- Acquired 12,800 bitcoins since Q1 for $361.4 million, or

$28,233 per bitcoin

- As of July 31, 2023, held 152,800 bitcoins acquired for total

cost of $4.53 billion, or $29,672 per bitcoin

- Total Revenues of $120.4 million, 1% decrease year-over-year,

flat at constant currency

- Software Licenses Revenues of $35.4 million, 4% increase

year-over-year, 7% on a constant currency basis

- Subscription Services Revenues of $19.9 million, 42% increase

year-over-year, 44% on a constant currency basis

MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy” or

the “Company”), the largest independent publicly-traded business

intelligence company, today announced financial results for the

three-month period ended June 30, 2023 (the second quarter of its

2023 fiscal year).

“Our new MicroStrategy ONE platform is the most important

product innovation in the history of our company because it

represents a fundamental shift in our industry to harness the power

of business intelligence and artificial intelligence together to

upgrade the way organizations do business. The growth in our

recurring revenue this quarter illustrated the strength of our

enterprise cloud platform, despite ongoing macroeconomic

headwinds,” said Phong Le, President and Chief Executive Officer,

MicroStrategy.

“Our bitcoin holdings increased to 152,800 bitcoins as of July

31, 2023, with the addition in the second quarter of 12,333

bitcoins being the largest increase in a single quarter since Q2

2021. We efficiently raised capital through our at-the-market

equity program and used cash from operations to continue to

increase bitcoins on our balance sheet. And we did so against the

promising backdrop of increasing institutional interest, progress

on accounting transparency, and ongoing regulatory clarity for

bitcoin,” said Andrew Kang, Chief Financial Officer,

MicroStrategy.

Second Quarter 2023 Financial Highlights

- Revenues: Total revenues for the second quarter of 2023

were $120.4 million, a 1.4% decrease, or a 0.5% decrease on a

non-GAAP constant currency basis, compared to the second quarter of

2022. Product licenses and subscription services revenues for the

second quarter of 2023 were $35.4 million, a 3.7% increase, or a

6.6% increase on a non-GAAP constant currency basis, compared to

the second quarter of 2022. Product support revenues for the second

quarter of 2023 were $66.1 million, a 0.7% decrease on both a GAAP

basis and non-GAAP constant currency basis, compared to the second

quarter of 2022. Other services revenues for the second quarter of

2023 were $18.9 million, an 11.6% decrease, or a 10.9% decrease on

a non-GAAP constant currency basis, compared to the second quarter

of 2022.

- Gross Profit: Gross profit for the second quarter of

2023 was $93.3 million, representing a 77.5% gross margin, compared

to a gross profit of $96.9 million, representing a gross margin of

79.4%, for the second quarter of 2022.

- Operating Expenses: Operating expenses for the second

quarter of 2023 were $120.0 million, an 88.2% decrease compared to

the second quarter of 2022. Operating expenses include impairment

losses on the Company’s digital assets, which were $24.1 million

during the second quarter of 2023, compared to $917.8 million in

the second quarter of 2022.

- Loss from Operations and Net Income (Loss): Loss from

operations for the second quarter of 2023 was $26.7 million,

compared to $918.1 million for the second quarter of 2022. Net

income for the second quarter of 2023 was $22.2 million, or $1.52

per share on a diluted basis, as compared to a net loss of $1.062

billion, or $94.01 per share on a diluted basis, for the second

quarter of 2022. Digital asset impairment losses of $24.1 million

and $917.8 million for the second quarter of 2023 and 2022,

respectively, were reflected in these amounts. Benefit from income

taxes of $60.3 million and provision for income taxes of $136.1

million for the second quarter of 2023 and 2022, respectively, were

reflected in net income (loss).

- Cash and Cash Equivalents: As of June 30, 2023, the

Company had cash and cash equivalents of $66.0 million, as compared

to $43.8 million as of December 31, 2022, an increase of $22.1

million.

- Digital Assets: As of June 30, 2023, the carrying value

of the Company’s digital assets (comprised of approximately 152,333

bitcoins) was $2.323 billion, which reflects cumulative impairment

losses of $2.196 billion since acquisition and an average carrying

amount per bitcoin of approximately $15,251. As of June 30, 2023,

the original cost basis and market value of the Company’s bitcoin

were $4.519 billion and $4.625 billion, respectively, which

reflects an average cost per bitcoin of approximately $29,668 and a

market price per bitcoin of $30,361.51, respectively.

- Sales Agreement: On May 1, 2023, MicroStrategy entered

into a Sales Agreement (the “2023 Sales Agreement”) with Cowen and

Company, LLC and Canaccord Genuity LLC as agents (collectively, the

“2023 Sales Agents”), pursuant to which MicroStrategy may issue and

sell shares of its class A common stock having an aggregate

offering price of up to $625.0 million from time to time through

the 2023 Sales Agents. During the three months ended June 30, 2023,

the Company issued and sold 1,079,170 shares of its class A common

stock under the 2023 Sales Agreement for aggregate net proceeds

(less sales commissions and expenses) of approximately $333.5

million. As of June 30, 2023, approximately $290.0 million of the

Company’s class A common stock remained available for issuance and

sale pursuant to the 2023 Sales Agreement.

The tables provided at the end of this press release include a

reconciliation of the most directly comparable financial measures

prepared in accordance with generally accepted accounting

principles in the United States (“GAAP”) to non-GAAP financial

measures for the three months ended June 30, 2023 and 2022. An

explanation of non-GAAP financial measures is also included under

the heading “Non-GAAP Financial Measures” below. Additional

non-GAAP financial measures are included in MicroStrategy’s “Q2

2023 Earnings Presentation,” which will be available under the

“Events and Presentations” section of MicroStrategy’s investor

relations website at

https://www.microstrategy.com/en/investor-relations.

Non-GAAP Financial Measures

MicroStrategy is providing supplemental financial measures for

(i) non-GAAP loss from operations that excludes the impact of

share-based compensation expense, (ii) non-GAAP net income (loss)

and non-GAAP diluted earnings (loss) per share that exclude the

impacts of share-based compensation expense, interest expense

arising from the amortization of debt issuance costs related to

MicroStrategy’s long-term debt, gain on debt extinguishment, and

related income tax effects, and (iii) non-GAAP constant currency

revenues that exclude foreign currency exchange rate fluctuations.

These supplemental financial measures are not measurements of

financial performance under GAAP and, as a result, these

supplemental financial measures may not be comparable to similarly

titled measures of other companies. Management uses these non-GAAP

financial measures internally to help understand, manage, and

evaluate business performance and to help make operating

decisions.

MicroStrategy believes that these non-GAAP financial measures

are also useful to investors and analysts in comparing its

performance across reporting periods on a consistent basis. The

first supplemental financial measure excludes a significant

non-cash expense that MicroStrategy believes is not reflective of

its general business performance, and for which the accounting

requires management judgment and the resulting share-based

compensation expense could vary significantly in comparison to

other companies. The second set of supplemental financial measures

excludes the impacts of (i) share-based compensation expense, (ii)

non-cash interest expense arising from the amortization of debt

issuance costs related to MicroStrategy’s long-term debt, (iii) a

gain on debt extinguishment, and (iv) related income tax effects.

The third set of supplemental financial measures excludes changes

resulting from fluctuations in foreign currency exchange rates so

that results may be compared to the same period in the prior year

on a non-GAAP constant currency basis. MicroStrategy believes the

use of these non-GAAP financial measures can also facilitate

comparison of MicroStrategy’s operating results to those of its

competitors.

Conference Call

MicroStrategy will be discussing its second quarter 2023

financial results on a live Video Webinar today beginning at

approximately 5:00 p.m. ET. The live Video Webinar and accompanying

presentation materials will be available under the “Events and

Presentations” section of MicroStrategy’s investor relations

website at https://www.microstrategy.com/en/investor-relations.

Log-in instructions will be available after registering for the

event. An archived replay of the event will be available beginning

approximately two hours after the call concludes.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) is the largest independent

publicly-traded analytics and business intelligence company. The

MicroStrategy analytics platform is consistently rated as the best

in enterprise analytics and is used by many of the world’s most

admired brands in the Fortune Global 500. We pursue two corporate

strategies: (1) acquire and hold bitcoin, which we view as a

dependable store of value supported by a robust, public,

open-source architecture untethered to sovereign monetary policy

and (2) grow our enterprise analytics software business to promote

our vision of Intelligence Everywhere. For more information about

MicroStrategy, visit www.microstrategy.com.

MicroStrategy, Intelligent Enterprise, and MicroStrategy Library

are either trademarks or registered trademarks of MicroStrategy

Incorporated in the United States and certain other countries.

Other product and company names mentioned herein may be the

trademarks of their respective owners.

This press release may include statements that may constitute

“forward-looking statements,” including estimates of future

business prospects or financial results and statements containing

the words “believe,” “estimate,” “project,” “expect,” “will,” or

similar expressions. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results of

MicroStrategy Incorporated and its subsidiaries (collectively, the

“Company”) to differ materially from the forward-looking

statements. Factors that could contribute to such differences

include: fluctuations in the market price of bitcoin and any

associated impairment charges that the Company may incur as a

result of a decrease in the market price of bitcoin below the value

at which the Company’s bitcoins are carried on its balance sheet;

gains or losses on any sales of bitcoins; changes in the accounting

treatment relating to the Company’s bitcoin holdings; changes in

securities laws or other laws or regulations, or the adoption of

new laws or regulations, relating to bitcoin that adversely affect

the price of bitcoin or the Company’s ability to transact in or own

bitcoin; a decrease in liquidity in the markets in which bitcoin is

traded; security breaches, cyberattacks, unauthorized access, loss

of private keys, fraud or other circumstances or events that result

in the loss of the Company’s bitcoins; impacts to the price and

rate of adoption of bitcoin associated with financial difficulties

and bankruptcies of various participants in the digital asset

industry; the level and terms of the Company’s substantial

indebtedness and its ability to service such debt; the extent and

timing of market acceptance of the Company’s new product offerings;

continued acceptance of the Company’s other products in the

marketplace; the Company’s ability to recognize revenue or deferred

revenue through delivery of products or satisfactory performance of

services; the timing of significant orders; delays in or the

inability of the Company to develop or ship new products; customers

shifting from a product license model to a cloud subscription

model, which may delay the Company’s ability to recognize revenue;

fluctuations in tax benefits or provisions; changes in the market

price of bitcoin as of period-end and their effect on our deferred

tax assets and related valuation allowance; competitive factors;

general economic conditions, including levels of inflation and

interest rates; currency fluctuations; and other risks detailed in

MicroStrategy’s registration statements and periodic reports filed

with the Securities and Exchange Commission (“SEC”). The Company

undertakes no obligation to update these forward-looking statements

for revisions or changes after the date of this release.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Revenues:

Product licenses

$

15,522

$

20,129

$

32,934

$

36,642

Subscription services

19,878

14,017

38,688

26,862

Total product licenses and subscription

services

35,400

34,146

71,622

63,504

Product support

66,081

66,521

131,562

133,672

Other services

18,919

21,406

39,131

44,174

Total revenues

120,400

122,073

242,315

241,350

Cost of revenues:

Product licenses

444

431

978

908

Subscription services

7,216

5,498

15,072

10,908

Total product licenses and subscription

services

7,660

5,929

16,050

11,816

Product support

5,816

5,127

11,584

10,318

Other services

13,645

14,148

27,428

28,747

Total cost of revenues

27,121

25,204

55,062

50,881

Gross profit

93,279

96,869

187,253

190,469

Operating expenses:

Sales and marketing

37,660

36,862

73,766

70,102

Research and development

29,354

31,790

60,712

65,313

General and administrative

28,830

28,502

56,736

55,208

Digital asset impairment losses

24,143

917,838

43,054

1,087,929

Total operating expenses

119,987

1,014,992

234,268

1,278,552

Loss from operations

(26,708

)

(918,123

)

(47,015

)

(1,088,083

)

Interest expense, net

(11,095

)

(13,187

)

(26,025

)

(24,226

)

Gain on debt extinguishment

0

0

44,686

0

Other (expense) income, net

(250

)

5,120

(1,693

)

7,345

Loss before income taxes

(38,053

)

(926,190

)

(30,047

)

(1,104,964

)

(Benefit from) provision for income

taxes

(60,296

)

136,108

(513,483

)

88,085

Net income (loss)

$

22,243

$

(1,062,298

)

$

483,436

$

(1,193,049

)

Basic earnings (loss) per share

(1)

$

1.68

$

(94.01

)

$

41.18

$

(105.64

)

Weighted average shares outstanding used

in computing basic earnings (loss) per share

13,247

11,300

11,739

11,294

Diluted earnings (loss) per share

(1)

$

1.52

$

(94.01

)

$

33.56

$

(105.64

)

Weighted average shares outstanding used

in computing diluted earnings (loss) per share

16,095

11,300

14,534

11,294

(1) Basic and fully diluted earnings

(loss) per share for class A and class B common stock are the

same.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share data)

June 30,

December 31,

2023

2022*

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

65,968

$

43,835

Restricted cash

2,085

7,033

Accounts receivable, net

121,901

189,280

Prepaid expenses and other current

assets

19,680

24,418

Total current assets

209,634

264,566

Digital assets

2,323,252

1,840,028

Property and equipment, net

30,507

32,311

Right-of-use assets

58,264

61,299

Deposits and other assets

22,421

23,916

Deferred tax assets, net

719,026

188,152

Total Assets

$

3,363,104

$

2,410,272

Liabilities and Stockholders’ Equity

(Deficit)

Current liabilities

Accounts payable, accrued expenses, and

operating lease liabilities

$

33,660

$

42,976

Accrued compensation and employee

benefits

41,492

53,716

Accrued interest

1,493

2,829

Current portion of long-term debt, net

468

454

Deferred revenue and advance payments

195,817

217,428

Total current liabilities

272,930

317,403

Long-term debt, net

2,177,974

2,378,560

Deferred revenue and advance payments

11,244

12,763

Operating lease liabilities

63,814

67,344

Other long-term liabilities

17,826

17,124

Deferred tax liabilities

198

198

Total liabilities

2,543,986

2,793,392

Stockholders’ Equity (Deficit)

Preferred stock undesignated, $0.001 par

value; 5,000 shares authorized; no shares issued or outstanding

0

0

Class A common stock, $0.001 par value;

330,000 shares authorized; 20,803 shares issued and 12,119 shares

outstanding, and 18,269 shares issued and 9,585 shares outstanding,

respectively

21

18

Class B convertible common stock, $0.001

par value; 165,000 shares authorized; 1,964 shares issued and

outstanding, and 1,964 shares issued and outstanding,

respectively

2

2

Additional paid-in capital

2,559,268

1,841,120

Treasury stock, at cost; 8,684 shares and

8,684 shares, respectively

(782,104

)

(782,104

)

Accumulated other comprehensive loss

(13,150

)

(13,801

)

Accumulated deficit

(944,919

)

(1,428,355

)

Total Stockholders’ Equity

(Deficit)

819,118

(383,120

)

Total Liabilities and Stockholders’

Equity (Deficit)

$

3,363,104

$

2,410,272

* Derived from audited financial

statements.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

(in thousands)

Six Months Ended

June 30,

2023

2022

(unaudited)

(unaudited)

Net cash provided by operating

activities

$

18,925

$

22,863

Net cash used in investing activities

(527,416

)

(227,019

)

Net cash provided by financing

activities

525,911

218,487

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash

(235

)

(3,224

)

Net increase in cash, cash equivalents,

and restricted cash

17,185

11,107

Cash, cash equivalents, and restricted

cash, beginning of period

50,868

64,434

Cash, cash equivalents, and restricted

cash, end of period

$

68,053

$

75,541

MICROSTRATEGY

INCORPORATED

REVENUE AND COST OF REVENUE

DETAIL

(in thousands)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Revenues

Product licenses and subscription

services:

Product licenses

$

15,522

$

20,129

$

32,934

$

36,642

Subscription services

19,878

14,017

38,688

26,862

Total product licenses and subscription

services

35,400

34,146

71,622

63,504

Product support

66,081

66,521

131,562

133,672

Other services:

Consulting

17,980

20,273

37,317

41,708

Education

939

1,133

1,814

2,466

Total other services

18,919

21,406

39,131

44,174

Total revenues

120,400

122,073

242,315

241,350

Cost of revenues

Product licenses and subscription

services:

Product licenses

444

431

978

908

Subscription services

7,216

5,498

15,072

10,908

Total product licenses and subscription

services

7,660

5,929

16,050

11,816

Product support

5,816

5,127

11,584

10,318

Other services:

Consulting

13,180

12,837

26,192

26,137

Education

465

1,311

1,236

2,610

Total other services

13,645

14,148

27,428

28,747

Total cost of revenues

27,121

25,204

55,062

50,881

Gross profit

$

93,279

$

96,869

$

187,253

$

190,469

MICROSTRATEGY

INCORPORATED

DIGITAL ASSETS – ADDITIONAL

INFORMATION

ROLLFORWARD OF BITCOIN

HOLDINGS

(unaudited)

Approximate

Digital Asset

Digital Asset

Digital Asset

Approximate

Average

Source of Capital

Original Cost

Impairment

Carrying

Number of

Purchase or

Used to Purchase

Basis

Losses

Value

Bitcoins Held

Sale Price Per

Bitcoin

(in thousands)

(in thousands)

(in thousands)

(Disposed) *

Bitcoin

Balance at December 31, 2021

$

3,751,529

$

(901,319

)

$

2,850,210

124,391

$

30,159

Digital asset purchases

(a)

215,500

215,500

4,827

44,645

Digital asset impairment losses

(170,091

)

(170,091

)

Balance at March 31, 2022

$

3,967,029

$

(1,071,410

)

$

2,895,619

129,218

$

30,700

Digital asset purchases

(b)

10,000

10,000

481

20,790

Digital asset impairment losses

(917,838

)

(917,838

)

Balance at June 30, 2022

$

3,977,029

$

(1,989,248

)

$

1,987,781

129,699

$

30,664

Digital asset purchases

(c)

5,978

5,978

301

19,860

Digital asset impairment losses

(727

)

(727

)

Balance at September 30, 2022

$

3,983,007

$

(1,989,975

)

$

1,993,032

130,000

$

30,639

Digital asset purchases

(d)

56,443

56,443

3,204

17,616

Digital asset impairment losses

(198,557

)

(198,557

)

Digital asset sales **

(46,260

)

35,370

(10,890

)

(704

)

16,786

Balance at December 31, 2022

$

3,993,190

$

(2,153,162

)

$

1,840,028

132,500

$

30,137

Digital asset purchases

(e)

179,275

179,275

7,500

23,903

Digital asset impairment losses

(18,911

)

(18,911

)

Balance at March 31, 2023

$

4,172,465

$

(2,172,073

)

$

2,000,392

140,000

$

29,803

Digital asset purchases

(f)

347,003

347,003

12,333

28,136

Digital asset impairment losses

(24,143

)

(24,143

)

Balance at June 30, 2023

$

4,519,468

$

(2,196,216

)

$

2,323,252

152,333

$

29,668

*

MicroStrategy owns and has purchased

bitcoins both directly and indirectly through its wholly-owned

subsidiary, MacroStrategy. References to MicroStrategy below refer

to MicroStrategy and its subsidiaries on a consolidated basis.

**

In the fourth quarter of 2022,

MicroStrategy sold approximately 704 bitcoins having an original

cost basis of $46.3 million and cumulative digital asset impairment

losses of $35.4 million, resulting in a carrying value of $10.9

million at the time of sale. The approximately 704 bitcoins were

sold for cash proceeds of $11.8 million, net of fees and expenses,

resulting in gains on sale of $0.9 million.

(a)

In the first quarter of 2022,

MicroStrategy purchased bitcoin using $190.5 million of the net

proceeds from the issuance of the 2025 Secured Term Loan and Excess

Cash.

(b)

In the second quarter of 2022,

MicroStrategy purchased bitcoin using Excess Cash.

(c)

In the third quarter of 2022,

MicroStrategy purchased bitcoin using Excess Cash.

(d)

In the fourth quarter of 2022,

MicroStrategy purchased bitcoin using $44.6 million of the net

proceeds from its sale of class A common stock under its

at-the-market offering program, and $11.8 million in proceeds from

sales of bitcoin.

(e)

In the first quarter of 2023,

MicroStrategy purchased bitcoin using $179.3 million of the net

proceeds from its sale of class A common stock under its

at-the-market offering program.

(f)

In the second quarter of 2023,

MicroStrategy purchased bitcoin using $336.9 million of the net

proceeds from its sale of class A common stock under its

at-the-market offering program, and Excess Cash.

Excess Cash refers to cash in excess of the minimum Cash Assets

that MicroStrategy is required to hold under its Treasury Reserve

Policy, which may include cash generated by operating activities

and cash from the proceeds of financing activities. Cash Assets

refers to cash and cash equivalents and short-term investments.

MICROSTRATEGY

INCORPORATED

DIGITAL ASSETS – ADDITIONAL

INFORMATION

MARKET VALUE OF BITCOIN

HOLDINGS

(unaudited)

Market Value

Market Value

Market Value

of Bitcoin

of Bitcoin

of Bitcoin

Held at End

Held at End

Held at End

Approximate

Lowest

of Quarter

Highest

of Quarter

of Quarter

Number of

Market Price

Using Lowest

Market Price

Using Highest

Market Price

Using Ending

Bitcoins Held

Per Bitcoin

Market Price

Per Bitcoin

Market Price

Per Bitcoin at

Market Price

at End of

During

(in thousands)

During

(in thousands)

End of Quarter

(in thousands)

Quarter *

Quarter (a)

(b)

Quarter (c)

(d)

(e)

(f)

December 31, 2021

124,391

$

42,333.00

$

5,265,844

$

69,000.00

$

8,582,979

$

45,879.97

$

5,707,055

March 31, 2022

129,218

$

32,933.33

$

4,255,579

$

48,240.00

$

6,233,476

$

45,602.79

$

5,892,701

June 30, 2022

129,699

$

17,567.45

$

2,278,481

$

47,469.40

$

6,156,734

$

18,895.02

$

2,450,665

September 30, 2022

130,000

$

18,153.13

$

2,359,907

$

25,214.57

$

3,277,894

$

19,480.51

$

2,532,466

December 31, 2022

132,500

$

15,460.00

$

2,048,450

$

21,478.80

$

2,845,941

$

16,556.32

$

2,193,712

March 31, 2023

140,000

$

16,490.00

$

2,308,600

$

29,190.04

$

4,086,606

$

28,468.44

$

3,985,582

June 30, 2023

152,333

$

24,750.00

$

3,770,242

$

31,443.67

$

4,789,909

$

30,361.51

$

4,625,060

*

MicroStrategy owns and has purchased

bitcoins both directly and indirectly through its wholly-owned

subsidiary, MacroStrategy. References to MicroStrategy below refer

to MicroStrategy and its subsidiaries on a consolidated basis.

(a)

The "Lowest Market Price Per Bitcoin During Quarter" represents

the lowest market price for one bitcoin reported on the Coinbase

exchange during the respective quarter, without regard to when

MicroStrategy purchased any of its bitcoin.

(b)

The "Market Value of Bitcoin Held at End

of Quarter Using Lowest Market Price" represents a mathematical

calculation consisting of the lowest market price for one bitcoin

reported on the Coinbase exchange during the respective quarter

multiplied by the number of bitcoins held by MicroStrategy at the

end of the applicable period.

(c)

The "Highest Market Price Per Bitcoin

During Quarter" represents the highest market price for one bitcoin

reported on the Coinbase exchange during the respective quarter,

without regard to when MicroStrategy purchased any of its

bitcoin.

(d)

The "Market Value of Bitcoin Held at End

of Quarter Using Highest Market Price" represents a mathematical

calculation consisting of the highest market price for one bitcoin

reported on the Coinbase exchange during the respective quarter

multiplied by the number of bitcoins held by MicroStrategy at the

end of the applicable period.

(e)

The "Market Price Per Bitcoin at End of

Quarter" represents the market price of one bitcoin on the Coinbase

exchange at 4:00 p.m. Eastern Time on the last day of the

respective quarter.

(f)

The "Market Value of Bitcoin Held at End

of Quarter Using Ending Market Price" represents a mathematical

calculation consisting of the market price of one bitcoin on the

Coinbase exchange at 4:00 p.m. Eastern Time on the last day of the

respective quarter multiplied by the number of bitcoins held by

MicroStrategy at the end of the applicable period.

The amounts reported as “Market Value” in the above table

represent only a mathematical calculation consisting of the price

for one bitcoin reported on the Coinbase exchange (MicroStrategy’s

principal market for bitcoin) in each scenario defined above

multiplied by the number of bitcoins held by MicroStrategy at the

end of the applicable period. The SEC has previously stated that

there has not been a demonstration that (i) bitcoin and bitcoin

markets are inherently resistant to manipulation or that the spot

price of bitcoin may not be subject to fraud and manipulation; and

(ii) adequate surveillance-sharing agreements with bitcoin-related

markets are in place, as bitcoin-related markets are either not

significant, not regulated, or both. Accordingly, the Market Value

amounts reported above may not accurately represent fair market

value, and the actual fair market value of MicroStrategy’s bitcoin

may be different from such amounts and such deviation may be

material. Moreover, (i) the bitcoin market historically has been

characterized by significant volatility in price, limited liquidity

and trading volumes compared to sovereign currencies markets,

relative anonymity, a developing regulatory landscape, potential

susceptibility to market abuse and manipulation, compliance and

internal control failures at exchanges, and various other risks

that are, or may be, inherent in its entirely electronic, virtual

form and decentralized network and (ii) MicroStrategy may not be

able to sell its bitcoins at the Market Value amounts indicated

above, at the market price as reported on the Coinbase exchange

(its principal market) on the date of sale, or at all.

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

LOSS FROM OPERATIONS

(in thousands)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Reconciliation of non-GAAP loss from

operations:

Loss from operations

$

(26,708

)

$

(918,123

)

$

(47,015

)

$

(1,088,083

)

Share-based compensation expense

15,494

15,294

33,049

29,688

Non-GAAP loss from operations

$

(11,214

)

$

(902,829

)

$

(13,966

)

$

(1,058,395

)

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

NET INCOME (LOSS) AND DILUTED

EARNINGS (LOSS) PER SHARE

(in thousands, except per

share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Reconciliation of non-GAAP net income

(loss):

Net income (loss)

$

22,243

$

(1,062,298

)

$

483,436

$

(1,193,049

)

Share-based compensation expense

15,494

15,294

33,049

29,688

Interest expense arising from amortization

of debt issuance costs

2,190

2,168

4,400

4,297

Gain on debt extinguishment

0

0

(44,686

)

0

Income tax effects (1)

(2,998

)

(3,898

)

5,768

(7,342

)

Non-GAAP net income (loss)

$

36,929

$

(1,048,734

)

$

481,967

$

(1,166,406

)

Reconciliation of non-GAAP diluted

earnings (loss) per share (2):

Diluted earnings (loss) per share

$

1.52

$

(94.01

)

$

33.56

$

(105.64

)

Share-based compensation expense (per

diluted share)

0.96

1.35

2.27

2.63

Interest expense arising from amortization

of debt issuance costs (per diluted share) (3)

0.03

0.19

0.06

0.38

Gain on debt extinguishment (per diluted

share)

0.00

0.00

(3.07

)

0.00

Income tax effects (per diluted share)

(3)

(0.16

)

(0.34

)

0.46

(0.65

)

Non-GAAP diluted earnings (loss) per

share

$

2.35

$

(92.81

)

$

33.28

$

(103.28

)

(1)

Income tax effects reflect the net tax effects of share-based

compensation expense, which includes tax benefits and expenses on

exercises of stock options and vesting of share-settled restricted

stock units, interest expense for amortization of debt issuance

costs, and gain on debt extinguishment.

(2)

For reconciliation purposes, the non-GAAP diluted earnings

(loss) per share calculations use the same weighted average shares

outstanding as that used in the GAAP diluted earnings (loss) per

share calculations for the same period. For example, in periods of

GAAP net loss, otherwise dilutive potential shares of common stock

from MicroStrategy’s share-based compensation arrangements and

Convertible Notes are excluded from the GAAP diluted loss per share

calculation as they would be antidilutive, and therefore are also

excluded from the non-GAAP diluted earnings or loss per share

calculation.

(3)

For the three and six months ended June 30, 2023, interest

expense from the amortization of issuance costs of the Convertible

Notes has been added back to the numerator in the GAAP diluted

earnings per share calculation, and therefore the per diluted share

effects of the amortization of issuance costs of the Convertible

Notes have been excluded from the “Interest expense arising from

amortization of debt issuance costs (per diluted share)” and

“Income tax effects (per diluted share)” lines in the above

reconciliation for the three and six months ended June 30,

2023.

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

CONSTANT CURRENCY

(in thousands)

Three Months Ended

June 30,

(unaudited)

Foreign

Non-GAAP

Currency

Non-GAAP

Constant

Exchange Rate

Constant

GAAP %

Currency %

GAAP

Impact (1)

Currency (2)

GAAP

Change

Change (3)

2023

2023

2023

2022

2023

2023

Revenues

Product licenses

$

15,522

$

(658

)

$

16,180

$

20,129

-22.9

%

-19.6

%

Subscription services

19,878

(328

)

20,206

14,017

41.8

%

44.2

%

Total product licenses and subscription

services

35,400

(986

)

36,386

34,146

3.7

%

6.6

%

Product support

66,081

34

66,047

66,521

-0.7

%

-0.7

%

Other services

18,919

(147

)

19,066

21,406

-11.6

%

-10.9

%

Total revenues

120,400

(1,099

)

121,499

122,073

-1.4

%

-0.5

%

Six Months Ended

June 30,

(unaudited)

Foreign

Non-GAAP

Currency

Non-GAAP

Constant

Exchange Rate

Constant

GAAP %

Currency %

GAAP

Impact (1)

Currency (2)

GAAP

Change

Change (3)

2023

2023

2023

2022

2023

2023

Revenues

Product licenses

$

32,934

$

(1,715

)

$

34,649

$

36,642

-10.1

%

-5.4

%

Subscription services

38,688

(1,062

)

39,750

26,862

44.0

%

48.0

%

Total product licenses and subscription

services

71,622

(2,777

)

74,399

63,504

12.8

%

17.2

%

Product support

131,562

(1,458

)

133,020

133,672

-1.6

%

-0.5

%

Other services

39,131

(986

)

40,117

44,174

-11.4

%

-9.2

%

Total revenues

242,315

(5,221

)

247,536

241,350

0.4

%

2.6

%

(1)

The “Foreign Currency Exchange Rate Impact” reflects the

estimated impact of fluctuations in foreign currency exchange rates

on international revenues. It shows the increase (decrease) in

international revenues from the same period in the prior year,

based on comparisons to the prior year quarterly average foreign

currency exchange rates. The term “international” refers to

operations outside of the United States and Canada.

(2)

The “Non-GAAP Constant Currency” reflects the current period

GAAP amount, less the Foreign Currency Exchange Rate Impact.

(3)

The “Non-GAAP Constant Currency % Change” reflects the

percentage change between the current period Non-GAAP Constant

Currency amount and the GAAP amount for the same period in the

prior year.

MICROSTRATEGY

INCORPORATED

DEFERRED REVENUE

DETAIL

(in thousands)

June 30,

December 31,

June 30,

2023

2022*

2022

(unaudited)

(unaudited)

Current:

Deferred product licenses revenue

$

974

$

2,825

$

754

Deferred subscription services revenue

49,898

51,861

40,295

Deferred product support revenue

141,605

155,366

143,524

Deferred other services revenue

3,340

7,376

3,525

Total current deferred revenue and advance

payments

$

195,817

$

217,428

$

188,098

Non-current:

Deferred product licenses revenue

$

2,493

$

2,742

$

0

Deferred subscription services revenue

2,888

3,030

2,639

Deferred product support revenue

5,340

6,387

5,272

Deferred other services revenue

523

604

586

Total non-current deferred revenue and

advance payments

$

11,244

$

12,763

$

8,497

Total current and non-current:

Deferred product licenses revenue

$

3,467

$

5,567

$

754

Deferred subscription services revenue

52,786

54,891

42,934

Deferred product support revenue

146,945

161,753

148,796

Deferred other services revenue

3,863

7,980

4,111

Total current and non-current deferred

revenue and advance payments

$

207,061

$

230,191

$

196,595

* Derived from audited financial

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230801942986/en/

MicroStrategy Incorporated Shirish Jajodia Investor Relations

ir@microstrategy.com (703) 848-8600

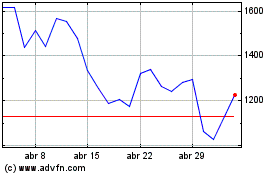

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024