Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today announced it has added two

new developments with an aggregate estimated total project

investment of approximately $117.4 million to its pipeline of

build-to-suit development commitments. BNL also announced that it

will release its financial and operating results for the quarter

and year ended December 31, 2024, after the market closes on

Wednesday, February 19, 2025. The Company will host its earnings

conference call and audio webcast on Thursday, February 20, 2025,

at 1:00 p.m. Eastern Time.

“We are proud of the significant progress we have made in

growing our pipeline of committed build-to-suit developments,

particularly securing the land on a build-to-suit development for

Southwire Company prior to year end, adding to a year substantially

comprised of directly-sourced investments,” said John Moragne,

BNL’s Chief Executive Officer. “Build-to-suit developments are a

key part of our differentiated core building blocks of growth, and

we are excited by the host of additional build-to-suit

opportunities we are currently evaluating and are looking forward

to building a robust and resilient committed pipeline of projects

during 2025.”

As of the date of this release, we have secured the land and

started construction on two additional build-to-suit development

opportunities as outlined below, notably including a new

state-of-the-art distribution warehouse facility for Southwire

Company that is expected to deliver in the third quarter of 2026.

The following table summarizes developments that are actively under

construction:

(unaudited, in thousands)

Property

Property Type

Projected Rentable Square

Feet

Start Date

Target Completion Date

Total Project

Commitment

Estimated Total Project

Investment

Cumulative Investment at

12/31/24

Estimated Remaining Funding

Investment

Estimated Cash Capitalization

Rate

Estimated Straight- line

Yield1

Sierra Nevada (Dayton - OH)

Industrial

122

Oct. 2024

Nov. 2025

58,563

$

58,563

$

4,638

$

53,925

7.6

%

9.4

%

Sierra Nevada (Dayton - OH)

Industrial

122

Oct. 2024

Mar. 2026

55,525

55,525

4,257

51,268

7.7

%

9.6

%

Southwire (Bremen - GA)

Industrial

1,200

Dec. 2024

Jul. 2026

115,411

107,333

8,285

99,048

7.6

%

8.6

%

7 Brew (High Point - NC)

Retail

1

Dec. 2024

Mar. 2025

1,975

1,975

1,173

802

7.8

%

8.6

%

UNFI (Sarasota - FL)

Industrial

1,016

May 2023

Substantially Completed

204,833

200,186

190,573

9,613

7.2

%

8.6

%

Total

2,461

$

436,307

$

423,582

$

208,926

$

214,656

1 Represents the estimated first year

yield to be generated on a real estate investment, which was

computed at the time of investment based on the estimated annual

straight-line rental income computed in accordance with GAAP,

divided by the estimated total project investment.

We are also pleased to announce the addition of Sam DeLemos as

the Company’s Vice President of Build-to-Suit Development. Prior to

joining BNL, Sam worked as a Director in the Structured Real Estate

group for Truist Securities where he led structuring and execution

for developer and lease initiatives, along with executing

build-to-suit transactions through developer and tenant

relationships within the bank. During this time, Sam executed over

$2.0 billion in transaction volume from acquisition through

disposition, including industrial build-to-suit transactions

totaling more than 7.0 million square feet.

“We have built a lot of momentum in our build-to-suit pipeline

over the last 12 months and are excited by the continued growth

prospects that this core building block brings to our business. Sam

brings additional relationships and significant experience from

sourcing, managing, and closing build-to-suit development projects

throughout his career,” said Ryan Albano, President & Chief

Operating Officer. “He will play a key role in growing and managing

our build-to-suit pipeline, and we are very excited to have him

join our team.”

Conference Call and Webcast Details To access the live

webcast, which will be available in listen-only mode, please visit:

https://events.q4inc.com/attendee/369889726. If you prefer to

listen via phone, U.S. participants may dial: 1-833-470-1428 (toll

free) or 1-404-975-4839 (local), access code 165365. International

access numbers are viewable here:

https://www.netroadshow.com/events/global-numbers?confId=76041.

A replay of the conference call webcast will be available

approximately one hour after the conclusion of the live broadcast.

To listen to a replay of the call via the web, which will be

available for one year, please visit:

https://investors.bnl.broadstone.com.

About Broadstone Net Lease, Inc. BNL is an

industrial-focused, diversified net lease REIT that invests in

primarily single-tenant commercial real estate properties that are

net leased on a long-term basis to a diversified group of tenants.

Utilizing an investment strategy underpinned by strong fundamental

credit analysis and prudent real estate underwriting, as of

September 30, 2024, BNL’s diversified portfolio consisted of 773

individual net leased commercial properties with 766 properties

located in 44 U.S. states and seven properties located in four

Canadian provinces across the industrial, restaurant, retail,

healthcare, and office property types.

Forward-Looking Statements This press release contains

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, regarding, among other

things, our plans, strategies, and prospects, both business and

financial. Such forward-looking statements can generally be

identified by our use of forward-looking terminology such as

“outlook,” “potential,” “may,” “will,” “should,” “could,” “seeks,”

“approximately,” “projects,” “predicts,” “expect,” “intends,”

“anticipates,” “estimates,” “plans,” “would be,” “believes,”

“continues,” or the negative version of these words or other

comparable words. Forward-looking statements, including our 2024

guidance and assumptions, involve known and unknown risks and

uncertainties, which may cause BNL’s actual future results to

differ materially from expected results, including, without

limitation, risks and uncertainties related to general economic

conditions, including but not limited to increases in the rate of

inflation and/or interest rates, local real estate conditions,

tenant financial health, property investments and acquisitions, and

the timing and uncertainty of completing these property investments

and acquisitions, and uncertainties regarding future distributions

to our stockholders. These and other risks, assumptions, and

uncertainties are described in Item 1A “Risk Factors” of the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the SEC on February 22,

2024, which you are encouraged to read, and will be available on

the SEC’s website at www.sec.gov. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

indicated or anticipated by such forward-looking statements.

Accordingly, you are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they

are made. The Company assumes no obligation to, and does not

currently intend to, update any forward-looking statements after

the date of this press release, whether as a result of new

information, future events, changes in assumptions, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250106714896/en/

Company Contact:

Brent Maedl Director, Corporate Finance & Investor Relations

brent.maedl@broadstone.com 585.382.8507

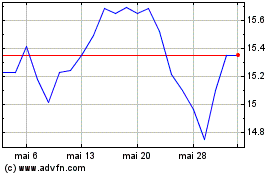

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025