Net Sales Decreased 17% and Diluted EPS

Decreased 63% to $1.09

Organic Net Sales1 Decreased 11% and

Adjusted Diluted EPS Fell 44% in Constant Currency

Exceeded Adjusted Diluted EPS Outlook

Despite Incremental External Headwinds

Lowering Second Half Outlook Amid Volatility

in Travel Retail

The Estée Lauder Companies Inc. (NYSE: EL) today reported net

sales of $4.62 billion for its second quarter ended December 31,

2022, a decline of 17% from $5.54 billion in the prior-year period,

including negative impacts from foreign currency. Organic net sales

fell 11%. In the fiscal 2023 second quarter, the evolution of the

COVID-19 environment, including restrictions in mainland China and

the rising number of COVID cases (collectively “COVID-related

impacts”), led to stronger headwinds as the quarter progressed. As

a result, tourism and product shipments to Hainan remained largely

curtailed and traffic in brick-and-mortar in the rest of China was

limited. These challenges were partially offset by broad-based

strong organic net sales growth across developed and emerging

markets globally. Organic net sales benefited from continued

double-digit growth in Fragrance as well as strong holiday

offerings and performance during the 11.11 Global Shopping

Festival.

The Company reported net earnings of $0.39 billion, compared

with net earnings of $1.09 billion in the prior-year period2.

Diluted net earnings per common share was $1.09, compared with

$2.97 reported in the prior-year period, including the impacts of

other intangible asset impairments. Excluding restructuring and

other charges and adjustments as detailed on page 3, adjusted

diluted net earnings per common share declined 49% to $1.54,

decreasing 44% in constant currency, better than the Company’s

expectations. These declines include a negative impact of 4% from

certain foreign currency transactions in key international travel

retail locations.

Fabrizio Freda, President and Chief Executive Officer said, “We

delivered on our expectations for the second quarter of fiscal

2023, despite the incremental pressure of COVID-19 in China in

December. Many developed and emerging markets around the world

outperformed to realize our organic sales growth outlook and, given

disciplined expense management and moderation of the stronger U.S.

dollar, we exceeded our adjusted diluted EPS outlook. Fragrance

excelled globally, while Makeup prospered in a great number of

markets, as our brands are realizing the promise of the category’s

renaissance as usage occasions resume.

__________________________________

1 Organic net sales represents net sales

excluding returns associated with restructuring and other

activities; non-comparable impacts of acquisitions, divestitures

and brand closures; as well as the impact from foreign currency

translation. The Company believes that the Non-GAAP measure of

organic net sales growth provides year-over-year sales comparisons

on a consistent basis. See page 2 for reconciliations to GAAP.

2 Net earnings attributable to The Estée

Lauder Companies Inc. which excludes net loss (earnings)

attributable to redeemable noncontrolling interests for the second

fiscal quarter of fiscal 2023 and fiscal 2022 and noncontrolling

interests for the second quarter of fiscal 2022.

For fiscal 2023, we are lowering our outlook given the November

and December disruption to travel and staffing levels in Hainan

that slowed the expected normalization of inventory and the

recently-announced potential roll-back of COVID-related supportive

measures in Korea duty free. Together, these are creating a

near-term, transitory pressure to our travel retail business. In

the third quarter, this is more than offsetting the initial

positive impact from the resumption of international travel by

Chinese consumers, as well as favorable trends from our second

quarter results, including outstanding performance across many

developed markets in Western Europe and Asia/Pacific, as well as

many emerging markets globally, and a less onerous currency

environment. All told, our return to growth has shifted to the

fourth quarter. We remain focused on investing in our brands,

including for innovation, advertising, and entry into new

countries, among others, to fuel our multiple engines of growth

strategy.”

Freda concluded, “We are encouraged by both our strong momentum

in numerous markets globally and improving macro trends. Moreover,

so far this fiscal year, we have made exciting progress on several

strategic initiatives to drive growth and resiliency in our

business, with the opening of our China Innovation Labs as well as

our first-ever manufacturing facility in Asia/Pacific, and with our

deal to acquire Tom Ford, to name just a few. We have great

confidence that we will emerge from this year even better

positioned to realize the long-term growth opportunities of global

prestige beauty.”

Business Update The COVID-19

pandemic continued to disrupt the Company’s operating environment

through the first half of fiscal 2023, including the COVID-related

impacts, affecting Asia travel retail, particularly Hainan, and

retail traffic in mainland China. In Asia travel retail, these

challenges led to prolonged store closures as well as the

curtailment of travel and caused the tightening of inventory by

certain retailers who had previously placed orders in anticipation

of the return of travel that was since delayed.

During the first half of fiscal 2023, the Company’s business was

also negatively impacted by the strong U.S. dollar, along with

inflationary pressures and recession concerns, which caused certain

retailers in the United States to tighten inventory. While the

Company’s monthly retail trends improved sequentially during the

fiscal 2023 second quarter in the United States, the pace was

slower than anticipated resulting in lower replenishment orders

compared to the prior-year period.

Fiscal 2023 Second Quarter

Results Product category and geographic region net sales

commentary reflect organic performance.

Reconciliation between GAAP

and Non-GAAP Net Sales Growth (Unaudited)

Three Months Ended December

31, 2022(3)

As Reported - GAAP(1)

(17

)%

Organic, Non-GAAP(2)

(11

)%

Impact of the license terminations related

to certain of the Company’s designer fragrances

(1

)

Impact of foreign currency translation

(5

)

Returns associated with restructuring and

other activities

—

As Reported - GAAP(1)

(17

)%

(1)Includes returns associated with

restructuring and other activities

(2)Organic net sales growth represents net

sales growth excluding returns associated with restructuring and

other activities; non-comparable impacts of acquisitions,

divestitures and brand closures (the license terminations related

to certain of the Company’s designer fragrances); as well as the

impact of foreign currency translation.

(3)Percentages are calculated on an

individual basis

Adjusted diluted net earnings per common share excludes

restructuring and other charges and adjustments as detailed in the

following table.

Reconciliation between GAAP

and Non-GAAP - Diluted Net Earnings Per Share (“EPS”)

(Unaudited)

Three Months Ended

December 31

2022

2021

Growth

As Reported EPS - GAAP(1)

$

1.09

$

2.97

(63

)%

Non-GAAP

Restructuring and other charges

.02

.03

Change in fair value of

acquisition-related stock options (less the portion attributable

to

redeemable noncontrolling interest)

(.01

)

.01

Other intangible asset impairments

.44

—

Adjusted EPS - Non-GAAP

$

1.54

$

3.01

(49

)%

Impact of foreign currency translation on

earnings per share

.15

Adjusted Constant Currency EPS -

Non-GAAP

$

1.69

$

3.01

(44

)%

(1)Includes restructuring and other

charges and adjustments

Net sales and operating income in the Company’s product

categories and regions were unfavorably impacted by a stronger U.S.

dollar in relation to most currencies. Reported net sales was

negatively impacted by 5% of foreign currency translation, with

negative impacts in Asia/Pacific and Europe, the Middle East &

Africa of 10% and 4%, respectively. In addition, reported and

organic net sales was negatively impacted by 1% from foreign

currency transactions in key international travel retail locations,

with a negative impact in Europe, the Middle East & Africa of

3%.

Total reported operating income was $0.56 billion, a 61%

decrease from $1.42 billion in the prior-year period. In constant

currency, adjusted operating income decreased 42%, primarily

reflecting lower net sales, and excludes the following items:

- Fiscal 2023 second quarter: $207 million of other intangible

asset impairments related to Dr.Jart+, Too Faced and Smashbox,

combined, as well as $5 million restructuring and other charges and

adjustments

- Fiscal 2022 second quarter: $17 million of restructuring and

other charges and adjustments

- The unfavorable impact of foreign currency translation of $68

million

Results by Product Category

(Unaudited)

Three Months Ended December

31

Net Sales

Percentage Change

Operating Income

(Loss)

Percentage Change

($ in millions)

2022

2021

Reported Basis

Constant

Currency

2022

2021

Reported Basis

Skin Care

$

2,382

$

3,159

(25

)%

(20

)%

$

421

$

1,082

(61

)%

Makeup

1,268

1,386

(9

)

(3

)

(37

)

130

(100

+)

Fragrance

775

799

(3

)

3

177

210

(16

)

Hair Care

182

180

1

4

5

8

(38

)

Other

14

16

(13

)

—

(1

)

3

(100

+)

Subtotal

$

4,621

$

5,540

(17

)%

(11

)%

$

565

$

1,433

(61

)%

Returns/charges associated with

restructuring and other activities

(1

)

(1

)

(9

)

(15

)

Total

$

4,620

$

5,539

(17

)%

(12

)%

$

556

$

1,418

(61

)%

Organic Net Sales Growth -

Reconciliation to GAAP (Unaudited)

Three Months Ended December

31 2022 vs. 2021(2)

Organic Net Sales

Growth (Non-GAAP)(1)

Impact of Acquisitions,

Divestitures and Brand Closures, Net

Impact of Foreign Currency

Translation

Net Sales Growth

(GAAP)

Skin Care

(20

)%

—

%

(5

)%

(25

)%

Makeup

(3

)

—

(5

)

(9

)

Fragrance

12

(9

)

(6

)

(3

)

Hair Care

4

—

(3

)

1

Other

(6

)

6

(13

)

(13

)

Subtotal

(11

)%

(1

)%

(5

)%

(17

)%

Returns associated with restructuring and

other activities

—

Total

(11

)%

(1

)%

(5

)%

(17

)%

(1)Organic net sales growth represents net

sales growth excluding returns associated with restructuring and

other activities; non-comparable impacts of acquisitions,

divestitures and brand closures (the license terminations related

to certain of the Company’s designer fragrances); as well as the

impact of foreign currency translation.

(2)Percentages are calculated on an

individual basis

Skin Care

- Skin Care net sales declined 20%, primarily reflecting the

challenges of the prolonged COVID-related impacts, including both

the anticipated tightening of inventory by certain retailers in

Asia travel retail and limited retail traffic in mainland China.

Lower replenishment orders in the United States also negatively

impacted the category’s growth. Net sales growth from The Ordinary

and Bobbi Brown was offset by declines from Estée Lauder, La Mer,

Dr.Jart+ and Clinique.

- Net sales from Estée Lauder, La Mer, Dr.Jart+ and Clinique

declined, reflecting the aforementioned Skin Care challenges.

- Net sales from The Ordinary grew double digits across every

region, reflecting growth in hero products, successful innovation,

such as New! Multi-Peptide Lash & Brow Serum and increased

productive distribution.

- Hero products, including Soothing Cleansing Oil and Vitamin

Enriched Face Base, drove net sales growth from Bobbi Brown.

- Skin Care operating income decreased, reflecting the decline in

net sales and an other intangible asset impairment of $100 million

related to Dr.Jart+, partially offset by disciplined expense

management.

Makeup

- Makeup net sales decreased 3%, primarily reflecting the ongoing

COVID-related impacts affecting Asia travel retail and mainland

China, partially offset by the progression of the makeup

renaissance as usage occasions increased in many other markets. Net

sales growth from M·A·C and Clinique was offset by declines from

Estée Lauder and Tom Ford Beauty.

- Net sales from Estée Lauder and Tom Ford Beauty were negatively

impacted by the decline in retail traffic and travel due to the

ongoing COVID-related impacts.

- M·A·C double-digit net sales growth reflected continued success

from hero products, such as Studio Fix foundation, and recent

launches, including Powder Kiss Velvet Blur Slim Stick lipstick, as

well as strong 11.11 Global Shopping Festival performance and

holiday demand. The increase in net sales also reflected the

expected benefit from changes to the brand’s take back loyalty

program made in the fiscal 2023 second quarter.

- The continued success of Almost Lipstick in Black Honey

continues to drive net sales growth from Clinique. Strength from

the concealer and eye subcategories also contributed to

growth.

- Net sales grew double digits in most countries in Europe, the

Middle East & Africa, Asia/Pacific and Latin America as they

continued to reopen and evolve in recovery.

- Makeup operating income decreased, primarily reflecting $107

million of other intangible asset impairments relating to Too Faced

and Smashbox, combined, and lower net sales, partially offset by

disciplined expense management.

Fragrance

- Net sales grew in every region, driven primarily by growth from

Estée Lauder, Le Labo and Tom Ford Beauty.

- The license terminations related to certain of the Company’s

designer fragrances was dilutive to reported net sales growth by

approximately 9 percentage points.

- Estée Lauder net sales grew double digits, driven primarily by

strong holiday demand for the Beautiful franchise line of products,

such as Beautiful Magnolia Intense.

- Net sales from Le Labo rose strong double digits, reflecting

growth in every region due to the continued consumer demand for the

brand’s artisanal offerings, robust holiday performance and

targeted expanded consumer reach.

- Tom Ford Beauty net sales grew double digits, fueled by growth

in existing hero franchises like Oud Wood and Ombre Leather and

recent launches, such as Noir Extreme Parfum.

- Fragrance operating income decreased, driven primarily by

strategic investments to support brick-and-mortar recovery and the

expansion of freestanding stores, as well as investments in

advertising and promotional activity to support holiday.

Hair Care

- Hair Care net sales rose 4%, reflecting growth from both The

Ordinary, due to the recent launch of the brand’s hair care

products, and Aveda.

- Aveda’s net sales growth reflected strength in Europe, the

Middle East & Africa, the launch of the brand in mainland China

and strong performance during holiday and key shopping

moments.

- Hair Care operating results decreased, reflecting strategic

investments to support innovation and Aveda’s launch in mainland

China, partially offset by higher net sales.

Results by Geographic Region

(Unaudited)

Three Months Ended December

31

Net Sales

Percentage Change

Operating Income

(Loss)

Percentage Change

($ in millions)

2022

2021

Reported Basis

Constant

Currency

2022

2021

Reported Basis

The Americas

$

1,235

$

1,300

(5

)%

(6

)%

$

(85

)

$

382

(100

+)%

Europe, the Middle East & Africa

1,816

2,338

(22

)

(18

)

409

620

(34

)

Asia/Pacific

1,570

1,902

(17

)

(8

)

241

431

(44

)

Subtotal

$

4,621

$

5,540

(17

)%

(11

)%

$

565

$

1,433

(61

)%

Returns/charges associated with

restructuring and

other activities

(1

)

(1

)

(9

)

(15

)

Total

$

4,620

$

5,539

(17

)%

(12

)%

$

556

$

1,418

(61

)%

Organic Net Sales Growth -

Reconciliation to GAAP (Unaudited)

Three Months Ended December

31 2022 vs. 2021(2)

Organic Net Sales

Growth (Non-GAAP)(1)

Impact of Acquisitions,

Divestitures and Brand Closures, Net

Impact of Foreign Currency

Translation

Net Sales Growth

(GAAP)

The Americas

(3

)%

(2

)%

1

%

(5

)%

Europe, the Middle East & Africa

(17

)

(1

)

(4

)

(22

)

Asia/Pacific

(7

)

—

(10

)

(17

)

Subtotal

(11

)%

(1

)%

(5

)%

(17

)%

Returns associated with restructuring and

other activities

—

Total

(11

)%

(1

)%

(5

)%

(17

)%

(1)Organic net sales growth represents net

sales growth excluding returns associated with restructuring and

other activities; non-comparable impacts of acquisitions,

divestitures and brand closures (the license terminations related

to certain of the Company’s designer fragrances); as well as the

impact of foreign currency translation.

(2)Percentages are calculated on an

individual basis

The Americas

- Net sales declined 3%, driven by the negative impact from lower

replenishment orders in the United States primarily impacting the

Skin Care category. Conversely, net sales grew in both the

Fragrance and Makeup categories.

- The license terminations related to certain of the Company’s

designer fragrances contributed approximately 2 percentage points

to the decline in reported net sales.

- In Latin America, net sales rose double digits, fueled by

growth in the Makeup and Fragrance categories.

- Operating income in The Americas decreased, primarily

reflecting lower intercompany royalty income due to the decline in

income from the Company’s travel retail business, other intangible

asset impairments of $107 million relating to Too Faced and

Smashbox, combined, and the decline in net sales.

Europe, the Middle East &

Africa

- Net sales declined 17%, primarily due to the ongoing

COVID-related impacts, affecting Asia travel retail.

- The license terminations related to certain of the Company’s

designer fragrances contributed approximately 1 percentage point to

the decline in reported net sales.

- Global travel retail net sales decreased double digits,

reflecting the ongoing COVID-related impacts that led to reduced

travel in Asia, particularly to Hainan. Travel retail net sales

grew in Europe, the Middle East & Africa and The Americas,

benefiting from an increase in professional and personal travel

compared to the prior-year period.

- Net sales in the United Kingdom grew mid-single-digits, powered

by the progression of the makeup renaissance as usage occasions

returned, as well as strong growth in Fragrance and Skin Care.

- Net sales from most emerging markets in the region increased

double digits, led by India and Turkey, driven by growth in the

Makeup category. Developed markets also grew, led by France, Spain

and Italy.

- Operating income decreased, driven by the decline in net sales,

partially offset by a lower intercompany royalty expense due to the

decline in income from the Company’s travel retail business and

disciplined expense management.

Asia/Pacific

- Net sales declined 7%, due to the ongoing COVID-related impacts

affecting brick-and-mortar in Greater China and Dr.Jart+ travel

retail in Korea.

- In other markets in Asia/Pacific, COVID recovery drove strong

net sales growth in most countries, led by Japan, Australia,

Malaysia and the Philippines. In Korea, double-digit growth from

most brands was more than offset by the decline from Dr.Jart+’s

travel retail business.

- Fragrance and Hair Care net sales grew double digits in the

region.

- Operating income decreased, driven by the decline in net sales

and an other intangible asset impairment of $100 million related to

Dr.Jart+, partially offset by disciplined expense management.

Six-Months Results

- For the six months ended December 31, 2022, the Company

reported net sales of $8.55 billion, a 14% decrease compared with

$9.93 billion in the prior-year period. Organic net sales decreased

8%.

- Net earnings3 were $0.88 billion, and diluted earnings per

share was $2.45. In the prior year six months, the Company reported

net earnings of $1.78 billion and diluted earnings per share of

$4.85.

__________________________________

3 Net earnings attributable to The Estée

Lauder Companies Inc. which excludes net (earnings) attributable to

redeemable noncontrolling interests for the six months ended

December 31, 2022 and noncontrolling interests for the six months

ended December 31, 2021.

- During the six-months ended December 31, 2022, the Company

recorded restructuring and other charges, other intangible asset

impairments, and change in fair value of acquisition-related stock

options, that, combined, resulted in an unfavorable impact of $219

million ($167 million less the portion attributable to redeemable

noncontrolling interest and net of tax), equal to $.46 per diluted

share, as detailed on page 16. The prior-year period results

include restructuring and other charges, change in fair value of

acquisition-related stock options, and other income related to a

gain on previously held equity investment in Deciem Beauty Group

Inc. that, combined, resulted in a favorable impact of $22 million

($18 million after tax), equal to $.05 per diluted share.

- Excluding restructuring and other charges and adjustments

referred to in the previous bullet, adjusted diluted net earnings

per common share for the six months ended December 31, 2022 was

$2.91, and declined 36% in constant currency. For the six months

ended December 31, 2022, the unfavorable impact of foreign currency

translation on diluted net earnings per common share was $.22.

Cash Flows

- For the six months ended December 31, 2022, net cash flows

provided by operating activities were $0.75 billion, compared with

$1.85 billion in the prior-year period. This reflects lower

earnings before taxes, excluding non-cash items, and the negative

impact from changes in working capital, primarily accounts payable,

due to the timing of payments.

- Capital Expenditures decreased to $419 million compared to $459

million last year, primarily reflecting timing of investments.

- The Company ended the quarter with $3.73 billion in cash and

cash equivalents after returning $0.71 billion cash to stockholders

through dividends and share repurchases.

- In November 2022, the Company announced it signed an agreement

to acquire the TOM FORD brand. The transaction is expected to be

completed in the fiscal 2023 fourth quarter and to be funded

through a combination of cash, debt and deferred payments to the

sellers.

Outlook for Fiscal 2023 Third Quarter

and Full Year The Company expects the remainder of the

fiscal year to be volatile, including risks associated with the

uncertain pace of recovery of consumers in travel retail, and

pressured by the ongoing disruptions due to the evolving COVID-19

environment, inflation, supply chain disruptions, and the risk of a

slowdown in certain markets globally.

The Company remains optimistic about the prospects and future

growth in global prestige beauty and plans to invest in its

business during this difficult environment to support share gains

and long-term growth, including investments in advertising,

innovation, its innovation center in Shanghai and its manufacturing

facility in Japan. In the near-term, these investments will have a

greater impact to diluted net earnings per common share due to the

expected decline in net sales. With multiple engines of growth

across regions, brands, product categories and channels, the

Company is well-positioned to drive diversified long-term growth

across its portfolio.

The second half outlook reflects the following assumptions and

expectations:

- A shift in the return to growth in Asia Travel Retail and

mainland China from the fiscal 2023 third quarter to the fourth

quarter, reflecting:

- The normalization of inventory levels in Hainan, given the

disruptions from the COVID-related impacts in November and

December.

- The transitory pressure to the Company’s travel retail business

with its Korean duty free retailers due to the potential roll-back

of temporary COVID-related government supportive measures in Korea

duty free.

- An acceleration of retail sales in the fourth quarter of fiscal

2023 in travel retail, primarily due to the resumption of outbound

Chinese traveling consumers.

- A moderate return to net sales growth in mainland China, given

the disruption from the COVID-related impacts in November and

December that slowed expected brick-and-mortar retail traffic in

the second quarter and is continuing to dampen traffic in the third

quarter.

- Increased productive distribution throughout the year to

retailers that provide new consumer reach and continued strategic

entry into new countries for some of the Company’s brands.

- The mitigation of most inflationary pressures through strategic

price increases, mix optimization and cost savings in other

areas.

- Incremental savings from the Post-COVID Business Acceleration

Program and reinvestment in advertising and capabilities.

- Full-year effective tax rate of approximately 25.5%.

The full year outlook does not reflect the net sales and the

slight dilution to earnings per share from the acquisition of the

TOM FORD brand that is expected to be completed in the fiscal 2023

fourth quarter.

The Company is mindful of ongoing risks related to the COVID-19

pandemic as well as risks related to the effects of the global

macro environment, including the risk of recession; foreign

currency volatility; increasing inflationary pressures; supply

chain disruptions; social and political issues; regulatory matters,

including the imposition of tariffs and sanctions; geopolitical

tensions; and global security issues. The Company is also mindful

of inflationary pressures on its cost base and consumer behaviors.

Third Quarter Fiscal 2023

Sales Outlook

- Reported net sales are forecasted to decrease between 14% and

12% versus the prior-year period. This range includes:

- A shift in the return to growth in Asia Travel Retail and

mainland China, as detailed above.

- A negative 3% due to foreign currency translation.

- The negative impact of 1% from the termination of the Company’s

license agreements for the Donna Karan New York, DKNY, Michael

Kors, Tommy Hilfiger and Ermenegildo Zegna product lines effective

June 30, 2022.

- Organic net sales, which excludes returns associated with

restructuring and other activities; non-comparable impacts from

acquisitions, divestitures and brand closures; as well as the

impact of foreign currency translation, are forecasted to decrease

between 10% and 8%.

Earnings per Share Outlook

- Reported diluted net earnings per common share are projected to

be between $.32 and $.43. Excluding restructuring and other

charges, diluted net earnings per common share are projected to be

between $.37 and $.47.

- Adjusted diluted earnings per common share are expected to

decrease between 79% and 73% on a constant currency basis. Currency

exchange rates are volatile and difficult to predict. Using

December 30, 2022 spot rates for the third quarter of fiscal 2023:

- The negative foreign currency translation impact equates to

about $.04 of diluted earnings per share.

- As reported and adjusted diluted earnings per share in constant

currency are expected to be negatively impacted 1% from certain

foreign currency transactions in key international travel retail

locations.

Full Year Fiscal 2023

Sales Outlook

- Reported net sales are forecasted to decrease between 7% and 5%

versus the prior-year period. This range includes:

- A shift in the return to growth in Asia Travel Retail and

mainland China, as detailed above.

- A negative 4% due to foreign currency translation, as well as

an additional 1% due to certain foreign currency transactions in

key international travel retail locations.

- The negative impact of 1% from the termination of the Company’s

license agreements for the Donna Karan New York, DKNY, Michael

Kors, Tommy Hilfiger and Ermenegildo Zegna product lines effective

June 30, 2022.

- Organic net sales, which excludes returns associated with

restructuring and other activities; non-comparable impacts from

acquisitions, divestitures and brand closures; as well as the

impact of foreign currency translation, are forecasted to be down

2% to flat. This includes the negative impact related to foreign

currency transactions, noted above.

Earnings per Share Outlook

- Reported diluted net earnings per common share are projected to

be between $4.25 and $4.44. Excluding restructuring and other

charges, diluted net earnings per common share are projected to be

between $4.87 and $5.02.

- Adjusted diluted earnings per common share are expected to

decrease between 29% and 27% on a constant currency basis. Currency

exchange rates are volatile and difficult to predict. Using

December 30, 2022 spot rates for fiscal 2023:

- The negative foreign currency translation impact equates to

about $.29 of diluted earnings per share.

- As reported and adjusted diluted earnings per share in constant

currency are expected to be negatively impacted by 4% from certain

foreign currency transactions in key international travel retail

locations.

Reconciliation between GAAP

and Non-GAAP - Net Sales Growth (Unaudited)

Three Months Ending

Twelve Months Ending

March 31, 2023(F)

June 30, 2023(F)

As Reported - GAAP(1)

(14%) - (12

%)

(7%) - (5

%)

Organic, Non-GAAP(2)

(10%) - (8

%)

(2%) - 0

%

Impact of the license terminations related

to certain of the Company’s

designer fragrances

(1

)

(1

)

Impact of foreign currency translation

(3

)

(4

)

Returns associated with restructuring and

other activities

—

—

As Reported - GAAP(1)

(14%) - (12

%)

(7%) - (5

%)

(1)Includes returns associated with

restructuring and other activities

(2)Organic net sales growth represents net

sales growth excluding returns associated with restructuring and

other activities; non-comparable impacts of already announced

acquisitions, divestitures and brand closures (the license

terminations related to certain of the Company’s designer

fragrances); as well as the impact of foreign currency

translation.

(F)Represents forecast

Reconciliation between GAAP

and Non-GAAP - Diluted Net Earnings Per Share (“EPS”)

(Unaudited)

Three Months Ending

Twelve Months Ending

March 31

June 30

2023(F)

2022

Growth

2023(F)

2022

Variance

Forecasted/As Reported EPS -

GAAP(1)

$0.32 - $0.43

$

1.53

(79%) - (72%)

$4.25 - $4.44

$

6.55

(35%) - (32%)

Non-GAAP

Restructuring and other charges

.04 - .05

.05

.15 - .19

.31

Change in fair value of

acquisition-related stock

options (less the portion attributable

to

redeemable noncontrolling interest)

—

(.13

)

(.01

)

(.12

)

Other intangible asset

impairments

—

.45

.44

.50

Forecasted/Adjusted EPS -

Non-GAAP

$0.37 - $0.47

$

1.90

(81%) - (75%)

$4.87 - $5.02

$

7.24

(33%) - (31%)

Impact of foreign currency translation

.04

.29

Forecasted/Adjusted Constant Currency

EPS -

Non-GAAP

$0.41 - $0.51

$

1.90

(79%) - (73%)

$5.16 - $5.31

$

7.24

(29%) - (27%)

(1)Includes restructuring and other

charges and adjustments

(F)Represents forecast

Conference Call The Estée

Lauder Companies will host a conference call at 9:30 a.m. (ET)

today, February 2, 2023 to discuss its results. The dial-in

number for the call is 877-883-0383 in the U.S. or 412-902-6506

internationally (conference ID number: 7167229). The call will also

be webcast live at

http://www.elcompanies.com/investors/events-and-presentations.

Cautionary Note Regarding Forward-Looking

Statements Statements in this press release, in

particular those in “Outlook,” as well as remarks by the CEO and

other members of management, may constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements may address the Company’s

expectations regarding sales, earnings or other future financial

performance and liquidity, other performance measures, product

introductions, entry into new geographic regions, information

technology initiatives, new methods of sale, the Company’s

long-term strategy, restructuring and other charges and resulting

cost savings, and future operations or operating results. These

statements may contain words like “expect,” “will,” “will likely

result,” “would,” “believe,” “estimate,” “planned,” “plans,”

“intends,” “may,” “should,” “could,” “anticipate,” “estimate,”

“project,” “projected,” “forecast,” and “forecasted” or similar

expressions. Although the Company believes that its expectations

are based on reasonable assumptions within the bounds of its

knowledge of its business and operations, actual results may differ

materially from the Company’s expectations.

Factors that could cause actual results to differ from

expectations include, without limitation:

(1)

increased competitive activity from

companies in the skin care, makeup, fragrance and hair care

businesses;

(2)

the Company’s ability to develop, produce

and market new products on which future operating results may

depend and to successfully address challenges in the Company’s

business;

(3)

consolidations, restructurings,

bankruptcies and reorganizations in the retail industry causing a

decrease in the number of stores that sell the Company’s products,

an increase in the ownership concentration within the retail

industry, ownership of retailers by the Company’s competitors or

ownership of competitors by the Company’s customers that are

retailers and the Company’s inability to collect receivables;

(4)

destocking and tighter working capital

management by retailers;

(5)

the success, or changes in timing or

scope, of new product launches and the success, or changes in

timing or scope, of advertising, sampling and merchandising

programs;

(6)

shifts in the preferences of consumers as

to where and how they shop;

(7)

social, political and economic risks to

the Company’s foreign or domestic manufacturing, distribution and

retail operations, including changes in foreign investment and

trade policies and regulations of the host countries and of the

United States;

(8)

changes in the laws, regulations and

policies (including the interpretations and enforcement thereof)

that affect, or will affect, the Company’s business, including

those relating to its products or distribution networks, changes in

accounting standards, tax laws and regulations, environmental or

climate change laws, regulations or accords, trade rules and

customs regulations, and the outcome and expense of legal or

regulatory proceedings, and any action the Company may take as a

result;

(9)

foreign currency fluctuations affecting

the Company’s results of operations and the value of its foreign

assets, the relative prices at which the Company and its foreign

competitors sell products in the same markets and the Company’s

operating and manufacturing costs outside of the United States;

(10)

changes in global or local conditions,

including those due to volatility in the global credit and equity

markets, natural or man-made disasters, real or perceived

epidemics, supply chain challenges, inflation, or increased energy

costs, that could affect consumer purchasing, the willingness or

ability of consumers to travel and/or purchase the Company’s

products while traveling, the financial strength of the Company’s

customers, suppliers or other contract counterparties, the

Company’s operations, the cost and availability of capital which

the Company may need for new equipment, facilities or acquisitions,

the returns that the Company is able to generate on its pension

assets and the resulting impact on funding obligations, the cost

and availability of raw materials and the assumptions underlying

the Company’s critical accounting estimates;

(11)

impacts attributable to the COVID-19

pandemic, including disruptions to the Company’s global

business;

(12)

shipment delays, commodity pricing,

depletion of inventory and increased production costs resulting

from disruptions of operations at any of the facilities that

manufacture the Company’s products or at the Company’s distribution

or inventory centers, including disruptions that may be caused by

the implementation of information technology initiatives, or by

restructurings;

(13)

real estate rates and availability, which

may affect the Company’s ability to increase or maintain the number

of retail locations at which the Company sells its products and the

costs associated with the Company’s other facilities;

(14)

changes in product mix to products which

are less profitable;

(15)

the Company’s ability to acquire, develop

or implement new information and distribution technologies and

initiatives on a timely basis and within the Company’s cost

estimates and the Company’s ability to maintain continuous

operations of such systems and the security of data and other

information that may be stored in such systems or other systems or

media;

(16)

the Company’s ability to capitalize on

opportunities for improved efficiency, such as publicly-announced

strategies and restructuring and cost-savings initiatives, and to

integrate acquired businesses and realize value therefrom;

(17)

consequences attributable to local or

international conflicts around the world, as well as from any

terrorist action, retaliation and the threat of further action or

retaliation;

(18)

the timing and impact of acquisitions,

investments and divestitures; and

(19)

additional factors as described in the

Company’s filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

June 30, 2022.

The Company assumes no responsibility to

update forward-looking statements made herein or otherwise.

The Estée Lauder Companies Inc. is one of the world’s leading

manufacturers, marketers and sellers of quality skin care, makeup,

fragrance and hair care products. The Company’s products are sold

in approximately 150 countries and territories under brand names

including: Estée Lauder, Aramis, Clinique, Lab Series, Origins,

M·A·C, La Mer, Bobbi Brown, Aveda, Jo Malone London, Bumble and

bumble, Darphin Paris, TOM FORD BEAUTY, Smashbox, AERIN Beauty, Le

Labo, Editions de Parfums Frédéric Malle, GLAMGLOW, KILIAN PARIS,

Too Faced, Dr.Jart+, and the DECIEM family of brands, including The

Ordinary and NIOD.

ELC-F ELC-E

CONSOLIDATED STATEMENT OF

EARNINGS (Unaudited)

Three Months Ended

December 31

Percentage Change

Six Months Ended

December 31

Percentage Change

($ in millions, except per share data)

2022

2021

2022

2021

Net sales(A)

$

4,620

$

5,539

(17

)%

$

8,550

$

9,931

(14

)%

Cost of sales(A)

1,219

1,223

—

2,242

2,280

(2

)

Gross profit

3,401

4,316

(21

)

6,308

7,651

(18

)

Gross margin

73.6

%

77.9

%

73.8

%

77.0

%

Operating expenses

Selling, general and administrative(B)

2,630

2,885

(9

)

4,874

5,279

(8

)

Restructuring and other charges(A)

8

13

(38

)

10

19

(47

)

Impairment of other intangible

assets(C)

207

—

100

207

—

100

Total operating expenses

2,845

2,898

(2

)

5,091

5,298

(4

)

Operating expense margin

61.6

%

52.3

%

59.5

%

53.3

%

Operating income

556

1,418

(61

)

1,217

2,353

(48

)

Operating income margin

12.0

%

25.6

%

14.2

%

23.7

%

Interest expense

52

42

24

98

84

17

Interest income and investment income,

net

26

10

100

+

41

14

100

+

Other components of net periodic benefit

cost

(2

)

(2

)

—

(5

)

(1

)

(100

+)

Other income

—

—

—

—

1

(100

)

Earnings before income taxes

532

1,388

(62

)

1,165

2,285

(49

)

Provision for income taxes

135

298

(55

)

278

500

(44

)

Net earnings

397

1,090

(64

)

887

1,785

(50

)

Net earnings attributable to

noncontrolling interests

—

(4

)

100

—

(5

)

100

Net loss (earnings) attributable to

redeemable

noncontrolling interest

(3

)

2

(100

+)

(4

)

—

(100

)

Net earnings attributable to The Estée

Lauder

Companies Inc.

$

394

$

1,088

(64

)%

$

883

$

1,780

(50

)%

Net earnings attributable to The Estée

Lauder

Companies Inc. per common share

Basic

$

1.10

$

3.02

(64

)%

$

2.47

$

4.93

(50

)%

Diluted

$

1.09

$

2.97

(63

)%

$

2.45

$

4.85

(50

)%

Weighted-average common shares

outstanding

Basic

357.7

360.6

357.8

361.4

Diluted

360.4

366.0

360.9

367.0

(A)In August 2020, the Company announced a

two-year restructuring program, Post-COVID Business Acceleration

Program (the “PCBA Program”), designed to realign its business to

address the dramatic shifts to its distribution landscape and

consumer behaviors in the wake of the COVID-19 pandemic. The PCBA

Program will help improve efficiency and effectiveness by

rebalancing resources to growth areas of prestige beauty. It is

expected to further strengthen the Company by building upon the

foundational capabilities in which the Company has invested. The

PCBA Program’s main areas of focus include accelerating the shift

to online with the realignment of the Company’s distribution

network reflecting freestanding store and certain department store

closures, with a focus on North America and Europe, the Middle East

& Africa; the reduction in brick-and-mortar point of sale

employees and related support staff; and the redesign of the

Company’s regional branded marketing organizations, plus select

opportunities in global brands and functions. This program is

expected to position the Company to better execute its long-term

strategy while strengthening its financial flexibility. The Company

approved specific initiatives under the PCBA Program through fiscal

2022 and expects to substantially complete those initiatives

through fiscal 2023. The Company expects that the PCBA Program will

result in related restructuring and other charges totaling between

$500 million and $515 million, before taxes.

(B)For the three and six months ended

December 31, 2022, the Company recorded $(4) million ($(4) million,

less the portion attributable to redeemable noncontrolling interest

and net of tax) and $(3) million ($(3) million, less the portion

attributable to redeemable noncontrolling interest and net of tax),

respectively, of income related to the change in fair value of

acquisition-related stock options related to DECIEM, and recorded

$2 million ($2 million, less the portion attributable to redeemable

noncontrolling interest and net of tax) for the three and six

months ended December 31, 2021.

(C)During the fiscal 2023 second quarter,

given the lower-than-expected results in the overall business, the

Company made revisions to the internal forecasts relating to its

Smashbox reporting unit. The Company concluded that the changes in

circumstances in the reporting unit triggered the need for an

interim impairment review of its trademark intangible asset. The

remaining carrying value of the trademark intangible asset was not

recoverable and the Company recorded an impairment charge of $21

million reducing the carrying value to zero.

During the fiscal 2023 second quarter, the

Dr.Jart+ reporting unit experienced lower-than-expected growth

within key geographic regions and channels that continue to be

impacted by the spread of COVID-19 variants, resurgence in cases,

and the potential future impacts relating to the uncertainty of the

duration and severity of COVID-19 impacting the financial

performance of the reporting unit. In addition, due to

macro-economic factors, Dr.Jart+ has experienced

lower-than-expected growth within key geographic regions. The Too

Faced reporting unit experienced lower-than-expected results in key

geographic regions and channels coupled with delays in future

international expansion to areas that continue to be impacted by

COVID-19. As a result, the Company made revisions to the internal

forecasts relating to its Dr.Jart+ and Too Faced reporting units.

Additionally, there were increases in the weighted average cost of

capital for both reporting units as compared to the prior year

annual goodwill and other indefinite-lived intangible asset

impairment testing as of April 1, 2022.

The Company concluded that the changes in

circumstances in the reporting units, along with increases in the

weighted average cost of capital, triggered the need for interim

impairment reviews of their trademarks and goodwill. These changes

in circumstances were also an indicator that the carrying amounts

of Dr.Jart+’s and Too Faced’s long-lived assets, including customer

lists, may not be recoverable. Accordingly, the Company performed

interim impairment tests for the trademarks and a recoverability

test for the long-lived assets as of November 30, 2022. The Company

concluded that the carrying value of the trademark intangible

assets exceeded their estimated fair values, which were determined

utilizing the relief-from-royalty method to determine discounted

projected future cash flows and recorded an impairment charge of

$100 million for Dr.Jart+ and $86 million for Too Faced. The

Company concluded that the carrying amounts of the long-lived

assets were recoverable. After adjusting the carrying values of the

trademarks, the Company completed interim quantitative impairment

tests for goodwill. As the estimated fair value of the Dr.Jart+ and

Too Faced reporting units were in excess of their carrying values,

the Company concluded that the carrying amounts of the goodwill

were recoverable and did not record a goodwill impairment charge

related to these reporting units. The fair values of these

reporting units were based upon an equal weighting of the income

and market approaches, utilizing estimated cash flows and a

terminal value, discounted at a rate of return that reflects the

relative risk of the cash flows, as well as valuation multiples

derived from comparable publicly traded companies that are applied

to operating performance of the reporting units. The significant

assumptions used in these approaches include revenue growth rates

and profit margins, terminal values, weighted average cost of

capital used to discount future cash flows and royalty rates for

trademarks. The most significant unobservable input used to

estimate the fair values of the Dr.Jart+ and Too Faced trademark

intangible assets was the weighted-average cost of capital, which

was 11% and 13%, respectively.

For the three and six months ended

December 31, 2022, other intangible asset impairment charges were

$207 million ($159 million, net of tax), with an impact of $.44 per

common share in both periods.

Returns and Charges Associated

With Restructuring and Other Activities and Other Adjustments

(Unaudited)

Three Months Ended December

31, 2022

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring Charges

Other Charges/

Adjustments

Leading Beauty Forward

$

—

$

—

$

—

$

1

$

1

$

1

$

—

PCBA Program

1

—

4

3

8

6

.02

Change in fair value of

acquisition-related

stock options

—

—

—

(4

)

(4

)

(4

)

(.01

)

Other intangible asset impairments

—

—

—

207

207

159

.44

Total

$

1

$

—

$

4

$

207

$

212

$

162

$

.45

Six Months Ended December 31,

2022

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring Charges

Other Charges/

Adjustments

Leading Beauty Forward

$

—

$

—

$

(2

)

$

3

$

1

$

1

$

—

PCBA Program

6

(1

)

6

3

14

10

.03

Change in fair value of

acquisition-related

stock options

—

—

—

(3

)

(3

)

(3

)

(.01

)

Other intangible asset impairments

—

—

—

207

207

159

.44

Total

$

6

$

(1

)

$

4

$

210

$

219

$

167

$

.46

Three Months Ended December

31, 2021

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring

Charges

Other Charges/

Adjustments

Leading Beauty Forward

$

—

$

2

$

(2

)

$

5

$

5

$

4

$

.01

PCBA Program

1

(1

)

7

3

10

8

.02

Change in fair value of

acquisition-related

stock options

—

—

—

2

2

2

.01

Total

$

1

$

1

$

5

$

10

$

17

$

14

$

.04

Six Months Ended December 31,

2021

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring

Charges

Other Charges/

Adjustments

Leading Beauty Forward

$

—

$

2

$

(1

)

$

8

$

9

$

7

$

.02

PCBA Program

2

(2

)

7

5

12

10

.03

Change in fair value of

acquisition-related

stock options

—

—

—

2

2

2

—

Other income

—

—

—

(1

)

(1

)

(1

)

—

Total

$

2

$

—

$

6

$

14

$

22

$

18

$

.05

Results by Product Category

(Unaudited)

Six Months Ended December

31

Net Sales

Percentage Change

Operating Income

(Loss)

Percentage Change

($ in millions)

2022

2021

Reported Basis

Constant

Currency

2022

2021

Reported Basis

Skin Care

$

4,486

$

5,608

(20

)%

(16

)%

$

951

$

1,799

(47

)%

Makeup

2,320

2,560

(9

)

(5

)

(21

)

221

(100

+)

Fragrance

1,382

1,408

(2

)

4

310

341

(9

)

Hair Care

340

328

4

7

(7

)

10

(100

+)

Other

28

29

(3

)

3

(1

)

3

(100

+)

Subtotal

$

8,556

$

9,933

(14

)%

(9

)%

$

1,232

$

2,374

(48

)%

Returns/charges associated with

restructuring and other activities

(6

)

(2

)

(15

)

(21

)

Total

$

8,550

$

9,931

(14

)%

(9

)%

$

1,217

$

2,353

(48

)%

Organic Net Sales Growth -

Reconciliation to GAAP (Unaudited)

Six Months Ended December

31 2022 vs. 2021(2)

Organic Net Sales

Growth (Non-GAAP)(1)

Impact of Acquisitions,

Divestitures and Brand Closures, Net

Impact of Foreign Currency

Translation

Net Sales Growth

(GAAP)

Skin Care

(16

)%

—

%

(4

)%

(20

)%

Makeup

(5

)

—

(5

)

(9

)

Fragrance

14

(10

)

(6

)

(2

)

Hair Care

7

—

(4

)

4

Other

(3

)

7

(7

)

(3

)

Subtotal

(8

)%

(1

)%

(5

)%

(14

)%

Returns associated with restructuring and

other activities

—

Total

(8

)%

(1

)%

(5

)%

(14

)%

(1)Organic net sales growth represents net

sales growth excluding returns associated with restructuring and

other activities; non-comparable impacts of acquisitions,

divestitures and brand closures (the license terminations related

to certain of the Company’s designer fragrances); as well as the

impact of foreign currency translation.

(2)Percentages are calculated on an

individual basis

Results by Geographic

Region (Unaudited)

Six Months Ended December

31

Net Sales

Percentage Change

Operating Income

(Loss)

Percentage

Change

($ in millions)

2022

2021

Reported Basis

Constant

Currency

2022

2021

Reported Basis

The Americas

$

2,358

$

2,494

(5

)%

(6

)%

$

40

$

636

(94

)%

Europe, the Middle East & Africa

3,498

4,211

(17

)

(13

)

743

1,085

(32

)

Asia/Pacific

2,700

3,228

(16

)

(7

)

449

653

(31

)

Subtotal

$

8,556

$

9,933

(14

)%

(9

)%

$

1,232

$

2,374

(48

)%

Returns/charges associated with

restructuring

and other activities

(6

)

(2

)

(15

)

(21

)

Total

$

8,550

$

9,931

(14

)%

(9

)%

$

1,217

$

2,353

(48

)%

Organic Net Sales Growth -

Reconciliation to GAAP

(Unaudited)

Six Months Ended December

31

2022 vs. 2021(2)

Organic Net Sales

Growth (Non-GAAP)(1)

Impact of Acquisitions,

Divestitures and Brand Closures, Net

Impact of Foreign Currency

Translation

Net Sales Growth

(GAAP)

The Americas

(3

)%

(3

)%

1

%

(5

)%

Europe, the Middle East & Africa

(12

)

(1

)

(4

)

(17

)

Asia/Pacific

(7

)

—

(9

)

(16

)

Subtotal

(8

)%

(1

)%

(5

)%

(14

)%

Returns associated with restructuring and

other activities

—

Total

(8

)%

(1

)%

(5

)%

(14

)%

(1)Organic net sales growth represents net

sales growth excluding returns associated with restructuring and

other activities; non-comparable impacts of acquisitions,

divestitures and brand closures (the license terminations related

to certain of the Company’s designer fragrances); as well as the

impact of foreign currency translation.

(2)Percentages are calculated on an

individual basis

This earnings release includes some non-GAAP financial measures

relating to charges associated with restructuring and other

activities and adjustments, as well as organic net sales. Included

herein are reconciliations between the non-GAAP financial measures

and the most directly comparable GAAP measures for certain

consolidated statements of earnings accounts before and after these

items. The Company uses certain non-GAAP financial measures, among

other financial measures, to evaluate its operating performance,

which represent the manner in which the Company conducts and views

its business. Management believes that excluding certain items that

are not comparable from period-to-period, or do not reflect the

Company’s underlying ongoing business, provides transparency for

such items and helps investors and others compare and analyze

operating performance from period-to-period. In the future, the

Company expects to incur charges or adjustments similar in nature

to those presented herein; however, the impact to the Company’s

results in a given period may be highly variable and difficult to

predict. The Company’s non-GAAP financial measures may not be

comparable to similarly titled measures used by, or determined in a

manner consistent with, other companies. While the Company

considers the non-GAAP measures useful in analyzing its results,

they are not intended to replace, or act as a substitute for, any

presentation included in the consolidated financial statements

prepared in conformity with GAAP.

The Company operates on a global basis, with the majority of its

net sales generated outside the United States. Accordingly,

fluctuations in foreign currency exchange rates can affect the

Company’s results of operations. Therefore, the Company presents

certain net sales, operating results and diluted net earnings per

share information excluding the effect of foreign currency rate

fluctuations to provide a framework for assessing the performance

of its underlying business outside the United States. Constant

currency information compares results between periods as if

exchange rates had remained constant period-over-period. The

Company calculates constant currency information by translating

current-period results using prior-year period monthly average

foreign currency exchange rates and adjusting for the

period-over-period impact of foreign currency cash flow hedging

activities.

Reconciliation of Certain

Consolidated Statements of Earnings Accounts Before and

After Returns, Charges and Other Adjustments

(Unaudited)

Three Months Ended December

31

2022

2021

% Change

($ in millions, except per share data)

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Impact of Foreign Currency

Translation

Non- GAAP, Constant

Currency

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Non- GAAP

Non- GAAP, Constant

Currency

Net sales

$

4,620

$

1

$

4,621

$

282

$

4,903

$

5,539

$

1

$

5,540

(17

)%

(11

)%

Cost of sales

1,219

—

1,219

64

1,283

1,223

(1

)

1,222

Gross profit

3,401

1

3,402

218

3,620

4,316

2

4,318

(21

)%

(16

)%

Gross margin

73.6

%

73.6

%

73.8

%

77.9

%

77.9

%

Operating expenses

2,845

(211

)

2,634

150

2,784

2,898

(15

)

2,883

(9

)%

(3

)%

Operating expense

margin

61.6

%

57.0

%

56.8

%

52.3

%

52.0

%

Operating income

556

212

768

68

836

1,418

17

1,435

(46

)%

(42

)%

Operating income

margin

12.0

%

16.6

%

17.1

%

25.6

%

25.9

%

Provision for income

taxes

135

50

185

17

202

298

3

301

(39

)%

(33

)%

Net earnings

attributable to The

Estée Lauder

Companies Inc.

$

394

$

162

$

556

$

54

$

610

$

1,088

$

14

$

1,102

(50

)%

(45

)%

Diluted EPS

$

1.09

$

.45

$

1.54

$

.15

$

1.69

$

2.97

$

.04

$

3.01

(49

)%

(44

)%

Six Months Ended December

31

2022

2021

% Change

($ in millions, except per share data)

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Impact of Foreign Currency

Translation

Non- GAAP, Constant

Currency

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Non- GAAP

Non- GAAP, Constant

Currency

Net sales

$

8,550

$

6

$

8,556

$

458

$

9,014

$

9,931

$

2

$

9,933

(14

)%

(9

)%

Cost of sales

2,242

1

2,243

94

2,337

2,280

—

2,280

Gross profit

6,308

5

6,313

364

6,677

7,651

2

7,653

(18

)%

(13

)%

Gross margin

73.8

%

73.8

%

74.1

%

77.0

%

77.0

%

Operating expenses

5,091

(214

)

4,877

265

5,142

5,298

(21

)

5,277

(8

)%

(3

)%

Operating expense

margin

59.5

%

57.0

%

57.0

%

53.3

%

53.1

%

Operating income

1,217

219

1,436

99

1,535

2,353

23

2,376

(40

)%

(35

)%

Operating income

margin

14.2

%

16.8

%

17.0

%

23.7

%

23.9

%

Other income

—

—

—

—

—

1

(1

)

—

Provision for income

taxes

278

52

330

24

354

500

4

504

(35

)%

(30

)%

Net earnings

attributable to The

Estée Lauder

Companies Inc.

$

883

$

167

$

1,050

$

78

$

1,128

$

1,780

$

18

$

1,798

(42

)%

(37

)%

Diluted EPS

$

2.45

$

.46

$

2.91

$

.22

$

3.13

$

4.85

$

.05

$

4.90

(41

)%

(36

)%

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited, except where

noted)

December 31, 2022

June 30, 2022

December 31, 2021

($ in millions)

(Audited)

ASSETS

Cash and cash equivalents

$

3,725

$

3,957

$

4,603

Accounts receivable, net

1,932

1,629

2,079

Inventory and promotional merchandise

3,069

2,920

2,612

Prepaid expenses and other current

assets

641

792

661

Total current assets

9,367

9,298

9,955

Property, plant and equipment, net

2,908

2,650

2,451

Operating lease right-of-use assets

1,847

1,949

2,102

Other assets

6,609

7,013

7,570

Total assets

$

20,731

$

20,910

$

22,078

LIABILITIES AND EQUITY

Current debt

$

260

$

268

$

272

Accounts payable

1,507

1,822

1,639

Operating lease liabilities

349

365

397

Other accrued liabilities

3,539

3,360

3,454

Total current liabilities

5,655

5,815

5,762

Long-term debt

5,111

5,144

5,259

Long-term operating lease liabilities

1,757

1,868

2,028

Other noncurrent liabilities

1,487

1,651

1,937

Total noncurrent liabilities

8,355

8,663

9,224

Redeemable noncontrolling

interest

819

842

840

Total equity

5,902

5,590

6,252

Total liabilities and equity

$

20,731

$

20,910

$

22,078

SELECT CASH FLOW DATA

(Unaudited)

Six Months Ended December

31

($ in millions)

2022

2021

Net earnings

$

887

$

1,785

Adjustments to reconcile net earnings to

net cash flows from operating

activities:

Depreciation and amortization

359

364

Deferred income taxes

(31

)

(43

)

Impairment of other intangible assets

207

—

Other items

192

212

Changes in operating assets and

liabilities:

Increase in accounts receivable, net

(295

)

(407

)

Increase in inventory and promotional

merchandise

(156

)

(164

)

Decrease (increase) in other assets,

net

33

(57

)

Increase (decrease) in accounts payable

and other liabilities, net

(445

)

156

Net cash flows provided by operating

activities

$

751

$

1,846

Other Investing and Financing Sources

(Uses):

Capital expenditures

$

(419

)

$

(459

)

Settlement of net investment hedges

138

58

Payments to acquire treasury stock

(257

)

(1,428

)

Dividends paid

(451

)

(409

)

Proceeds (repayments) of current debt,

net

244

(4

)

Repayments and redemptions of long-term

debt, net

(258

)

(10

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230202005036/en/

Investors: Rainey Mancini rmancini@estee.com

Media: Jill Marvin jimarvin@estee.com

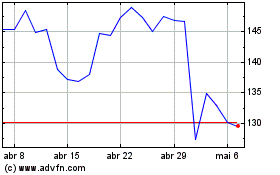

Estee Lauder Companies (NYSE:EL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Estee Lauder Companies (NYSE:EL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024