AG Mortgage Investment Trust, Inc. Announces Closing of Public Offering of $65 Million Senior Notes

15 Maio 2024 - 5:05PM

Business Wire

AG Mortgage Investment Trust, Inc. (NYSE: MITT) (the “Company”)

announced today that it has closed its previously announced

underwritten public offering of $65 million aggregate principal

amount of its 9.500% senior notes due 2029 (the “Notes”). The

Company has applied to list the Notes on the New York Stock

Exchange under the symbol “MITP” and expects trading in the Notes

on the New York Stock Exchange to begin on May 20, 2024.

“We are extremely pleased to complete this successful follow-on

bond offering, which along with our $34.5 million bond offering in

January, effectively puts the legacy WMC convertible note maturity

in the rear-view mirror,” said TJ Durkin, Chief Executive Officer

and President. “We were proactive in addressing this upcoming

September maturity so we can fully focus on continuing to prove to

the market the sustainability of our portfolio’s earnings power

while also seeking ways to further optimize our capital structure

and scale.”

Mr. Durkin added, “The seamless execution of today’s issuance is

a testament to the skills and expertise of our advisors. I would

like to take this opportunity to acknowledge the hard work and

thank everyone involved.”

Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, UBS

Securities LLC, Wells Fargo Securities, LLC, Keefe, Bruyette &

Woods, Inc. and Piper Sandler & Co. served as joint

book-running managers for the offering. Hunton Andrews Kurth LLP

acted as legal advisor to MITT. Venable LLP acted as Maryland

counsel to MITT. Skadden, Arps, Slate, Meagher & Flom LLP acted

as legal advisor to the joint book-running managers.

The offering was made pursuant to the Company’s currently

effective shelf registration statement filed with the Securities

and Exchange Commission (the “SEC”).

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes or any other securities,

nor shall there be any sale of such Notes or any other securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or other

jurisdiction.

About AG Mortgage Investment Trust, Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a diversified credit and real

estate investing platform within TPG.

Additional information can be found on the Company’s website at

www.agmit.com. The information contained on, or that may be

accessed through, our website is not incorporated by reference

into, and is not a part of, this document.

About TPG Angelo Gordon

Founded in 1988, Angelo, Gordon & Co., L.P. (“TPG Angelo

Gordon”) is a diversified credit and real estate investing platform

within TPG. The platform currently manages approximately $80

billion across a broad range of credit and real estate strategies.

For more information, visit www.angelogordon.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The Company intended such statements to be covered by the

safe harbor provisions for forward-looking statements contained in

the Private Securities Litigation Reform Act of 1995 and includes

this statement for purposes of complying with the safe harbor

provisions. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,”

“projects,” “could,” “estimates” or variations of such words and

other similar expressions are intended to identify such

forward-looking statements, which generally are not historical in

nature, but not all forward-looking statements include such

identifying words. Forward-looking statements regarding the Company

include, but are not limited to, statements regarding the offering

and the intended use of proceeds. These forward-looking statements

are subject to various risks and uncertainties. Accordingly, there

are or will be important factors that could cause actual outcomes

or results to differ materially from those indicated in these

statements. The Company believes these factors include, without

limitation, the risk factors contained in the Company’s filings

with the SEC, including those described in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

in other reports and documents filed by the Company with the SEC

from time to time. Copies are available free of charge on the SEC’s

website, http://www.sec.gov/. Moreover, other risks and

uncertainties of which the Company is not currently aware may also

affect the Company’s forward-looking statements and may cause

actual results and the timing of events to differ materially from

those anticipated. The forward-looking statements made in this

press release are made only as of the date of this press release or

as of the dates indicated in the forward-looking statements, even

if they are subsequently made available by the Company on its

websites or otherwise. The Company undertakes no obligation to

update or supplement any forward-looking statements to reflect any

change in our expectations or any change in events, conditions or

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515581346/en/

Investors AG Mortgage Investment Trust, Inc. Investor Relations

(212) 692-2110 ir@agmit.com Media AG Mortgage Investment Trust,

Inc. media@angelogordon.com

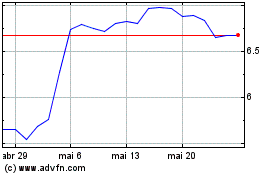

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024