AM Best Affirms Credit Ratings of Mercury General Corporation and Its Subsidiaries

15 Fevereiro 2024 - 5:58PM

Business Wire

AM Best has affirmed the Financial Strength Rating (FSR)

of A (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term

ICRs) of “a” (Excellent) for the members of Mercury Casualty Group

(Mercury). Concurrently, AM Best has affirmed the Long-Term ICR of

“bbb” (Good) of the organization’s publicly traded ultimate parent,

Mercury General Corporation (MGC) (Los Angeles, CA) [NYSE: MCY]. AM

Best also has affirmed the Long-Term Issue Credit Rating of “bbb”

(Good) of MGC’s $375 million, 4.4% senior unsecured notes, due

2027. The outlook of these Credit Ratings (ratings) is stable.

(Please see below for a detailed list of Mercury’s member

companies.)

The ratings of Mercury reflect its balance sheet strength, which

AM Best assesses as very strong, as well as its adequate operating

performance, neutral business profile and appropriate enterprise

risk management.

The very strong balance sheet strength assessment reflects

Mercury’s strongest level of risk-adjusted capitalization, as

measured by Best’s Capital Adequacy Ratio (BCAR) and generally

risk-balanced investment portfolio, which benefited from the higher

interest rate environment in 2023. Financial flexibility is

provided through the group’s publicly traded parent MGC. Mercury’s

operating performance in the past two years has deteriorated due to

weakened underwriting performance; this resulted from increased

claim frequency and severity caused largely by catastrophe losses

incurred in its geographic footprint. These were exacerbated by

Mercury’s business concentration in California, where the

regulatory environment has been challenging in recent years,

particularly with respect to the company’s and other insurers’

difficulty in achieving rate increases in the private passenger

auto (PPA) line of business, which comprises most of Mercury’s

underwritten portfolio. As of Jan. 31, 2024, Mercury has received a

significant rate increase of 20.7% for California PPA, effective

Feb. 25, 2024. The increase is in addition to two rate increases of

6.99% each, already approved in 2023.

AM Best notes that detailed strategic initiatives Mercury has

implemented to restore underwriting profitability, which include

rate and non-rate actions, should strengthen its prospective

underwriting performance. AM Best expects that the group’s earnings

to gradually improve in 2024.

The FSR of A (Excellent) and the Long-Term ICRs of “a”

(Excellent) have been affirmed with stable outlooks for the

following members of Mercury Casualty Group:

- Mercury Casualty Company

- Mercury Insurance Company

- California Automobile Insurance Company

- California General Underwriters Insurance Company, Inc.

- Mercury Indemnity Company of Georgia

- Mercury Insurance Company of Georgia

- Mercury Insurance Company of Illinois

- Mercury Indemnity Company of America

- Orion Indemnity Company

- American Mercury Insurance Company

- American Mercury Lloyds Insurance Company

- Mercury County Mutual Insurance Company

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of

Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240215993343/en/

Billiah Moturi Financial Analyst +1 908 882

2191 billiah.moturi@ambest.com

Alan Murray Director +1 908 882 2195

alan.murray@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

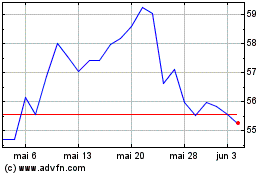

Mercury General (NYSE:MCY)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Mercury General (NYSE:MCY)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025