Veolia Environnement: Another Quarter of Strong Revenue and Results Growth

04 Maio 2023 - 2:30AM

Business Wire

Key Figures at 31 March 2023 (Non Audited IFRS Data)

Good Commercial Momentum Confirmation

of the Strength of Our Business Models EBITDA up Sharply by

+8% Like for Like Driven by Price Increases and €130m of

Efficiencies and Synergies

2023 Guidance Fully Confirmed

- Significant Organic Revenue Growth of +19.9%1 to €12 007

M

- +6.3%1 Excluding Energy Price Impact

- EBITDA Strongly up by +8.0%1 to €1 574 M

- €87 M of Efficiency Gains and €43 M of Synergies in Q1, in

Line With Annual Objective

- Sharp Increase of Current EBIT of +14.0%1, to €788

M2

- Net Financial Debt Well Under Control, at €18 727

M2

- 2023 Guidance Fully Confirmed:

- Solid Organic Revenue Growth

- Organic Growth of EBITDA Between +5% and +7%

- Current Net Income Group Share Around €1.3 bn

- Leverage Ratio Around 3x

1 at constant scope and exchange rates 2 Excluding the impact of

the Suez PPA.

Regulatory News:

Veolia Environnement (Paris:VIE):

Estelle Brachlianoff, CEO of the Group, commented : "2023

has started perfectly for Veolia and builds on the excellent trends

of the end of 2022. Our organic revenue growth was 19.9%. In terms

of results, the group's EBITDA grew by +8% and our recurring EBIT

by +14%. This performance again illustrates our low sensitivity to

the economic cycle and our ability to pass on cost increases in our

prices. Our commercial successes confirm the relevance of our

Decarbonisation, Depollution and Resource Regeneration service

offerings and our strong differentiation in serving our clients, as

we have just done with major contracts in Lille, Istanbul and Gold

Coast. As a global leader with strong positions in all key

geographies, Veolia is ideally positioned to seize the

opportunities of the ecological transformation market, which makes

us very confident in our ability to pursue solid growth in the

years to come.

We are therefore starting fiscal year 2023 at full speed,

perfectly launched for another year of strong growth, and fully

confirm our objectives."

Detailed key figures at 31 March 2023

- Revenue in Q1 2023 was 12,007 million euros compared to

9,935 million euros in Q1 2022, up +19.9% at constant scope and

exchange rates and +6.3% excluding energy prices

The evolution of revenue by effect is as follows :

The exchange rate effect was -106 million euros (-1.1%)

and mainly reflects the depreciation of sterling pound, polish

zloty and argentinian peso, partially offset by higher US

dollar.

Scope effect was +204 million euros (+2.1%) and mainly

includes the impacts of the finalization of antitrust divestitures

associated with the acquisition of Suez in 2022.

The Commerce / Volumes / Works effect was +377 million

euros (+3.8 %) thanks mainly to Energy and Water Technologies.

The climate effect was slightly negative at -35 million

euros (-0.3%), and was due to the mild winter in Central and

Eastern Europe.

The impact of energy prices amounted to +1 353 million

euros (+13.6%) due to the very strong increase of heat and

electricity prices in Central and Eastern Europe.

The impact of the price of recycled materials amounted to

-93 million euros (-0.9%) mainly due to decreased paper and

cardboard prices in France, Germany and in the UK between August

and December 2022. Prices stabilized in the beginning of 2023 and

have increased since April.

Price effects in Water and Waste were very favorable, of

+372 million euros (+3.7%), reflecting increased prices and

indexations, of +4.9% on average in Water and +4.1% in Waste.

- Revenue at 31 March 2023 progressed across all operating

segments compared to 31 March 2023

- Revenue in France and Special waste Europe amounted to

€2,354 million and showed organic growth of +3.0% compared

to 31 March 2022 :

- Water France revenue was up by +1.5% thanks to increased

indexations compensating for the end of the Lyon contract. Volumes

are slightly down, by -0.6%.

- Waste France revenue decreased by 1.1% mainly due to

lower recycled material prices partially offset by increased

service and energy prices.

- The Hazardous Waste Europe activities continued to grow,

by +5.8%, benefitting from the pursuit of price increases. SARPI

grew by +7.3% and SARP-OSIS by +6.9%.

- SADE revenue was up by +4.3%, thanks to continued strong

commercial momentum.

- Revenue in Europe excluding France reached €5,664

million at 31 March 2023, with organic growth of +32.6%, mainly

due to higher energy prices in Central and Eastern Europe.

- In Central and Eastern Europe, revenue reached 3,786

million euros, a sharp increase of +57.3 % driven by higher heat

and electricity prices. The weather effect in Energy was slightly

negative (-35 million euros).

- In Northern Europe, revenue amounted to 973 million

euros, up 6.1%. UK (Veolia only) was up by +8.9% at constant

scope and forex thanks notably to good municipal and C&I waste

collection, combined with new decarbonization contracts.

Belux organic growth was +6.4%.

- In Italy, revenue decreased by -14.5%, to 290 million

euros due to lower energy prices.

- In Iberia, revenue was up +11.0%, to 615 million euros ,

thanks to Energy services but also to Water, with volumes up by

+0.5% and increased tariffs.

- Revenue in the Rest of the World reached €2,924

million, with organic growth of +11.2%.

- Revenue in Latin America increased by +26.7%, thanks to

increased tariff indexations notably in water in Chile.

- In Africa Middle East, revenue increased by +18.4%.

- In North America, revenue reached 769 million euros, up

+8.3% thanks to strong hazardous waste business, benefiting from

favorable mix and increased prices, combined with increased tariffs

in Water.

- Asia was back to solid revenue growth, of +8.2 %. China

activity improved and grew by +6.7%, while South Korea, Japan and

Taiwan continued to register double-digit growth rates.

- In the Pacific, revenue increased by +1.7 %.

- The Water Technologies business grew strongly by 14.7% to

€1,059 million. Veolia Water Technologies recorded growth of

+11.6% thanks to service and technology and Water Technologies

Services grew sharply by +16.4%, thanks to a good level of activity

and price increases, particularly in the sale of water treatment

chemicals and engineering services.

- By business, at constant scope and exchange rates, the 19.9%

growth was mainly driven by Energy due to sharply increased energy

prices . Excluding energy prices, organic growth was +6.3%.

- Water revenue increased by +9.9%, to 4 270 million

euros, with slightly higher volumes (+1.9% in Central and Eastern

Europe, -0.6% in France, +0.5% in Spain, +1% in Chile and -0.7% in

the US), the full impact of higher indexations in all geographies

(+4.6% in total) and double-digit growth of Water Technologies

.

- Waste revenue grew by +3.2% at constant scope and forex,

to 3 603 million euros. Volume effect was +0.6%, price effect was

+4.1%, partially offset by lower recyclate prices (mostly cardboard

and paper) with a negative impact of -2.5% on revenue growth.

- Energy revenue increased sharply, by 54% at constant

scope and forex to 4 133 million euros, mainly due to higher heat

and electricity prices reflecting increased cost of energies (gas,

coal, biomass). Weather effect was slightly negative, -1,3% due to

mild winter.

- Strong EBITDA growth of +8% at constant scope and exchange

rates, from 1,456 million euros to 1 574 million euros.

- Exchange rate fluctuations had an unfavorable impact of -€7M,

offset by favorable scope effects of +€9M.

- Strong EBITDA growth was driven by a volume effect of +23

million euros (+1.6%), a slightly negative weather effect of -10

million euros, an energy price effect of +40 million euros

partially offset by a recyclate prices impact of -24 million euros,

an effect of price increases net of cost increases and contract

renegotiations of -43 million euros (-2.9%) and efficiencies and

synergies for +130 million euros (+8.9%), including 43 million

euros of synergies in line with annual target.

- Very strong growth of Current EBIT of +14% at constant scope

and exchange rates to 788 million euros(1) . Currency movements

weighed by -€10M on current EBIT. The increase in recurring EBIT on

a like-for-like basis (€100m) breaks down as follows :

- Strong EBITDA growth (+117 million euros at constant scope and

forex).

- Depreciation and amortization (excluding operating financial

assets reimbursements) increase of +2.4% at constant scope and

forex

- Decrease of Industrial capital gains net of asset impairments

from +28 million euros in Q1 2022 to -3 million euros in Q1 2023.

In Q1 2022 the Group had registered industrial capital gains on

antitrust asset divestitures in Australia notably.

- Increased share of current net income of JV and associates from

+18 million euros to +28 million euros.

- Net financial debt(1) is well under control, at 18 727

million euros at 31 March 2023 vs. 18 138 million euros at 31 March

2022.

- Compared with 31 December 2022, the change in net financial

debt is mainly explained by the following elements :

- Net free cash-flow amounted to -482 million euros vs. - 451

million euros in Q1 2022, including gross capex of 942 million

euros vs. 762 million euros in Q1 2022(2) due to higher

decarbonization capex in Central and Eastern Europe and in

hazardous waste projects, and an improved seasonal variation of

Working Capital despite increased revenue.

- Net financial debt was also impacted by an unfavorable exchange

rate and fair value variation effect of -167 million euros at 31

March 2023.

(1) Excluding Suez PPA impact (2) Including the 17 days for 39

million euros

In view of the very strong 1st quarter 2023 performance, 2023

guidance is fully confirmed.

- Objectives 2023 (1)(2)

- Solid organic growth of revenue

- Efficiency gains above €350m complemented by additional

synergies for a cumulated amount of €280m end-2023, in line with

the €500m cumulated objective.

- Organic growth of EBITDA between +5% and +7%

- Current net income group share around €1.3bn(2)

- Confirmation of the EPS accretion(3) of around 40% in 2024

- Leverage ratio around 3x

- Dividend growth in line with current EPS growth

(1)

At constant forex and without extension of

the conflict beyond the Ukrainian territory and without significant

change in the energy supply conditions in Europe

(2)

Before Suez PPA

(3)

Current net income per share after hybrid

costs and before PPA

About Veolia

Veolia Group aims to become the benchmark company for ecological

transformation. Present on five continents with nearly 220,000

employees, the Group designs and deploys useful, practical

solutions for the management of water, waste and energy that are

contributing to a radical turnaround of the current situation.

Through its three complementary activities, Veolia helps to develop

access to resources, to preserve available resources and to renew

them. In 2022, the Veolia group provided 111 million inhabitants

with drinking water and 97 million with sanitation, produced 44

terawatt hours of energy and recovered 61 million tonnes of waste.

Veolia Environnement (Paris Euronext: VIE) achieved consolidated

revenue of 42 885 million euros in 2022. www.veolia.com

Important disclaimer

As the changes in the health crisis are difficult to estimate,

we draw your attention to the “forward-looking statements” that may

appear in this press release and relating to the consequences of

this crisis which may affect the future performance of the

Company.

Veolia Environnement is a corporation listed on the Euronext

Paris. This press release contains “forward-looking statements''

within the meaning of the provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including but not limited to: the risk of suffering

reduced profits or losses as a result of intense competition, the

risk that changes in energy prices and taxes may reduce Veolia

Environnement’s profits, the risk that governmental authorities

could terminate or modify some of Veolia Environnement’s contracts,

the risk that acquisitions may not provide the benefits that Veolia

Environnement hopes to achieve, the risks related to customary

provisions of divestiture transactions, the risk that Veolia

Environnement’s compliance with environmental laws may become more

costly in the future, the risk that currency exchange rate

fluctuations may negatively affect Veolia Environnement’s financial

results and the price of its shares, the risk that Veolia

Environnement may incur environmental liability in connection with

its past, present and future operations, as well as the other risks

described in the documents Veolia Environnement has filed with the

Autorité des Marchés Financiers (French securities regulator).

Veolia Environnement does not undertake, nor does it have, any

obligation to provide updates or to revise any forward-looking

statements. Investors and security holders may obtain from Veolia

Environnement a free copy of documents it filed (www.veolia.com)

with the Autorités des marchés financiers.

This document contains "non‐GAAP financial measures". These

"non‐GAAP financial measures" might be defined differently from

similar financial measures made public by other groups and should

not replace GAAP financial measures prepared pursuant to IFRS

standards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230503005941/en/

Group Media Relations Laurent Obadia Evgeniya Mazalova

+33 (0)1 85 57 86 25

Investor Relations Ronald Wasylec - Ariane de Lamaze

+33 (0)1 85 57 84 76 / 84 80

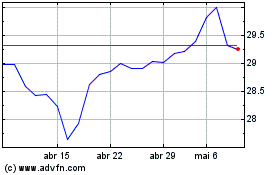

Veolia Environnement (EU:VIE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Veolia Environnement (EU:VIE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024