FG Financial Group Continues to Achieve

Increase in Net Reinsurance Premiums Earned, Net Investment Income,

and Sees Progress in Strategic Merchant Banking

FG Financial Group, Inc. (Nasdaq: FGF) (the “Company”),

today announced results for the second quarter and six months ended

June 30, 2023. FG Financial is a reinsurance and asset management

holding company focused on collateralized and loss-capped

reinsurance and merchant banking that allocates capital in

partnership with Fundamental Global®, a private partnership led by

Kyle Cerminara and Joe Moglia, as well as other strategic

investors.

FG Financial Group CEO Larry Swets, Jr. commented, “The Company

continued to achieve solid progress during the quarter executing

our strategy of identifying asymmetric risk/reward opportunities

and patiently allocating capital to drive long-term returns for our

shareholders. Our reinsurance division continued to build its

differentiated and flexible reinsurance model, generating increased

net premiums earned as we deployed capital to highly structured

loss-capped contracts. We are also focused on broadening our

revenue base with no-downside, fee-based revenue through our FG RE

Solutions unit and we see the opportunity for substantial long-term

growth as the range of joint-ventures and structures expands. Our

merchant banking division has established an extraordinary

portfolio of businesses across attractive end markets. This

quarter, FG Acquisition Corp. announced a business combination with

ThinkMarkets, an online and leveraged trading multi-asset brokerage

with established global partnerships and a scalable business model.

Additionally, FG Merger Corp.’s merger agreement with iCoreConnect

Inc., a cloud-based SaaS company bringing much needed workflow

efficiencies to the dental and medical industries, continues to

progress. As we look to the second half of the year, we are

optimistic about the opportunities ahead of us and will continue to

execute our strategy to drive long-term returns for our

shareholders.”

FG Financial Group Chairman Kyle Cerminara, added, “We are

pleased with the progress made in the first half of this year. Our

merchant banking division continues to build Craveworthy, a growing

restaurant brand platform made up of diverse, relevant and highly

scalable brands, as well as FG Communities which owns and operates

an attractive portfolio of manufactured housing communities.

Furthermore, we are leveraging our deep experience in the SPAC

industry to introduce innovative deal structures that make sense

for both our companies and a broader base of investors. We look

forward to continuing to execute our strategy in 2023 and beyond as

we identify opportunities with the aim of building long-term

shareholder value.”

Select 2023 Second Quarter Results and Six Months Financial

Results and Highlights

FG Financial Group’s 2023 second quarter and six-month financial

results included:

- Net reinsurance premiums earned increased to $3.7 million for

the three months ended June 30, 2023, from $3.0 million in the

second quarter of the prior year. Net reinsurance premiums for the

six months ended June 30, 2023, increased to $7.3 million from $5.4

million in the six months ended June 30, 2022. The increase in

reinsurance premiums was due primarily to the additional

reinsurance agreement entered into with Funds at Lloyds to cover

risks written by the syndicate during the calendar year 2023.

- Net investment loss for the three months ended June 30, 2023,

decreased to $1.5 million compared to a net investment loss of $3.7

million in the second quarter of the prior year. Net investment

income for the six months ended June 30, 2023, increased to $1.3

million from a loss of $6.1 million in the six months ended June

30, 2022.

- The Company paid the 8% Series A Preferred Share dividend of

$0.45 million, or $0.50 per share, which represents the Company’s

21st consecutive quarter of paying the full dividend due on the 8%

Series A Preferred Shares since their issuance in February

2018.

- General and administrative expense was $2.3 million and $4.9

million for the three and six months ended June 30, 2023,

respectively, as compared to $2.3 million and $4.0 million for the

same periods in the prior year, respectively. The increase was

primarily related to an increase in non-cash stock compensation

expense.

Net loss attributable to common shareholders for the second

quarter of 2023 decreased to $3.4 million, or $(0.35) per fully

diluted share, compared to a loss of $5.9 million, or $(0.87) per

fully diluted share for the second quarter of 2022. Net loss

attributable to common shareholders for the six month period ended

June 30, 2023, was $2.5 million, decreasing by 76% compared to a

loss of $10.2 million, or $(1.55) per fully diluted share, for the

six month period ended June 30, 2022.

Balance Sheet Highlights

As of June 30, 2023, FG Financial Group’s key balance sheet

items included:

- Cash and cash equivalents of $3.0 million.

- Investment holdings totaling $25.8 million, including directly

or indirectly held investments in OppFi, holdings under the

Company’s Merchant Banking Platform for FG Merger Corp. and FG

Acquisition Corp., and other investments.

- Total shareholders’ equity of $37.0 million, an increase of

$9.3 million from $27.7 million at June 30, 2022.

FG Financial Group, Inc.

FG Financial Group, Inc. is a reinsurance and asset management

holding company focused on collateralized and loss capped

reinsurance and merchant banking that allocates capital in

partnership with Fundamental Global®, a private partnership led by

Kyle Cerminara and Joe Moglia, as well as other strategic

investors. The Company’s principal business operations are

conducted through its subsidiaries and affiliates.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These

statements are therefore entitled to the protection of the safe

harbor provisions of these laws. These statements may be identified

by the use of forward-looking terminology such as “anticipate,”

“believe,” “budget,” “can,” “contemplate,” “continue,” “could,”

“envision,” “estimate,” “expect,” “evaluate,” “forecast,” “goal,”

“guidance,” “indicate,” “intend,” “likely,” “may,” “might,”

“outlook,” “plan,” “possibly,” “potential,” “predict,” “probable,”

“probably,” “pro-forma,” “project,” “seek,” “should,” “target,”

“view,” “will,” “would,” “will be,” “will continue,” “will likely

result” or the negative thereof or other variations thereon or

comparable terminology. In particular, discussions and statements

regarding the Company’s future business plans and initiatives are

forward-looking in nature. We have based these forward-looking

statements on our current expectations, assumptions, estimates, and

projections. While we believe these to be reasonable, such

forward-looking statements are only predictions and involve a

number of risks and uncertainties, many of which are beyond our

control. These and other important factors may cause our actual

results, performance, or achievements to differ materially from any

future results, performance or achievements expressed or implied by

these forward-looking statements, and may impact our ability to

implement and execute on our future business plans and initiatives.

Management cautions that the forward-looking statements in this

release are not guarantees of future performance, and we cannot

assume that such statements will be realized or the forward-looking

events and circumstances will occur. Factors that might cause such

a difference include, without limitation: risks associated with our

inability to identify and realize business opportunities, and the

undertaking of any new such opportunities; general conditions in

the global economy, our lack of operating history or established

reputation in the reinsurance industry; our inability to obtain or

maintain the necessary approvals to operate reinsurance

subsidiaries; risks associated with operating in the reinsurance

industry, including inadequately priced insured risks, credit risk

associated with brokers we may do business with, and inadequate

retrocessional coverage; our inability to execute on our investment

and investment management strategy, including our strategy to

invest in the risk capital of special purpose acquisition companies

(SPACs); potential loss of value of investments; risk of becoming

an investment company; fluctuations in our short-term results as we

implement our new business strategy; risks of being unable to

attract and retain qualified management and personnel to implement

and execute on our business and growth strategy; failure of our

information technology systems, data breaches and cyber-attacks;

our ability to establish and maintain an effective system of

internal controls; our limited operating history as a public

company; the requirements of being a public company and losing our

status as a smaller reporting company or becoming an accelerated

filer; any potential conflicts of interest between us and our

controlling stockholders and different interests of controlling

stockholders; potential conflicts of interest between us and our

directors and executive officers; risks associated with our related

party transactions and investments; and risks associated with our

investments in SPACs, including the failure of any such SPAC to

complete its initial business combination. Our expectations and

future plans and initiatives may not be realized. If one of these

risks or uncertainties materializes, or if our underlying

assumptions prove incorrect, actual results may vary materially

from those expected, estimated or projected. You are cautioned not

to place undue reliance on forward-looking statements. The

forward-looking statements are made only as of the date hereof and

do not necessarily reflect our outlook at any other point in time.

We do not undertake and specifically decline any obligation to

update any such statements or to publicly announce the results of

any revisions to any such statements to reflect new information,

future events or developments.

FG FINANCIAL GROUP,

INC.

Consolidated Balance

Sheets

($ in thousands, except per

share data)

June 30, 2023

(unaudited)

December 31,

2022

ASSETS

Equity securities, at fair value (cost

basis of $1,916 and $889, respectively)

$

1,783

$

841

Other investments

23,994

24,839

Cash and cash equivalents

2,962

3,010

Deferred policy acquisition costs

1,231

1,527

Reinsurance balances receivable (net of

current expected losses allowance of $84 and zero,

respectively)

10,608

9,269

Funds deposited with reinsured

companies

6,667

9,277

Other assets

1,321

712

Total assets

$

48,566

$

49,475

LIABILITIES

Loss and loss adjustment expense

reserves

$

4,665

$

4,409

Unearned premium reserves

6,270

6,823

Accounts payable and accrued expenses

508

723

Other liabilities

116

225

Total liabilities

$

11,559

$

12,180

SHAREHOLDERS’ EQUITY

Series A Preferred Shares, $25.00 par and

liquidation value, 1,000,000 shares authorized; 894,580 shares

issued and outstanding as of June 30, 2023 and December 31,

2022

$

22,365

$

22,365

Common stock, $0.001 par value;

100,000,000 shares authorized; 10,303,739 and 9,410,473 shares

issued and outstanding as of June 30, 2023 and December 31, 2022,

respectively

10

9

Additional paid-in capital

52,302

50,021

Accumulated deficit

(37,670

)

(35,100

)

Total shareholders’ equity

37,007

37,295

Total liabilities and shareholders’

equity

$

48,566

$

49,475

FG FINANCIAL GROUP,

INC.

Consolidated Statements of

Operations

($ in thousands, except per

share data)

(Unaudited)

Three months ended

June 30,

Six months ended

June 30,

2023

2022

2023

2022

Revenue:

Net premiums earned

$

3,685

$

2,953

$

7,342

$

5,426

Net investment (loss) income

(1,529

)

(3,714

)

1,311

(6,059

)

Other income

30

26

60

50

Total revenue

2,186

(735

)

8,713

(583

)

Expenses:

Net losses and loss adjustment

expenses

1,960

1,868

3,876

3,391

Amortization of deferred policy

acquisition costs

817

606

1,529

1,318

General and administrative expenses

2,332

2,269

4,881

4,009

Total expenses

5,109

4,743

10,286

8,718

Net loss

$

(2,923

)

$

(5,478

)

$

(1,573

)

$

(9,301

)

Dividends declared on Series A Preferred

Shares

444

447

891

894

Loss attributable to FG Financial Group,

Inc. common shareholders

$

(3,367

)

$

(5,925

)

$

(2,464

)

$

(10,195

)

Basic and diluted net loss per common

share:

$

(0.35

)

$

(0.87

)

$

(0.26

)

$

(1.55

)

Weighted average common shares

outstanding:

Basic and diluted

9,704,893

6,775,501

9,564,225

6,589,296

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230810600857/en/

INVESTOR RELATIONS: IMS Investor Relations John

Nesbett/Rosalyn Christian (203) 972-9200 IR@fgfinancial.com

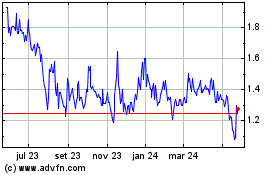

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

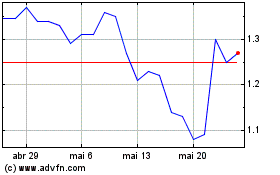

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024