Broadstone Net Lease Provides Business Update

05 Junho 2023 - 5:10PM

Business Wire

Broadstone Net Lease, Inc. (NYSE: BNL) ("BNL," the "Company,"

"we," "our," or "us"), today provided an update on the Company’s

second quarter activity to date.

MANAGEMENT COMMENTARY

“I am pleased to provide a preview of our second quarter

activity,” said John Moragne, Chief Executive Officer. “Our

portfolio continues to demonstrate its strength and resiliency with

100% collections through April and May. We continue to selectively

find accretive opportunities to deploy capital in today’s market

including new acquisitions, continued investment in our existing

properties, and attractive build-to-suit opportunities. We remain

committed to our disciplined and prudent approach to capital

allocation as we continue to navigate today’s challenging market

backdrop.”

INVESTMENT ACTIVITY

- During the second quarter, we invested $60.1 million in 4

properties at a weighted average initial cash capitalization rate

of 7.3%. Investments were all industrial opportunities and

consisted of $20.4 million in new property acquisitions, $7.0

million in revenue generating capital expenditures, and $32.7

million in development funding opportunities. The leases on new

property acquisitions and revenue generating capital expenditures

had a weighted average initial term of over 15 years and minimum

annual rent increases of 1.9%. Year-to-date, we have completed

investments totaling $80.1 million at a weighted average initial

cash capitalization rate of 7.1%.

- On May 22, 2023, BNL closed on the acquisition of the land in

connection with the previously announced $204.8 million

build-to-suit transaction, of which $32.7 million was funded

through the date of this release and included in the development

opportunities referenced above. The facility is projected to open

in the third quarter of 2024, with rent commencing no later than

October 15, 2024. During the 18-month construction period, BNL will

earn capitalized interest at customary rates. Once completed, the

facility will be leased to a leading distributor to retailers in

the United States and Canada pursuant to a 15-year lease with

multiple renewal options and 2.50% annual rent escalations,

translating into a GAAP cap rate of 8.1%.

- We currently have commitments to fund $13.5 million in revenue

generating capital expenditures with existing tenants and $172.1

million in development funding opportunities.

- During the second quarter, we sold four properties for proceeds

of $69.4 million at a weighted average cap rate of 5.6% on tenanted

properties. Year-to-date, we have sold seven assets for proceeds of

$121.3 million at a weighted average cap rate of 5.7% on tenanted

properties.

REAL ESTATE PORTFOLIO UPDATE

- Collected 100% of base rents due through April and May for all

properties under lease, and as of the date of this release our

portfolio was 99.4% leased based on rentable square footage as of

the end of the first quarter, with two of our total properties

vacant and not subject to a lease.

About Broadstone Net Lease, Inc.

BNL is a real estate investment trust that acquires, owns, and

manages primarily single-tenant commercial real estate properties

that are net leased on a long-term basis to a diversified group of

tenants. The Company utilizes an investment strategy underpinned by

strong fundamental credit analysis and prudent real estate

underwriting. As of March 31, 2023, BNL's diversified portfolio

consisted of 801 individual net leased commercial properties with

794 properties located in 44 U.S. states and seven properties

located in four Canadian provinces across the industrial,

healthcare, restaurant, retail, and office property types.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our plans, strategies, and

prospects, both business and financial. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “may,” “will,” “should,”

“expect,” “intend,” “anticipate,” “estimate,” “would be,”

“believe,” “continue,” or other similar words. Forward-looking

statements, including our 2023 guidance and assumptions, involve

known and unknown risks and uncertainties, which may cause BNL’s

actual future results to differ materially from expected results,

including, without limitation, risks and uncertainties related to

general economic conditions, including but not limited to increases

in the rate of inflation and/or interest rates, local real estate

conditions, tenant financial health, property investments and

acquisitions, and the timing and uncertainty of completing these

property investments and acquisitions, and uncertainties regarding

future distributions to our stockholders. These and other risks,

assumptions, and uncertainties are described in Item 1A “Risk

Factors” of the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, which BNL filed with the SEC on

February 23, 2023, which you are encouraged to read, and is

available on the SEC’s website at www.sec.gov. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. The Company assumes no obligation to,

and does not currently intend to, update any forward-looking

statements after the date of this press release, whether as a

result of new information, future events, changes in assumptions,

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230605005812/en/

Michael Caruso SVP, Corporate Strategy & Investor Relations

michael.caruso@broadstone.com 585.402.7842

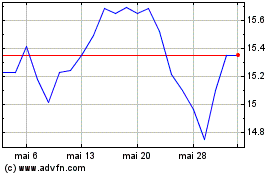

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025