FG Financial Group, Inc. (Nasdaq: FGF)

(the “Company”), a reinsurance and asset management holding company

focused on collateralized and loss capped reinsurance and merchant

banking that allocates capital in partnership with Fundamental

Global®, a private partnership led by Kyle Cerminara and Joe

Moglia, as well as other strategic investors, today announced the

pricing of an underwritten public offering of 865,000 shares of its

common stock at a public offering price of $1.85 per share, for

gross proceeds of $1,600,250, before deducting underwriting

discounts, commissions and offering expenses. All of the shares of

common stock are being offered by the Company. In addition, the

Company has granted the underwriters a 45-day option to purchase up

to an additional 129,750 shares of common stock at the public

offering price less discounts and commissions, to cover

over-allotments. The offering is expected to close on June 2, 2023,

subject to satisfaction of customary closing conditions.

The Company intends to use the net proceeds from the offering

primarily for general working capital purposes.

ThinkEquity is acting as sole book-running manager for the

offering.

The securities will be offered and sold pursuant to a shelf

registration statement on Form S-3 (File No. 333-253285), including

a base prospectus, filed with the U.S. Securities and Exchange

Commission (the “SEC”) on February 19, 2021, and declared effective

on April 9, 2021. The offering will be made only by means of a

written prospectus. A prospectus supplement and accompanying

prospectus describing the terms of the offering will be filed with

the SEC on its website at www.sec.gov. Copies of the prospectus

supplement and the accompanying prospectus relating to the offering

may also be obtained, when available, from the offices of

ThinkEquity, 17 State Street, 41st Floor, New York, New York

10004.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

About FG Financial Group, Inc.

FG Financial Group, Inc. is a reinsurance and asset management

holding company focused on collateralized and loss capped

reinsurance and merchant banking that allocates capital in

partnership with Fundamental Global®, a private partnership led by

Kyle Cerminara and Joe Moglia, as well as other strategic

investors. The Company’s principal business operations are

conducted through its subsidiaries and affiliates.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These

statements are therefore entitled to the protection of the safe

harbor provisions of these laws. These statements may be identified

by the use of forward-looking terminology such as “anticipate,”

“believe,” “budget,” “can,” “contemplate,” “continue,” “could,”

“envision,” “estimate,” “expect,” “evaluate,” “forecast,” “goal,”

“guidance,” “indicate,” “intend,” “likely,” “may,” “might,”

“outlook,” “plan,” “possibly,” “potential,” “predict,” “probable,”

“probably,” “pro-forma,” “project,” “seek,” “should,” “target,”

“view,” “will,” “would,” “will be,” “will continue,” “will likely

result” or the negative thereof or other variations thereon or

comparable terminology. In particular, discussions and statements

regarding the Company’s future business plans and initiatives are

forward-looking in nature. We have based these forward-looking

statements on our current expectations, assumptions, estimates, and

projections. While we believe these to be reasonable, such

forward-looking statements are only predictions and involve a

number of risks and uncertainties, many of which are beyond our

control. These and other important factors may cause our actual

results, performance, or achievements to differ materially from any

future results, performance or achievements expressed or implied by

these forward-looking statements, and may impact our ability to

implement and execute on our future business plans and initiatives.

Management cautions that the forward-looking statements in this

release are not guarantees of future performance, and we cannot

assume that such statements will be realized or the forward-looking

events and circumstances will occur. Factors that might cause such

a difference include, without limitation: whether the offering will

close, whether the underwriter’s exercise their option to purchase

additional shares of common stock, risks associated with our

inability to identify and realize business opportunities, and the

undertaking of any new such opportunities; general conditions in

the global economy, our lack of operating history or established

reputation in the reinsurance industry; our inability to obtain or

maintain the necessary approvals to operate reinsurance

subsidiaries; risks associated with operating in the reinsurance

industry, including inadequately priced insured risks, credit risk

associated with brokers we may do business with, and inadequate

retrocessional coverage; our inability to execute on our investment

and investment management strategy, including our strategy to

invest in the risk capital of special purpose acquisition companies

(SPACs); potential loss of value of investments; risk of becoming

an investment company; fluctuations in our short-term results as we

implement our new business strategy; risks of being unable to

attract and retain qualified management and personnel to implement

and execute on our business and growth strategy; failure of our

information technology systems, data breaches and cyber-attacks;

our ability to establish and maintain an effective system of

internal controls; our limited operating history as a public

company; the requirements of being a public company and losing our

status as a smaller reporting company or becoming an accelerated

filer; any potential conflicts of interest between us and our

controlling stockholders and different interests of controlling

stockholders; potential conflicts of interest between us and our

directors and executive officers; risks associated with our related

party transactions and investments; and risks associated with our

investments in SPACs, including the failure of any such SPAC to

complete its initial business combination. Our expectations and

future plans and initiatives may not be realized. If one of these

risks or uncertainties materializes, or if our underlying

assumptions prove incorrect, actual results may vary materially

from those expected, estimated or projected. You are cautioned not

to place undue reliance on forward-looking statements. The

forward-looking statements are made only as of the date hereof and

do not necessarily reflect our outlook at any other point in time.

We do not undertake and specifically decline any obligation to

update any such statements or to publicly announce the results of

any revisions to any such statements to reflect new information,

future events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230530005715/en/

Investor Relations: IMS Investor Relations John

Nesbett/Rosalyn Christian (203) 972-9200 IR@fgfinancial.com

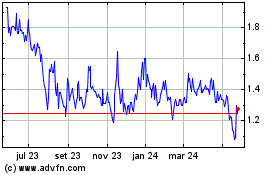

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

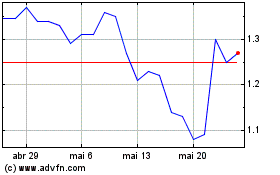

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024