Company reaffirms first-quarter 2023

guidance

Intel Corporation today announced that its board of directors

has reset its dividend policy, reducing the quarterly dividend to

$0.125 per share (or $0.50 annually) on the company’s common stock.

The dividend will be payable on June 1, 2023, to stockholders of

record on May 7, 2023. Intel also reaffirmed its first-quarter 2023

business outlook provided at its most recent earnings call,

including revenue of between $10.5 billion and $11.5 billion; gross

margin of 34.1% on a GAAP basis and 39% on a non-GAAP basis; tax

rate of (84%) on a GAAP basis and 13% on a non-GAAP basis; and

earnings per share of $(0.80) on a GAAP basis and $(0.15) on a

non-GAAP basis.1

The decision to decrease the quarterly dividend reflects the

board’s deliberate approach to capital allocation and is designed

to best position the company to create long-term value. The

improved financial flexibility will support the critical

investments needed to execute Intel’s transformation during this

period of macroeconomic uncertainty. Since first initiated in 1992,

Intel’s dividend has delivered more than $80 billion in cash

returns to the company’s stockholders, and the board is committed

to maintaining a competitive dividend.

“Prudent allocation of our owners’ capital is important to

enable our IDM 2.0 strategy and sustain our momentum as we rebuild

our execution engine,” said Pat Gelsinger, CEO of Intel. “We remain

on track to deliver five nodes in four years and continue to expand

the IFS (Intel Foundry Services) customer base. We are well into

the ramp of 13th Gen Intel® Core™ and 4th Gen Intel® Xeon® Scalable

processors, and we look forward to the launch of Meteor Lake and

Emerald Rapids in 2023 and Granite Rapids and Sierra Forest in

2024.”

In addition to its prudent capital allocation, Intel continues

to take decisive actions to advance its strategy, optimize its cost

structure and provide transparency to its stakeholders. These

actions include:

- Delivering $3 billion in cost savings in 2023, on the path

to $8 billion to $10 billion in annualized savings by the end of

2025. This includes the difficult steps previously taken to

reduce headcount and the company’s ongoing efforts to reduce other

operating expenses. The company is also temporarily reducing

compensation and rewards programs for employees and executives, and

the board has decided to temporarily reduce its compensation as

well. This is in addition to the exit of seven non-core businesses

since early 2021, as the company continues to sharpen its focus and

drive a best-in-class operating structure.

- Operating net CapEx intensity in the low 30% range in

2023 as the company prioritizes investment in strategic capital

and adjusts the timing of capacity expansion in response to

near-term changes in demand.

- Establishing an internal foundry model that will help

Intel unleash the structural advantages of IDM 2.0 with a

competitive cost structure and optimized operating model while

providing further transparency into its strategic progress and

performance against industry benchmarks.

- Advancing its Smart Capital strategy, which allows Intel

to access new pools of capital that provide additional financial

flexibility to invest for the long term while executing its

transformation. This includes the innovative Semiconductor

Co-Investment Program (SCIP), for which Intel intends to announce a

second partner later this year.

“We are well on our way to meeting our commitment to reduce $3

billion in costs this year as we look to deliver $8 to $10 billion

in savings exiting 2025," said David Zinsner, chief financial

officer of Intel. "While we will continue to prudently manage cash

and capital outlays in the near term, we are setting the foundation

for significant operating leverage and free cash flow growth when

we emerge from this period of outsized investments."

Webcast

Intel will hold a public webcast at 5:45 a.m. PDT today to

discuss this news. Please visit

https://edge.media-server.com/mmc/p/pqmxigih to register for the

webcast. The webcast replay will also be available on Intel's

Investor Relations website at intc.com.

About Intel

Intel (Nasdaq: INTC) is an industry leader, creating

world-changing technology that enables global progress and enriches

lives. Inspired by Moore’s Law, we continuously work to advance the

design and manufacturing of semiconductors to help address our

customers’ greatest challenges. By embedding intelligence in the

cloud, network, edge and every kind of computing device, we unleash

the potential of data to transform business and society for the

better. To learn more about Intel’s innovations, go to

newsroom.intel.com and intel.com.

Forward-Looking Statements

Intel’s business outlook and other statements in this release

that refer to future plans and expectations are forward-looking

statements that involve a number of risks and uncertainties. Words

such as "access," "adjust," "advance, " "allow," "believes,"

"committed," "continues," "deliver," "drive," "establish, "

"evaluate, " "execute, " "expand," "expects," "focus," "future,"

"guidance," "improve," "intend, " "invest, " "look, " "manage,"

"meet, " "on track," "optimize, " "outlook," "plan," "positioned,"

"potential," "prioritize, " "progress," "provide, " "ramp," "set, "

"sharpen," "support," "take, " "unleash, " "will," and variations

of such words and similar expressions are intended to identify such

forward-looking statements. Statements that refer to or are based

on estimates, forecasts, projections, uncertain events or

assumptions, including statements relating to Intel's strategy and

its anticipated benefits, including our IDM 2.0 strategy, Smart

Capital strategy, SCIP, the transition to an internal foundry

model, and updates to our reporting structure; manufacturing

expansion, financing, and investment plans; plans, customers, and

goals related to Intel’s foundry business; projected costs; pending

or anticipated transactions; expected completion and impacts of

restructuring activities and cost-saving or efficiency initiatives;

market opportunity; business plans and financial expectations;

future macroeconomic and geopolitical conditions, including

regional or global downturns or recessions; tax- and

accounting-related expectations; future products, technology, and

services, and the expected regulation, availability, production,

and benefits of such products, technology, and services, including

product ramps, manufacturing goals, plans, timelines, and future

progress, future process nodes and technologies, process

performance parity and leadership expectations, future product

architectures, and future GPU and IPU products; future business,

social, and environmental performance, goals, measures, and

strategies; availability, uses, sufficiency, and cost of capital

resources and sources of funding, including future capital and

R&D investments, and expected returns to stockholders such as

stock repurchases and dividends; expectations regarding customers,

including with respect to designs, wins, orders, and partnerships;

projections regarding competitors; and anticipated trends in our

businesses or the markets relevant to them, including with respect

to future demand and industry growth, also identify forward-looking

statements. All forward-looking statements included in this release

are based on management's expectations as of the date of this

release and, except as required by law, Intel disclaims any

obligation to update these forward-looking statements to reflect

future events or circumstances. Unless specifically indicated

otherwise, the forward-looking statements in this release do not

reflect the potential impact of any divestitures, mergers,

acquisitions, or other business combinations that have not been

completed as of the date of this release. Forward-looking

statements involve many risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in such statements. Detailed information regarding the risk factors

that could affect Intel’s business and results is included in

Intel’s SEC filings, including the company’s most recent reports on

Forms 10-K and 10-Q, particularly the “Risk Factors” sections of

those reports. Copies of these filings may be obtained by visiting

our Investor Relations website at www.intc.com or the SEC’s website

at www.sec.gov.

Intel Corporation Reconciliations of GAAP

Outlook to Non-GAAP Outlook

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the financial outlook prepared in

accordance with US GAAP and the reconciliations from this business

outlook should be carefully evaluated.

Q1 2023 Outlook

Approximately

GAAP gross margin

34.1

%

Acquisition-related adjustments

3.3

%

Share-based compensation

1.6

%

Non-GAAP gross margin

39.0

%

GAAP tax rate

(84)

%

Income tax effects

97

%

Non-GAAP tax rate

13

%

GAAP earnings (loss) per

share—diluted1

$

(0.80)

Acquisition-related adjustments

0.11

Share-based compensation

0.20

Restructuring and other charges

(0.03)

(Gains) losses on equity investments,

net

(0.01)

(Gains) losses from divestiture

(0.01)

Income tax effects

0.39

Non-GAAP earnings (loss) per

share—diluted

$

(0.15)

For more information on these adjustments, please see our

disclosure in the “Explanation of Non-GAAP Measures” section of our

most recent earnings release on INTC.com or as furnished with the

SEC on Jan. 26, 2023.

1The impact of non-controlling interest to our non-GAAP

adjustments in Q1 2023 is expected to be insignificant and thus is

not included in our reconciliation of non-GAAP measures. Outlook

contemplates the change in depreciable life from 5 to 8 years,

described in our most recent earnings release, and a fixed

long-term projected non-GAAP tax rate.

© Intel Corporation. Intel, the Intel logo and other Intel marks

are trademarks of Intel Corporation or its subsidiaries. Other

names and brands may be claimed as the property of others.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230222005387/en/

Penelope Bruce Media Relations 1-408-893-0601

penelope.bruce@intel.com

Erin Tyrrell Investor Relations 1-916-377-9036

erin.tyrrell@intel.com

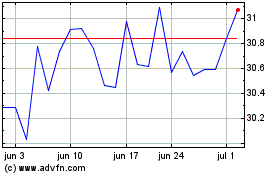

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024