Western Asset Mortgage Capital Corporation Announces Stockholder Approval of Merger With AG Mortgage Investment Trust

05 Dezembro 2023 - 6:05PM

Business Wire

Western Asset Mortgage Capital Corporation (the “Company,” “we,”

or “WMC”) (NYSE: WMC) announced today that its stockholders have

voted to approve the proposed merger transaction with AG Mortgage

Investment Trust, Inc. (“MITT”) (NYSE: MITT) at a special meeting

of stockholders of WMC held today.

Approximately 55% of the issued and outstanding shares of WMC

common stock entitled to vote at the special meeting of

stockholders of WMC voted in favor of the adoption of the

previously announced Agreement and Plan of Merger, dated as of

August 8, 2023 (the “Merger Agreement”), by and among MITT, AGMIT

Merger Sub, LLC, a wholly owned subsidiary of MITT (“Merger Sub”),

WMC and, solely for the limited purposes set forth therein, AG REIT

Management, LLC (“MITT Manager”), and the approval of the

transactions contemplated thereby, including the merger of WMC with

and into Merger Sub, with Merger Sub continuing as the surviving

entity and a subsidiary of MITT (the “Merger”).

“On behalf of the Board of Directors of WMC, I would like to

thank our stockholders for their support of this transaction,” said

James Hirschmann, Chairman of the Board of Directors of WMC. “We

look forward to working with MITT to successfully complete the

Merger,” added Bonnie Wongtrakool, Chief Executive Officer of

WMC.

If the Merger is completed, and upon the satisfaction of the

conditions set forth in the Merger Agreement, each outstanding

share of WMC common stock will be converted into the right to

receive: (i) from MITT, 1.498 shares of MITT common stock and (ii)

from MITT Manager, the per share portion of a cash payment equal to

the lesser of $7,000,000 or approximately 9.9% of the aggregate per

share merger consideration. Any difference between $7,000,000 and

such smaller amount will be used to benefit the combined company

post-closing by offsetting reimbursable expenses that would

otherwise be payable to MITT Manager, which will be the manager of

the combined company. MITT will pay cash in lieu of any fractional

shares of MITT common stock that would otherwise have been received

as a result of the Merger.

The Merger is expected to close on December 6, 2023, subject to

the satisfaction of the remaining customary closing conditions set

forth in the Merger Agreement and discussed in detail in the joint

proxy statement/prospectus filed with the U.S. Securities and

Exchange Commission (the “SEC”) on September 29, 2023.

ABOUT WMC

WMC is a real estate investment trust that invests in, finances,

and manages a diverse portfolio of assets consisting of Residential

Whole Loans, Non-Agency RMBS, and to a lesser extent GSE Risk

Transfer Securities, Commercial Loans, Non-Agency CMBS, Agency

RMBS, Agency CMBS, and ABS. WMC is externally managed and advised

by Western Asset Management Company, LLC, an investment advisor

registered with the SEC and a wholly-owned subsidiary of Franklin

Resources, Inc.

Forward-Looking Statements

This document contains certain “forward-looking” statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. WMC and MITT intend such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 and include this statement for purposes of complying

with the safe harbor provisions. Words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “will,” “should,” “may,” “projects,” “could,”

“estimates” or variations of such words and other similar

expressions are intended to identify such forward-looking

statements, which generally are not historical in nature, but not

all forward-looking statements include such identifying words.

Forward-looking statements regarding WMC and MITT include, but are

not limited to, statements related to the Merger, including the

anticipated timing, benefits and financial and operational impact

thereof; other statements of management’s belief, intentions or

goals; and other statements that are not historical facts. These

forward-looking statements are based on each of the companies’

current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties. Actual

results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these

risks and uncertainties, which include, without limitation, risks

and uncertainties associated with: WMC’s and MITT’s ability to

complete the Merger on the proposed terms or on the anticipated

timeline, or at all, including the satisfaction of closing

conditions to consummate the Merger; the occurrence of any event,

change or other circumstance that could give rise to the

termination of the Merger Agreement; risks related to diverting the

attention of WMC and MITT management from ongoing business

operations; failure to realize the expected benefits of the Merger;

significant transaction costs and/or unknown or inestimable

liabilities; the risk of stockholder litigation in connection with

the Merger, including resulting expense or delay; the risk that

WMC’s and MITT’s respective businesses will not be integrated

successfully or that such integration may be more difficult,

time-consuming or costly than expected; and effects relating to the

announcement of the Merger or any further announcements or the

consummation of the Merger on the market price of WMC’s and MITT’s

common stock. Additional risks and uncertainties related to WMC’s

and MITT’s business are included under the headings

“Forward-Looking Statements” and “Risk Factors” in WMC’s and MITT’s

Annual Report on Form 10-K for the year ended December 31, 2022,

WMC’s and MITT’s Quarterly Report on Form 10-Q for the quarter

ended September 30, 2023, the joint proxy statement/prospectus and

in other reports and documents filed by either company with the SEC

from time to time. Moreover, other risks and uncertainties of which

WMC or MITT are not currently aware may also affect each of the

companies’ forward-looking statements and may cause actual results

and the timing of events to differ materially from those

anticipated. The forward-looking statements made in this

communication are made only as of the date hereof or as of the

dates indicated in the forward-looking statements, even if they are

subsequently made available by WMC or MITT on their respective

websites or otherwise. Neither WMC nor MITT undertakes any

obligation to update or supplement any forward-looking statements

to reflect actual results, new information, future events, changes

in its expectations or other circumstances that exist after the

date as of which the forward-looking statements were made, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231204252224/en/

Investors Western Asset Mortgage Capital Corporation

Larry Clark Financial Profiles, Inc. (310) 622-8223

lclark@finprofiles.com

Media Western Asset Mortgage Capital Corporation Tricia

Ross Financial Profiles, Inc. (310) 622-8226

tross@finprofiles.com

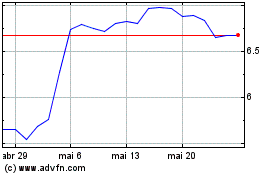

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024