Air Liquide: Completion of the Tender Offer for Part of Three Bond Series Maturing on June 5, 2024, June 13, 2024 and April 2, 2025

14 Novembro 2023 - 12:00PM

Business Wire

Regulatory News:

Air Liquide (Paris:AI):

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION DIRECTLY OR

INDIRECTLY TO ANY U.S. PERSON (AS DEFINED IN REGULATION S OF THE

U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “ SECURITIES ACT”)) OR

ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA, ITS

TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO, THE U.S. VIRGIN

ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA

ISLANDS), ANY STATE OF THE UNITED STATES OR THE DISTRICT OF

COLUMBIA OR IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO

RELEASE, PUBLISH OR DISTRIBUTE THIS DOCUMENT.

Air Liquide Finance (the “Company”) completed the tender

offer in cash (the “Tender Offer”) for part of the following

three bond series: €500,000,000 1.875 per cent. notes due June 5,

2024 (ISIN: FR0011951771) issued by the Company on June 5, 2014,

unconditionally and irrevocably guaranteed by L’Air Liquide S.A.

(the “5 June 2024 Notes”), €500,000,000 0.75 per cent. notes

due June 13, 2024 (ISIN: FR0013182839) issued by the Company on

June 13, 2016, unconditionally and irrevocably guaranteed by L’Air

Liquide S.A. (the “13 June 2024 Notes”) and €500,000,000

1.000 per cent. notes due April 2, 2025 (ISIN: FR0013505559) issued

by the Company on April 2, 2020, unconditionally and irrevocably

guaranteed by L’Air Liquide S.A. (the “2 April 2025 Notes”

and, together with the 5 June 2024 Notes and the 13 June 2024

Notes, the “Notes”).

The Tender Offer expired at 4 p.m. CET on 13 November 2023 and

the settlement date for the Tender Offer is expected on 16 November

2023.

The aggregate nominal amount of Notes accepted by the Company in

the context of the Tender Offer amounts to €236.2 million, split as

follows: €59.2 million in principal amount of 5 June 2024 Notes,

€48.6 million in principal amount of 13 June 2024 Notes and €128.4

million in principal amount of 2 April 2025 Notes. The tendered

Notes will be cancelled in the Company’s books.

The remaining outstanding amount of the three series of Notes

will hence amount to, respectively, €440.8 million in principal

amount of 5 June 2024 Notes, €451.4 million in principal amount of

13 June 2024 Notes and €371.6 million in principal amount of 2

April 2025 Notes.

This Tender Offer enables the Company to proactively optimise

its funding structure.

Barclays Bank Ireland PLC, Crédit Industriel et Commercial S.A.

and Intesa Sanpaolo S.p.A. acted as Dealer Managers.

* * *

WARNING This regulated information contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. The Company makes no

undertaking in any form to publish updates or adjustments to these

forward-looking statements, nor to report new information, new

future events or any other circumstances that might cause these

statements to be revised.

This regulated information does not constitute an invitation to

participate in the Tender Offer in or from any jurisdiction in or

from which, or to or from any person to or from whom, it is

unlawful to make such invitation under applicable securities laws.

The distribution of this announcement in certain jurisdictions may

be restricted by law. Persons into whose possession this

announcement comes are required to inform themselves about, and to

observe, any such restrictions.

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 73 countries with

approximately 67,100 employees and serves more than 3.9 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Taking action today while preparing the future is at the heart

of Air Liquide’s strategy. With ADVANCE, its strategic plan for

2025, Air Liquide is targeting a global performance, combining

financial and extra-financial dimensions. Positioned on new

markets, the Group benefits from major assets such as its business

model combining resilience and strength, its ability to innovate

and its technological expertise. The Group develops solutions

contributing to climate and the energy transition—particularly with

hydrogen—and takes action to progress in areas of healthcare,

digital and high technologies.

Air Liquide’s revenue amounted to more than 29.9 billion euros

in 2022. Air Liquide is listed on the Euronext Paris stock exchange

(compartment A) and belongs to the CAC 40, CAC 40 ESG, EURO STOXX

50, FTSE4Good and DJSI Europe indexes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114683984/en/

Relations Médias media@airliquide.com

Relations Investisseurs IRTeam@airliquide.com

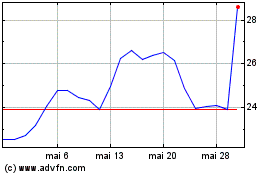

C3 AI (NYSE:AI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

C3 AI (NYSE:AI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024