– Company Raises Outlook for 2023

–

- Q1 Revenue of $18.6 million, up 113% year-over-year

- Q1 Ending ARR1 of $42.0 million, up 153%

year-over-year

- Q1 Ending RPO2 of $161.8 million, up 154%

year-over-year

- Q1 Ending Evolv Express® subscriptions of 2,787, up 206%

year-over-year

Evolv Technology (NASDAQ: EVLV), the leader in AI-based weapons

detection security screening, today announced financial results for

the quarter ended March 31, 2023 and raised its business outlook

for 2023.

Results for the First Quarter of 2023

Total revenue for the first quarter of 2023 was $18.6 million,

an increase of 113% compared to $8.7 million for the first quarter

of 2022. Annual Recurring Revenue (“ARR”)1 was $42.0 million at the

end of first quarter of 2023, an increase of 153% compared to $16.6

million at the end of the first quarter of 2022. Net loss for the

first quarter of 2023 was $(28.6) million, or $(0.20) per basic and

diluted share, compared to net loss of $(13.8) million, or $(0.10)

per basic and diluted share, in the first quarter of 2022. Adjusted

earnings (loss)3 for the first quarter of 2023 was $(16.9) million,

or $(0.12) per diluted share, compared to adjusted earnings (loss)3

of $(18.5) million, or $(0.13) per diluted share, for the first

quarter of 2022. Adjusted EBITDA3 for the first quarter of 2023 was

$(15.4) million compared to $(17.3) million in the first quarter of

2022. Cash and cash equivalents as of March 31, 2023 was $182

million which reflected the Company's decision to pay off its $30

million debt facility during the first quarter of 2023. The Company

had no debt as of March 31, 2023.

The following table summarizes the breakdown of recurring and

non-recurring revenue4 during each quarter:

Three Months Ended

March 31,

2023

2022

% Change

Recurring revenue

$

9,075

$

3,159

187

%

Non-recurring revenue

9,506

5,551

71

%

Total revenue

$

18,581

$

8,710

113

%

The following table summarizes operating cash flows during each

quarter:

Three Months Ended

March 31,

2023

2022

Net loss

$

(28,609

)

$

(13,801

)

Non-cash (income) expense

14,005

(5,126

)

Changes in operating assets and

liabilities

11,170

(10,503

)

Net cash used in operating activities

$

(3,434

)

$

(29,430

)

Company Raises Outlook for 2023

The Company today commented on its business outlook for 2023.

The Company's outlook is based on the current indications for its

business, which may change at any time.

2023 Business Outlook

Estimate (In millions)

Issued March 1, 2023

Issued May 10, 2023

Total Revenue

$55-$60

$60-$65

Annual Recurring Revenue1 (ARR) at

12/31/23

$65-$70

$67-$71

Adjusted Gross Margin3

30%-35%

35%-40%

Adjusted EBITDA3

($55-$60)

($53-$58)

Company to Host Live Conference Call and Webcast

The Company’s management team plans to host a live conference

call and webcast at 4:30 p.m. Eastern Time today to discuss the

financial results as well as management’s outlook for the business

and other matters. The conference call may be accessed in the

United States by dialing +1.877.692.8955 and using access code

825879. The conference call may be accessed outside of the United

States by dialing +1.234.720.6979 and using the same access code.

The conference call will be simultaneously webcast on the Company’s

investor relations website, which can be accessed at

http://ir.evolvtechnology.com. A replay of the conference call will

be available for a period of 30 days by dialing +1.866.207.1041 or

+1.402.970.0847 and using access code 9795540 or by accessing the

webcast replay on the Company’s investor relations website at

http://ir.evolvtechnology.com.

About Evolv Technology

Evolv Technology (NASDAQ: EVLV) is transforming human security

to make a safer, faster, and better experience for the world’s most

iconic venues and companies as well as schools, hospitals, and

public spaces, using industry leading artificial intelligence

(AI)-powered weapons detection and analytics. Its mission is to

transform security to create a safer world to work, learn, and

play. Evolv has digitally transformed the gateways in places where

people gather by enabling seamless integration combined with

powerful analytics and insights. Evolv’s advanced systems have

scanned more than 600 million people, second only to the Department

of Homeland Security’s Transportation Security Administration (TSA)

in the United States. Evolv has been awarded the U.S. Department of

Homeland Security (DHS) SAFETY Act Designation as a Qualified

Anti-Terrorism Technology (QATT) as well as the Security Industry

Association (SIA) New Products and Solutions (NPS) Award in the Law

Enforcement/Public Safety/Guarding Systems category. Evolv

Technology®, Evolv Express®, Evolv Insights®, and Evolv Cortex AI®

are registered trademarks of Evolv Technologies, Inc. in the United

States and other jurisdictions. For more information, visit

https://evolvtechnology.com.

1 We define Annual Recurring Revenue, or ARR, as

subscription revenue and the recurring service revenue related to

purchase subscriptions for the final month of the quarter

normalized to a one-year period. Our calculation of ARR is not

adjusted for the impact of any known or projected future events

(such as customer cancellations, upgrades or downgrades, or price

increases or decreases) that may cause any such contract not to be

renewed on its existing terms. In addition, the amount of actual

revenue that we recognize over any 12-month period is likely to

differ from ARR at the beginning of that period, sometimes

significantly. This may occur due to new bookings, cancellations,

upgrades, downgrades or other changes in pending renewals, as well

as the effects of professional services revenue and acquisitions or

divestitures. As a result, ARR should be viewed independently of,

and not as a substitute for or forecast of, revenue and deferred

revenue. Our calculation of ARR may differ from similarly titled

metrics presented by other companies.

2 We define Remaining Performance Obligation, or RPO, as

estimated revenues expected to be recognized in the future related

to performance obligations that are unsatisfied or partially

satisfied as of the end of the quarter.

3 Non-GAAP Financial Measures In this press release, the

Company’s adjusted operating expenses, adjusted gross profit

(loss), adjusted gross margin, adjusted operating income (loss),

adjusted EBITDA, adjusted earnings (loss), and adjusted earnings

per share-diluted are not presented in accordance with generally

accepted accounting principles (GAAP) and are not intended to be

used in lieu of GAAP presentations of results of operations.

Adjusted gross profit and adjusted gross margin exclude one-time

items including stock-based compensation expense which management

believes provides a more meaningful representation of contribution

margin. Adjusted operating expenses is defined as operating

expenses less one-time items including stock-based compensation

expense, restructuring expenses, and loss on impairment of lease

equipment which management believes provides a more meaningful

representation of on-going operating expense levels. Adjusted

EBITDA is defined as net income (loss) plus depreciation and

amortization, share-based compensation, and certain other one-time

expenses. Adjusted earnings (loss) is defined as net income (loss)

plus stock-based compensation, change in fair value of derivative

liability, change in fair value of contingent earn-out liability,

change in fair value of contingently issuable common stock

liability, change in fair value of public warrant liability, change

in fair value of common stock warrant liability, restructuring

expenses, loss on impairment of lease equipment, and certain other

one-time expenses. Management presents non-GAAP financial measures

because it considers them to be important supplemental measures of

performance. Management uses non-GAAP financial measures for

planning purposes, including analysis of the Company's performance

against prior periods, the preparation of operating budgets and to

determine appropriate levels of operating and capital investments.

Management also believes non-GAAP financial measures provide

additional insight for analysts and investors in evaluating the

Company's financial and operational performance. However, non-GAAP

financial measures have limitations as an analytical tool and are

not intended to be an alternative to financial measures prepared in

accordance with GAAP. We intend to provide non-GAAP financial

measures as part of our future earnings discussions and, therefore,

the inclusion of non-GAAP financial measures will provide

consistency in our financial reporting. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measures included in this press

release. The Company is unable to provide a reconciliation of

Adjusted Gross Margin to GAAP Gross Margin and non-GAAP Adjusted

EBITDA to Net Income (Loss), each measure's most directly

comparable GAAP financial measure, on a forward-looking basis

without unreasonable effort, because items that impact these GAAP

financial measures are not within the Company’s control and/or

cannot be reasonably predicted. These items may include, but are

not limited to, predicting forward-looking share-based

compensation, changes in the fair value of derivative liabilities,

changes in the fair value of contingent earn out liabilities,

changes in the fair value of contingently issuable common stock

liabilities and changes in fair value of public warrant

liabilities. Such information may have a significant, and

potentially unpredictable, impact on the Company’s future financial

results.

4 Recurring revenue includes the recurring portion of

revenue associated with pure subscription contracts and hardware

purchase subscription contracts. Non-recurring revenue

includes revenue that is one-time in nature, such as product

revenue, shipping revenue, and revenue from installation, training,

and professional services.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements contained in this press release other than statements of

historical facts, including without limitation statements regarding

our ability to meet our 2023 annual guidance for revenue, ARR,

adjusted gross margin, adjusted EBITDA, as well as our estimates

for cash and cash equivalents for fiscal year 2023. Words such as

“believe” “may,” “will,” “expect,” “should,” “could,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,”

“continue,” “project,” “plan,” “target,” “is/are likely to” or the

negative of these terms or other similar expressions are intended

to identify forward-looking statements, though not all

forward-looking statements use these words or expressions. These

statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, the following:

expectations regarding the Company’s strategies and future

financial performance, including its future business plans or

objectives, prospective performance and opportunities and

competitors, revenues, products and services, pricing, operating

expenses, market trends, liquidity, cash flows and uses of cash,

capital expenditures; the Company’s history of losses and lack of

profitability; the Company’s reliance on third party contract

manufacturing and a global supply chain; the rate of innovation

required to maintain competitiveness in the markets in which the

Company competes; the loss of designation of the Evolv Express

system as a Qualified Anti-Terrorism Technology under the Homeland

Security SAFETY Act; the ability for the Company to obtain,

maintain, protect and enforce the Company’s intellectual property

rights and use of “open source” software; the concentration of the

Company’s revenues on a single solution; the Company’s ability to

timely design, produce and launch its solutions, the Company’s

ability to invest in growth initiatives and pursue acquisition

opportunities; the limited liquidity and trading of the Company’s

securities; risks related to existing and changing tax laws;

geopolitical risk and changes in applicable laws or regulations;

the possibility that the Company may be adversely affected by other

economic, business, and/or competitive factors; operational risk;

the impact of fluctuating general economic and market conditions;

the need for additional capital to support business growth, which

might not be available on acceptable terms, if at all; risks

related to our indebtedness; and litigation and regulatory

enforcement risks, including the diversion of management time and

attention and the additional costs and demands on resources, the

Company’s ability to identify and implement digital advances in its

technology. These and other important factors discussed under the

caption “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2022 filed with the Securities and Exchange

Commission ("SEC") on March 24, 2023 as may be updated from time to

time in other filings we make with the SEC, could cause actual

results to differ materially from those indicated by the

forward-looking statements made in this press release.

These statements reflect management’s current expectations

regarding future events and operating performance and speak only as

of the date of this press release. You should not put undue

reliance on any forward-looking statements. Although we believe

that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee that future results, levels of

activity, performance and events and circumstances reflected in the

forward-looking statements will be achieved or will occur. Except

as required by law, we undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made or to reflect the occurrence of

unanticipated events.

EVOLV TECHNOLOGY

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Revenue:

Product revenue

$

8,754

$

5,194

Subscription revenue

6,466

3,004

Service revenue

3,361

512

Total revenue

18,581

8,710

Cost of revenue:

Cost of product revenue

10,578

5,206

Cost of subscription revenue

2,351

1,542

Cost of service revenue

887

1,065

Total cost of revenue

13,816

7,813

Gross profit

4,765

897

Operating expenses:

Research and development

5,389

4,175

Sales and marketing

12,804

9,672

General and administrative

8,926

10,817

Loss from impairment of property and

equipment

137

96

Total operating expenses

27,256

24,760

Loss from operations

(22,491

)

(23,863

)

Other income (expense), net:

Interest expense

(654

)

(142

)

Interest income

953

68

Other expense, net

19

—

Loss on extinguishment of debt

(626

)

—

Change in fair value of contingent

earn-out liability

(3,318

)

3,078

Change in fair value of contingently

issuable common stock liability

(742

)

1,472

Change in fair value of public warrant

liability

(1,750

)

5,586

Total other income (expense), net

(6,118

)

10,062

Net loss

$

(28,609

)

$

(13,801

)

Weighted average common shares outstanding

– basic and diluted

146,433,378

142,878,406

Net loss per share - basic and diluted

$

(0.20

)

$

(0.10

)

Net loss

$

(28,609

)

$

(13,801

)

Other comprehensive income (loss)

Cumulative translation adjustment

(16

)

—

Total other comprehensive loss

(16

)

—

Total comprehensive loss

$

(28,625

)

$

(13,801

)

EVOLV TECHNOLOGY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

(Unaudited)

March 31, 2023

December 31, 2022

Assets

Current assets:

Cash and cash equivalents

$

180,996

$

229,783

Restricted cash

1,000

—

Accounts receivable, net

23,156

31,920

Inventory

8,816

10,257

Current portion of contract assets

3,265

2,852

Current portion of commission asset

3,293

3,384

Prepaid expenses and other current

assets

14,413

14,388

Total current assets

234,939

292,584

Restricted cash, noncurrent

275

275

Contract assets, noncurrent

715

1,386

Commission asset, noncurrent

6,390

5,655

Property and equipment, net

59,789

44,707

Operating lease right-of-use assets

1,459

1,673

Other assets

1,965

1,835

Total assets

$

305,532

$

348,115

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

19,192

$

18,194

Accrued expenses and other current

liabilities

6,477

11,545

Current portion of deferred revenue

23,977

18,273

Current portion of long-term debt

—

10,000

Current portion of operating lease

liabilities

1,122

1,114

Total current liabilities

50,768

59,126

Deferred revenue, noncurrent

20,748

17,695

Long-term debt, noncurrent

—

19,683

Operating lease liabilities,

noncurrent

630

892

Contingent earn-out liability

17,536

14,218

Contingently issuable common stock

liability

4,134

3,392

Public warrant liability

7,874

6,124

Total liabilities

101,690

121,130

Stockholders’ equity:

Preferred stock, $0.0001 par value;

100,000,000 authorized at March 31, 2023 and December 31, 2022; no

shares issued and outstanding at March 31, 2023 and December 31,

2022

—

—

Common stock, $0.0001 par value;

1,100,000,000 shares authorized at March 31, 2023 and December 31,

2022; 147,977,034 and 145,204,974 shares issued and outstanding at

March 31, 2023 and December 31, 2022, respectively

15

15

Additional paid-in capital

424,672

419,190

Accumulated other comprehensive loss

(26

)

(10

)

Accumulated deficit

(220,819

)

(192,210

)

Stockholders’ equity

203,842

226,985

Total liabilities and stockholders’

equity

$

305,532

$

348,115

EVOLV TECHNOLOGY

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Cash flows from operating

activities:

Net loss

$

(28,609

)

$

(13,801

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

1,815

1,086

Write-off of inventory and change in

inventory reserve

214

324

Adjustment to property and equipment for

sales type leases

—

(625

)

Loss from impairment of property and

equipment

137

96

Stock-based compensation

5,043

3,927

Non-cash interest expense

22

5

Non-cash lease expense

214

197

Change in allowance for expected credit

losses

124

—

Loss on extinguishment of debt

626

—

Change in fair value of earn-out

liability

3,318

(3,078

)

Change in fair value of contingently

issuable common stock

742

(1,472

)

Change in fair value of public warrant

liability

1,750

(5,586

)

Changes in operating assets and

liabilities

Accounts receivable

8,640

(2,112

)

Inventory

1,418

(1,310

)

Commission assets

(644

)

(351

)

Contract assets

258

108

Other assets

(130

)

141

Prepaid expenses and other current

assets

(25

)

(5,571

)

Accounts payable

(2,213

)

(855

)

Deferred revenue

8,757

2,577

Accrued expenses and other current

liabilities

(4,637

)

(2,433

)

Operating lease liability

(254

)

(697

)

Net cash used in operating activities

(3,434

)

(29,430

)

Cash flows from investing

activities:

Development of internal-use software

(733

)

(728

)

Purchases of property and equipment

(13,365

)

(6,689

)

Proceeds from sale of property and

equipment

60

—

Net cash used in investing activities

(14,038

)

(7,417

)

Cash flows from financing

activities:

Proceeds from exercise of stock

options

33

227

Proceeds from long-term debt

1,876

—

Repayment of principal on long-term

debt

(31,876

)

—

Payment of debt issuance costs and

prepayment penalty

(332

)

—

Net cash provided by (used in) financing

activities

(30,299

)

227

Effect of exchange rate changes on cash

and cash equivalents

(16

)

—

Net increase (decrease) in cash, cash

equivalents and restricted cash

(47,787

)

(36,620

)

Cash, cash equivalents and restricted

cash

Cash, cash equivalents and restricted cash

at beginning of period

230,058

308,167

Cash, cash equivalents and restricted cash

at end of period

$

182,271

$

271,547

EVOLV TECHNOLOGY REVISION OF PRIOR

PERIOD FINANCIAL STATEMENTS (In thousands)

(Unaudited)

In preparing the condensed consolidated financial statements as

of and for the three and six months ended June 30, 2022, the

Company identified various errors in its previously issued

financial statements. The identified errors impacted the Company's

previously issued quarterly financial statements for the three

months ended March 31, 2022, and accordingly the Company has made

adjustments to the prior period amounts presented herein.

Additionally, the Company has made adjustments to correct for other

previously identified immaterial errors. The Company evaluated the

errors and determined that the related impacts were not material to

any previously issued annual or interim financial statements. The

impact of the revisions to the quarterly period ending March 31,

2022 is presented as follows (in thousands):

Three Months Ended

March 31, 2022

As Previously Reported

Adjustment

As Revised

Revenue:

Product revenue

$

5,194

$

—

$

5,194

Subscription revenue

3,020

(16

)

3,004

Service revenue

501

11

512

Total revenue

8,715

(5

)

8,710

Cost of revenue:

Cost of product revenue

5,576

(370

)

5,206

Cost of subscription revenue

1,065

477

1,542

Cost of service revenue

448

617

1,065

Total cost of revenue

7,089

724

7,813

Gross profit

1,626

(729

)

897

Operating expenses:

Research and development

4,286

(111

)

4,175

Sales and marketing expense

12,053

(2,381

)

9,672

General and administrative

11,093

(276

)

10,817

Loss from impairment of property and

equipment

96

—

96

Total operating expenses

27,528

(2,768

)

24,760

Loss from operations

(25,902

)

2,039

(23,863

)

Other income (expense), net:

Interest expense

(142

)

—

(142

)

Interest income

209

(141

)

68

Change in fair value of contingent

earn-out liability

4,226

(1,148

)

3,078

Change in fair value of contingently

issuable common stock liability

1,472

—

1,472

Change in fair value of public warrant

liability

5,586

—

5,586

Total other income (expense), net

11,351

(1,289

)

10,062

Net loss

$

(14,551

)

$

750

$

(13,801

)

Weighted average common shares outstanding

- basic and diluted

142,878,406

—

142,878,406

Net loss per share - basic and diluted

$

(0.10

)

$

—

$

(0.10

)

Three Months Ended

March 31, 2022

As Previously Reported

Adjustment

As Revised

Cash flows from operating

activities:

Net loss

$

(14,551

)

$

750

$

(13,801

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

948

138

1,086

Write-off of inventory

324

—

324

Adjustment to property and equipment for

sales type leases

(321

)

(304

)

(625

)

Loss from impairment of property and

equipment

96

—

96

Stock-based compensation

5,190

(1,263

)

3,927

Non-cash interest expense

5

—

5

Non-cash lease expense

197

—

197

Change in fair value of earn-out

liability

(4,226

)

1,148

(3,078

)

Change in fair value of contingently

issuable common stock

(1,472

)

—

(1,472

)

Change in fair value of public warrant

liability

(5,586

)

—

(5,586

)

Changes in operating assets and

liabilities

Accounts receivable

(2,112

)

—

(2,112

)

Inventory

(6,985

)

5,675

(1,310

)

Commission assets

(351

)

—

(351

)

Contract assets

108

—

108

Other assets

—

141

141

Prepaid expenses and other current

assets

(5,280

)

(291

)

(5,571

)

Accounts payable

(1,867

)

1,012

(855

)

Deferred revenue

2,778

(201

)

2,577

Deferred rent

(468

)

468

—

Accrued expenses and other current

liabilities

(2,065

)

(368

)

(2,433

)

Operating lease liability

(229

)

(468

)

(697

)

Net cash used in operating activities

(35,867

)

6,437

(29,430

)

Cash flows from investing

activities:

Development of internal-use software

(646

)

(82

)

(728

)

Purchases of property and equipment

(323

)

(6,366

)

(6,689

)

Net cash used in investing activities

(969

)

(6,448

)

(7,417

)

Cash flows from financing

activities:

Proceeds from exercise of stock

options

216

11

227

Net cash provided by financing

activities

216

11

227

Net increase (decrease) in cash, cash

equivalents and restricted cash

(36,620

)

—

(36,620

)

Cash, cash equivalents and restricted

cash

Cash, cash equivalents and restricted cash

at beginning of period

308,167

—

308,167

Cash, cash equivalents and restricted cash

at end of period

$

271,547

$

—

$

271,547

Supplemental disclosure of non-cash

activities

Transfer of inventory to property and

equipment

$

4,620

$

(4,620

)

$

—

Capital expenditures incurred but not yet

paid

1,693

698

2,391

EVOLV TECHNOLOGY

SUMMARY OF KEY OPERATING

STATISTICS

(Unaudited)

Three Months Ended or as

of,

($ in thousands)

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

March 31, 2023

New customers

44

53

92

106

61

Annual recurring revenue

$

16,641

$

20,865

$

28,741

$

34,120

$

42,021

Recurring revenue

$

3,159

$

4,604

$

6,221

$

7,388

$

9,075

Remaining performance obligation

$

63,750

$

80,978

$

109,407

$

144,561

$

161,813

Net additions

207

237

545

575

520

Ending deployed units

910

1,147

1,692

2,267

2,787

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP

OPERATING EXPENSES TO ADJUSTED OPERATING EXPENSES

(In thousands)

(Unaudited)

Three Months Ended,

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

March 31, 2023

Operating expenses, GAAP

$

24,760

$

25,835

$

26,827

$

26,868

$

27,256

Stock-based compensation

(3,819

)

(4,781

)

(6,298

)

(6,771

)

(4,898

)

Restructuring expenses

(324

)

13

—

—

—

Loss on impairment of lease equipment

(96

)

(316

)

(626

)

(123

)

(137

)

Other one-time expenses

(1,107

)

(2,298

)

(69

)

(41

)

(53

)

Adjusted Operating Expenses

$

19,414

$

18,453

$

19,834

$

19,933

$

22,168

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP GROSS

PROFIT TO ADJUSTED GROSS PROFIT, GAAP GROSS MARGIN TO ADJUSTED

GROSS MARGIN AND GAAP OPERATING INCOME (LOSS) TO ADJUSTED OPERATING

INCOME (LOSS)

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Revenue

$

18,581

$

8,710

Cost of revenue

13,816

7,813

Gross Profit, GAAP

4,765

897

Stock-based compensation

145

108

Amortization of capitalized stock-based

compensation

10

3

Adjusted Gross Profit

$

4,920

$

1,008

Gross Margin %

25.6

%

10.3

%

Adjusted Gross Margin %

26.5

%

11.6

%

Three Months Ended

March 31,

2023

2022

Operating income (loss), GAAP

$

(22,491

)

$

(23,863

)

Stock-based compensation

5,043

3,927

Amortization of capitalized stock-based

compensation

10

3

Restructuring expenses

—

324

Loss on impairment of lease equipment

137

96

Other one-time expenses

53

1,107

Adjusted Operating Income (Loss)

$

(17,248

)

$

(18,406

)

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP NET

INCOME (LOSS) TO ADJUSTED EBITDA

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Net loss

$

(28,609

)

$

(13,801

)

Depreciation & amortization

1,815

1,086

Stock-based compensation

5,043

3,927

Interest expense (income)

(299

)

74

Loss on disposal of property &

equipment

—

—

Loss on extinguishment of debt

626

—

Change in fair value of contingent

earn-out liability

3,318

(3,078

)

Change in fair value of contingently

issuable common stock liability

742

(1,472

)

Change in fair value of public warrant

liability

1,750

(5,586

)

Restructuring expenses

—

324

Loss on impairment of lease equipment

137

96

Other one-time expenses

53

1,107

Adjusted EBITDA

$

(15,424

)

$

(17,323

)

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP NET

INCOME (LOSS) TO ADJUSTED EARNINGS (LOSS)

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Net loss

$

(28,609

)

$

(13,801

)

Stock-based compensation

5,043

3,927

Amortization of capitalized stock-based

compensation

10

3

Loss on extinguishment of debt

626

—

Change in fair value of contingent

earn-out liability

3,318

(3,078

)

Change in fair value of contingently

issuable common stock liability

742

(1,472

)

Change in fair value of public warrant

liability

1,750

(5,586

)

Restructuring expenses

—

324

Loss on impairment of lease equipment

137

96

Other one-time expenses

53

1,107

Adjusted Earnings (Loss)

$

(16,930

)

$

(18,480

)

Weighted average common shares outstanding

– diluted

146,433,378

142,878,406

Adjusted Earnings (Loss) Per Share –

diluted

$

(0.12

)

$

(0.13

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230510005730/en/

Investor Relations: Brian Norris Senior Vice President of

Finance and Investor Relations bnorris@evolvtechnology.com

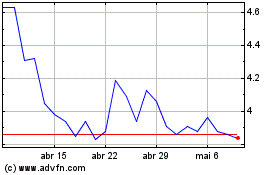

Evolv Technologies (NASDAQ:EVLV)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Evolv Technologies (NASDAQ:EVLV)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024