THIRD QUARTER 2022

HIGHLIGHTS

- 3Q 2022 Invoiced Sales Amounted to €116.6 Million, an

Increase of 14.5% Versus 3Q 2021 and 32.4% Versus Pre-Pandemic 3Q

2019

- 3Q 2022 Branded Invoiced Sales Amounted to €103.7 Million,

an Increase of 22.5% Versus 3Q 2021 and 57.6% Versus 3Q

2019.

- Gross Margin Resulted of 37.7%, Compared to 36.0% in 3Q 2021

and 28.7% in 3Q 2019, Despite Persisting High Raw Materials Costs

and the Spike in Energy Costs

- 3Q 2022 Operating Profit of €4.1 Million Compares to an

Operating Loss of (€0.4) Million in 3Q 2021 and an Operating Loss

of (€8.7) Million In 3Q 2019

- 2022 First Nine Months Operating Profit of €6.7 Million,

Compares to €4.3 Million in 2021 Same Period, That Benefitted From

€4.2 Million One-Off COVID-related Measures. The Operating Profit

of €6.7 Million Compares to a Loss of (€19.5) Million in 2019 First

Nine Months

- 3Q 2022 Profit Per Ordinary Share of €0.10, or €0.50 Per

American Depositary Receipt (ADR), Versus a Loss Per Ordinary Share

in 3Q 2021 of (€0.07), or (€0.35) per ADR, and a Loss Per Ordinary

Share in 3Q 2019 of (€0.21), or (€1.05) Per ADR

- Cash of €53.0 Million as of September 30, 2022 Compares to

€53.5 Million as of December 31, 2021 and €39.8 Million as of

December 31, 2019

- Store Traffic and New Orders Continue the Negative Trend

Started in April and Are Below Expectations Given the Challenges

Affecting the Core Markets Where We Operate

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the third quarter and first nine months ended

September 30, 2022.

Pasquale Natuzzi, Chairman of the Group commented: “We continue

improving our operating model, as shown by the Ebit result of this

quarter. However, the business environment for the whole economy

and specifically for our industry remains challenging. The high

inflation is reducing the disposable income of our consumers. This,

together with a perduring uncertainty on the geopolitical and

economic outlook, is leading consumers to postpone their decision

to buy furniture. These dynamics have caused a weaker demand

starting from April. We remain committed to our long-term growth

plan, but we need to acknowledge the unexpected conditions of the

market we are facing. I have the highest confidence in our CEO and

our team to overcome the short-term challenges posed by the market

to our turnaround.”

Antonio Achille, CEO of the Group commented: “In the third

quarter, the work our team is doing to improve marginality, while

continuing to support the growth of our revenues, started to become

visible. We improved marginality by almost 10 percentage points vs

2019 notwithstanding the pressure of energy and other production

costs on our P&L.

At the same time, we are not isolated from the negative market

dynamics that affect consumers and retailers globally. Traffic in

our stores has been decreasing since April and our retail partners,

most notably in US, are still dealing with the extra stock they

have built over the last months, which limits their ability to

place new orders. We shared the general hope that the Chinese

Congress would have reviewed and lifted some of the zero-covid

policies which instead continue being a main obstacle to our growth

plan for the Region. The combination of these effects is causing a

material reduction in the pace of new orders.

Our commercial team is committed and working hard to sustain

revenues in response of these market challenges. We are also

evolving and strengthening our commercial organizations in our main

geographies, including US and Europe, to better manage our existing

clients and enrich the client portfolio with new selective

introductions. On the retail front, we continue investing to

improve the organic growth of our stores reaching the level of

retail excellence the Company aspires to, for the benefit of both

our DOS and our franchising partners. To accelerate this process,

we recently hired a new senior manager, Mr. Michele Ciani, who will

be responsible for the Retail Customer Experience for the Group.

Michele brings a wealth of deep retail knowledge and more than 20

years of experience within multination furniture retailers to help

them sharpening their brand & story visual identity in Europe

and China.

Despite the adverse market conditions, we continued our retail

journey: during the first nine months of 2022, we added 55 Natuzzi

franchise stores, of which 43 located in China. This brings the

total number of stores to 708, of which 51 DOS directly managed by

the Group in addition to 24 DOS directly managed by our JV in

China.

The price adjustments, enacted in the first part of the year to

contrast the rising trend in the cost of transportation, energy,

raw materials and production inputs, are now almost entirely

factorized in the top line and that have helped us protect our

marginality from the continue pressure of cost on our business.

In particular, the energy cost to run our industrial operations

worldwide has increased by €2.8 million compared to the first nine

months of 2021, mainly concentrated in our European factories. For

instance, if we consider our factories in Italy, which represent

almost half of the consolidated sales, the energy cost has

increased by 140% in the first nine months of 2022.

As for the remaining production costs, we are seeing a

decreasing trend in the cost of leather, whereas the cost for

fabrics and other materials, which absorb significant energy for

their production, is still increasing.

Transportation, costs are decreasing, especially for the long

Asia-North America routes.

In response to the tough market conditions, we have launched a

set of actions to lower the costs of our G&A, tightly manage

our working capital and protect our cash position.

*****

3Q 2022 CONSOLIDATED REVENUE

3Q 2022 consolidated revenue amounted to €116.6 million, an

increase of 14.5% from €101.8 million in 3Q 2021, and 32.4% from

€88.1 million of the pre-pandemic 3Q 2019.

During the third quarter, the Group’s Shanghai factory carried

out its operations with no COVID-related restrictions.

Excluding “other sales” of €2.6 million, 3Q 2022 invoiced sales

from upholstered and other home furnishings products amounted to

€114.0 million, an increase of 15.8% compared to 3Q 2021 and 36.3%

compared to the pre-pandemic 3Q 2019. Delivered sales of

upholstered and home furnishings benefitted from the reduction in

the order backlog which is now approaching to its standard

levels.

Revenue from upholstered and other home furnishings products are

hereafter described according to the main dimensions of the Group’s

business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. Branded/Unbranded business

The Group operates in the branded business (with the Natuzzi

Italia, Natuzzi Editions and Divani&Divani by Natuzzi) and the

unbranded business, the latter with collections dedicated to

large-scale distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brands strategy:

- Natuzzi Italia, our luxury

furniture brand, offers products entirely designed and manufactured

in Italy and targets an affluent and more sophisticated global

consumer with a highly inspirational collection that is largely the

same across all our global stores to best represent our Brand.

Natuzzi Italia products are almost exclusively sold in mono-brand

stores (directly operated or franchises).

- Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania, Brazil). Natuzzi

Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi. The store merchandising of Natuzzi

Editions, starting from a common collection, is tailored to best

fit the opportunities of each market. The Natuzzi Editions products

are sold primarily through galleries and selected mono-brand

franchise stores.

In 3Q 2022, Natuzzi’s branded invoiced sales amounted to €103.6

million, an increase of 22.5% compared to 3Q 2021 and 57.6%

compared to 3Q 2019.

The following is the contribution of each Brand to 3Q 2022

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €42.7 million,

an increase of 15.1% compared to 3Q 2021 and 36.6% compared to 3Q

2019.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €60.9 million,

an increase of 28.3% compared to 3Q 2021, and 76.8% compared to the

pre-pandemic 3Q 2019.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €10.4 million, a decrease of (25.4%) and

(42.0%) compared to 3Q 2021 and 3Q 2019, respectively. The

Company’s strategy is to focus on selected large accounts and serve

them with a more efficient go-to-market model.

B. Key Markets

Here below a breakdown of 3Q 2022 upholstery and

home-furnishings invoiced sales compared to 3Q 2021, according to

the following geographic areas.

3Q 2022

3Q 2021

Delta €

Delta %

North America

37.4

38.5

(1.1)

(2.8)%

Greater China

20.0

9.1

10.9

118.8%

West & South Europe

26.6

28.9

(2.3)

(8.0)%

Emerging Markets

13.9

10.3

3.6

35.9%

Rest of the World*

16.1

11.7

4.4

37.7%

Total

114.0

98.5

15.5

15.8%

Figures in €/million, except percentage

*Include South and Central America, Rest of APAC.

The performance of invoiced sales in the North America is mainly

due to the unbranded business, as the branded part increased medium

single digit over 3Q 2021.

West & South Europe suffered from a challenging comparison

base in 3Q 2021, and it is still up medium single digit versus 3Q

2019.

C. Distribution

During 3Q 2022, the Group distributed its branded collections in

105 countries, according to the following table.

Direct Retail

FOS**

Galleries

Total

Sept. 30, 2022

North America

12

8

152

172

West & South Europe

34

100

130

264

Greater China

24(1)

359

─

383

Emerging Markets

─

77

141

218

Rest of the World

5

89

98*

192

Total

75

633

521

1,229

* It

includes 11 Natuzzi galleries (store-in-store points of sale)

directly managed by the Mexican subsidiary of the Group.

**

Franchise stores managed by independent partners.

(1) All directly operated by our Joint Venture in

China. As the Natuzzi Group owns a 49% stake in the Joint Venture

and does not control it, we consolidate only the sell-in from such

DOS.

During 3Q 2022, Group’s direct retail invoiced sales amounted to

€19.3 million, an increase of 20.9% compared to 3Q 2021, mainly due

to our DOS located in the U.S. (+35.4% compared to 3Q 2021).

In 3Q 2022, invoiced sales from franchise stores amounted to

€50.8 million, an increase of 90.3% compared to 3Q 2021.

We continue executing our strategy to become a Brand Retailer

and improve the quality of our distribution network. The weight of

the invoiced sales generated by the retail network (Directly

Operated Stores, or DOS, and Franchise Operated Stores, or FOS) on

total upholstered and home furnishings business in 3Q 2022 was

61.5% compared to 43.3% in 3Q 2021.

During the first nine months of 2022, we added 55 Natuzzi

franchise stores to our distribution network, of which 43 located

in China, four in Brazil, three in Italy and two in the US.

The Group also sells its products through the wholesale channel,

consisting primarily of Natuzzi-branded galleries in multi-brand

stores, as well as mass distributors selling unbranded products.

During 3Q 2022, invoiced sales from the wholesale channel amounted

to €43.9 million, a decrease of (21.3%) compared to 3Q 2021.

3Q 2022 GROSS MARGIN

In 3Q 2022, we had a gross margin of 37.7%, as compared to 36.0%

in 3Q 2021, mainly due a better operating leverage from higher

delivered sales, a favorable sales mix, higher efficiency in our

manufacturing processes, as well as effective price adjustments

that were enacted in the first part of the year in response to

inflationary pressure.

In particular, during the quarter, industrial costs at the Group

level increased by €0.9 million over 3Q 2021, mostly due to the

spike in the cost of energy.

As for production inputs, we continue to see a mixed picture.

Indeed, the cost of some raw materials, especially those that are

energy-intensive, such as iron components and mechanisms, or wood,

as well as oil-related products, such us polyurethane, still

remains at high levels. On the contrary, we see some downward trend

in the cost of leather.

In response to the current challenging business environment, the

Company has started to take actions to reduce the industrial cost

of labor, by optimizing the level of indirect workers, rightsizing

of workers at Group level, in addition to a generalized review of

the industrial fixed costs.

3Q 2022 OPERATING EXPENSES

During 3Q 2022, operating expenses (which include selling

expenses, administrative expenses, other operating income/expenses,

and the impairment of trade receivables) were €39.8 million (or

34.1% on revenue), compared to €37.1 million (or 36.4% on revenue)

in 3Q 2021.

In particular, in 3Q 2022, transportation costs were 12.4% of

revenue as compared to 13.1% in 3Q 2021.

In addition, following the adoption of the Stock Option Plan

(“SOP”) approved by the Company’s shareholders on July 1, 2022, and

pursuant to the registration statement on Form S-8 filed with the

SEC on July 29, 2022, during the third quarter of 2022 the Company

accrued €0.6 million for higher labor cost within selling expenses

on the basis of an independent qualified third-party estimation of

the fair value of the equity instruments granted under the SOP.

KEY RESULTS SUMMARY: FIRST NINE MONTHS OF 2022

During the first nine months of 2022, the Company reported the

following results:

- Total revenue of €352.0 million, an increase of 12.9% compared

to first nine months of 2021 and 22.9% compared to the first nine

months of the pre-pandemic 2019.

- We had a gross margin of 34.4%, from 36.1% and 29.0% reported

in the first nine months of 2021 and 2019, respectively.

- Depreciation and amortization for the period, which include the

depreciation charge of right-of-use assets related to the operating

leases and accounted for in the cost of sales, selling and

administrative expenses, amounted to €16.0 million, compared to

€15.6 million and €17.7 million in the first nine months of 2021

and 2019, respectively.

- We had an operating profit of €6.7 million, compared to an

operating profit of €4.3 million in 2021 first nine months, which

benefitted also from €4.2 million of higher savings deriving from

the adoption, mainly in Italy, of temporary public measures on the

cost of labor, most of which were COVID-related. Such benefits were

not renewed in 2022. The €6.7 million operating profit compares to

an operating loss of (€19.5) million reported for the first nine

months of 2019.

- We had a profit after tax for the period of €6.6 million, which

compares to a profit after tax of €2.5 million in 2021 that

included a one-off gain of €4.8 million from the disposal of a

formerly wholly owned subsidiary of the Company, as part of

Natuzzi’s strategy to streamline its operating model. The €6.6

million profit after tax compares to a loss after tax of (€26.8)

million reported for the first nine months of 2019.

BALANCE SHEET AND CASH FLOW

During the first nine months of 2022, €6.0 million of net cash

were provided by operating activities as a result of:

- profit for the period of €6.6 million;

- adjustments for non-monetary items of €16.9 million, of which

depreciation and amortization of €16.0 million;

- (€9.9) million of cash used in working capital mainly as a

result of higher inventories, (€2.9) million, higher trade and

other receivables, (€7.9) million, partially offset by higher trade

and other payables;

- interest and taxes paid of (€7.5) million.

During the first nine months of 2022, (€2.3) million of cash

were used in investing activities, as a result of (€6.6) million of

cash invested in capital expenditures, (€0.5) million as capital

contribution in the joint venture Natuzzi Texas LLC to open Natuzzi

stores, partially offset by €3.7 million as dividends received from

our JV in China in addition to €1.1 million of cash collected in

connection with the completion of the sale transaction of a former

Company’s subsidiary.

In the same period, (€6.3) million of cash were used in

financing activities, due to the repayment of long-term borrowing

for (€3.7) million, (€2.5) million for short-term borrowing

repayment and (€9.0) million for lease repayment, partially offset

by €4.0 million provided by a long-term loan made available by the

Italian government as part of the COVID-19 measures to support

businesses, and €4.9 million as a capital contribution by the

Vietnamese partner who acquired a 20% stake in Natuzzi

Singapore.

As a result, as of September 30, 2022, cash and cash equivalents

was €53.0 million compared to €53.5 million as of December 31,

2021.

As of September 30, 2022, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of €1.0 million compared

to (€0.1) million as of December 31, 2021.

CONFERENCE CALL

The Company will host a conference call to discuss the third

quarter 2022 financial results on Monday, November 28, 2022, at

10:00 a.m. US Eastern Time.

To join live the conference call, interested persons will need

to either

- dial-in the following number: Toll/International:

+1-412-717-9633, then passcode 39252103#; or

- click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join

via video. Participants also have option to listen via phone after

registering to the link.

***********

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the third quarter of 2022 and 2021

on the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

Third quarter ended on

Change

Percentage of revenue

30-Sep-22

30-Sep-21

%

30-Sep-22

30-Sep-21

Revenue

116.6

101.8

14.5%

100.0%

100.0%

Cost of Sales

(72.7)

(65.2)

11.5%

-62.3%

-64.0%

Gross profit

43.9

36.6

19.9%

37.7%

36.0%

Other income

2.0

2.0

1.7%

1.9%

Selling expenses

(32.6)

(30.8)

5.7%

-27.9%

-30.2%

Administrative expenses

(9.1)

(8.1)

11.5%

-7.8%

-8.0%

Impairment on trade receivables

0.1

(0.1)

0.0%

-0.1%

Other expenses

(0.2)

(0.1)

-0.2%

0.0%

Operating profit/(loss)

4.1

(0.4)

3.6%

-0.4%

Finance income

0.6

0.0

0.5%

0.0%

Finance costs

(2.2)

(1.9)

-1.8%

-1.9%

Net exchange rate gains/(losses)

3.1

(0.3)

2.7%

-0.3%

Gain from disposal and loss of control of a subsidiary ─ ─

0.0%

0.0%

Net finance income/(costs)

1.6

(2.2)

1.4%

-2.2%

Share of profit/(loss) of equity-method investees

1.1

0.8

1.0%

0.8%

Profit/(Loss) before tax

6.9

(1.9)

5.9%

-1.8%

Income tax expense

(1.0)

(1.5)

-0.9%

-1.4%

Profit/(Loss) for the period

5.9

(3.3)

5.0%

-3.3%

Profit/(Loss) attributable to: Owners of the Company

5.4

(3.6)

Non-controlling interests

0.5

0.3

Profit/(loss) per Ordinary Share*

0.10

(0.07)

* Natuzzi’s Ordinary Shares are listed on the NYSE in the form

of American Depositary Receipts (ADRs). 1 ADR represents 5 Ordinary

Shares

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the nine months of 2022 and 2021 on

the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

Nine months ended on

Change

Percentage of revenue

30-Sep-22

30-Sep-21

%

30-Sep-22

30-Sep-21

Revenue

352.0

311.8

12.9%

100.0%

100.0%

Cost of Sales

(230.8)

(199.2)

15.9%

-65.6%

-63.9%

Gross profit

121.2

112.6

7.7%

34.4%

36.1%

Other income

4.8

5.0

1.4%

1.6%

Selling expenses

(92.8)

(89.7)

3.5%

-26.4%

-28.8%

Administrative expenses

(25.9)

(23.4)

10.9%

-7.4%

-7.5%

Impairment on trade receivables

(0.3)

(0.1)

-0.1%

0.0%

Other expenses

(0.3)

(0.1)

-0.1%

0.0%

Operating profit/(loss)

6.7

4.3

1.9%

1.4%

Finance income

0.7

0.1

0.2%

0.0%

Finance costs

(5.9)

(5.2)

-1.7%

-1.7%

Net exchange rate gains/(losses)

4.8

(1.0)

1.4%

-0.3%

Gain from disposal and loss of control of a subsidiary ─

4.8

0.0%

1.5%

Net finance income/(costs)

(0.4)

(1.4)

-0.1%

-0.4%

Share of profit/(loss) of equity-method investees

1.9

2.8

0.6%

0.9%

Profit/(Loss) before tax

8.2

5.7

2.3%

1.8%

Income tax expense

(1.6)

(3.2)

-0.5%

-1.0%

Profit/(Loss) for the period

6.6

2.5

1.9%

0.8%

Profit/(Loss) attributable to: Owners of the Company

5.4

2.1

Non-controlling interests

1.1

0.4

Profit/(loss) per Ordinary Share

0.10

0.04

* Natuzzi’s Ordinary Shares are listed on the NYSE in the form

of American Depositary Receipts (ADRs). 1 ADR represents 5 Ordinary

Shares

Natuzzi S.p.A. and Subsidiaries

Unaudited consolidated

statements of financial position (condensed)

on the basis of

IFRS-IAS

(Expressed in millions of

Euro)

30-Sep-22

31-Dec-21

ASSETS

Non-current assets

187.5

189.6

Current assets

211.2

200.4

TOTAL ASSETS

398.6

390.0

EQUITY AND LIABILITIES

Equity attributable to Owners of the Company

98.0

82.3

Non-controlling interests

5.0

1.5

Non-current liabilities

100.2

107.5

Current liabilities

195.4

198.7

TOTAL EQUITY AND LIABILITIES

398.6

390.0

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

30-Sep-22

31-Dec-21

Net cash provided by (used in) operating

activities

6.0

0.5

Net cash provided by (used in) investing activities

(2.3)

7.0

Net cash provided by (used in) financing activities

(6.3)

(2.0)

Increase (decrease) in cash and cash equivalents

(2.5)

5.5

Cash and cash equivalents, beginning of the year

52.2

46.1

Effect of movements in exchange rates on cash held

1.6

0.6

Cash and cash equivalents, end of the period

51.3

52.2

For the purpose of the statements of cash flow,

cash and cash equivalents comprise the following: (Expressed in

millions of Euro)

30-Sep-22

31-Dec-21

Cash and cash equivalents in the statement of financial position

53.0

53.5

Bank overdrafts repayable on demand

(1.6)

(1.2)

Cash and cash equivalents in the statement of cash flows

51.3

52.2

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS Certain statements included

in this press release constitute forward-looking statements within

the meaning of the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, as amended. These statements may be expressed in a

variety of ways, including the use of future or present tense

language. Words such as “estimate,” “forecast,” “project,”

“anticipate,” “likely,” “target,” “expect,” “intend,” “continue,”

“seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,”

“may,” “might,” “will,” “strategy,” “synergies,” “opportunities,”

“trends,” “ambition,” “objective,” “aim,” “future,” “potentially,”

“outlook” and words of similar meaning may signify forward-looking

statements. These statements involve risks and uncertainties that

could cause the Company’s actual results to differ materially from

those stated or implied by such forward-looking statements

including, but not limited to, potential risks and uncertainties

described at page 3 of this document relating to the supply-chain,

the cost and availability of raw material, production and shipping

and the modernization of our Italian manufacturing and those

relating to the duration, severity and geographic spread of the

COVID-19 pandemic, actions that may be taken by governmental

authorities to contain the COVID-19 pandemic or to mitigate its

impact, the potential negative impact of COVID-19 on the global

economy, consumer demand and our supply chain, and the impact of

COVID-19 on the Company's financial condition, business operations

and liquidity, as well as the geopolitical tensions and market

uncertainties resulting from the Russian invasion of Ukraine and

current conflict. Additional information about potential factors

that could affect the Company’s business and financial results is

included in the Company’s filings with the U.S. Securities and

Exchange Commission, including the Company’s most recent Annual

Report on Form 20-F. The Company undertakes no obligation to update

any of the forward-looking statements after the date of this press

release.

About Natuzzi S.p.A. Founded

in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of the most

renowned brands in the production and distribution of design and

luxury furniture. With a global retail network of 708 mono-brand

stores and 521 galleries as of September 30, 2022, Natuzzi

distributes its collections worldwide. Natuzzi products embed the

finest spirit of Italian design and the unique craftmanship details

of the “Made in Italy”, where a predominant part of its production

takes place. Natuzzi has been listed on the New York Stock Exchange

since May 13, 1993. Always committed to social responsibility and

environmental sustainability, Natuzzi S.p.A. is ISO 9001 and 14001

certified (Quality and Environment), ISO 45001 certified (Safety on

the Workplace) and FSC® Chain of Custody, CoC (FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221125005302/en/

For information: Natuzzi

Investor Relations James Carbonara | tel. +1 (646)-755-7412 |

james@haydenir.com Piero Direnzo | tel. +39 080-8820-812 |

pdirenzo@natuzzi.com

Natuzzi Corporate Communication Giacomo Ventolone (Press

Office) | tel. +39.335.7276939 | gventolone@natuzzi.com

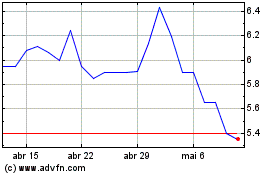

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025