FG Financial Group, Inc. Declares Cash Dividend on Its 8.00% Cumulative Preferred Stock, Series A

05 Fevereiro 2024 - 6:10PM

Business Wire

FG Financial Group, Inc. (Nasdaq: FGF) (the “Company”),

today announced that it has declared a quarterly cash dividend on

its 8.00% Cumulative Preferred Stock, Series A (the “Preferred

Stock”), for the period commencing on December 15, 2023 and ending

on March 14, 2024. FG Financial is a reinsurance and asset

management holding company focused on collateralized and loss

capped reinsurance and merchant banking that allocates capital in

partnership with Fundamental Global®, a private partnership led by

Kyle Cerminara and Joe Moglia, as well as other strategic

investors.

In accordance with the terms of the Preferred Stock, on February

5, 2024, the board of directors of the Company declared a Preferred

Stock cash dividend of $0.50 per share for the period commencing on

December 15, 2023 and ending on March 14, 2024. The dividend is

payable on March 15, 2024, to holders of record on March 1, 2024.

The Preferred Stock is currently listed on the Nasdaq Stock Market

and trades under the ticker symbol “FGFPP”.

FG Financial Group, Inc.

FG Financial Group, Inc. is a reinsurance and asset management

holding company focused on collateralized and loss capped

reinsurance and merchant banking that allocates capital in

partnership with Fundamental Global®, a private partnership led by

Kyle Cerminara and Joe Moglia, as well as other strategic

investors. The Company’s principal business operations are

conducted through its subsidiaries and affiliates.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These

statements are therefore entitled to the protection of the safe

harbor provisions of these laws. These statements may be identified

by the use of forward-looking terminology such as “anticipate,”

“believe,” “budget,” “can,” “contemplate,” “continue,” “could,”

“envision,” “estimate,” “expect,” “evaluate,” “forecast,” “goal,”

“guidance,” “indicate,” “intend,” “likely,” “may,” “might,”

“outlook,” “plan,” “possibly,” “potential,” “predict,” “probable,”

“probably,” “pro-forma,” “project,” “seek,” “should,” “target,”

“view,” “will,” “would,” “will be,” “will continue,” “will likely

result” or the negative thereof or other variations thereon or

comparable terminology. In particular, discussions and statements

regarding the Company’s future business plans and initiatives are

forward-looking in nature. We have based these forward-looking

statements on our current expectations, assumptions, estimates, and

projections. While we believe these to be reasonable, such

forward-looking statements are only predictions and involve a

number of risks and uncertainties, many of which are beyond our

control. These and other important factors may cause our actual

results, performance, or achievements to differ materially from any

future results, performance or achievements expressed or implied by

these forward-looking statements, and may impact our ability to

implement and execute on our future business plans and initiatives.

Management cautions that the forward-looking statements in this

release are not guarantees of future performance, and we cannot

assume that such statements will be realized or the forward-looking

events and circumstances will occur. Factors that might cause such

a difference include, without limitation: risks associated with our

inability to identify and realize business opportunities, and the

undertaking of any new such opportunities;; our lack of operating

history or established reputation in the reinsurance industry; our

inability to obtain or maintain the necessary approvals to operate

reinsurance subsidiaries; risks associated with operating in the

reinsurance industry, including inadequately priced insured risks,

credit risk associated with brokers we may do business with, and

inadequate retrocessional coverage; our inability to execute on our

investment and investment management strategy, including our

strategy to invest in the risk capital of special purpose

acquisition companies (SPACs); potential loss of value of

investments; risk of becoming an investment company; fluctuations

in our short-term results as we implement our new business

strategy; risks of being unable to attract and retain qualified

management and personnel to implement and execute on our business

and growth strategy; failure of our information technology systems,

data breaches and cyber-attacks; our ability to establish and

maintain an effective system of internal controls; our limited

operating history as a public company; the requirements of being a

public company and losing our status as a smaller reporting company

or becoming an accelerated filer; any potential conflicts of

interest between us and our controlling stockholders and different

interests of controlling stockholders; potential conflicts of

interest between us and our directors and executive officers; risks

associated with our related party transactions and investments; and

risks associated with our investments in SPACs, including the

failure of any such SPAC to complete its initial business

combination. Our expectations and future plans and initiatives may

not be realized. If one of these risks or uncertainties

materializes, or if our underlying assumptions prove incorrect,

actual results may vary materially from those expected, estimated

or projected. You are cautioned not to place undue reliance on

forward-looking statements. The forward-looking statements are made

only as of the date hereof and do not necessarily reflect our

outlook at any other point in time. We do not undertake and

specifically decline any obligation to update any such statements

or to publicly announce the results of any revisions to any such

statements to reflect new information, future events or

developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240205442853/en/

INVESTOR RELATIONS: Hassan R. Baqar (847) 773-1665

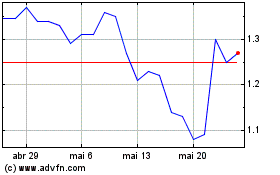

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

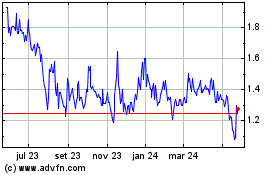

Fundamental Global (NASDAQ:FGF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024