AG Mortgage Investment Trust, Inc. Announces Fourth Quarter 2023 Common Dividend

15 Dezembro 2023 - 6:05PM

Business Wire

AG Mortgage Investment Trust, Inc. (NYSE: MITT) (the “Company”)

announced that its Board of Directors has declared a dividend of

$0.05 per common share. The dividend is payable on January 31, 2024

to shareholders of record at the close of business on December 29,

2023.

The $0.05 per common share dividend represents the remaining

portion of the Company’s regular fourth quarter 2023 dividend of

$0.18 per common share. As previously announced, the Company

declared interim fourth quarter 2023 dividends of (1) $0.08 per

common share on October 24, 2023, which was paid on November 8,

2023 to common shareholders of record as of November 3, 2023, and

(2) $0.05 per common share on November 20, 2023, which is payable

on January 2, 2024 to common shareholders of record as of November

30, 2023. The interim fourth quarter dividends were made pursuant

to the terms of the Agreement and Plan of Merger between the

Company, Western Asset Mortgage Capital Corporation and, solely for

the limited purposes set forth in the Merger Agreement, AG REIT

Management, LLC.

About AG Mortgage Investment Trust, Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a diversified credit and real

estate investing platform within TPG.

Additional information can be found on the Company’s website at

www.agmit.com.

About TPG Angelo Gordon

Founded in 1988, Angelo, Gordon & Co., L.P. (“TPG Angelo

Gordon”) is a diversified credit and real estate investing platform

within TPG. The platform currently manages approximately $76

billion* across a broad range of credit and real estate strategies.

TPG Angelo Gordon has over 700 employees, including more than 230

investment professionals, across offices in the U.S., Europe and

Asia. For more information, visit www.angelogordon.com.

*TPG Angelo Gordon’s currently stated assets under management

(“AUM”) of approximately $76 billion as of September 30, 2023

reflects fund-level asset-related leverage. Prior to May 15, 2023,

TPG Angelo Gordon calculated its AUM as net assets under management

excluding leverage, which resulted in TPG Angelo Gordon AUM of

approximately $53 billion as of December 31, 2022. The difference

reflects a change in the TPG Angelo Gordon’s AUM calculation

methodology and not any material change to TPG Angelo Gordon’s

investment advisory business. For a description of the factors TPG

Angelo Gordon considers when calculating AUM, please see the

disclosure linked here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231215446683/en/

AG Mortgage Investment Trust, Inc. Investor Relations

(212) 692-2110 ir@agmit.com

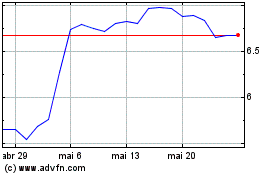

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024