Total revenue of $242.8 million, up 7% year

over year

GAAP operating margin of (8)%, non-GAAP

operating margin of 19%

New Relic, Inc. (NYSE: NEWR), the all-in-one observability

platform for every engineer, announced financial results for the

second quarter of fiscal year 2024.

Fiscal 2024 Second Quarter Results:

- Revenue: Total revenue was $242.8 million, up 7% from

$226.9 million one year ago. Consumption revenue was $223.3

million, up 33% year over year.

- Gross Margin and Non-GAAP Gross Margin(1): Gross margin

was 78.3%, compared to 71.5% one year ago. Non-GAAP gross margin

was 79.7%, compared to 73.7% one year ago.

- Operating Income and Non-GAAP Operating Income(1): Loss

from operations was $(20.5) million, compared to $(45.3) million

one year ago. Non-GAAP operating income was $45.2 million, compared

to $6.9 million one year ago.

- Operating Margin and Non-GAAP Operating Margin(1):

Operating margin was (8.4)%, compared to (20.0)% one year ago.

Non-GAAP operating margin was 18.6%, compared to 3.0% one year

ago.

- Net Income Per Share and Non-GAAP Net Income Per

Share(1): Fully diluted net loss per share was $(0.34),

compared to $(0.70) one year ago, while non-GAAP fully diluted net

income per share was $0.51, compared to $0.14 one year ago. Fully

diluted share count was 72.5 million.

- Cash, Cash Equivalents and Short-Term Investments: Cash,

cash equivalents, and short-term investments were $436.6 million as

of September 30, 2023.

- Cash Flows From Operating Activities and Free Cash Flow:

Trailing four quarter cash flows from operating activities was

$94.4 million, compared to $36.3 million one year ago. Trailing

four quarter free cash flow was $76.6 million, compared to $16.4

million one year ago.

Recent Business Highlights:

- Continuing to Enhance AIOps Capabilities – Launched

recommended alerts, which provides the ability to quickly detect

and easily resolve alert coverage gaps by using AI to identify

anomalous behavior, determine areas of the technology stack that

aren’t being monitored, and recommend new alerts to engineers.

- Expanding Digital Experience Monitoring (DEM)

Capabilities – Launched New Relic Session Replay to provide

engineers with vital context through a video-like playback feature

to reproduce and resolve issues faster.

- Providing Insight into Observability Trends – Published

the 2023 Observability Forecast report, the largest and most

comprehensive study on the state and future of observability. One

key finding revealed that enterprises realize 2X ROI using

observability solutions, with 41% receiving more than $1 million

total annual value.

- Attracting Top Talent – For the second year in a row,

New Relic earned a spot on the 2023 PEOPLE Companies that CareⓇ

list for its comprehensive employee benefits and commitment to

charitable work.

- Leading in ESG – New Relic earned a spot on Newsweek’s

list of America’s Greenest Companies for 2024 for its commitment to

being good stewards of the environment.

Transaction with Private Equity Consortium

Given the announcement made on July 31, 2023, regarding New

Relic’s entry into a definitive agreement to be acquired by

Francisco Partners and TPG, New Relic will not host an earnings

conference call or provide financial guidance in conjunction with

this earnings release. The company’s previously issued guidance for

full year fiscal 2024 should no longer be relied upon. For further

detail and discussion of New Relic’s financial performance please

refer to New Relic’s Quarterly Report on Form 10-Q for the quarter

ended September 30, 2023, filed today with the SEC.

_______

(1) This press release uses non-GAAP financial metrics that are

adjusted for the impact of various GAAP items. See the section

titled “Non-GAAP Financial Measures” and the tables entitled

“Reconciliation from GAAP to Non-GAAP Results” below for

details.

About New Relic

As a leader in observability, New Relic empowers engineers with

a data-driven approach to planning, building, deploying, and

running great software. New Relic delivers the only unified data

platform that empowers engineers to get all telemetry—metrics,

events, logs, and traces—paired with powerful full stack analysis

tools to help engineers do their best work with data, not opinions.

Delivered through the industry’s first usage-based consumption

pricing that’s intuitive and predictable, New Relic gives engineers

more value for the money by helping improve planning cycle times,

change failure rates, release frequency, and mean time to

resolution. This helps the world’s leading brands including adidas

Runtastic, American Red Cross, Australia Post, Banco Inter, Chegg,

GoTo Group, Ryanair, Sainsbury’s, Signify Health, TopGolf, and

World Fuel Services (WFS) improve uptime, reliability, and

operational efficiency to deliver exceptional customer experiences

that fuel innovation and growth. www.newrelic.com

Important Information and Where to Find It

This communication is being made in respect of the proposed

transaction involving New Relic, FP and TPG. A special stockholder

meeting will be held on November 1, 2023 to obtain stockholder

approval in connection with the proposed transaction. New Relic has

filed with the Securities and Exchange Commission (the “SEC”) a

proxy statement and other relevant documents in connection with the

proposed merger. The definitive proxy statement sent or given to

the stockholders of New Relic contains important information about

the proposed transaction and related matters. INVESTORS OF NEW

RELIC ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER

RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND

RELATED MATTERS. Investors may obtain a free copy of these

materials and other documents filed by the Company with the SEC at

the SEC’s website at www.sec.gov, at New Relic’s website at

ir.newrelic.com/financial-information.

Participants in the Solicitation

New Relic and certain of its directors, executive officers and

other members of management and employees may be deemed to be

participants in the solicitation of proxies from its stockholders

in connection with the proposed merger. Information regarding the

persons who may, under the rules of the SEC, be considered to be

participants in the solicitation of New Relic’s stockholders in

connection with the proposed merger are set forth in New Relic’s

definitive proxy statement for its special stockholder meeting.

Additional information regarding these individuals and any direct

or indirect interests they may have in the proposed merger are set

forth in the definitive proxy statement filed with the SEC in

connection with the proposed merger.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of federal securities laws, including Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are based on New Relic’s current expectations, estimates

and projections about the expected date of closing of the proposed

transaction and the potential benefits thereof, its business and

industry, management’s beliefs and certain assumptions made by New

Relic, FP and TPG, all of which are subject to change. Words such

as “may,” “will,” “should,” “would,” “might,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential,”

or “continue” or the negative of these words or other similar terms

or expressions that concern our expectations, estimates and

projections. The forward-looking statements in this communication

include statements regarding the transaction and the ability to

consummate the transaction. Forward-looking statements speak only

as of the date they are made, and New Relic undertakes no

obligation to update any of them publicly in light of new

information or future events. Actual results could differ

materially from those contained in any forward-looking statement as

a result of various factors, including, without limitation: (i) the

completion of the proposed transaction on anticipated terms and

timing, including obtaining stockholder and regulatory approvals,

anticipated tax treatment, unforeseen liabilities, future capital

expenditures, revenues, expenses, earnings, synergies, economic

performance, indebtedness, financial condition, losses, future

prospects, business and management strategies for the management,

expansion and growth of New Relic’s business and other conditions

to the completion of the transaction; (ii) conditions to the

closing of the transaction may not be satisfied; (iii) the

transaction may involve unexpected costs, liabilities or delays;

(iv) the outcome of any legal proceedings related to the

transaction; (v) the failure by FP and TPG to obtain the necessary

debt financing arrangements set forth in the commitment letters

received in connection with the transaction; (vi) New Relic’s

ability to implement its business strategy; (vii) significant

transaction costs associated with the proposed transaction; (viii)

potential litigation relating to the proposed transaction; (ix) the

risk that disruptions from the proposed transaction will harm New

Relic’s business, including current plans and operations; (x) the

ability of New Relic to retain and hire key personnel; (xi)

potential adverse reactions or changes to business relationships

resulting from the announcement or completion of the proposed

transaction; (xii) legislative, regulatory and economic

developments affecting New Relic’s business; (xiii) general

economic and market developments and conditions; (xiv) the evolving

legal, regulatory and tax regimes under which New Relic operates;

(xv) potential business uncertainty, including changes to existing

business relationships, during the pendency of the merger that

could affect New Relic’s financial performance; (xvi) restrictions

during the pendency of the proposed transaction that may impact New

Relic’s ability to pursue certain business opportunities or

strategic transactions; and (xvii) unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, as well as New Relic’s

response to any of the aforementioned factors. While the list of

factors presented here is considered representative, such list

should not be considered to be a complete statement of all

potential risks and uncertainties. Unlisted factors may present

significant additional obstacles to the realization of

forward-looking statements. Consequences of material differences in

results as compared with those anticipated in the forward-looking

statements could include, among other things, business disruption,

operational problems, financial loss, legal liability to third

parties and similar risks, any of which could have a material

adverse effect on New Relic’s financial condition, results of

operations, or liquidity. New Relic does not assume any obligation

to publicly provide revisions or updates to any forward-looking

statements, whether as a result of new information, future

developments or otherwise, should circumstances change, except as

otherwise required by securities and other applicable laws.

Non-GAAP Financial Measures

New Relic discloses the following non-GAAP financial measures in

this press release and the earnings call referencing this press

release: non-GAAP operating income (loss), non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating expenses (research and

development, sales and marketing, and general and administrative),

non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net

income (loss) per diluted share, non-GAAP net income (loss) per

basic share and free cash flow. New Relic uses each of these

non-GAAP financial measures internally to understand and compare

operating results across accounting periods, for internal budgeting

and forecasting purposes, for short- and long-term operating plans,

and to evaluate New Relic’s financial performance. In addition, New

Relic’s bonus plan for eligible employees and executives is based

in part on non-GAAP income (loss) from operations. New Relic

believes these non-GAAP financial measures are useful to investors,

as a supplement to GAAP measures, in evaluating its operational

performance, as further discussed below. New Relic’s non-GAAP

financial measures may not provide information that is directly

comparable to that provided by other companies in its industry, as

other companies in its industry may calculate non-GAAP financial

results differently, particularly related to non-recurring and

unusual items. In addition, there are limitations in using non-GAAP

financial measures because the non-GAAP financial measures are not

prepared in accordance with GAAP and may be different from non-GAAP

financial measures used by other companies and exclude expenses

that may have a material impact on New Relic’s reported financial

results.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, or superior to, financial

information prepared in accordance with GAAP. A reconciliation of

the historical non-GAAP financial measures to their most directly

comparable GAAP measures has been provided in the financial

statement tables included below in this press release.

New Relic defines non-GAAP income (loss) from operations,

non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating

expenses (sales and marketing, research and development, general

and administrative), non-GAAP operating margin, non-GAAP net income

(loss), non-GAAP net income (loss) per diluted share and non-GAAP

net income (loss) per basic share as the respective GAAP balances,

adjusted for, as applicable: (1) stock-based compensation-related

expenses, (2) the amortization of purchased intangibles, (3) the

amortization of debt discount and issuance costs, (4) the

transaction costs related to acquisitions, (5) expenses related to

litigation and other transaction-related expenses, (6)

restructuring charges, and (7) non-GAAP tax adjustment. Non-GAAP

net income (loss) per basic and diluted share is calculated as

non-GAAP net income (loss) divided by weighted-average shares used

to compute net income (loss) per share, basic and diluted, with the

number of weighted-average shares decreased to reflect the

anti-dilutive impact of the capped call transactions entered into

in connection with the 0.50% Convertible Senior Notes due 2023

issued in May 2018. New Relic defines free cash flow as GAAP cash

from operations, minus capital expenditures and minus capitalized

software. Investors are encouraged to review the reconciliation of

these historical non-GAAP financial measures to their most directly

comparable GAAP financial measures.

Management believes these non-GAAP financial measures are useful

to investors and others in assessing New Relic’s operating

performance due to the following factors:

Stock-based compensation-related expenses. New Relic’s

stock-based compensation-related expenses include stock-based

compensation expense, amortization of stock-based compensation

capitalized in software development costs and employer payroll tax

expense on equity incentive plans. New Relic utilizes share-based

compensation to attract and retain employees. It is principally

aimed at aligning their interests with those of the Company’s

stockholders and at long-term retention, rather than to address

operational performance for any particular period. As a result,

share-based compensation expenses vary for reasons that are

generally unrelated to financial and operational performance in any

particular period. The Company further excludes employer payroll

tax expense on equity incentive plans as these expenses are tied to

the exercise or vesting of underlying equity awards and the price

of the Company’s common stock at the time of vesting or exercise.

As a result, these taxes may vary in any particular period

independent of the financial and operating performance of the

Company’s business.

Amortization of purchased intangibles. New Relic views

amortization of purchased intangible assets as items arising from

pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for

impairment regularly, amortization of the cost of purchased

intangibles is an expense that is not typically affected by

operations during any particular period. Amortization of purchased

intangibles varies in amount and frequency and is significantly

impacted by the timing and size of the Company’s acquisitions.

Management finds it useful to exclude these non-cash charges from

operating expenses to assist in budgeting, planning, and

forecasting future periods. The use of intangible assets

contributed to the Company’s revenues during the periods presented

and will also contribute to its revenues in future periods.

Amortization of purchased intangible assets will recur in future

periods.

Amortization of debt discount and issuance costs. In May 2018,

New Relic issued $500.25 million of its 0.50% convertible senior

notes due 2023 (the “Notes”), which bore interest at an annual

fixed rate of 0.5%. The Notes matured and were repaid in cash on

May 1, 2023. The debt issuance costs were amortized as interest

expense. The expense for the amortization of debt issuance costs is

a non-cash item, and New Relic believes the exclusion of this

interest expense will provide for a more useful comparison of its

operational performance in different periods.

Transaction costs related to acquisitions. New Relic may from

time to time incur direct transaction costs related to

acquisitions. New Relic believes it is useful to exclude such

charges because it does not consider such amounts to be part of the

ongoing operation of New Relic’s business.

Expenses related to litigation and other transaction-related

expenses. New Relic may from time to time incur charges or benefits

related to litigation or transactions that are outside of the

ordinary course of New Relic’s business. In connection with the

Merger Agreement entered into on July 30, 2023, New Relic incurred

transaction expenses of $16.7 million and $19.3 million in the

three and six months ended September 30, 2023, respectively. New

Relic believes it is useful to exclude such charges or benefits

because it does not consider such amounts to be part of the ongoing

operation of New Relic’s business and because of the singular

nature of the claims underlying the matter.

Restructuring charges. In August 2022, New Relic commenced a

restructuring plan to realign its cost structure with its business

needs as the Company moved to focus resources on top priorities,

and in March 2023, the Company approved a new restructuring plan in

connection with the reduction of its global real estate footprint

in line with its Flex First philosophy. In the first fiscal quarter

of 2024, the Company announced the adoption of a new restructuring

plan focused on realigning resources with the Company’s business

needs in driving the growth of its consumption business. As a

result of this and previously announced restructuring plans, New

Relic incurred charges of approximately $1.5 million and $23.2

million consisting of termination benefits and lease exit costs for

the three and six months ended September 30, 2023, respectively.

New Relic believes it is appropriate to exclude the restructuring

charges because they are not indicative of future operating

results.

Non-GAAP tax adjustment. The Company used a long-term projected

non-GAAP tax rate to provide consistency across interim reporting

periods with non-GAAP net income. As the Company was forecasted to

be non-GAAP profitable on an annual basis starting in fiscal year

2024, New Relic applied the non-GAAP tax rate prospectively in the

first fiscal quarter of 2024. In determining the non-GAAP tax rate,

New Relic excluded the impact of nonrecurring items and made

assumptions including those about tax legislation and its tax

positions. New Relic projected a 24.0% non-GAAP tax rate based on

non-GAAP financial projections and applied it to the non-GAAP

profit before tax.

Additionally, New Relic’s management believes that the non-GAAP

financial measure free cash flow is meaningful to investors because

management reviews cash flows generated from operations after

taking into consideration capital expenditures and the

capitalization of software development costs due to the fact that

these expenditures are considered to be a necessary component of

ongoing operations.

Operating Metrics

Active Customer Accounts. New Relic defines an Active Customer

Account at the end of any period as an individual account, as

identified by a unique account identifier, aggregated at the parent

hierarchy level, for which New Relic has recognized any revenue in

the fiscal quarter. The number of Active Customer Accounts that is

reported as of a particular date is rounded down to the nearest

hundred.

Number of Active Customer Accounts with Revenue Greater than

$100,000. As a measure of New Relic’s ability to scale with its

customers and attract large enterprises to its platform, New Relic

counts the number of Active Customer Accounts for which it has

recognized greater than $100,000 in revenue in the trailing

12-months.

Percentage of Revenue from Active Customer Accounts Greater than

$100,000. New Relic also looks at its percentage of overall revenue

it receives from its Active Customer Accounts with revenue greater

than $100,000 in any given quarter as an indicator of its relative

performance when selling to New Relic’s large customer

relationships or its smaller revenue accounts.

Net Revenue Retention Rate (“NRR”). NRR monitors the growth in

use of New Relic’s platform by its existing active customer

accounts and allows New Relic to measure the health of its business

and future growth prospects. To calculate NRR, New Relic first

identifies the cohort of Active Customer Accounts that were Active

Customer Accounts in the same quarter of the prior fiscal year.

Next, New Relic identifies the measurement period as the 12-month

period ending with the period reported and the prior comparison

period as the corresponding period in the prior year. NRR is the

quotient obtained by dividing the revenue generated from a cohort

of Active Customer Accounts in the measurement period by the

revenue generated from that same cohort in the prior comparison

period.

New Relic is a registered trademark of New Relic, Inc.

All product and company names herein may be trademarks of their

registered owners.

New Relic, Inc.Condensed Consolidated Statements of

Operations(In thousands, except per share data; unaudited)

Three Months Ended September 30, Six Months Ended

September 30,

2023

2022

2023

2022

Revenue

$

242,757

$

226,912

$

485,385

$

443,371

Cost of revenue

52,709

64,783

107,149

128,676

Gross profit

190,048

162,129

378,236

314,695

Operating expenses: Research and development

69,411

68,730

149,721

133,499

Sales and marketing

84,096

96,203

178,115

200,623

General and administrative

57,020

42,483

103,869

81,513

Total operating expenses

210,527

207,416

431,705

415,635

Loss from operations

(20,479

)

(45,287

)

(53,469

)

(100,940

)

Other income (expense): Interest income

3,896

2,425

8,489

3,535

Interest expense

(15

)

(1,233

)

(444

)

(2,465

)

Other income (expense), net

(75

)

207

(1,741

)

(2

)

Loss before income taxes

(16,673

)

(43,888

)

(47,165

)

(99,872

)

Income tax provision (benefit)

76

(381

)

2,906

(114

)

Net loss

$

(16,749

)

$

(43,507

)

$

(50,071

)

$

(99,758

)

Net loss and adjustment attributable to redeemable non-controlling

interest

(7,003

)

(3,268

)

(11,112

)

2,744

Net loss attributable to New Relic

$

(23,752

)

$

(46,775

)

$

(61,183

)

$

(97,014

)

Net loss attributable to New Relic per share, basic and diluted

$

(0.34

)

$

(0.70

)

$

(0.87

)

$

(1.45

)

Weighted-average shares used to compute net loss per share, basic

and diluted

70,484

67,207

70,018

66,816

New Relic, Inc.Supplemental Revenue Disaggregation(In

thousands; unaudited)

Three Months Ended September

30, Six Months Ended September 30,

2023

2022

2023

2022

Subscription

$

19,409

$

59,555

$

48,129

$

122,635

Consumption

223,348

167,357

437,256

320,736

Total revenue

$

242,757

$

226,912

$

485,385

$

443,371

New Relic, Inc.Condensed Consolidated Balance

Sheets(In thousands, except par value; unaudited)

September 30, 2023 March 31, 2023 Assets

Current assets: Cash and cash equivalents

$

301,879

$

625,727

Short-term investments

134,693

254,085

Accounts receivable, net of allowances of $2,257 and $3,121,

respectively

150,271

234,287

Prepaid expenses and other current assets

22,062

17,747

Deferred contract acquisition costs

13,849

14,962

Total current assets

622,754

1,146,808

Property and equipment, net

46,770

48,509

Restricted cash

5,816

5,795

Goodwill

172,298

172,298

Intangible assets, net

8,653

11,603

Deferred contract acquisition costs, non-current

18,278

8,558

Lease right-of-use assets

15,384

19,678

Other assets, non-current

5,057

5,759

Total assets

$

895,010

$

1,419,008

Liabilities, redeemable non-controlling interest, and

stockholders’ equity Current liabilities: Accounts payable

$

28,277

$

29,452

Accrued compensation and benefits

40,935

37,552

Other current liabilities

37,719

39,424

Convertible senior notes, current

-

500,044

Deferred revenue

278,628

370,987

Lease liabilities

9,195

10,928

Total current liabilities

394,754

988,387

Lease liabilities, non-current

33,533

38,384

Deferred revenue, non-current

7,004

3,800

Other liabilities, non-current

38,064

24,897

Total liabilities

473,355

1,055,468

Redeemable non-controlling interest

34,217

23,105

Stockholders’ equity: Common stock, $0.001 par value

70

69

Treasury stock - at cost (260 shares)

(263

)

(263

)

Additional paid-in capital

1,417,512

1,311,615

Accumulated other comprehensive loss

(5,144

)

(7,432

)

Accumulated deficit

(1,024,737

)

(963,554

)

Total stockholders’ equity

387,438

340,435

Total liabilities, redeemable non-controlling interest and

stockholders’ equity

$

895,010

$

1,419,008

New Relic, Inc.Condensed Consolidated Statements of Cash

Flows(In thousands; unaudited)

Six Months Ended

September 30,

2023

2022

Cash flows from operating activities: Net loss attributable

to New Relic:

$

(61,183

)

$

(97,014

)

Net loss and adjustment attributable to redeemable non-controlling

interest

11,112

(2,744

)

Net loss:

$

(50,071

)

$

(99,758

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

12,326

20,607

Amortization of deferred contract acquisition costs

10,526

13,691

Stock-based compensation expense

90,594

74,734

Amortization of debt discount and issuance costs

206

1,188

Loss on facilities exit

-

2,717

Non-cash charges related to restructuring activities

3,167

-

Other

540

(588

)

Changes in operating assets and liabilities, net of acquisition of

business: Accounts receivable, net

84,016

113,570

Prepaid expenses and other assets

(3,577

)

2,075

Deferred contract acquisition costs

(19,133

)

(3,489

)

Lease right-of-use assets

2,794

5,411

Accounts payable

(967

)

1,544

Accrued compensation and benefits and other liabilities

6,807

(5,519

)

Lease liabilities

(1,889

)

(7,045

)

Deferred revenue

(89,155

)

(113,575

)

Net cash provided by operating activities

46,184

5,563

Cash flows from investing activities: Purchases of property

and equipment

(747

)

(2,416

)

Proceeds from sale of property and equipment

669

1,724

Cash paid for acquisition, net of cash acquired

-

(257

)

Purchases of short-term investments

-

(50,373

)

Proceeds from sale and maturity of short-term investments

121,450

243,475

Capitalized software development costs

(7,377

)

(7,907

)

Net cash provided by investing activities

113,995

184,246

Cash flows from financing activities: Payment of convertible

senior notes

(500,250

)

-

Proceeds from employee stock purchase plan

5,552

6,062

Proceeds from exercise of employee stock options

10,692

6,502

Net cash provided by (used in) financing activities

(484,006

)

12,564

Net increase (decrease) in cash, cash equivalents and restricted

cash

(323,827

)

202,373

Cash, cash equivalents and restricted cash at beginning of period

631,522

274,470

Cash, cash equivalents and restricted cash at end of period

$

307,695

$

476,843

New Relic, Inc.Reconciliation from GAAP to Non-GAAP

Results(In thousands, except per share data; unaudited)

Three Months Ended September 30, Six Months Ended

September 30,

2023

2022

2023

2022

Reconciliation of gross profit and gross

margin: GAAP gross profit

$

190,048

$

162,129

$

378,236

$

314,695

Plus: Stock-based compensation-related expenses

1,832

2,352

3,682

4,489

Plus: Amortization of purchased intangibles

1,475

2,292

2,950

4,583

Plus: Restructuring charges

46

407

1,106

407

Non-GAAP gross profit

$

193,401

$

167,180

$

385,974

$

324,174

GAAP gross margin

78.3

%

71.5

%

77.9

%

71.0

%

Non-GAAP adjustments

1.4

%

2.2

%

1.6

%

2.1

%

Non-GAAP gross margin

79.7

%

73.7

%

79.5

%

73.1

%

Reconciliation of operating

expenses: GAAP research and development

$

69,411

$

68,730

$

149,721

$

133,499

Less: Stock-based compensation-related expenses

(16,366

)

(14,822

)

(33,625

)

(28,347

)

Less: Restructuring charges

(516

)

(1,435

)

(9,337

)

(1,435

)

Non-GAAP research and development

$

52,529

$

52,473

$

106,759

$

103,717

GAAP sales and marketing

$

84,096

$

96,203

$

178,115

$

200,623

Less: Stock-based compensation-related expenses

(12,515

)

(13,062

)

(24,819

)

(23,813

)

Less: Restructuring charges

(726

)

(3,757

)

(8,511

)

(3,757

)

Non-GAAP sales and marketing

$

70,855

$

79,384

$

144,785

$

173,053

GAAP general and administrative

$

57,020

$

42,483

$

103,869

$

81,513

Less: Stock-based compensation-related expenses

(15,086

)

(11,224

)

(27,393

)

(21,190

)

Less: Transaction costs related to acquisitions

-

(929

)

-

(929

)

Less: Expenses related to litigation and other transaction-related

expenses

(16,885

)

(262

)

(19,458

)

(88

)

Less: Restructuring charges

(205

)

(1,610

)

(4,196

)

(1,610

)

Non-GAAP general and administrative

$

24,844

$

28,458

$

52,822

$

57,696

Reconciliation of income (loss) from

operations and operating margin: GAAP loss from

operations

$

(20,479

)

$

(45,287

)

$

(53,469

)

$

(100,940

)

Plus: Stock-based compensation-related expenses

45,799

41,460

89,519

77,839

Plus: Amortization of purchased intangibles

1,475

2,292

2,950

4,583

Plus: Transaction costs related to acquisitions

-

929

-

929

Plus: Expenses related to litigation and other transaction-related

expenses

16,885

262

19,458

88

Plus: Restructuring charges

1,493

7,210

23,150

7,210

Non-GAAP income (loss) from operations

$

45,173

$

6,866

$

81,608

$

(10,291

)

GAAP operating margin

(8.4

%)

(20.0

%)

(11.0

%)

(22.8

%)

Non-GAAP adjustments

27.0

%

23.0

%

27.8

%

20.4

%

Non-GAAP operating margin

18.6

%

3.0

%

16.8

%

(2.4

%)

Reconciliation of net income

(loss): GAAP net loss

$

(16,749

)

$

(43,507

)

$

(50,071

)

$

(99,758

)

Plus: Stock-based compensation-related expenses

45,799

41,460

89,519

77,839

Plus: Amortization of purchased intangibles

1,475

2,292

2,950

4,583

Plus: Transaction costs related to acquisitions

-

929

-

929

Plus: Expenses related to litigation and other transaction-related

expenses

16,885

262

19,458

88

Plus: Amortization of debt discount and issuance costs

-

594

206

1,187

Plus: Restructuring charges

1,493

7,210

23,150

7,210

Less: Non-GAAP tax adjustment

(11,661

)

-

(17,545

)

-

Non-GAAP net income (loss)

$

37,242

$

9,240

$

67,667

$

(7,922

)

Non-GAAP net income (loss) per share: Basic

$

0.53

$

0.14

$

0.97

$

(0.12

)

Diluted

$

0.51

$

0.14

$

0.94

$

(0.12

)

Shares used in non-GAAP per share calculations: Basic

70,484

67,207

70,018

66,816

Diluted

72,519

68,224

72,000

66,816

New Relic, Inc.Reconciliation of GAAP Cash Flows from

Operating Activities to Free Cash Flow(In thousands; unaudited)

Six Months Ended September 30,

2023

2022

Net cash provided by operating activities

$

46,184

$

5,563

Capital expenditures

(747

)

(2,416

)

Capitalized software development costs

(7,377

)

(7,907

)

Free cash flows (Non-GAAP)

$

38,060

$

(4,760

)

Net cash provided by investing activities

$

113,995

$

184,246

Net cash provided by (used in) financing activities

$

(484,006

)

$

12,564

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231026335340/en/

Investor Contact Ingo Friedrichowitz New Relic, Inc.

IR@newrelic.com

Media Contact Elena Keamy New Relic, Inc

PR@newrelic.com

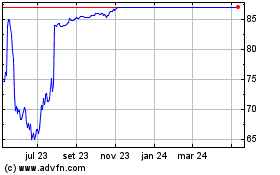

New Relic (NYSE:NEWR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

New Relic (NYSE:NEWR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025