Fourth Quarter 2022

Highlights

- 4Q 2022 Invoiced Sales Amounted to €116.5 Million, an

Increase of 0.7% Versus 4Q 2021 and 15.8% Versus Pre-Pandemic 4Q

2019.

- Gross Margin of 37.0%, Compared to 35.6% in 4Q 2021 and

31.9% in 4Q 2019. Excluding (€2.1) Million of One-Off Restructuring

Costs, Accounted in Labor Cost, Gross Margin Would Have Been of

38.8%.

- 4Q 2022 Operating Profit of €1.8 Million. Operating Profit

Would Have Been of €5.6 Million, Net of (€3.8) Million of

Non-Recurring Items Futher Detailed in the Press Release. 4Q 2022

Operating Profit Compares to an Operating Profit of €0.6 Million in

4Q 2021 and an Operating Loss of (€3.0) Million in 4Q

2019.

- Despite Positive Results From Operations, 4Q 2022 Reports a

Loss After Taxes of (€5.3) Million, Due to (€2.4) Million of

Adverse FX Impact, (€2.7) Million of Financing Costs Deriving From

Higher Interest Rates and the Impact of COVID on China

Retail.

- Challenging Market Conditions Continue Affecting Clients’

Orders and Store Traffic, Which Might Adversely Impact Our

Operations in the Short-Term, While Group’s Long-Term Plans Are

Confirmed.

Fiscal Year 2022

Highlights

- 2022 Invoiced Sales Amounted to €468.5 Million, an Increase

of 9.6% Versus 2021 and 21.1% Versus Pre-Pandemic 2019.

- Gross Margin of 35.1% vs 36.0% in 2021 and 29.7% In

2019.

- 2022 Operating Profit of €8.4 Million, Compares to a Profit

of €4.9 Million in 2021 and a Loss of (€22.5) Million in 2019. 2022

Operating Profit Would Have Been of €12.9 Million, Net of (€4.5)

Million of Accruals for Non-Recurring Items Futher Detailed in the

Press Release

- Net Cash Provided by Operating Activities of €18.7 Million

in 2022, Compared to €0.5 Million in 2021 and €4.7 Million in

2019.

- We Reported Net Financial Costs of (€5.2) Million, Mainly

Due to Increase in Interest Rates, That Compare to Net Financial

Income of €0.3 Million in 2021 and Net Financial Costs of (€9.9)

Million in 2019.

- 2022 Profit of €1.3 Million, Compared to a Profit of €4.4

Million in 2021 Which Included €5.0 Million From an Asset Disposal,

and to a Loss of (€33.7) Million in 2019.

- Cash of €54.5 Million as of December 31, 2022, From €53.5

Million as of December 31, 2021, and €39.8 Million as of December

31, 2019.

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the fourth quarter and full year ended December 31,

2022.

Pasquale Natuzzi, Chairman of the Group, commented: “We continue

reporting an operating profit as a result of the execution of our

Brand-Retailer strategy and of the work done by our team to

streamline costs. We are focusing on these two elements, execution

of our Brand-Retailer strategy and cost discipline, to ensure our

Group gets through a challenging phase for the entire industry.

High interest rates have caused a freezing of the house market and

negatively impacted the purchases of durables. These trends are

negatively affecting the furniture industry globally. Also, the

broader business environment remains uncertain, with perduring

geopolitical instability, continued inflation despite the increase

in interest rates, high stock market volatility. We remain

committed to our long-term plans, looking for business expansion

and internal efficiency; at the same time, we are extremely

vigilant to ensure a tight cost control and high financial

discipline to navigate these difficult times.”

Antonio Achille, CEO of the Group, commented: “We continue

strengthening our commercial organization and executing our dual

brand strategy to grow the business in line with our mid-term

plan.

The Company is accelerating the completion of its multiyear

journey to become a Brand Retailer, transitioning from its original

prevailing nature of manufacturer.

On the brand front, we are focusing to ensure a clear market

positioning for each of our two main brands, with appealing

collections targeting distinctive segments of the market. As a

result, today 92% of our sales are from Brands compared to 89% one

year earlier. Measured at sell-out retail values, net of commercial

discounts, our Branded Business has been of € 830 million in

2023.

On the retail side, the Group has done significant progresses

developing a retail merchandise that can sustain the performances

of our DOS as well the ones of our Franchisees. We are confident

the retail methodologies and IT tools we have developed will

positively impact our retail performance, that today accounts for

61% of our sales globally from 53% one year earlier.

2022 confirms the improvements achieved by the Group to enhance

marginality from operations. We have not yet achieved the level of

operational efficiency we aspire to, but these initial results

encourage us to execute our restructuring. Restructuring for us is

not an end-goal per se, but the way to create a more agile and

consumer-focused organization that can support the successful

growth of our brands.

During 4Q 2022, our net results has been impacted by

non-recurring items and unexpected costs, which need to be

explained in detail given their magnitude.

As for the non-recurring items, during the fourth quarter of

2022 we had the followings:

- First of all, as part of our effort to streamline our cost

structure, we accrued (€2.4) million of one-off restructuring costs

(i.e., employees termination incentives) for our Italian

operations.

- We also accrued (€1.0) for a legal dispute over a land on which

part of the Group’s Brazilian plant is located.

In addition, during the quarter, our income statement was

affected by unexpected costs, due to a changed business

environment:

- We reported (€2.4) million of adverse FX impact, chiefly due to

the sharp strengthening of the euro vs the dollars that started

from early October 2022. Overall FX impacts on 2022 remains

positive.

- We reported (€2.7) million of financing costs deriving from

higher interest rates. We are focusing on enhancing efficiency in

our working capital management in an effort to improve the cash

flow from operations and reduce the amount of third-party

financing.

- The pick of COVID contagions in China during the last quarter

has resulted in a stop of retail activity and a loss of (€1.6)

million.

Looking at our core business, we contemporarily focus on growth

and cost discipline since we are both very confident on our

mid-term potential, but also very aware of the difficult times the

furniture industry is currently facing.

On the growth side, in 2022, we added 52 Natuzzi franchise

stores to our network, of which 39 located in China, 1 Natuzzi

Editions DOS located in the US as well as 2 Natuzzi Editions DOS

opened in the US in joint venture with a local partner. Therefore,

as of the end of 2022, the total number of Natuzzi stores was 703,

including 52 DOS directly managed by the Group, 24 stores directly

managed by our JV in China and the 2 above mentioned DOS in JV in

the US. Of these 703 points of sales, 379 are overall located in

China.

The network expansion will progress also in 2023. In term of DOS

openings, we are focusing on U.S., which represents one of our

largest retail opportunities, while we continue ensuring the retail

expansion in the remaining geographies with franchises. In 2023 we

will open 6 DOS in the U.S., of which 5 Natuzzi Italia, namely in

San Diego, Atlanta, Denver, Houston and Manhasset, and 1 Natuzzi

Editions in Frisco. We plan to open about 100 Natuzzi franchise

stores worldwide in 2023.

On strengthening our financial position, we continue focusing on

our cash generation, with an effort to reduce the working capital

from operations. We are undergoing different initiatives to

optimize the inventory level of raw material and shorten the lead

time of production inputs. In 2022 cash from operations was of

€18.7 million compared to €0.5 million in 2021 and €4.7 million in

2019.

We also progress with initiatives to sell non-strategic assets

sitting in our balance sheet, in the U.S. and Italy in particular,

with the aim of increasing flexibility to our Group’s

structure.

While we are confident that mid-term this negative demand cycle

will end, we have not yet seen significant signs of inversion in

the weak trend of demand that started mid-2022. However, the

progressive de-stocking of North American retailers and the end of

Covid in China give us hope that we are close to a turning point at

least in these two continents. In Europe, consumer attitude

evolution is more difficult to predict, since it highly depends on

the development of geopolitical context and the economic health of

the continent.

We recently made steps toward the completion of our leadership

team both in HQ and in our Regions. As anticipated last December,

we are glad to have aboard Carlo Silvestri, our new Chief Financial

Officer of the Group, who joins us from Ferragamo. In addition, we

are glad to welcome Mr. Scott Kruger as new Vice President for our

North American wholesale operations. Scott has a terrific track

record in building and scaling business in Nord America and we are

honored to have him joining our US team. We are convinced he will

help us fostering the growth of our wholesale branded business for

the U.S. and Canadian markets.

4Q 2022 CONSOLIDATED REVENUE

4Q 2022 consolidated revenue amounted to €116.5 million, an

increase of 0.7% from €115.6 million in 4Q 2021, and 15.8% from

€100.6 million of the pre-pandemic 4Q 2019.

Excluding “other sales” of €3.1 million, 4Q 2022 invoiced sales

from upholstered and other home furnishings products amounted to

€113.4 million, an increase of 1.5% compared to 4Q 2021 and 18.5%

compared to the pre-pandemic 4Q 2019. Delivered sales of

upholstered and home furnishings benefitted from the reduction in

the order backlog.

Revenue from upholstered and other home furnishings products are

hereafter described according to the main dimensions of the Group’s

business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. Branded/Unbranded business

The Group operates in the branded business (with the Natuzzi

Italia, Natuzzi Editions and Divani&Divani by Natuzzi) and the

unbranded business, the latter with collections dedicated to

large-scale distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brands strategy:

- Natuzzi Italia, our luxury

furniture brand, offers products entirely designed and manufactured

in Italy and targets an affluent and more sophisticated global

consumer with a highly inspirational collection that is largely the

same across all our global stores to best represent our Brand.

Natuzzi Italia products are almost exclusively sold in mono-brand

stores (directly operated or franchises).

- Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania, Brazil). Natuzzi

Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi. The store merchandising of Natuzzi

Editions, starting from a common collection, is tailored to best

fit the opportunities of each market. The Natuzzi Editions products

are sold primarily through galleries and selected mono-brand

franchise stores.

In 4Q 2022, Natuzzi’s branded invoiced sales amounted to €103.9

million, an increase of 5.0% compared to 4Q 2021 and 28.0% compared

to the pre-pandemic 4Q 2019. During the quarter, the branded

portion of the business represented 91.6% of sales upholstered and

other home furnishings products compared to 88.6% in 4Q 2021.

The following is the contribution of each Brand to 4Q 2022

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €51.7 million,

an increase of 20.7% compared to 4Q 2021 and 38.1% compared to 4Q

2019.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €52.1 million,

a decrease of (7.0%) compared to 4Q 2021, mainly as a result of a

de-stocking process of large retailers in North America, and an

increase of 19.2% compared to 4Q 2019.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €9.5 million, a decrease of (25.6%) and

(34.5%) compared to 4Q 2021 and 4Q 2019, respectively. The

Company’s strategy is to focus on selected large accounts and serve

them with a more efficient go-to-market model.

B. Key Markets

Here below a breakdown of 4Q 2022 upholstery and

home-furnishings invoiced sales compared to 4Q 2021, according to

the following geographic areas.

4Q 2022

4Q 2021

Delta €

Delta %

North America

30.6

30.0

0.6

2.0%

Greater China

10.5

15.6

(5.1)

(33.0%)

West & South Europe

41.1

38.5

2.6

6.8%

Emerging Markets

16.6

14.0

2.6

18.6%

Rest of the World*

14.6

13.5

1.1

7.6%

Total

113.4

111.7

1.7

1.5%

Figures in €/million, except

percentage

*Include South and Central America, Rest

of APAC.

The performance of invoiced sales in the North America was

curbed by the weak sales of the unbranded business, as the branded

part increased medium-high single digit over 4Q 2021.

As anticipated, during the quarter, operations of our partner in

China were greatly affected by the difficult business environment

following the perduring level of contagions in the region that

significantly affected consumers’ traffic in our stores.

C. Distribution

In 2022, the Group distributed its branded collections in 105

countries, according to the following table.

Direct Retail

FOS

Galleries

Total Dec. 31,

2022

North America

15(1)

8

151

174

West & South Europe

34

101

130

265

Greater China

24(2)

355

─

379

Emerging Markets

─

73

134

207

Rest of the World

5

88

93(3)

186

Total

78

625

508

1,211

(1) Included two DOS managed in joint

venture with a local partner. As the Natuzzi Group does not exert

full control in each of the two DOS, we consolidate only the

sell-in from such DOS.

(2) All directly operated by our Joint

Venture in China. As the Natuzzi Group owns a 49% stake in the

Joint Venture and does not control it, we consolidate only the

sell-in from such DOS.

(3) It includes 11 Natuzzi galleries

(store-in-store points of sale) directly managed by the Mexican

subsidiary of the Group.

FOS = Franchise stores managed by

independent partners.

During 4Q 2022, Group’s invoiced sales from DOS and Concessions

directly managed by the Group amounted to €22.2 million, an

increase of 23.7% compared to 4Q 2021.

In 4Q 2022, invoiced sales from franchise stores amounted to

€46.6 million, an increase of 12.8% compared to 4Q 2021.

We continue executing our strategy to become a Brand Retailer

and improve the quality of our distribution network. The weight of

the invoiced sales generated by the retail network (Directly

Operated Stores, or DOS, and Franchise Operated Stores, or FOS) on

total upholstered and home furnishings business in 4Q 2022 was

60.7% compared to 53.0% in 4Q 2021.

The Group also sells its products through the wholesale channel,

consisting primarily of Natuzzi-branded galleries in multi-brand

stores, as well as mass distributors selling unbranded products.

During 4Q 2022, invoiced sales from the wholesale channel amounted

to €44.6 million, a decrease of (15.0%) compared to 4Q 2021. Such

decrease is mainly attributable to lower sales from our large

distributors in North America that are focusing on reducing their

stock, thus postponing orders for new products.

4Q 2022 GROSS MARGIN

In 4Q 2022, we had a gross margin of 37.0%, as compared to 35.6%

in 4Q 2021, mainly due to a favorable sales and channel mix, a

decrease in the average consumption of raw materials, as well as

effective price adjustments that were enacted in the first part of

the year in response to inflationary pressure.

During the fourth quarter of 2022, the Company accrued (€2.1)

million of labor-related cost following the incentive plan for

workers who terminate their employment relationship at the Italian

operations. Excluding such non-recurring restructuring labor cost,

gross margin would have been equal to 38.8%.

As for production inputs, we continue to face a mixed picture.

While we continue to see a downward trend in the cost of leather,

some raw materials, especially those that are energy-intensive,

such as iron components and mechanisms, or wood, as well as

oil-related products, such us polyurethane, remains stable and

still at high levels. Furthermore, industrial costs increased by

€0.4 million compared to the same quarter of 2021, almost entirely

due to the persisting high level of energy cost.

We are committed to modernize our industrial footprint,

especially at the Italian operations, toward a 4.0 industrial work

organization. The volatile business marketplace has led us to

postpone some planned investments that have partially affected the

improvement of performances in our factories.

4Q 2022 OPERATING EXPENSES

During 4Q 2022, operating expenses (which include selling

expenses, administrative expenses, other operating income/expenses,

and the impairment of trade receivables) were (€41.3) million (or

35.5% on revenue), compared to (€40.6) million (or 35.2% on

revenue) in 4Q 2021.

During the quarter, the Company accounted for a total of (€1.7)

million of accruals not linked to the ordinary course of the

business. Net of such accruals, operating expenses would have been

equal to (€39.6) million, or 34.0% of revenue. In particular,

during 4Q 2022 the Company accrued:

- (€0.3) million of labor-related cost following the incentive

plan for employees who terminate their employment relationship at

the Italian operations.

- (€1.0) million within the Other Expenses caption for a

contingency in connection with a legal dispute over a land on which

part of the Group’s Brazilian plant is located.

- (€0.4) million for higher labor cost, following the adoption of

the Stock Option Plan (“SOP”) approved by the Company’s

shareholders on July 1, 2022. This accrual was based on an

independent qualified third-party estimation of the fair value of

the equity instruments granted under the SOP.

In 4Q 2022, transportation costs were 12.5% of revenue, compared

to 13.6% in 4Q 2021.

4Q 2022 NET FINANCE INCOME/(COSTS)

During the fourth quarter of 2022, the Company reported (€4.8)

million of Net Finance costs compared to Net Finance income of €1.7

million in 4Q 2021.

Rising interest rates adversely impacted our results principally

in terms of increased interest expense of rental contracts and

third-party financing. As a consequence, during the quarter the

Company reported Finance costs of (€2.7) million compared to

Finance costs of (€1.5) million in 2021 fourth quarter.

In addition, the sharp rebound in Euro occurred during the

quarter toward major currencies has resulted in a net exchange rate

loss of (€2.4) million (compared to a net exchange rate gain of

€2.8 million in 4Q 2021), mainly deriving from the difference

between invoice exchange rates and collection/payment exchange

rates, as well as the mark-to-market evaluation on trade

receivables and payables not yet expired as of the end of the year.

Considering the full 2022, we had a net exchange rate gain €2.4

million, compared to a net gain of €1.9 million in 2021.

KEY RESULTS SUMMARY: FULL YEAR 2022

During 2022, the Company reported the following results:

- Total revenue of €468.5 million, an increase of 9.6% compared

to 2021 and 21.1% compared to the pre-pandemic 2019.

- We had a gross margin of 35.1%, compared to 36.0% and 29.7%

reported in 2021 and 2019, respectively. 2022 gross margin was

mainly affected by high cost of raw materials and spike in energy

costs. Furthermore, excluding (€2.2) million of labor-related

accrual following the incentive plan for workers who terminate

their employment relationship, gross margin would have been

35.6%.

- Depreciation and amortization for the period, which include the

depreciation charge of right-of-use assets related to the operating

leases and accounted for in the cost of sales, selling and

administrative expenses, amounted to €21.7 million, compared to

€21.4 million and €25.1 million in 2021 and 2019,

respectively.

- We had an operating profit of €8.4 million, compared to an

operating profit of €4.9 million in 2021 and an operating loss of

(€22.5) million reported in 2019. 2022 operating profit includes

further (€2.3) million of non-recurring accruals, namely (€1.0)

million in connection with the SOP, (€1.0) million for the legal

dispute in Brazil and (€0.3) million of labor-related cost

following the incentive plan for workers who terminate their

employment relationship.

- Net finance costs were (€5.2) million, mainly as a result of

Finance costs of (€8.5) million, due to rising interest rates, and

a Net exchange rate gain of €2.4 million. 2022 Net Finance costs

compare to net finance income of €0.3 million in 2021 and net

finance costs of (€9.9) million in 2019.

- We had a profit after tax for the period of €1.3 million, which

compares to a profit after tax of €4.4 million in 2021 that

included a one-off gain of €5.0 million from the disposal in 2021

of a formerly wholly owned subsidiary of the Company, as part of

Natuzzi’s strategy to streamline its operating model. The €1.3

million profit after tax compares to a loss after tax of (€33.7)

million reported for 2019.

BALANCE SHEET AND CASH FLOW

During 2022, €18.7 million of net cash were provided by

operating activities as a result of:

- A profit for the period of 1.3 million;

- adjustments for non-monetary items of €27.3 million, of which

depreciation and amortization of €21.7 million;

- nil change in working capital, mainly as a result of lower

inventories for €10.1 million, higher trade and other receivables

for (€1.2) million, offset by higher trade and other

liabilities;

- interest and taxes paid of (€9.9) million.

During 2022, (€4.7) million of cash were used in investing

activities, as a result of (€9.0) million of cash invested in net

capital expenditures, (€0.5) million as capital contribution in the

joint venture Natuzzi Texas LLC to open Natuzzi stores, partially

offset by €3.7 million as dividends received from our JV in China

in addition to €1.1 million of cash collected in connection with

the completion of the sale transaction of a former Company’s

subsidiary.

In the same period, (€13.5) million of cash were used in

financing activities, due to the repayment of long-term borrowing

for (€4.5) million, (€7.4) million for short-term borrowing

repayment and (€10.0) million for lease repayment and (€0.6)

million as dividends distribution in favor of non-controlling

interests, partially offset by €4.0 million provided by a long-term

loan made available by the Italian government as part of the

COVID-19 measures to support businesses, €4.9 million as a capital

contribution by the Vietnamese partner who acquired a 20% stake in

Natuzzi Singapore.

As a result, as of December 31, 2022, cash and cash equivalents

was €54.5 million compared to €53.5 million as of December 31,

2021.

As of December 31, 2022, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of €7.9 million, compared

to (€0.1) million as of December 31, 2021.

With reference to the SOP, as at December 31, 2022, only one

beneficiary has exercised the option by subscribing 220,000

ordinary shares of the Company (equivalent to 44,000 American

Depositary Receipts, or ADRs). Therefore, as of December 31, 2022,

the total number of ordinary shares issued and outstanding by the

Company is 55,073,045. Natuzzi’s Ordinary Shares are listed on the

NYSE in the form of American Depositary Receipts (ADRs), with 1 ADR

representing 5 Ordinary Shares.

******

CONFERENCE CALL

The Company will host a conference call to discuss fourth

quarter and full year 2022 financial results on Friday April 14,

2023, at 10:00 a.m. U.S. Eastern Time (4.00 p.m. Italy time, or

3.00 p.m. UK time).

To join the live conference call, interested persons will need

to either:

- dial-in the following number: Toll/International:

+1-412-717-9633, then passcode 39252103#; or

- click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join via

video. Participants also have the option to listen via phone after

registering to the link.

Natuzzi S.p.A. and Subsidiaries Unaudited

consolidated statement of profit or loss for the fourth quarter of

2022 and 2021 on the basis of IFRS-IAS (expressed in millions Euro,

except as otherwise indicated)

Fourth quarter ended

on

Change

Percentage of revenue

31-Dec-22

31-Dec-21

%

31-Dec-22

31-Dec-21

Revenue

116.5

115.6

0.7%

100.0%

100.0%

Cost of Sales (1)

(73.4)

(74.4)

-1.4%

-63.0%

-64.4%

Gross profit

43.1

41.2

4.6%

37.0%

35.6%

Other income

1.7

1.4

1.5%

1.2%

Selling expenses (2)

(32.1)

(32.0)

0.6%

-27.6%

-27.6%

Administrative expenses (3)

(9.5)

(9.9)

-3.8%

-8.2%

-8.6%

Impairment on trade receivables

(0.0)

(0.0)

0.0%

0.0%

Other expenses (4)

(1.4)

(0.2)

-1.2%

-0.1%

Operating profit/(loss)

1.8

0.6

1.5%

0.5%

Finance income

0.2

0.2

0.2%

0.1%

Finance costs

(2.7)

(1.5)

-2.3%

-1.3%

Net exchange rate gains/(losses)

(2.4)

2.8

-2.0%

2.4%

Gain from disposal and loss of control of a subsidiary

—

0.3

0.0%

0.2%

Net finance income/(costs)

(4.8)

1.7

-4.1%

1.5%

Share of profit/(loss) of equity-method investees

(1.6)

0.8

-1.4%

0.7%

Profit/(Loss) before tax

(4.6)

3.1

-4.0%

2.7%

Income tax expense

(0.6)

(1.2)

-0.5%

-1.1%

Profit/(Loss) for the period

(5.3)

1.9

-4.5%

1.6%

Profit/(Loss) attributable to: Owners of the Company

(6.0)

1.5

Non-controlling interests

0.7

0.4

(1) Included €2.1 million of labor-related

cost following the incentive plan for workers who terminate their

employment relationship at the Italian operations.

(2) Included €0.4 million of labor cost

related to the adoption of the SOP.

(3) Included €0.3 million of labor-related

cost following the incentive plan for employees who terminate their

employment relationship at the Italian operations.

(4) Included €1.0 million for a

contingency in connection with a legal dispute over a land on which

part of the Group’s Brazilian plant is located.

Natuzzi S.p.A. and Subsidiaries Unaudited

consolidated statement of profit or loss for the twelve months of

2022 and 2021 on the basis of IFRS-IAS (expressed in millions Euro,

except as otherwise indicated)

Twelve months ended on

Change

Percentage of revenue

31-Dec-22

31-Dec-21

%

31-Dec-22

31-Dec-21

Revenue

468.5

427.4

9.6%

100.0%

100.0%

Cost of Sales (1)

(304.2)

(273.6)

11.2%

-64.9%

-64.0%

Gross profit

164.3

153.8

6.8%

35.1%

36.0%

Other income

6.5

6.4

1.4%

1.5%

Selling expenses (2)

(124.9)

(121.6)

2.7%

-26.7%

-28.5%

Administrative expenses (3)

(35.5)

(33.3)

6.5%

-7.6%

-7.8%

Impairment on trade receivables

(0.3)

(0.1)

-0.1%

0.0%

Other expenses (4)

(1.7)

(0.3)

-0.4%

-0.1%

Operating profit/(loss)

8.4

4.9

1.8%

1.1%

Finance income

0.9

0.2

0.2%

0.1%

Finance costs

(8.5)

(6.8)

-1.8%

-1.6%

Net exchange rate gains/(losses)

2.4

1.9

0.5%

0.4%

Gain from disposal and loss of control of a subsidiary

—

5.0

0.0%

1.2%

Net finance income/(costs)

(5.2)

0.3

-1.1%

0.1%

Share of profit/(loss) of equity-method investees

0.4

3.6

0.1%

0.8%

Profit/(Loss) before tax

3.6

8.8

0.8%

2.1%

Income tax expense

(2.3)

(4.4)

-0.5%

-1.0%

Profit/(Loss) for the period

1.3

4.4

0.3%

1.0%

Profit/(Loss) attributable to: Owners of the Company

(0.5)

3.6

Non-controlling interests

1.8

0.8

(1) Included €2.2 million of labor-related

cost following the incentive plan for workers who terminate their

employment relationship at the Italian operations.

(2) Included €1.0 million of labor cost

related to the adoption of the SOP.

(3) Included €0.3 million of labor-related

cost following the incentive plan for employees who terminate their

employment relationship at the Italian operations.

(4) Included €1.0 million for a

contingency in connection with a legal dispute over a land on which

part of the Group’s Brazilian plant is located.

Natuzzi S.p.A. and Subsidiaries Unaudited

consolidated statements of financial position (condensed)on the

basis of IFRS-IAS(Expressed in millions of Euro)

31-Dec-22 31-Dec-21 ASSETS Non-current

assets

177.6

189.6

Current assets

191.0

200.4

TOTAL ASSETS

368.6

390.0

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

87.9

82.3

Non-controlling interests

4.7

1.5

Non-current liabilities

95.3

107.5

Current liabilities

180.8

198.7

TOTAL EQUITY AND LIABILITIES

368.6

390.0

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

31-Dec-22 31-Dec-21 Net cash provided

by (used in) operating activities

18.7

0.5

Net cash provided by (used in) investing activities

(4.7)

7.0

Net cash provided by (used in) financing activities

(13.5)

(2.0)

Increase (decrease) in cash and cash equivalents

0.5

5.5

Cash and cash equivalents, beginning of the year

52.2

46.1

Effect of movements in exchange rates on cash held

(0.1)

0.6

Cash and cash equivalents, end of the period

52.7

52.2

For the purpose of the statements of cash flow,

cash and cash equivalents comprise the following: (Expressed in

millions of Euro)

31-Dec-22 31-Dec-21 Cash and cash

equivalents in the statement of financial position

54.5

53.5

Bank overdrafts repayable on demand

(1.8)

(1.2)

Cash and cash equivalents in the statement of cash flows

52.7

52.2

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

Certain statements included in this press release constitute

forward-looking statements within the meaning of the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements may be expressed in a variety of ways, including the use

of future or present tense language. Words such as “estimate,”

“forecast,” “project,” “anticipate,” “likely,” “target,” “expect,”

“intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,”

“should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,”

“opportunities,” “trends,” “ambition,” “objective,” “aim,”

“future,” “potentially,” “outlook” and words of similar meaning may

signify forward-looking statements. These statements involve risks

and uncertainties that could cause the Company’s actual results to

differ materially from those stated or implied by such

forward-looking statements including, but not limited to, potential

risks and uncertainties described at page 3 of this document

relating to the supply-chain, the cost and availability of raw

material, production and shipping and the modernization of our

Italian manufacturing and those relating to the duration, severity

and geographic spread of the COVID-19 pandemic, actions that may be

taken by governmental authorities to contain the COVID-19 pandemic

or to mitigate its impact, the potential negative impact of

COVID-19 on the global economy, consumer demand and our supply

chain, and the impact of COVID-19 on the Company's financial

condition, business operations and liquidity, as well as the

geopolitical tensions and market uncertainties resulting from the

Russian invasion of Ukraine and current conflict. Additional

information about potential factors that could affect the Company’s

business and financial results is included in the Company’s filings

with the U.S. Securities and Exchange Commission, including the

Company’s most recent Annual Report on Form 20-F. The Company

undertakes no obligation to update any of the forward-looking

statements after the date of this press release.

About Natuzzi S.p.A.

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of

the most renowned brands in the production and distribution of

design and luxury furniture. With a global retail network of 703

mono-brand stores and 508 galleries as of December 31, 2022,

Natuzzi distributes its collections worldwide. Natuzzi products

embed the finest spirit of Italian design and the unique

craftmanship details of the “Made in Italy”, where a predominant

part of its production takes place. Natuzzi has been listed on the

New York Stock Exchange since May 13, 1993. Always committed to

social responsibility and environmental sustainability, Natuzzi

S.p.A. is ISO 9001 and 14001 certified (Quality and Environment),

ISO 45001 certified (Safety on the Workplace) and FSC® Chain of

Custody, CoC (FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230413005777/en/

Natuzzi Investor Relations Piero Direnzo | tel. +39

080-8820-812 | pdirenzo@natuzzi.com Natuzzi Corporate

Communication Giacomo Ventolone (Press Office) | tel.

+39.335.7276939 | gventolone@natuzzi.com

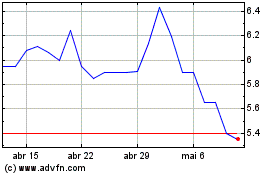

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Natuzzi S P A (NYSE:NTZ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024