024, compared to 2023 same

period, according to the following geographic areas.

2024

2023

Delta €

Delta %

North America

76.9

69.5

7.4

10.6%

Greater China

18.8

19.5

(0.7)

(3.4%)

West & South Europe

75.9

80.2

(4.3)

(5.3%)

Emerging Markets

31.8

34.2

(2.4)

(7.2%)

Rest of the World*

34.4

34.7

(0.3)

(0.9%)

Total

237.8

238.1

(0.3)

(0.1%)

Figures in €/million, except

percentage.

*Include South and Central America, Rest

of APAC.

In North America, the sales increase is primarily driven by the

branded segment of the business, with significant contributions

from our DOS and franchise stores in the U.S.

In Greater China, the furniture industry and real estate markets

continue to encounter significant challenges. Enhanced coordination

efforts within our joint venture are instrumental in reducing the

inventory of Natuzzi Italia products. The JV is realigning the

organization’s scale and capabilities to better reflect the current

business trends. To date, the JV has already reduced SG&A

expenses by almost 20% compared to the previous year, also as a

result of a reduced number of employees. The JV plans to continue

with this project to get a more agile structure, to a level

coherent with the current business rate.

The performance in West & South Europe reflects a

generalized difficult macroeconomic condition, especially for some

European mature markets, as well as the loss of disposable income

by consumers as a result of prior different quarters of high

interest rates and inflation.

The emerging markets, and in particular East Europe and the

Middle East, are still curbed by the worsening of international

relations and the associated conflicts.

C. Distribution

During the first nine months of 2024, the Group distributed its

branded collections in 103 countries, according to the following

table.

Direct Retail

FOS

Total retail stores

(Sept. 30, 2024)

North America

22(1)

10

32

West & South Europe

31

100

131

Greater China

19(2)

325

344

Emerging Markets

─

78

78

Rest of the World

4

89

93

Total

76

602

678

(1) Included 3 DOS in the U.S. managed in

joint venture with a local partner. As the Natuzzi Group does not

exert full control in each of these DOS, we consolidate only the

sell-in from such DOS.

(2) All directly operated by our joint

venture in China. As the Natuzzi Group owns a 49% stake in the

joint venture and does not control it, we consolidate only the

sell-in from such DOS.

FOS = Franchise stores managed by

independent partners.

The Group also sells its branded products by means of 628

Natuzzi galleries (including 12 Natuzzi Concessions, i.e.,

store-in-store points of sale directly managed by the Mexican

subsidiary of the Group).

During the first nine months of 2024, the Group's invoiced sales

from direct retail, including DOS and Concessions operated

by the Group, were €57.4 million, compared to €54.0 million in 2023

same period. This growth was primarily driven by a 22.3% increase

in sales from our US-based DOS. In 2024 we also closed two

non-performing stores in Zurich, Switzerland, and Madrid,

Spain.

During the first nine months of 2024, invoiced sales from

franchise stores (FOS) amounted to €97.8 million, compared

to €98.7 million in 2023 same period.

We continue executing our strategy to evolve into a

Brand/Retailer and improve the quality of our distribution network.

The weight of the invoiced sales generated by the retail network

(Direct retail and Franchise Operated Stores) on total upholstered

and home furnishings business in the first nine months of 2024 was

65.3% compared to 64.1% in 2023 same period and compared to 44.1%

in 2019 same period.

The Group also sells its products through the wholesale

channel, consisting primarily of Natuzzi-branded galleries in

multi-brand stores, as well as mass distributors selling mainly

unbranded products. During the first nine months of 2024, invoiced

sales from the wholesale channel amounted to €82.6 million,

compared to €85.5 million in 2023 same period.

We are placing renewed emphasis on the wholesale segment of our

business, which remains a strategic channel in several geographies,

including the U.S. and Europe. To support this, we are introducing

a re-imagined gallery concept, which provides a practical setting

for sales associates to engage with clients, narrate the

captivating Natuzzi story, showcase our collections, and support

sales.

GROSS MARGIN

Gross margin for the first nine months of 2024 was 35.8%,

which compares to 35.8% in 2023 and 29.0% in 2019 same periods.

Net of the (€4.1) million of one-off severance costs included in

cost of sales, gross margin for the first nine months of

2024 would have been 37.4%. This would compare to 36.3% in 2023

same period and 30.0% in 2019 same period.

2024 Gross margin was partially affected by the weak business

trend during 3Q 2024, that impacted deliveries in August and

September, below the average for 2024. This resulted in a less

efficient absorption of fixed costs, which, together with a

different brand mix, inventory exits and costs related to moving

production from Shanghai to Quanjiao, weighed on the improving

trajectory of gross margin.

2024 consumption was (36.5%) on revenues, improving from (37.4%)

in 2023 same period.

In 2024, labor costs increased by €2.8 million compared to the

same period in 2023. This rise includes €4.1 million in one-off

severance-related expenses, primarily in China, Romania, and Italy,

reflecting our ongoing efforts to optimize workforce levels across

the Group's facilities. Additionally, labor costs rose in Romania,

as part of the Government plan to increase the minimum wage, and in

Italy, due to the renegotiation of national collective bargaining

agreements.

3Q 2024 gross margin was 31.8%, compared to 35.4% in 3Q

2023 and 28.7% in 3Q 2019, as per the factors explained above.

Net of the (€2.9) million of one-off severance costs, 3Q 2024

gross margin would have been 35.7%, which would compare to

35.5% in 3Q 2023 and 30.5% in 3Q 2019.

OPERATING EXPENSES

During the first nine months of 2024, operating expenses, which

includes selling expenses, administrative expenses, other operating

income/expenses, and the impairment of trade receivables, totaled

(€90.8) million, or (37.2)% of revenue, compared to (€89.7)

million, or (36.7)% of revenue in 2023 same period.

In 2024, in particular, selling and administrative expenses were

affected by the following factors, for a total of €3.1 million,

compared to 2023 same period:

- a €2.1 million of extra costs related to

the opening of new DOS as well from the 4 additional stores opened

in 2023;

- a €1.0 million reduction in incentives from

the Italian government compared to 2023 same period.

During the first nine months of 2024, we accrued €0.7 million,

to reduce the number of employees in Italy and in some of the

Group’s subsidiaries.

During the first nine months of 2024, transportation costs as a

percentage of revenue decreased to (7.8%) from (8.3%) during the

same period in 2023. However, in 3Q 2024, they rose to (8.6%),

compared to (7.6%) in 3Q 2023, primarily due to the Suez Canal

crisis, which required rerouting shipments from China and Vietnam.

To counter this inflationary pressure, the Company implemented

freight surcharges starting in August 2024.

In addition, within “Other income”, during the first nine months

of 2023, we benefitted from €2.0 million of extraordinary income

mainly related to freight surcharges. In 2024, the benefits of

similar extraordinary income were not significant.

NET FINANCE INCOME/(COSTS)

During the first nine months of 2024, the Company accounted for

a total of (€7.4) million of Net Finance costs, compared to a total

of (€5.6) million of Net Finance costs in 2023 same period.

One of the main drivers of the difference between the two

periods relates to unfavorable currency exchange movements,

resulting in a net exchange rate loss of (€0.7) million in 2024,

compared to a net exchange rate gain of €0.3 million in 2023 same

period. Furthermore, persisting high interest rates continue to

adversely impact our results, principally in terms of high interest

expenses on lease contracts as well as third-party financing,

resulting in 2024 finance costs of (€7.3) million compared to

finance costs of (€6.6) million in 2023 same period.

2024 THIRD QUARTER: KEY RESULTS

During 3Q 2024, the Company reported the following results:

─ Total revenue of €75.0 million, in line with €74.9 million in

3Q 2023. The third quarter is historically our slowest quarter, as

Italian factories are customarily shut down for most of August. In

addition, delivered sales during 3Q 2024 were significantly

impacted by ongoing challenging business conditions resulting in

lower than usual delivered sales in August and September.

─ We had gross margin of 31.8%, compared to 35.4% in 3Q 2023 and

28.7% in 3Q 2019. Excluding (€2.9) million of one-off

severance-related costs to reduce workforce mainly at our Chinese

factory, 3Q 2024 gross margin would have been 35.7%. As

anticipated, 3Q 2024 gross margin was affected by a weak business

trend during the quarter, particularly impacting delivered sales of

Natuzzi Italia products, resulting in a less efficient absorption

of fixed costs. In addition, a different brand mix, inventory exits

and costs related to moving production from Shanghai to Quanjiao,

further weighed on gross margin in 3Q 2024.

─ Operating expenses, which includes selling expenses,

administrative expenses, other operating income/expenses, and the

impairment of trade receivables, totaled (€27.7) million, or

(36.9)% of revenue, compared to (€27.8) million, or (37.2)% of

revenue in 3Q 2023.

─ Depreciation and amortization, which include also the

depreciation charge of right-of-use assets related to the operating

leases and accounted for in the cost of sales, selling and

administrative expenses, amounted to €5.1 million in 3Q 2024,

compared to €5.7 million in 3Q 2023 and €6.2 million in 3Q

2019.

─ In 3Q 2024 operating loss was (€3.8) million, which compares

to a loss of (€1.4) million in 3Q 2023, and a loss of (€8.7)

million in 3Q 2019. Net of the (€3.4) million of one-off severance

costs, 3Q 2024 would have reported an operating loss of (€0.4)

million.

─ Total Net Finance costs were (€3.3) million, compared to total

Net Finance Costs of (€1.4) million in 3Q 2023, mainly as a result

of:

i) a €0.5 million increase in finance costs

due to persisting high interest rates affecting in particular

interest expenses on lease contracts and third-party financing,

and

ii) a €1.2 million negative difference from

net exchange rate, following unfavorable currency movements.

─ We had a loss after tax for the period of (€7.4) million,

primarily driven by the factors outlined above. This compares to a

loss after tax of (€2.7) million in 3Q 2023 and to a loss after tax

of (€11.7) million in 3Q 2019.

CASH FLOW AND BALANCE SHEET

As of September 30, 2024, we held €17.1 million in cash, from

€33.6 million as of December 31, 2023, representing a decrease of

€16.5 million. In particular, the difference in cash is determined

as follows:

─ Net cash used in operating activities (€5.1) million. Of this,

(€6.0) million to reduce workforce;

─ Net cash used in investing activities (€5.4) million;

─ Net cash used in financing activities (€7.1) million;

─ Effect of movements exchange rates on cash (€0.4) million;

─ Difference in bank-overdraft repayable on demand €1.5

million.

As of September 30, 2024, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€28.7) million,

compared to (€6.6) million as of December 31, 2023, indicating a

deterioration of €22.1 million in the period.

*******

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the third quarter of 2024 and 2023

on the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

Third quarter ended on

Change

Percentage of revenue 30-Sep-24 30-Sep-23

%

30-Sep-24 30-Sep-23 Revenue

75.0

74.9

0.1

%

100.0

%

100.0

%

Cost of Sales

(51.1

)

(48.4

)

5.7

%

-68.2

%

-64.6

%

Gross profit

23.8

26.5

-10.0

%

31.8

%

35.4

%

Other income

1.3

2.4

1.8

%

3.2

%

Selling expenses

(20.3

)

(21.6

)

-6.2

%

-27.0

%

-28.8

%

Administrative expenses

(8.5

)

(8.6

)

-0.8

%

-11.3

%

-11.4

%

Impairment on trade receivables

(0.3

)

(0.0

)

-0.4

%

0.0

%

Other expenses

0.0

(0.1

)

0.1

%

-0.1

%

Operating profit/(loss)

(3.8

)

(1.4

)

-5.1

%

-1.8

%

Finance income

0.2

0.4

0.3

%

0.5

%

Finance costs

(2.4

)

(1.9

)

-3.1

%

-2.5

%

Net exchange rate gains/(losses)

(1.1

)

0.1

-1.5

%

0.2

%

Net finance income/(costs)

(3.3

)

(1.4

)

-4.4

%

-1.9

%

Share of profit/(loss) of equity-method investees

(0.0

)

0.4

0.0

%

0.5

%

Profit/(Loss) before tax

(7.1

)

(2.4

)

-9.4

%

-3.2

%

Income tax expense/(benefit)

(0.3

)

(0.3

)

-0.4

%

-0.4

%

Profit/(Loss) for the period

(7.4

)

(2.7

)

-9.9

%

-3.6

%

Profit/(Loss) attributable to: Owners of the Company

(7.8

)

(2.7

)

Non-controlling interests

0.3

0.0

Natuzzi S.p.A. and Subsidiaries Unaudited

consolidated statement of profit or loss for the nine months of

2024 and 2023 on the basis of IFRS-IAS (expressed in millions Euro,

except as otherwise indicated)

Nine months ended on

Change

Percentage of revenue 30-Sep-24 30-Sep-23

%

30-Sep-24 30-Sep-23 Revenue

243.9

244.5

-0.3

%

100.0

%

100.0

%

Cost of Sales

(156.7

)

(157.0

)

-0.2

%

-64.25

%

-64.21

%

Gross profit

87.2

87.5

-0.4

%

35.8

%

35.8

%

Other income

3.8

6.0

1.6

%

2.5

%

Selling expenses

(67.3

)

(68.2

)

-1.4

%

-27.6

%

-27.9

%

Administrative expenses

(27.0

)

(27.3

)

-1.1

%

-11.1

%

-11.1

%

Impairment on trade receivables

(0.3

)

(0.1

)

-0.1

%

0.0

%

Other expenses

(0.1

)

(0.2

)

0.0

%

-0.1

%

Operating profit/(loss)

(3.6

)

(2.2

)

-1.5

%

-0.9

%

Finance income

0.6

0.7

0.2

%

0.3

%

Finance costs

(7.3

)

(6.6

)

-3.0

%

-2.7

%

Net exchange rate gains/(losses)

(0.7

)

0.3

-0.3

%

0.1

%

Net finance income/(costs)

(7.4

)

(5.6

)

-3.1

%

-2.3

%

Share of profit/(loss) of equity-method investees

0.1

2.4

0.0

%

1.0

%

Profit/(Loss) before tax

(11.0

)

(5.5

)

-4.5

%

-2.3

%

Income tax expense

(0.5

)

(0.9

)

-0.2

%

-0.3

%

Profit/(Loss) for the period

(11.5

)

(6.4

)

-4.7

%

-2.6

%

Profit/(Loss) attributable to: Owners of the Company

(11.9

)

(6.3

)

Non-controlling interests

0.4

(0.1

)

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of financial position (condensed)on the basis of

IFRS-IAS(Expressed in millions of Euro)

30-Sep-24

31-Dec-23 ASSETS Non-current assets

176.0

188.6

Current assets

140.4

149.7

TOTAL ASSETS

316.4

338.3

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

56.1

68.9

Non-controlling interests

4.6

4.3

Non-current liabilities

106.3

110.4

Current liabilities

149.5

154.7

TOTAL EQUITY AND LIABILITIES

316.4

338.3

Natuzzi S.p.A. and Subsidiaries Unaudited

consolidated statements of cash flows (condensed) (Expressed in

millions of Euro)

30-Sep-24 31-Dec-23 Net

cash provided by (used in) operating activities

(5.1

)

3.2

Net cash provided by (used in) investing activities

(5.4

)

(7.9

)

Net cash provided by (used in) financing activities

(7.1

)

(15.7

)

Increase (decrease) in cash and cash equivalents

(17.6

)

(20.4

)

Cash and cash equivalents, beginning of the year

31.6

52.7

Effect of movements in exchange rates on cash held

(0.4

)

(0.8

)

Cash and cash equivalents, end of the period

13.6

31.6

For the purpose of the statements of cash flow, cash and

cash equivalents comprise the following: (Expressed in millions

of Euro)

30-Sep-24 31-Dec-23 Cash and cash

equivalents in the statement of financial position

17.1

33.6

Bank overdrafts repayable on demand

(3.5

)

(2.0

)

Cash and cash equivalents in the statement of cash flows

13.6

31.6

CONFERENCE CALL

The Company will host a conference call on Friday December

13, 2024, at 10:00 a.m. U.S. Eastern time (4.00 p.m. Italy time, or

3.00 p.m. UK time) to discuss financial information.

To join live the conference call, interested persons will need

to either:

i) dial-in the following number: Toll/International: +

1-412-717-9633, then passcode 39252103#,

or

ii) click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join via

video. Participants also have the option to listen via phone after

registering to the link.

*****

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

Certain statements included in this press release constitute

forward-looking statements within the meaning of the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements may be expressed in a variety of ways, including the use

of future or present tense language. Words such as “estimate,”

“forecast,” “project,” “anticipate,” “likely,” “target,” “expect,”

“intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,”

“should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,”

“opportunities,” “trends,” “ambition,” “objective,” “aim,”

“future,” “potentially,” “outlook” and words of similar meaning may

signify forward-looking statements. These statements involve

inherent risks and uncertainties, as well as other factors that may

be beyond our control. The Company cautions readers that a number

of important factors could cause actual results to differ

materially from those contained in any forward-looking statement.

Such factors include, but are not limited to: effects on the Group

from competition with other furniture producers, material changes

in consumer demand or preferences, significant economic

developments in the Group’s primary markets, the Group’s execution

of its reorganization plans for its manufacturing facilities,

significant changes in labor, material and other costs affecting

the construction of new plants, significant changes in the costs of

principal raw materials and in energy costs, significant exchange

rate movements or changes in the Group’s legal and regulatory

environment, including developments related to the Italian

Government’s investment incentive or similar programs, the

duration, severity and geographic spread of any public health

outbreaks (including the spread of new variants of COVID-19),

consumer demand, our supply chain and the Company’s financial

condition, business operations and liquidity, the geopolitical

tensions and market uncertainties resulting from the ongoing armed

conflict between Russia and Ukraine and the Israel-Hamas war and

the inflationary environment and increases in interest rates. The

Company cautions readers that the foregoing list of important

factors is not exhaustive. When relying on forward-looking

statements to make decisions with respect to the Company, investors

and others should carefully consider the foregoing factors and

other uncertainties and events. Additional information about

potential factors that could affect the Company’s business and

financial results is included in the Company’s filings with the

U.S. Securities and Exchange Commission, including the Company’s

most recent Annual Report on Form 20-F. The Company undertakes no

obligation to update any of the forward-looking statements after

the date of this press release.

About Natuzzi S.p.A.

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of

the most renowned brands in the production and distribution of

design and luxury furniture. As of September 30, 2024, Natuzzi

distributes its collections worldwide through a global retail

network of 678 monobrand stores and 628 galleries. Natuzzi products

embed the finest spirit of Italian design and the unique

craftmanship details of the “Made in Italy”, where a predominant

part of its production takes place. Natuzzi has been listed on the

New York Stock Exchange since May 13, 1993. Committed to social

responsibility and environmental sustainability, Natuzzi S.p.A. is

ISO 9001 and 14001 certified (Quality and Environment), ISO 45001

certified (Safety on the Workplace) and FSC® Chain of Custody, CoC

(FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212991243/en/

For information: Natuzzi

Investor Relations Piero Direnzo | tel. +39 080-8820-812 |

pdirenzo@natuzzi.com

Natuzzi Corporate Communication Giancarlo Renna

(Communication Manager) | tel. +39. 342.3412261 |

grenna@natuzzi.com Barbara Colapinto | tel. +39 331 6654275 |

bcolapinto@natuzzi.com

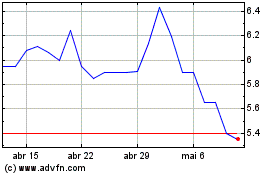

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024