Coty Inc. (NYSE: COTY) (“Coty”), one of the world’s largest

beauty companies with a portfolio of iconic brands across

fragrance, color cosmetics, and skin and body care, today announced

that it, together with its wholly-owned subsidiaries, HFC Prestige

Products, Inc. and HFC Prestige International U.S. LLC (the

“Co-Issuers” and collectively with Coty, the “Issuers”), launched

an offering of €500 million aggregate principal amount of senior

secured notes (the “Notes”), subject to market and customary

conditions. The interest rates and other key terms of the Notes

will be determined at the time of pricing.

The Notes will be senior secured obligations of the Issuers and

will be guaranteed on a senior secured basis by each of Coty’s

subsidiaries (other than the Co-Issuers) that guarantee, and will

be secured by first priority liens on the same collateral that

secures, Coty’s obligations under Coty’s existing senior secured

credit facilities and senior secured notes. The collateral security

will be released upon the Notes achieving investment grade ratings

from two out of the three ratings agencies.

Coty intends to use the net proceeds from the offering of the

Notes to repay a portion of the borrowings outstanding under Coty’s

revolving credit facility, without a reduction in commitment. Coty

will use cash on hand to pay the offering expenses payable by it in

connection with the offering of the Notes.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, the

Notes. No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful.

The Notes and the related guarantees have not been, and will not

be, registered under the Securities Act of 1933, as amended (the

“Securities Act”), or any applicable state or foreign securities

laws, and will be offered only to persons reasonably believed to be

qualified institutional buyers in reliance on Rule 144A, and to

non-U.S. persons outside the United States in compliance with

Regulation S under the Securities Act. Unless so registered, the

Notes and the related guarantees may not be offered or sold in the

United States except pursuant to an exemption from the registration

requirements of the Securities Act and applicable state securities

laws.

About Coty Inc.

Founded in Paris in 1904, Coty is one of the world’s largest

beauty companies with a portfolio of iconic brands across

fragrance, color cosmetics, and skin and body care. Coty serves

consumers around the world, selling prestige and mass market

products in more than 125 countries and territories. Coty and our

brands empower people to express themselves freely, creating their

own visions of beauty; and we are committed to protecting the

planet.

Cautionary Note Regarding Forward-looking Statements

The statements contained in this press release include certain

“forward-looking statements” within the meaning of the securities

laws. These forward-looking statements reflect Coty’s current views

with respect to, among other things, the offering of the Notes and

the use of proceeds therefrom. These forward-looking statements are

generally identified by words or phrases, such as “anticipate,”

“are going to,” “estimate,” “plan,” “project,” “expect,” “believe,”

“intend,” “foresee,” “forecast,” “will,” “may,” “should,”

“outlook,” “continue,” “temporary,” “target,” “aim,” “potential,”

“goal” and similar words or phrases. These statements are based on

certain assumptions and estimates that Coty considers reasonable

and are not guarantees of Coty’s future performance, but are

subject to a number of risks and uncertainties, many of which are

beyond Coty’s control, which could cause actual events or results

to differ materially from such statements, including the Issuers’

ability to consummate the offering of the Notes on a timely basis

and on terms commercially acceptable to Coty, or at all, and other

factors identified in “Risk Factors” included in Coty’s Annual

Report on Form 10-K for the fiscal year ended June 30, 2023. All

forward-looking statements made in this press release are qualified

by these cautionary statements. These forward-looking statements

are made only as of the date of this press release, and Coty does

not undertake any obligation, other than as may be required by law,

to update or revise any forward-looking or cautionary statements to

reflect changes in assumptions, the occurrence of events,

unanticipated or otherwise, or changes in future operating results

over time or otherwise.

This media release has been prepared on the basis that any offer

of Notes in any member state of the European Economic Area (“EEA”)

will be made pursuant to an exemption under the Prospectus

Regulation from a requirement to publish a prospectus for offers of

Notes. For these purposes the expression “Prospectus Regulation”

means Regulation (EU) 2017/1129.

The Notes are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made

available to any retail investor in the EEA. For these purposes, a

retail investor means a person who is one (or more) of (i) a retail

client as defined in point (11) of Article 4(1) of Directive

2014/65/EU (“MIFID II”), (ii) a customer within the meaning of the

Insurance Distribution Directive where that customer would not

qualify as a professional client as defined in point (10) of

Article 4(1) of MiFID II, or (iii) not a qualified investor as

defined in the Prospectus Regulation. Consequently no key

information document required by the PRIIPs Regulation for offering

or selling the Notes or otherwise making them available to retail

investors in the EEA has been prepared and therefore offering or

selling the Notes or otherwise making them available to any retail

investor in the EEA may be unlawful under the PRIIPs

Regulation.

MiFID II product governance / Professional investors and ECPs

only target market. Manufacturer target market (MiFID II product

governance) is eligible counterparties and professional clients

only (all distribution channels).

This media release has been prepared on the basis that any offer

of the Notes in the United Kingdom (the “UK”) will be made pursuant

to an exemption under the UK Prospectus Regulation from a

requirement to publish a prospectus for offers of Notes. For these

purposes UK Prospectus Regulation means Regulation (EU) 2017/1129

as it forms part of domestic law in the UK by virtue of the

European Union (Withdrawal) Act 2018 (the “EUWA”).

The Notes are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made

available to any retail investor in the UK. For these purposes, a

retail investor means a person who is one (or more) of: (i) a

retail client, as defined in point (8) of Article 2 of Regulation

(EU) No 2017/565 as it forms part of domestic law in the UK by

virtue of the EUWA; (ii) a customer within the meaning of the

provisions of the Financial Services and Markets Act 2000 (as

amended, the “FSMA”) and any rules or regulations made under the

FSMA to implement Directive (EU) 2016/97, where that customer would

not qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

domestic law in the UK by virtue of the EUWA, or (iii) not a

qualified investor as defined in Article 2 of the UK Prospectus

Regulation. Consequently, no key information document required by

Regulation (EU) No 1286/2014 as it forms part of domestic law in

the UK by virtue of the EUWA (the “UK PRIIPs Regulation”) for

offering or selling the Notes or otherwise making them available to

retail investors in the UK has been prepared and, therefore,

offering or selling the Notes or otherwise making them available to

any retail investor in the UK may be unlawful under the UK PRIIPs

Regulation.

UK MiFIR product governance / Professional investors and ECPs

only target market. Manufacturer target market (UK MiFIR product

governance) is eligible counterparties and professional clients

only (all distribution channels).

This media release is only being distributed to and is only

directed at: (i) persons who are outside the United Kingdom; (ii)

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended, the “Financial Promotion Order”); (iii) persons falling

within Article 49(2)(a) to (d) of the Order, or (iv) persons to

whom an invitation or inducement to engage in investment activity

(within the meaning of section 21 of the FSMA) in connection with

the issue or sale of any Notes may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “relevant persons”). This media

release is directed only at relevant persons and must not be acted

on or relied on by persons who are not relevant persons. Any

investment or investment activity to which this document relates is

available only to relevant persons and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such Notes

will be engaged in only with relevant persons.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230910677284/en/

Investor Relations Olga Levinzon +1 212 389-7733

olga_levinzon@cotyinc.com

Media Antonia Werther +31 621 394495

antonia_werther@cotyinc.com

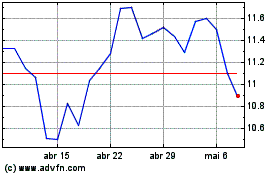

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024